If you’ve been trading crypto for any length of time, you’ve already built a skillset that most traditional market traders spend years developing. You just might not realise it yet.

There’s a common assumption that moving into Forex (FX) or gold (XAU) means starting from scratch. But the reality is much simpler. The core skills you use every day in crypto translate almost directly to these markets, and in many cases, they’re actually easier to apply.

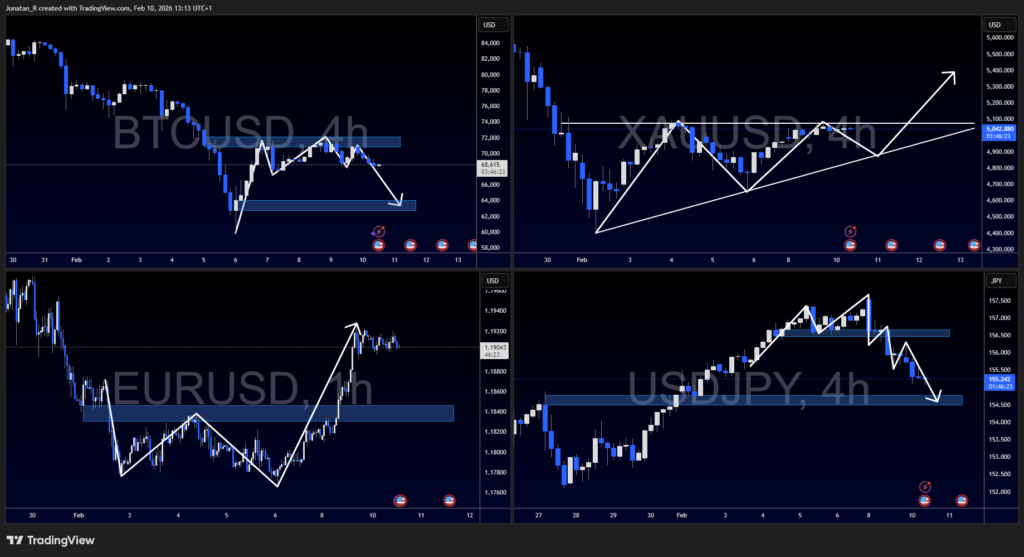

Your charts don’t care what asset you’re trading

A candlestick chart works the same way whether you’re looking at Bitcoin (BTC), EUR/USD, or XAU/USD. If you can spot a head-and-shoulders on a BTC/USD chart, you can spot one on gold. If you use RSI or MACD to time entries, those tools apply just as well to Forex pairs. Support and resistance, trendlines, Fibonacci retracements, none of these are exclusive to crypto. They were actually developed in traditional markets long before Bitcoin existed. Crypto borrowed them, and now you can bring them back.

You’re already built for volatility

One of the biggest concerns crypto traders have about FX and gold is that the markets might feel “slow.” And it’s true that EUR/USD won’t give you the 50% swings you might see in an altcoin. But that’s not a disadvantage.

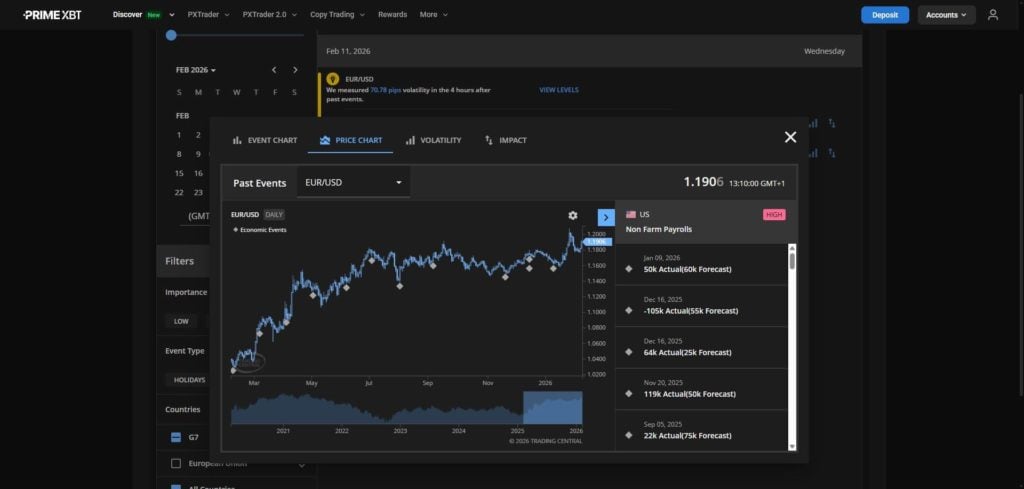

What you get in the Forex market that you don’t get in crypto is scheduled economic news releases, like non-farm payrolls, central bank rate decisions, and inflation reports, that can move major FX pairs several hundred pips in a single session. You could compare that to altcoins moving several hundred percent on a catalyst. The difference is that in Forex, you can see these events coming on the economic calendar and plan your trades around them.

Ultimately, it’s all about the risk-to-reward ratio of your setups, something you’re already familiar with. Switching from crypto to FX really just means switching your thinking about price moves from percentages to pips. These are two different ways of measuring the same thing: price movement. Once you make that mental shift, everything else feels familiar.

The macro knowledge you didn’t know you had

If you trade crypto, you probably already watch the US Federal Reserve, track inflation numbers, and pay attention to interest rate decisions. You likely understand how the US dollar’s strength impacts BTC/USD. All of that is Forex and gold analysis. You’ve been doing it without labelling it as such.

When the Fed raises rates, the US dollar tends to strengthen, putting pressure on gold prices. When inflation expectations rise, gold often benefits. These are the same dynamics you factor into your crypto positions. The difference is that in FX and commodities, these macro drivers tend to produce more consistent, readable reactions. There’s less noise from social media hype, fewer surprise token unlocks, and no sudden influencer-driven pumps.

Risk management translates directly

Position sizing, stop losses, risk-to-reward ratios, these are universal. If you risk 1-2% per trade in crypto, you should do the same in FX and gold. If you use trailing stops or scale into positions, those techniques work identically across asset classes.

Risk management can actually be easier to apply in traditional markets. Spreads tend to be tighter on major FX pairs, liquidity is deeper, and you’re less likely to experience the kind of slippage that happens during low-liquidity crypto sessions. Your existing risk framework doesn’t need rebuilding. It just needs a new chart.

You’re closer than you think

The gap between crypto and trading FX or gold is much smaller than most people assume. You already read charts, manage risk, handle volatility, and analyse macro events. Those are the hard skills, and you’ve already developed them.

At PrimeXBT, we offer all of these markets on a single platform, so you can apply your existing skills to Forex, gold, stocks, indices, and more without switching tools or accounts. If you’re already trading crypto with us, expanding into traditional markets could be as simple as opening a new chart.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.