After a flat finish in the previous week, Bitcoin has powered higher at the start of the new week, staging an Easter resurrection of its own, surging past 90k and recovering from the selloff sparked by Trump’s Liberation Day. The price has risen from just below 84k at the start of the week to 93.5k. Bitcoin has risen over 25% from its 74.4k low recorded on April 7 and 12% over the past 7 days.

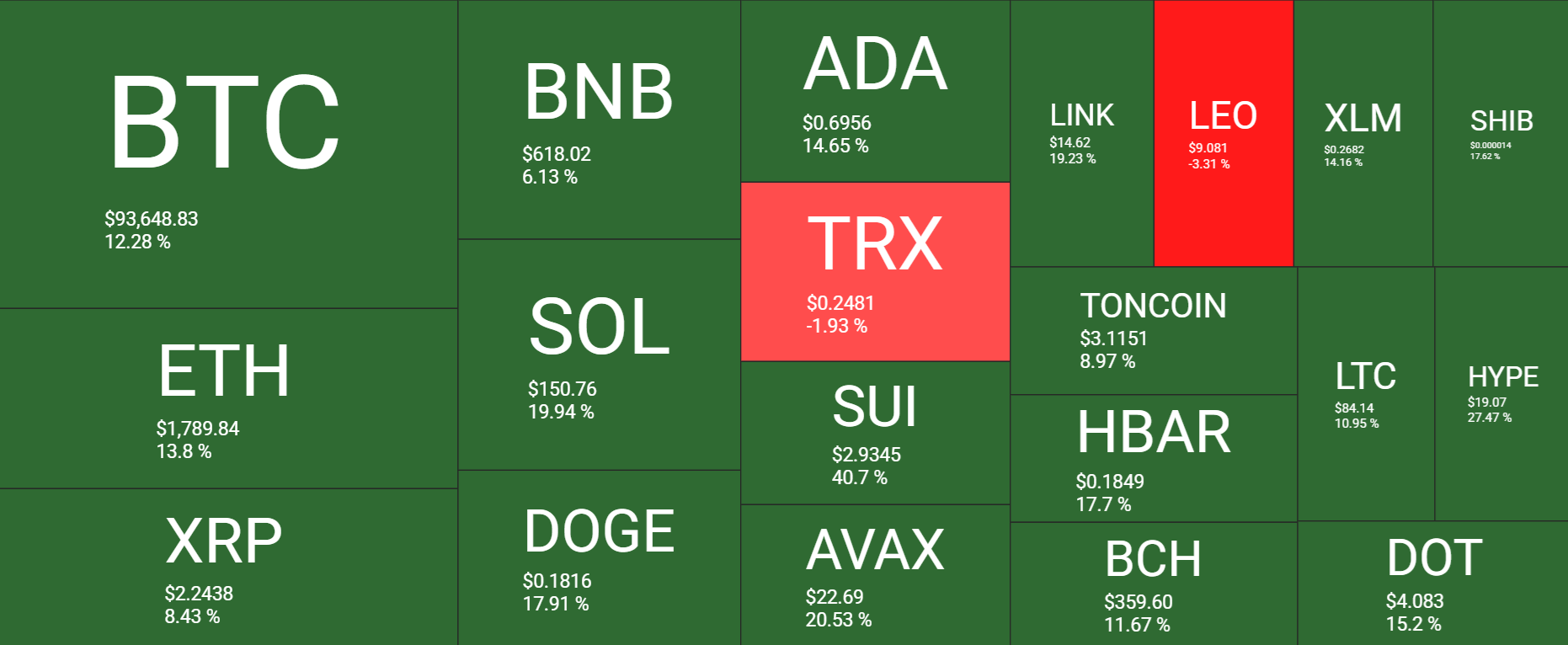

Bitcoin’s gains have been replicated across the crypto space. Substantial gains have been seen across the board. While BNB and XRP have risen 8% and 6% respectively, Ethereum has surged 13%, and SOL has jumped 20%, outperforming its peers.

The total cryptocurrency market cap has risen to above $3 trillion for the first time since early March as altcoins followed Bitcoin in its recovery. The market cap recovered from $2.35 trillion on April 7, with $500 billion entering since April 9. That said, Bitcoin’s dominance is still high at 64.4%, meaning that altcoin season is still a long way off.

Sentiment is also improving with the crypto fear and greed index rising to 52, matching the highs of late January, which marks an encouraging move from the fear zone into neutral territory. Such shifts are often followed by continued market strength following the pullback.

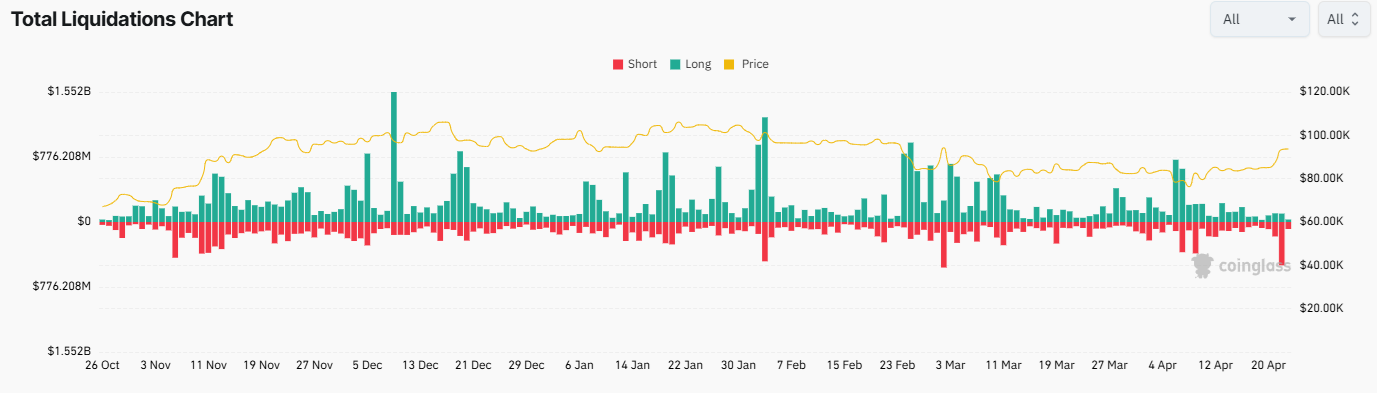

Crypto liquidations

The strong gains in the crypto market yesterday sparked a wave of liquidations. According to Coinglass data, total liquidations reached $617 million yesterday. Short positions were hardest hit, with $517 million liquidated compared to $100 million in long positions.

BTC ETF flows turning a corner?

Bitcoin’s surge to 93.5k could be more than a typical holiday rally. It may reflect growing signs of renewed institutional interest as Bitcoin ETFs flip back to net inflows after a week of significant outflows. Last week, Bitcoin ETF had $13.4 million in inflows, recovering from the previous week’s $708 million in net outflows. The flip to inflows coincided with Bitcoin’s sharp rally across the Easter holiday.

Meanwhile, Bitcoin ETF recorded the largest daily inflows on April 21 since January. The 11 Bitcoin tracking funds or joint net inflows of $381.3 million according to SoSo value data. This was the largest inflow day for the ETF since $588.1 million net inflows on January 30, days after Bitcoin hit a record high.

Macro backdrop

The US-China trade war remained a key focus in the previous week, with the US government saying it would add new restrictions on exports of chips to China in a further escalation of the trade war between the world’s two largest economies. Comments from Federal Reserve Chair Jerome Powell added to a slightly more negative mood in the latter part of the week. Powell spoke at the Economic Club of Chicago, echoing recent comments from Fed officials, stating that tariff increases have been significantly larger than anticipated and would likely lift inflation and slow growth.

Uncertainty over macroeconomic conditions resulted in some market pullbacks, but Bitcoin continued to outperform the S&P 500 and the NASDAQ on a risk-adjusted basis.

At the start of the new week, sentiment remains relatively choppy across financial markets. Trump had earlier called for Fed chair Powell’s removal, sparking concerns over the Fed’s independence. This move sent U.S. stocks plunging on Monday and safe-haven gold to record highs. However, on Tuesday, Trump walked back these comments, and Treasury Secretary Bessent sounded upbeat on a trade deal with China, boosting stocks and pulling gold from its record level.

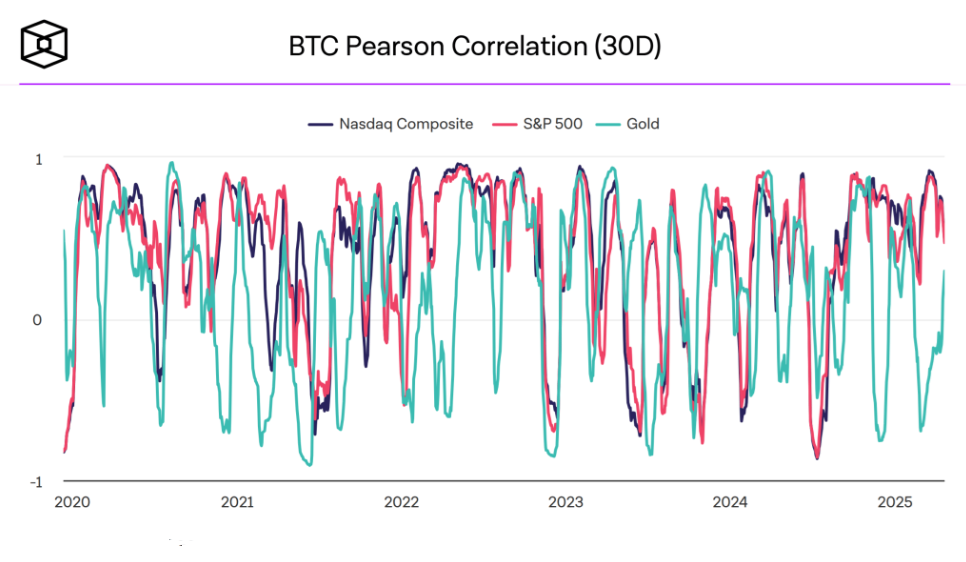

Bitcoin less, Nasdaq more, Gold?

Bitcoin is showing signs of decoupling from the US stock market. Over the past five trading days, the cryptocurrency has rallied over 5%. During the same period, the S&P 500 fell 5%, and the Nasdaq fell 6%.

According to the BTC Pearson Correlation (30-day) indicator, the crypto’s positive correlation to US stocks had strengthened from late February. However, on April 15, Bitcoin decoupled from the S&P 500 and the Nasdaq. It then moved towards a positive correlation with Gold, suggesting that it started to trade as a safe-haven asset from mid-April.

Gold reached record highs of $3500 per ounce this week, up 26% so far this year. Meanwhile, Bitcoin is trading at the same level as it started the year. Could this mean that Bitcoin will catch up?

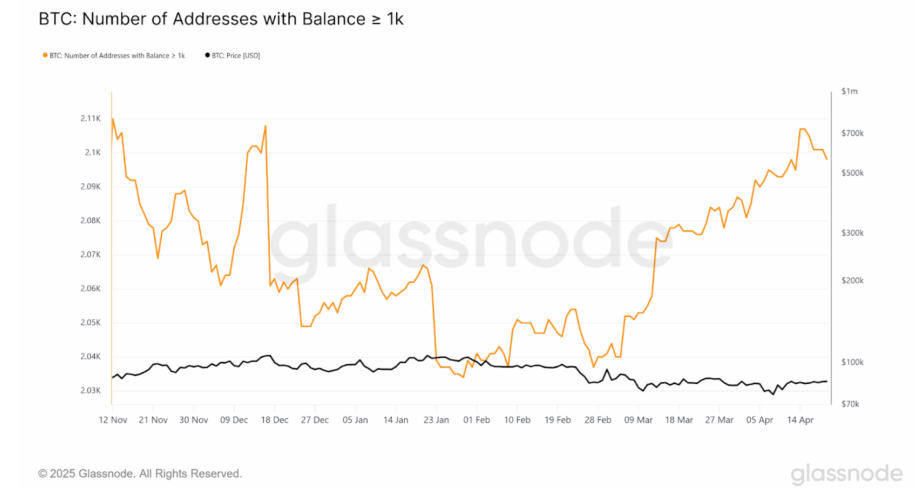

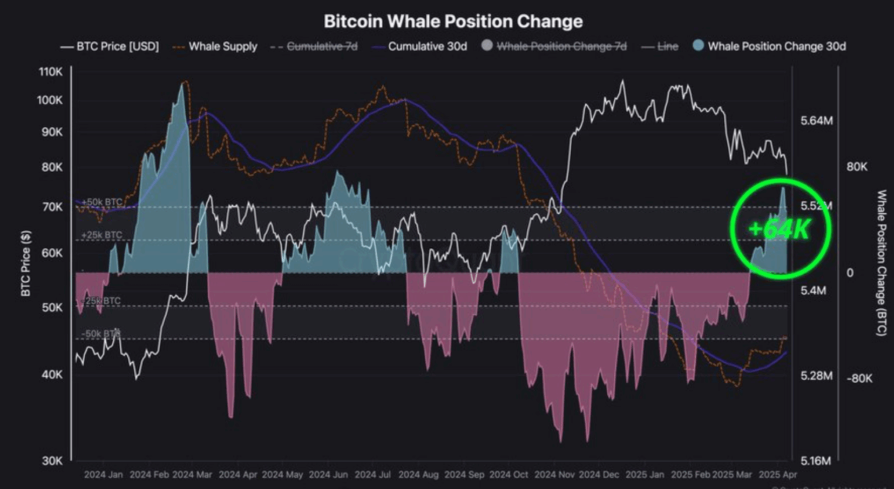

Whale wallets rise

According to Glassnode, the number of wallets with more than 1000 Bitcoin has risen to 2107, the highest level since December 2024. This marks a jump from 2037 in late February, adding more than 60 whales in under two months. The last time that whale addresses Thursday at this pace was during the November and December 2024 rallies, which followed Donald Trump’s election win. Then, Bitcoin rose to a high before retracing slightly.

According to data published by Mater Crypto on X, whales are accumulating Bitcoin at a pace of 300% of its yearly issuance. At the same time, reserves are dropping, tightening supply across the spot market.

One such whale is Strategy (formerly MicroStrategy), which continues its Bitcoin at acquisition strategy, purchasing an additional 6556 Bitcoin for $555.8 million at $84,785 per coin. This takes the firm’s holdings to 538,200 coins at an average price of $67,766 per bitcoin.

Metaplanet, often dubbed the Asian MicroStrategy, has just bought another 330 Bitcoin, taking its holding to 4855.

Public companies collectively hold 3.356% of the Bitcoin supply, whilst ETFs still dominate with 6.17%.

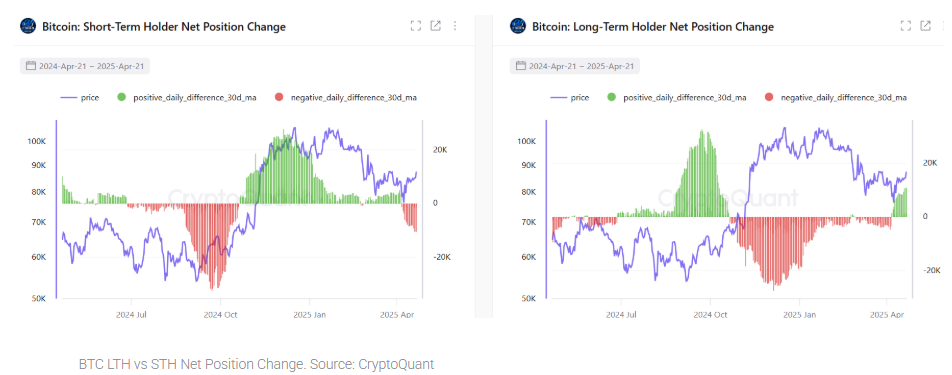

Long-term holders accumulate

The net position change for long-term holders indicates that they are accumulating more Bitcoin while short-term holders are selling. This behaviour hints at renewed demand for crypto among smart money investors.

According to CryptoQuant, the net position change for Long-Term Holders, those holding Bitcoin for over 155 days, has turned positive, while Short-Term Holders, those holding for less than 155 days, continue to offload their positions.

Critical technical level

Bitcoin has risen above a key technical junction. The price overcame multiple resistance layers between 88,000 and 91,000. These include the 200-day moving average, the mid-level of the consolidation channel, and the 100-day moving average. A move above these resistance levels opens the door to strong bullish momentum towards 100k.

BitMEX co-founder Arthur Hayes warned that this could be the last chance to buy Bitcoin below $100k.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.