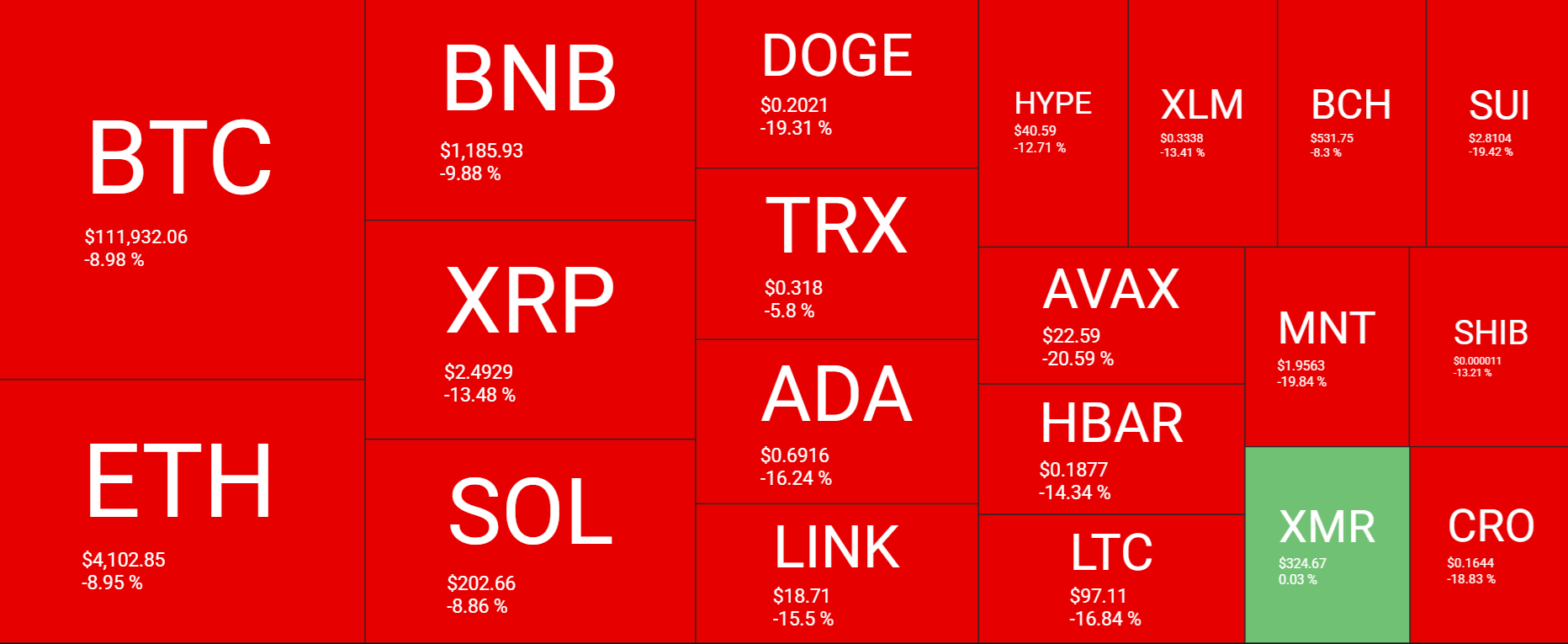

Bitcoin fell over 8% across the past 7 days, marking the second straight weekly decline. BTC fell from 115.8k last Monday to a low of 103.5k on Friday, a level last seen in June, before recovering to 107k over the weekend. The largest cryptocurrency by market cap is extending that recovery at the start of the week, rising to 111k.

Last week’s selloff wasn’t confined to Bitcoin, with major altcoins also a sea of red. Ethereum fell 9% across the week, falling to a low of 3675 on Friday, but has recovered above 4000 heading into the new week. Meanwhile, XRP fell 13%, SOL 8.8% and DOGE almost 20% over the past 7-days. All major altcoins are rising on Monday.

The total cryptocurrency market capitalisation fell from $3.95 trillion last Monday to $3.56 trillion on Friday, marking its lowest level since July. The total market cap has since recovered to $3.78 trillion at the time of writing.

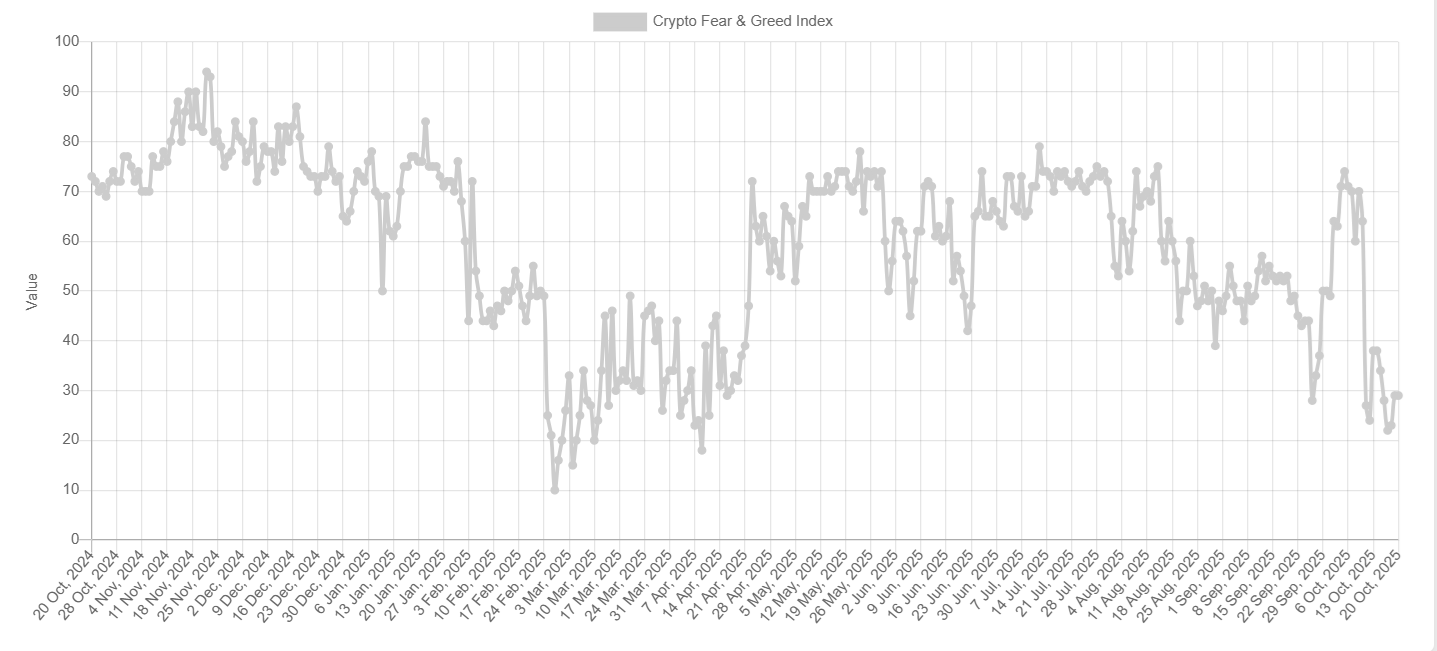

Sentiment analysis indicates that the market mood has improved from a week ago, rising from 24 (Extreme Fear) to 29 (Fear). The Fear and Greed Index had fallen to 23 on Friday, the lowest level since April. A level below 25 often signals excessive fear, creating buying opportunities. When the Fear and Greed Index dropped to this level in April, it marked a market bottom, which was then followed by a strong rebound when Bitcoin rallied 70%.

However, the strategy of being greedy when others are fearful can backfire if fears persist or deepen.

Interestingly, the negative sentiment was not just being seen in crypto, with equities also being struck by extreme fear for the first time in six months, although equities rose 1.7% last week.

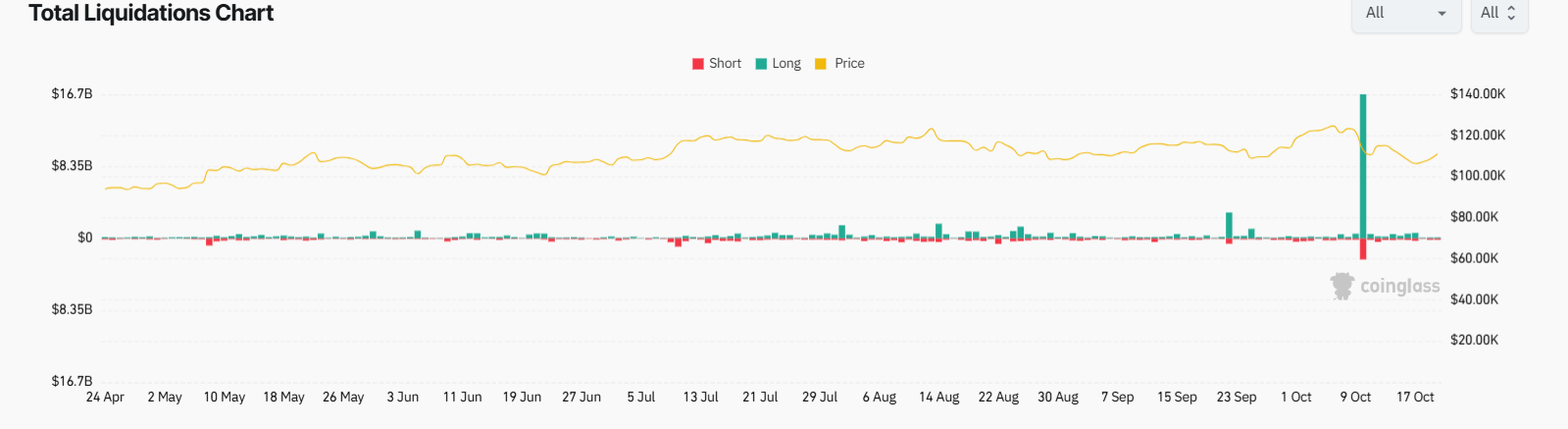

Crypto liquidations

As the bitcoin price fell below 106k on Friday, leveraged traders once again faced heavy losses, and liquidations surged again. Total crypto liquidations reached $911 million on Friday, of which 69% were long positions, reflecting how aggressively traders had positioned for a bounce earlier in the week.

While this is considered a large liquidation event, when compared to the $19.5 billion liquidation event of October, the largest liquidation event in crypto’s history, $911 seems somewhat muted.

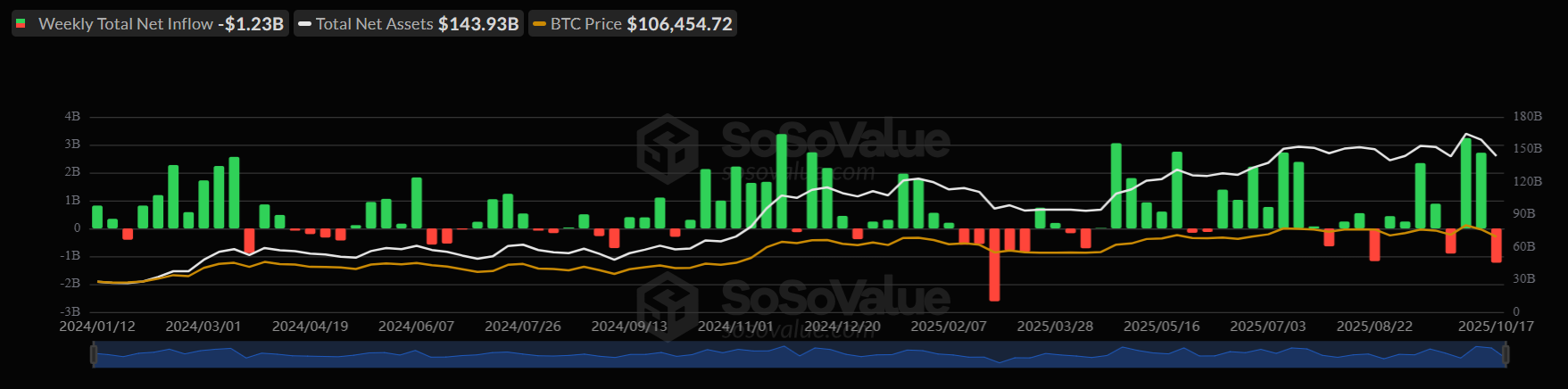

BTC ETFs see the largest weekly outflows since February

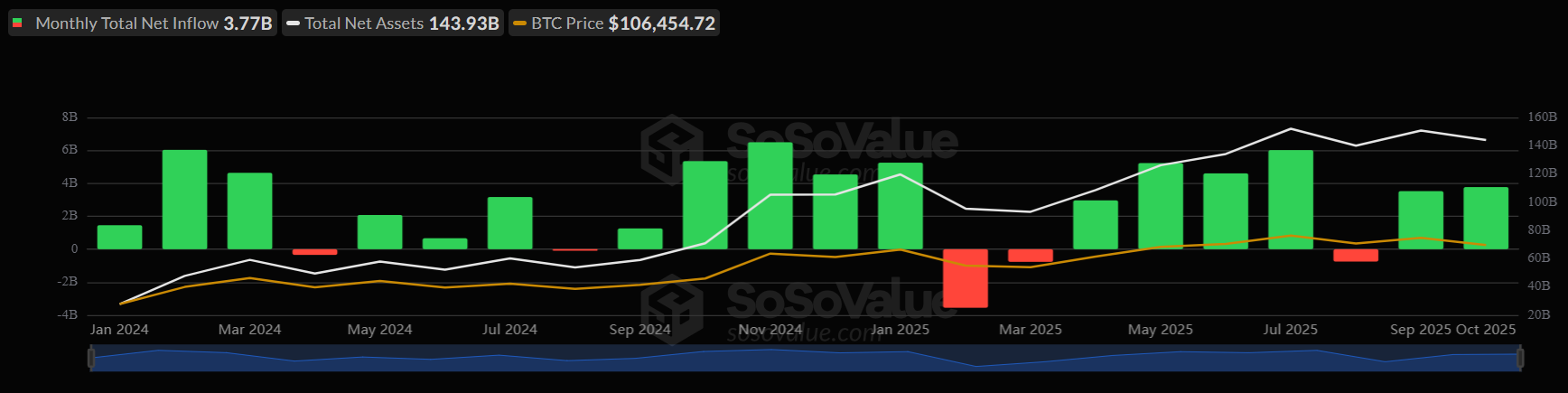

After two weeks of solid institutional demand, BTC ETFs experienced net outflows last week of $1.23 billion. This marked the largest weekly net outflow since late February, when the Bitcoin price fell from 95k to 84k.

Despite last week’s steep outflows, October is still a positive month with net inflows this month totalling $3.77 billion. Persistent institutional demand could continue to support the price higher.

Macro backdrop

President Trump confirmed on Sunday that he is meeting with China’s Xi Jinping at the Asia-Pacific Economic Cooperation (APEC) summit in Seoul, which begins on 31 October. Trump told Fox News that he expected a fair deal with China.

These latest comments helped to revive risk sentiment over the weekend after Trump had previously warned that he saw no reason to meet Xi Jinping in Seoul, followed by a threat of more trade tariffs on China, which sparked a sell-off in crypto just over a week ago. The post from Trump ignited a cascade of almost $20 billion in liquidations.

Trade worries had weighed on risk sentiment last week, with the crypto market and the broader financial market reacting to headlines from both the US and China.

In addition to US-China trade tensions, some concerns surrounding credit risk in US regional banks also hit risk sentiment. However, this is now considered to be an isolated incident. Finally, the US government shutdown is also ongoing, meaning that investors and the Federal Reserve are, to a degree, flying blind about the state of the economy ahead of the FOMC rate decision next week.

Elevated uncertainty surrounding US-China trade, the US government shutdown, rising global debt levels, and the prospect of further monetary easing by the Fed boosted Gold and Silver to record levels.

Gold, Silver & Bitcoin’s time to shine

Gold has risen 54% this year, and Silver 80%. Meanwhile, Bitcoin, which sees its main proposition offering as a store of value, has significantly underperformed, up just 15% YTD. The BTC/XAU ratio has fallen sharply, but found support at a key level, the April low. The hammer candlestick points to a bullish reversal, which could suggest that the gap between Bitcoin and Gold could narrow.

US CPI data ahead of next week’s FOMC rate decision

This week sees the special release of US CPI inflation data, despite the US government shutdown which could influence risk sentiment. Expectations are for CPI to rise to 3.1% YoY, up from 2.9%. Should CPI rise by less than in August, this could signal that inflationary pressures are easing. The market is 93% certain that the Fed will cut rates in October and again in December, as the Fed has signalled that it is concerned over a slowing labour market. However, sticky inflation could complicate the outlook. A lower interest rate environment boosts risk assets such as BTC due to increased liquidity.

Is the market bottom in? On-chain data points to a recovery:

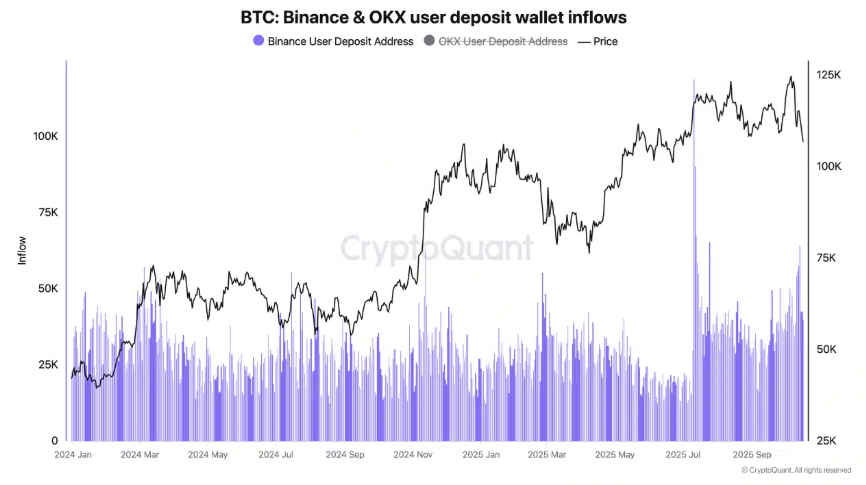

Bitcoin inflows ease

According to CryptoQuant analysis, between 54,300 and 57,780 unique addresses deposited BTC in the days following the October 10 tumble from 121.5k to 102k. On 14 October, 64,000 unique addresses deposited Bitcoin. This spike in Exchange inflows pointed to panic-driven selling and short-term capitulation. However, as of 18 October, the number of active addresses depositing Bitcoin fell to 30,850. This decline shows reduced selling pressure, suggesting the market is finding a new equilibrium.

Funding rate turned negative

The funding rate on Binance also turned negative. This means that traders holding short positions now pay fees to those holding long positions. Historically, this has also marked a market bottom, followed by a strong rally.

There have been seven negative funding rates across the past two years, each of which was followed by an average 22% recovery within 15 days.

Short-term holders absorb the dip

Short-term holder net unrealized profit loss (NUPL), a metric that measures whether recent buyers are in profit or loss, has fallen to -0.04, its lowest level since April 20. A negative reading means short-term holders are holding at a loss, which often signals a market bottom and an early recovery setup as selling pressure fades.

Similarly, on 25 September, when NUPL hit -0.02 Bitcoin then rose almost 5% in just four days.

On 11 October, STH NUPL dropped again to -0.02 and BTC climbed 4% to a high of 115.3 K within three days.

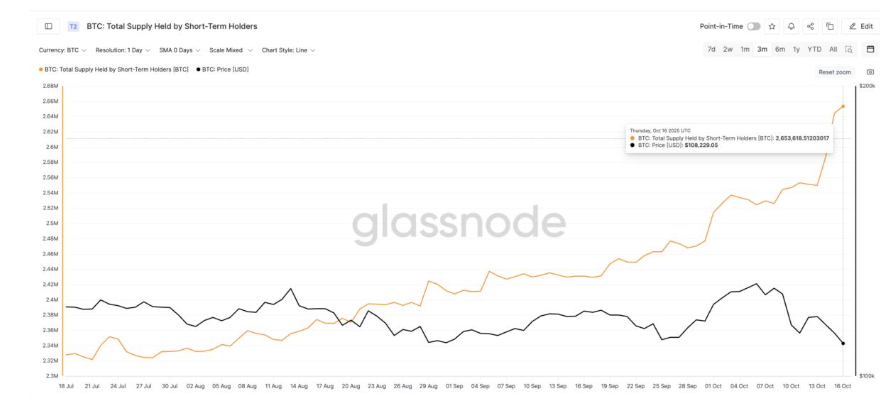

Within the STG NUPL falling even lower and losses deeper short-term holders appeared to be doubling down rather than exiting. According to Glassnode data, the total supply held by short-term holders surged from 2.54 million BTC on 13 October to 2.65 million BTC on Friday, a 4.3% increase. The shows STH bought up 110k BTC amid aggressive dip buying. The STH hitting a 3-month high despite a weak price point to near-term conviction.

This combination of the negative NUPL and growing supply usually signals a phase of growing accumulation when STH position for a potential rebound.

Technically, BTC recovered from the key 200 SMA, keeping buyers in control over the longer term. The price is testing the rising trendline, which it will need to rise above to bring 115k back into focus.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.