Following Biden’s peaceful swearing in as US President, stocks retreated as the weekend drew close. However, all 3 US indices still closed the week still near their ATHs. IBM led the markets lower on Friday after it missed 4Q earnings and as market participants pondered about the latest impact the surging COVID cases may bring. President Biden’s warning that the USA could see 100,00 deaths from the pandemic next month further added to market woes. However, stimulus hopes still managed to keep stock indices at elevated levels. This week may see more volatility as we get into the thick of the earnings reporting season, with large tech names like Apple poised to report their 4Q earnings.

The USD retreated back down to 90 from a high of 91 points made early in the week, but failed to lift Gold and Silver as both metals continued to consolidate. However, better times should be ahead with the new administration’s promise of more stimulus and financial aid.

The ECB meeting on Thursday was a non-event as policies remained unchanged.

Most action was again on cryptocurrency markets.

Bad Rumour Caused Largest Percentage Loss in BTC in Recent Times

BTC price plunged below $29,000 on Thursday as a double whammy of regulation and rumours of a critical flaw in its code caused panic.

With the price of BTC coiling into a triangle for most of the week, the price finally broke on the downside on Thursday after looking increasingly weak as the price failed to hold onto any attempts to stay higher after incoming US Treasury Secretary Janet Yellen made a negative comment about the cryptocurrency in her address on Tuesday. Yellen said cryptocurrencies are used in illicit financing and suggested lawmakers “curtail” the use of Bitcoin amid terrorism concerns.

Despite this news, it wasn’t the reason cryptocurrencies fell as other altcoins like ETH still managed to carve out an ATH of $1440 first, and then $1476 on Sunday. The news that broke BTC’s back was a report done by a crypto derivatives exchange about a flaw in the Bitcoin Network called a Double-Spend.

The report alleged that a critical flaw called “double spend” had occurred in the Bitcoin blockchain. Double spend is when someone is able to spend the same bitcoin twice. It is a feared and dire scenario for the asset, and the blockchain was thought to have solved the issue when Satoshi Nakamoto published the Bitcoin white paper in 2009.

If a double-spend occurred, it will render confidence in the asset to be completely destroyed, since the thesis of owning BTC is because of its scarcity as well as its unbreakable code. This piece of rumour sent the price of BTC and all other cryptocurrencies reeling down 15% on the day, with BTC hitting a low of $28,800 from the day’s high of around $35,800.

Ultimately, the report proved to be a farce and a double-spend event did not occur. However, the damage was already done on the charts and nervous traders rushed to their exits.

Large Whales and Miners suspected to Start Selloff

Most attributed the sale to come from Europe and USA after observing that the Coinbase Pro premium has gone down a lot. The latest plunge came amid increased selling seen at Coinbase Pro, the professional trading arm of United States cryptocurrency exchange Coinbase.

Major spikes in volume at Coinbase Pro had accompanied price volatility in recent weeks. Previously, it was chasing up the price of BTC. This time, selling pressure was observed as a dip in the so-called “Coinbase Premium” happened. The “Coinbase Premium” measures the price difference between the BTC/USD pair at the professional trading arm against other exchanges. The premium in price suddenly became negative during the selloff, suggesting that whales on Coinbase were leading the selloff.

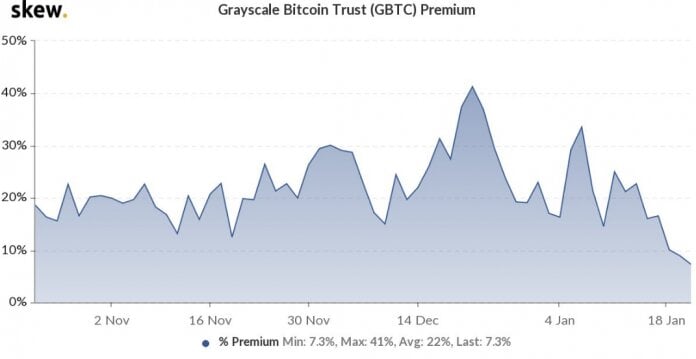

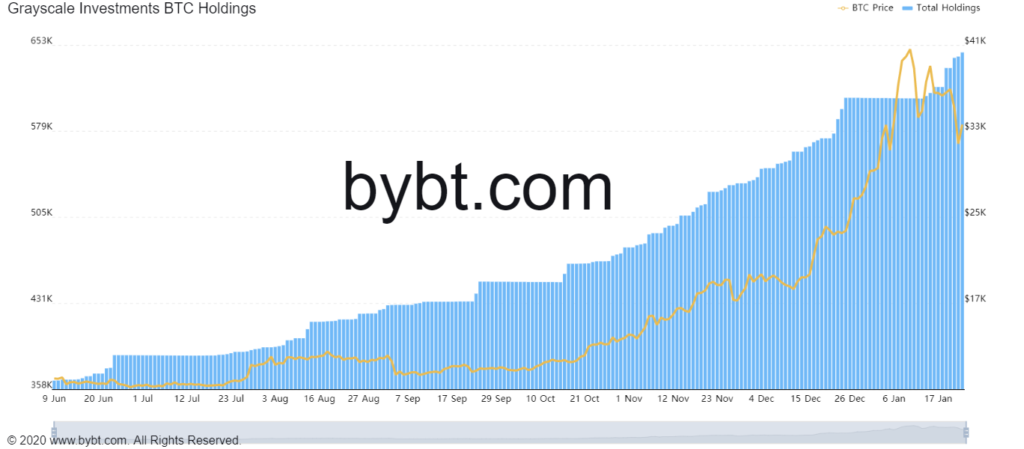

The Grayscale Bitcoin Trust Premium also posted a significant drop in the same period, suggesting that some of Grayscale investors may have sold their GBTC shares during the selloff. However, Grayscale did not sell any BTC, with the redemption possibly covered for by new investors.

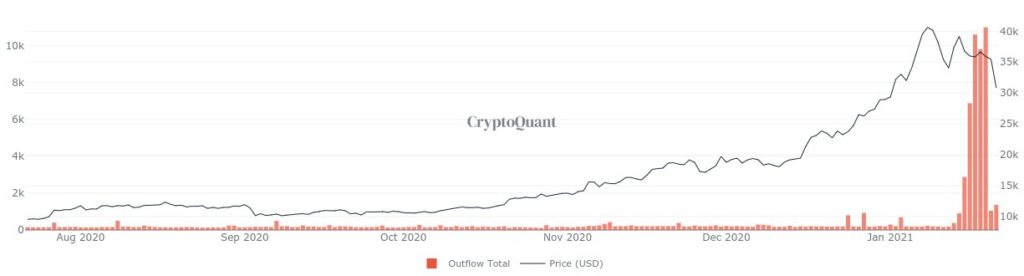

A corresponding increase in BTC deposits was also seen across exchanges a day before the selloff, indicating a potential desire to trade or sell BTC. F2Pool, currently the largest mining pool comprising roughly 15% of total hash rate, was suspected to be the main culprit driving down the price of BTC. Daily outflows from F2Pool’s mining wallet had been increasing and reached 10,000 BTC per day by 17 January. Although no one can confirm the wallet moves represent BTC sale, the coincidence is uncanny. The outflow has fallen back to a more normal levels since, which corresponds to a recovery of BTC price.

Post the selloff, sentiment of cryptocurrency market, which had been staying at a high of above 90 for months, signalling an exuberant GREED market, has finally fallen into the FEAR region reading of 40. Funding rates for BTC futures has also returned to normal levels when before, they were hovering at historical high rates. It seems much of the froth has been removed from this market, which is a healthy development for BTC to be able to sustain its next move higher.

Institutions Bought the Dip

This sentiment was echoed by institutional investors, as the selloff was quickly bought. Grayscale swooped in during the selloff to purchase 30,000 BTC over a few days, thereby cushioning the fall. MicroStrategy also revealed they bought another $10 million worth of BTC during the selloff, adding another 314 BTC to their portfolio.

Not only Grayscale and MicroStrategy bought BTC on the dip, but many other large whales also added to their stable, as the number of addresses with more than 1,000 BTC continued to climb during the BTC selloff.

Positive Developments on Regulatory Front

In a quick reversal, Janet Yellen, who only days ago called on regulators to curtail cryptocurrencies, later suggested that they should consider the benefits of cryptocurrencies and mentioned that cryptocurrencies can improve the financial system.

Other good news included reports that Biden has put a freeze on the proposed crypto wallet rule that outgoing Treasury Secretary, Steven Mnuchin, had put up. The proposed rule would allow FinCEN to regulate transactions on private crypto wallets and has been much opposed and feared by the crypto community.

ETH Price and Hash Rate finally breaks ATH

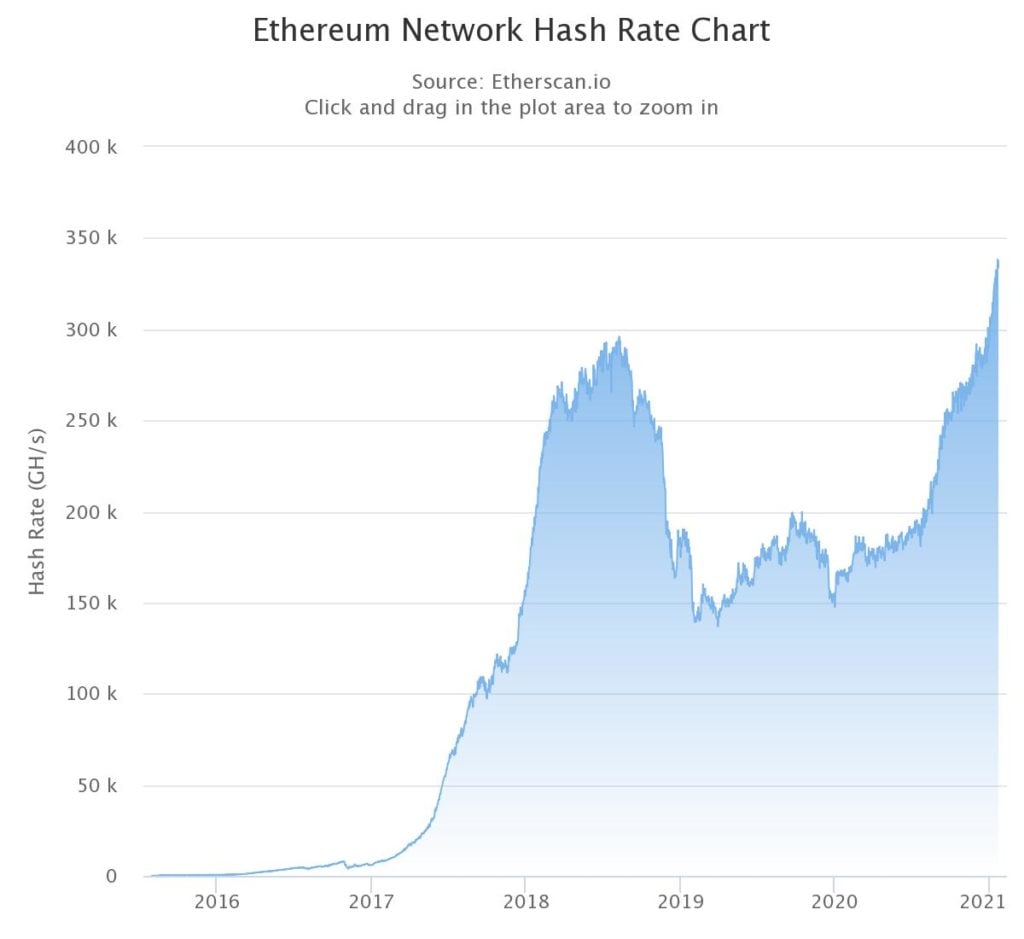

Meanwhile, the other major news was that ETH finally broke its ATH early in the week before the selloff that brought it down as a contagion to the BTC fall. On Tuesday, ETH rallied to a high of $1,440, $20 more than the ATH made on Jan 2018 of $1,420. The price shortly fell in tandem with the rest of the crypto market. However, ETH has reclaimed its price and made a new ATH of $1476 on Sunday. This positivity could be due to its hash rate surpassing its ATH made in 2018 by a big amount without any pullback even after the price of ETH retreated. An increase in hash rate is usually followed by price increase since hash rate signals mining difficulty and increase in mining difficulty is a sign of a healthy network that has increasing number of participants. Difficulty in mining ETH may also push some investors to buy it instead of mining.

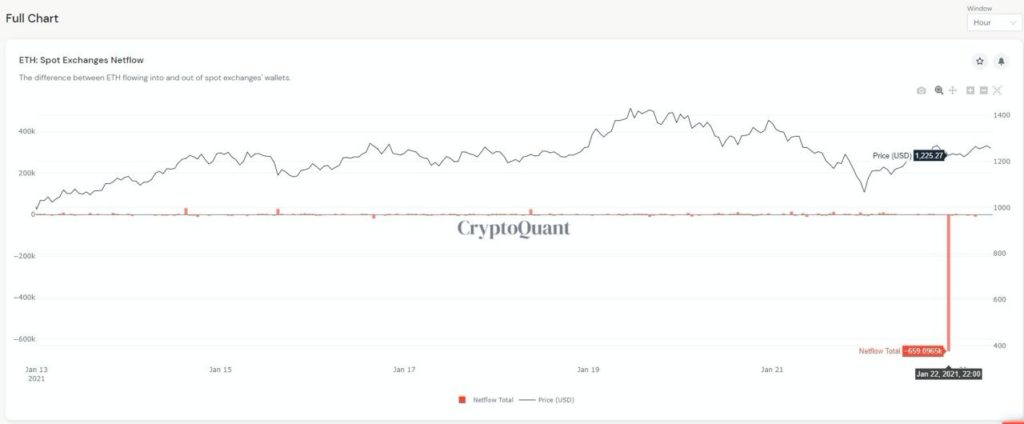

Indeed, investors came in droves as on Friday, the largest exchange withdrawal of ETH took place as large investors took the dip to buy ETH. According to data, a total of 659,000 units of ETH were withdrawn from spot exchanges in 1 hour on Friday as the price of ETH dropped to near $1,200.

There is an interesting difference between this retracement and previous retracements that we should take note of. The price of many altcoins did not pullback together with the price of BTC this time. In fact, many tokens went on to break their own respective ATHs even as BTC was struggling. The broad altcoin market has recovered a good amount of the week’s losses, especially for altcoins in the DeFi segment. Tokens like LINK, DOT, UNI, AAVE managed to recover almost all of their losses en route to continue pushing higher. Some DeFi tokens like AAVE, SUSHI, and UNI even made new ATHs when BTC was stuck in a range. News that Grayscale may launch its trust for 4 other crypto tokens also caused them to rally. These 4 tokens are LINK, BAT, MANA and XTZ. While it is still early to tell if Grayscale will eventually launch funds for these tokens, the move is a sign that sophisticated investors are looking beyond BTC and in search of other tokens that have good potential. Could this year be the year that altcoins finally break their association with the price of BTC?

About Kim Chua, PrimeXBT Market Analyst:

Kim Chua is an institutional trading specialist with a track record of success that extends across leading banks including Deutsche Bank, China Merchants Bank, and more. Chua later launched a hedge fund that consistently achieved triple-digit returns for seven years. Chua is also an educator at heart who developed her own proprietary trading curriculum to pass her knowledge down to a new generation of analysts. Kim Chua actively follows both traditional and cryptocurrency markets closely and is eager to find future investment and trading opportunities as the two vastly different asset classes begin to converge.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.