Bitcoin fell 2.6% last week. After starting last week at 109k, the price rose to a peak of 110k on Monday before falling to a low of 103.1k. The price has returned to 105k over the weekend and trades here at the start of the new week, putting gains at 1.3% over the past 7 days.

The altcoin market was more mixed. While ETH fell 2.8%, SOL declined 3.7%, and DOGE dropped 7% over the past 7 days. Meanwhile, HYPE surged 39%, XRM gained 17%, and LEO was up 2%.

The total crypto market capitalization rose to a peak of $3.53 trillion on Monday, June 23, before falling to current levels of $3.29 trillion at the time of writing. Meanwhile, the Fear and Greed index has eased to 56, which is neutral. This is down from 67, Greed last week, as the price reached a record high.

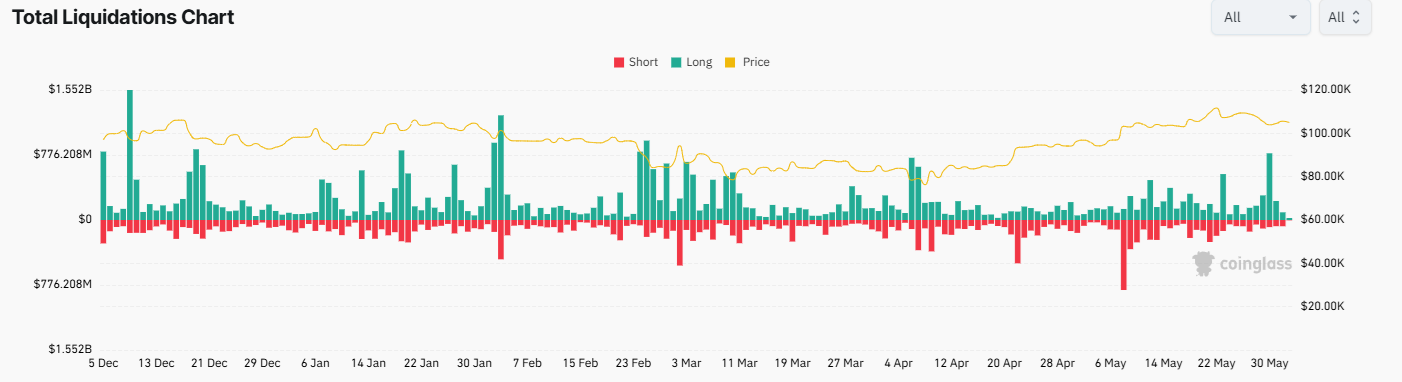

Bitcoin liquidations spiked at the end of last week as the price tumbled below 104k to a two-week low. Crypto liquidations spiked to $884 million on Friday, with $796 million long positions. This marked the largest wave of long position liquidations since February 25.

Bitcoin institutional demand wobbles

Bitcoin ETF recorded net outflows on the final two days of last week, following 10 straight days of net inflows. Friday’s net outflows topped $616 million, a level that was last seen on February 26.

On a weekly basis, BTC ETF recorded net outflows of $157.4 million. This market marked the first weekly net outflow after six weeks of net inflows. Should ETFs see demand weaken, that could limit the upside in BTC’s price for now.

Macro Backdrop

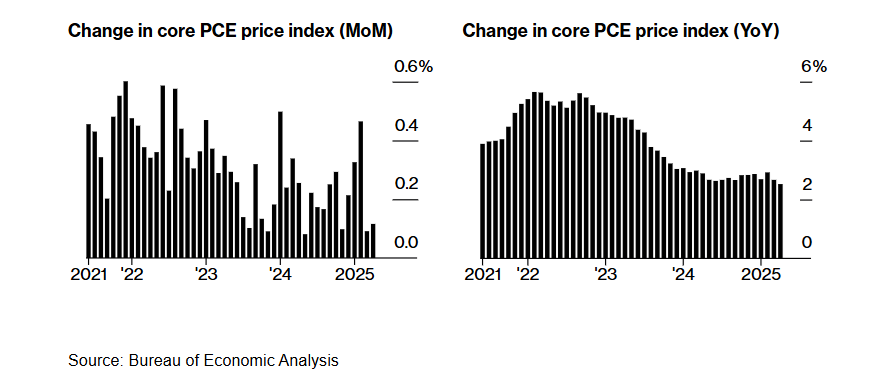

After reaching an all-time high earlier in the month, Bitcoin fell last week as concerns surrounding Trump’s trade tariffs returned, along with in-line inflation.

On Friday, President Trump said that China violated its trade agreement with the US. His comments came after Treasury Secretary Scott Bessent warned that trade talks with China had stalled, raising fears of the US-China trade war ramping up again between the world’s two largest economies. The market fears that the US is planning broader Chinese sanctions, which dealt a blow to risk sentiment. Meanwhile, over the weekend, Trump announced an increase in aluminium tariffs to 50%, up from 25%, escalating trade concerns. Headline risk remains.

On the data front, US core PCE was in line with expectations, easing to 2.5% YoY from 2.7% the previous month, marking the lowest level in four years. However, the Fed will likely continue with its wait-and-see approach to cutting rates, given that inflation is expected to increase owing to the impact of Trump’s trade tariffs.

Bitcoin Conference 2025 takeaways

Last week’s Bitcoin 2025 conference in Las Vegas brought some key political and technological announcements for mainstream adoption. These announcements coincided with a new all-time high for BTC USD.

In his keynote speech, the US vice president, JD Vance, discussed bitcoin’s potential as a strategic asset. He said regulatory clarity in the US is necessary to keep innovation from going offshore. He argued that stablecoins are a force multiplier for the economy rather than threatening the integrity of the USD.

White House Crypto Czar David Sacks also suggested that the US government has a legal path towards acquiring more Bitcoin.

Corporate treasury buying continues

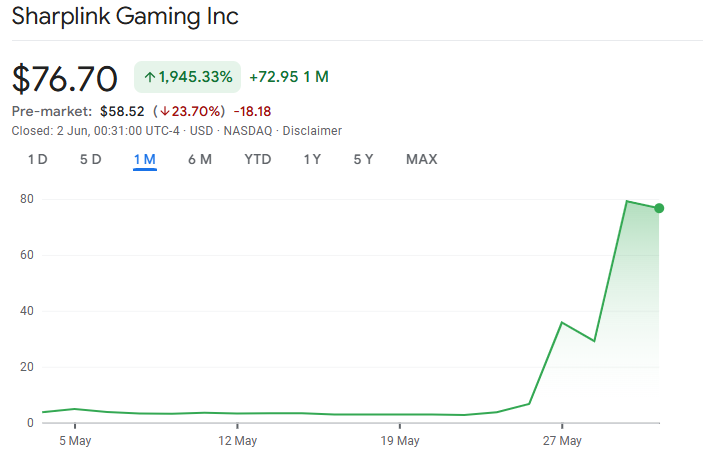

Following (Micro)Strategy’s lead, other companies are following suit with a crypto strategy. Sharplink announced an ether treasury strategy, which saw a 400% surge in the stock and lifted ETH following plans to raise $425 million for purchases.

Sol Strategies has also filed a preliminary base shelf prospectus with Canadian regulators to raise $1 billion to invest in the Solana ecosystem. GameStop’s share price increased before it announced a 4710 BTC purchase this week, but the share price then fell in a “buy the rumour, sell the fact” trade. Finally, Trump Media and Technology also announced plans to raise $2.5 billion to finance the purchase of BTC at some point in the future.

Corporations are not the only entity adding to their crypto balance sheets. The Pakistan Crypto Council’s chief executive officer announced a new BTC reserve at Bitcoin 2025 that could hold indefinitely. This move could influence other emerging economies to consider Bitcoin and other crypto assets.

Regulatory update

The US Senate is expected to pass the Genius Act by the end of this week, but the final vote has not yet been scheduled. The US House Financial Services Committee has signalled support for stablecoin legislation with a similar proposal, the STABLE Act. These bills are expected to increase innovation in the ecosystem, particularly the payment space, which could make crypto more accessible.

Tentative signs of overheating?

While Bitcoin is firmly in a bullish market, some signs of caution could be creeping in, suggesting that the price may have reached a near-term top.

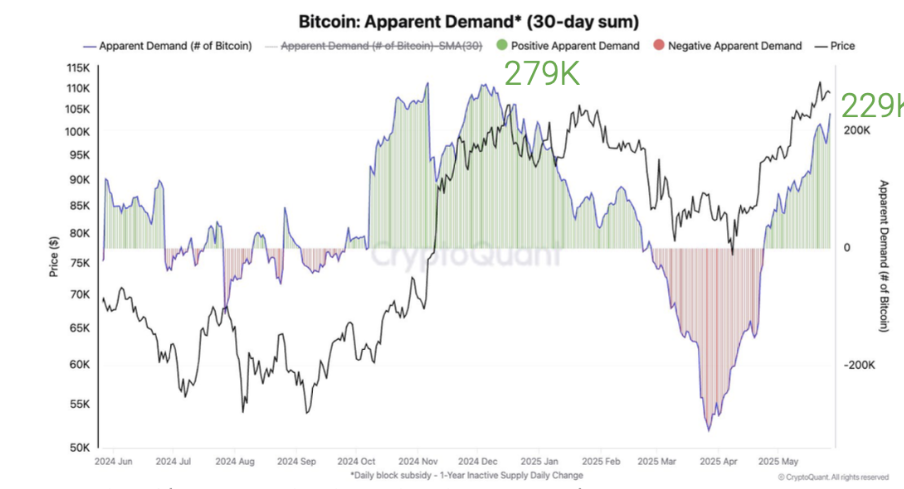

According to CryptoQuant data, whale BTC balances have increased by 2.8% over the past month. Across the same period, BTC demand grew to 229k, close to the demand growth level recorded in December 2024 at 279k when Bitcoin rallied over 100k for the first time. This pace of growth often precedes a slowdown in whale accumulation. BTC needs strong demand to sustain a rally.

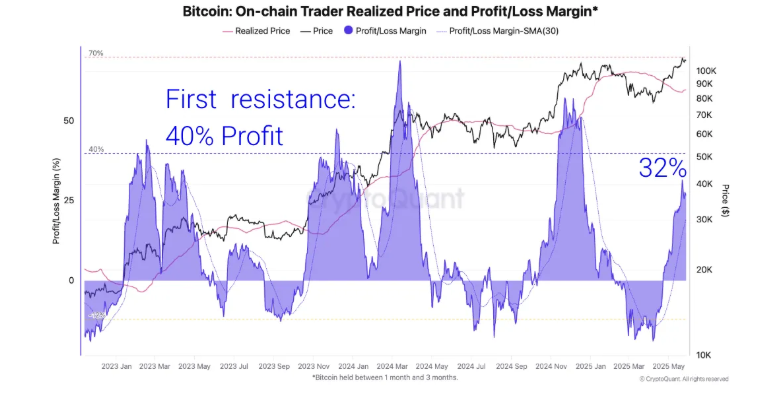

Unrealized profit margins have approached levels that also indicate possible price resistance. According to historical charts, BTC’s price surge often slows when the unrealized profit margin reaches 40% or crosses below its 30-day average, which is 19% at the moment. The metric rose to 32% as BTC rallied above 111k last week.

Should Bitcoin rise above 110k, expectations are for BTC to rise towards 120k. This is the upper band of the realised price margin, at the 40% level.

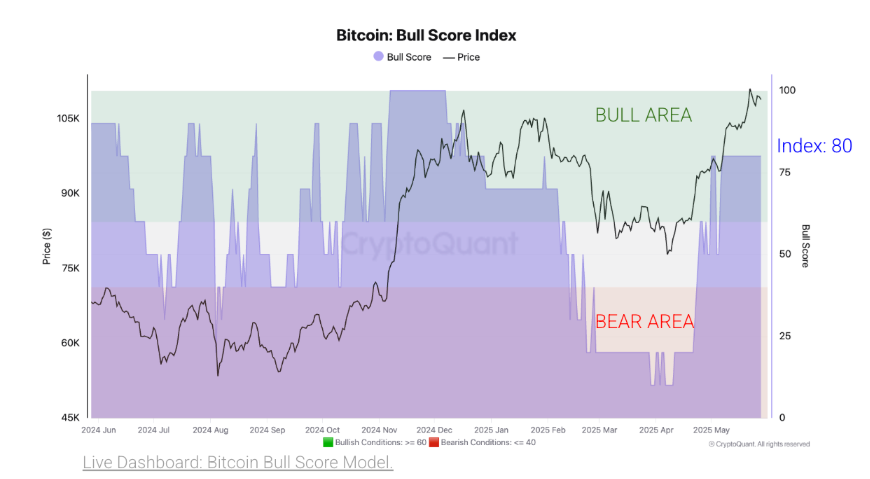

Bitcoin remains around the 105k level for now, but the bull run is still firmly in place as the Bull core index remains high at 80. Historically, BTC has continued to rally provided that the index remains above 50. With this in mind, a pullback could be short-lived.

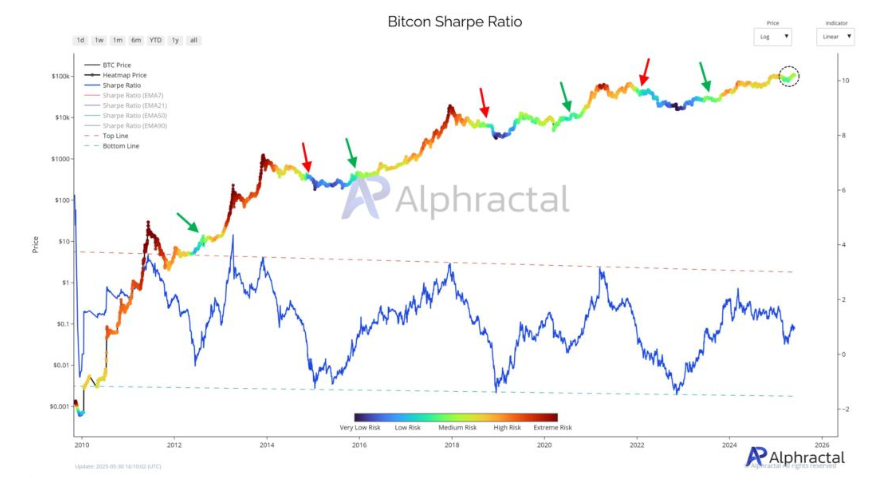

Bitcoin’s Sharpe Ratio indicates more gains

As Bitcoin’s price has cooled, the Sharpe Ratio has flashed a mid-range signal, suggesting that the market may not be overheated yet.

The Sharpe Ratio evaluates an asset’s risk-adjusted return. In this case, the indicator measures how much profit an investment offers per unit of risk, with risk measured by volatility. A rising Sharpe Ratio points to higher risk-adjusted performance.

According to Alphractical, the chart above shows that the Bitcoin Sharpe Ratio (the blue line) has not yet reached the upper trend line critical level that has served as a market peak indicator in the past. This suggests that Bitcoin is currently in a medium risk zone, where the market is less prone to uncontrolled movements. The Sharpe Ratio is still away from regions that signalled past tops in the 2013, 2017, and 2021 cycles.

However, investors may look to stay cautious until the metric climbs into extreme risk territory, especially given that June seasonality is less favourable.

Seasonality less favourable

Historically, June is a less favourable month for BTC. Typically, Bitcoin falls by 0.3% on average in June, making it the second-worst monthly performance when looking at an average since 2013. After two months of outperformance, seasonality may provide reason for caution, especially when combined with the murky macro backdrop.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.