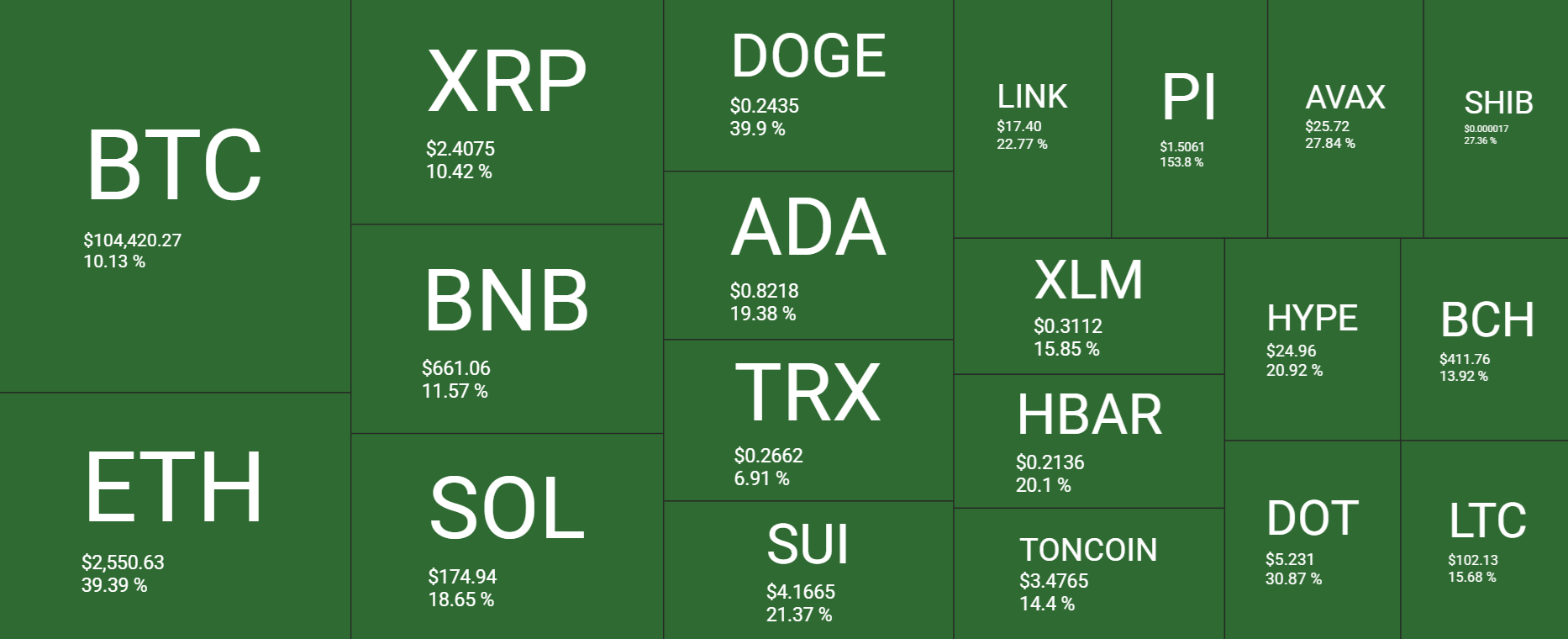

Bitcoin rose 10% across the past week, marking its third straight week of gains. The largest cryptocurrency extended its recovery from April’s 70.4K low, rising to 104.9k, over the weekend, its highest level since January 31st. BTC is rising further at the start of the new week, +2.5% to 105.5k, bringing its record high to within striking distance.

Strong gains were also seen by altcoins, many of which outperformed Bitcoin. Ethereum rose 39% over the past seven days, making it a top performer. Meanwhile, SOL gained 18%, and XRP 10%. Elsewhere, DOGE rose 39%, and PI rose 153%. Altcoins are rising strongly at the start of the new week.

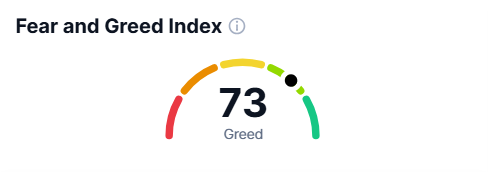

The total cryptocurrency market capitalisation has risen to $3.35 trillion amid a notable uptick across the board. This was a level last seen in early February. Meanwhile, the Fear & Greed index has risen to 73, back into Greed, rising from Neutral last week and Fear last month.

Crypto liquidations

The surge in cryptocurrencies last week, particularly on May 8, when Bitcoin rallied 6.5% from a low of 96.9k to 103.8k, caused a wave of liquidations. Liquidations reached $1.1 billion, with $835 million of those liquidated being short positions.

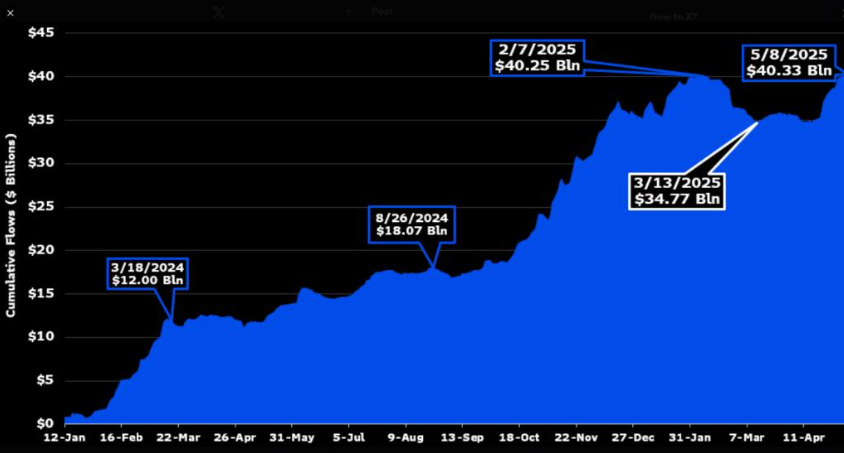

Bitcoin ETFs inflows

Bitcoin ETFs recorded $599.6 million in inflows, booking net inflows for a third straight week. This follows $1.8 billion in inflows the previous week and $3.06 billion the week before that, highlighting persistent institutional demand.

According to Bloomberg analysts James Sayffart, Bitcoin ETFs have already received over $40 billion in lifetime inflows. The rise to $40.33 billion followed inflows on May 8th, when funds’ total inflows surpassed the previous record on a single day.

When the Bitcoin Spot ETF launched in March 2024, total lifetime inflows were around $12 billion. This rose to $18 billion in August 2024 and $35 billion by March 2025, then jumped to $40 billion in just two more months. The increase points to continued Bitcoin exposure, with big money piling in as asset managers and hedge funds use ETFs to invest in Bitcoin rather than buying coins individually. ETF flows are likely to be increasingly seen as a sentiment gauge.

This week, 13F filings for Q1 2025 will provide more information on who has been buying into ETFs over the first three months of the year.

US-China trade war de-escalation

The market rallied strongly on Thursday on the outcome of a U.S. trade deal with the UK, and as the US and China met for talks this weekend in Switzerland. Following the trade talks, the US has agreed to lower imports of Chinese goods to 30% and China has agreed to lower imports on US goods to 10% in a massive de-escalation of the US-China trade war. The thawing of relations between the world’s two largest economies has boosted the market mood, lifting cryptocurrencies, U.S. stocks, and the US dollar at the start of the week.

Trade talks still appear to be the most important market driver at the moment, as evidenced by a lack of response to the Federal Reserve’s FOMC meeting on May 7th. In line with expectations, the Fed left interest rates on hold at 4.25% to 4.5%. Federal Reserve Chair Jerome Powell warned of the possibility of higher inflation and higher unemployment due to trade tariffs. Powell is due to speak again this week, and the market will watch to see whether his stance changes owing to the lower tariffs announced.

Regulatory news

This week, New Hampshire became the first state in the US to pass a Strategic Bitcoin reserve law, signaling stronger policy support for Bitcoin adoption.

Legislation proposals to establish strategic Bitcoin reserves are under consideration in 28 states. Of these eight, including Florida, Montana, South Dakota, Utah, and Wyoming, have rejected these proposals, leaving 19 states still in progress.

The US Senate failed to approve the GENIUS Act, a stablecoin bill, in a floor vote last week, with 48 votes in favour, which was below the 60 needed. However, the rejection has not dented demand for most crypto assets.

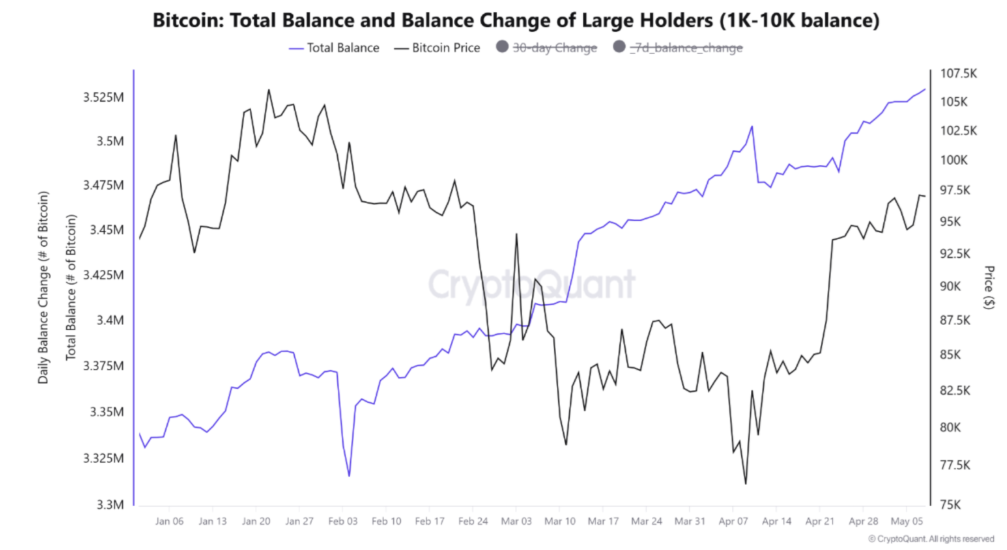

Whales continue to accumulate

According to CryptoQuant Quicktake, whale activity has risen over the past 30 days. Whale addresses holding between 1000 to 10,000 BTC have increased their total holdings by 41,300 BTC during the same period. Whale accumulation reflects growing institutional interest in the asset class despite economic uncertainty.

Corporate demand stays strong

Last week, corporations also continued to add BTC to add to their portfolios. Strategy announced at the start of last week that it acquired 1895 BTC for $480.30 million, bringing its total holdings to 555,450 BTC.

During the same period, Semler Scientific added 167 Bitcoin to its holdings, which now total 3634 BTC, making it the fourth largest Bitcoin treasury company in the US.

Demand for corporations is positive for Bitcoin as it indicates growing acceptance as a strategic asset while driving long-term adoption and demand.

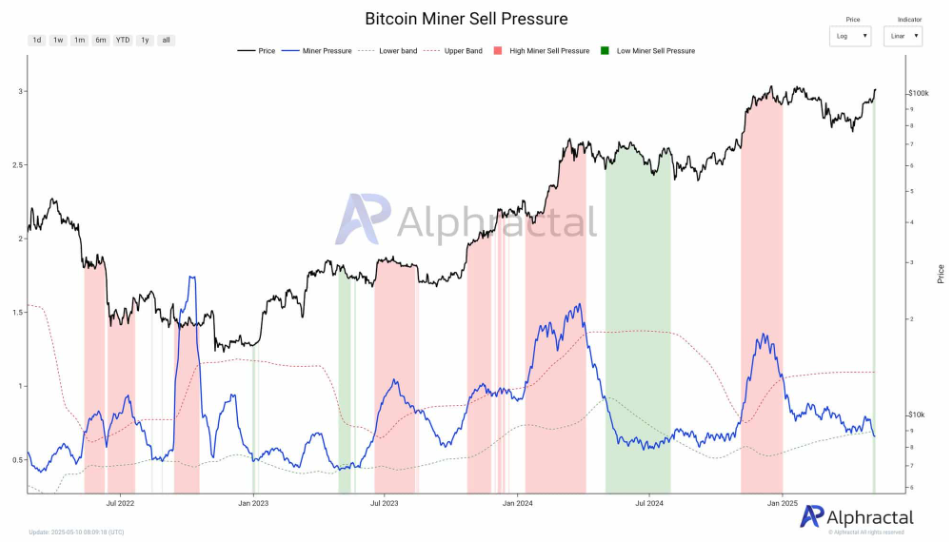

Miners selling pressure hits 2025 low

Bitcoin mining selling pressure has dropped to its lowest level since early 2024, according to Alphactical data. The miner pressure metric is hitting the lower band, suggesting that miners are choosing to hold rather than sell, which is historically a bullish signal for BTC stability and for BTC’s price amid reduced supply.

The last time selling pressure was this low, Bitcoin entered a period of relative calm before the next major move.

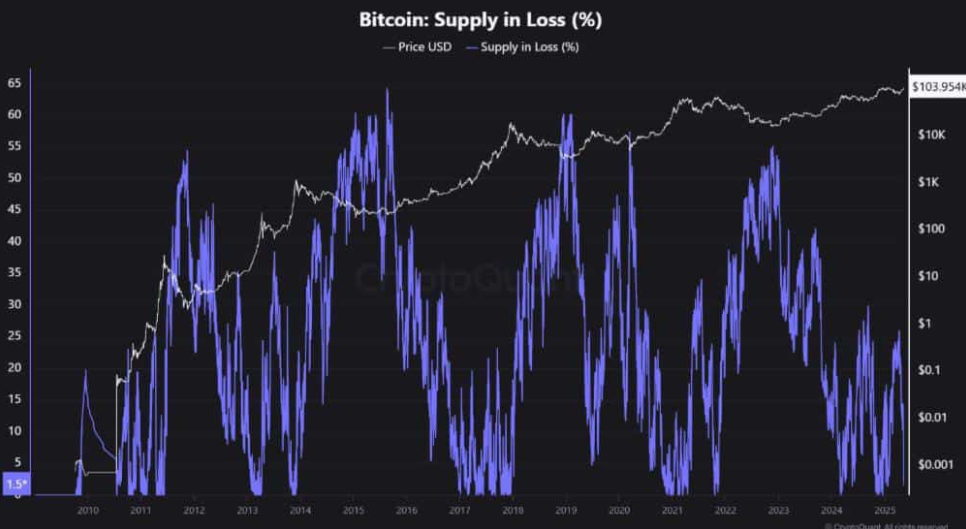

Bitcoin wallets in loss fall to a cycle low

According to data from CryptoQuant, 98% of Bitcoin holders are sitting on gains, pushing supply to under 2%, marking a historical low. Typically, these conditions align with early market euphoria, where the vast majority of holders are in profit. Meanwhile, Bitcoin’s NUPL has risen to 0.56, showing that Bitcoin holders are confident but not yet fully grown and, therefore, still foresee higher prices.

With the BTC supply at a loss below 2%, this can occur near market tops when holders become too overconfident. This is often when the NUPL rises towards 0.75. At these levels, the risk of distribution rises, and long-term holders could see this as a chance to de-risk.

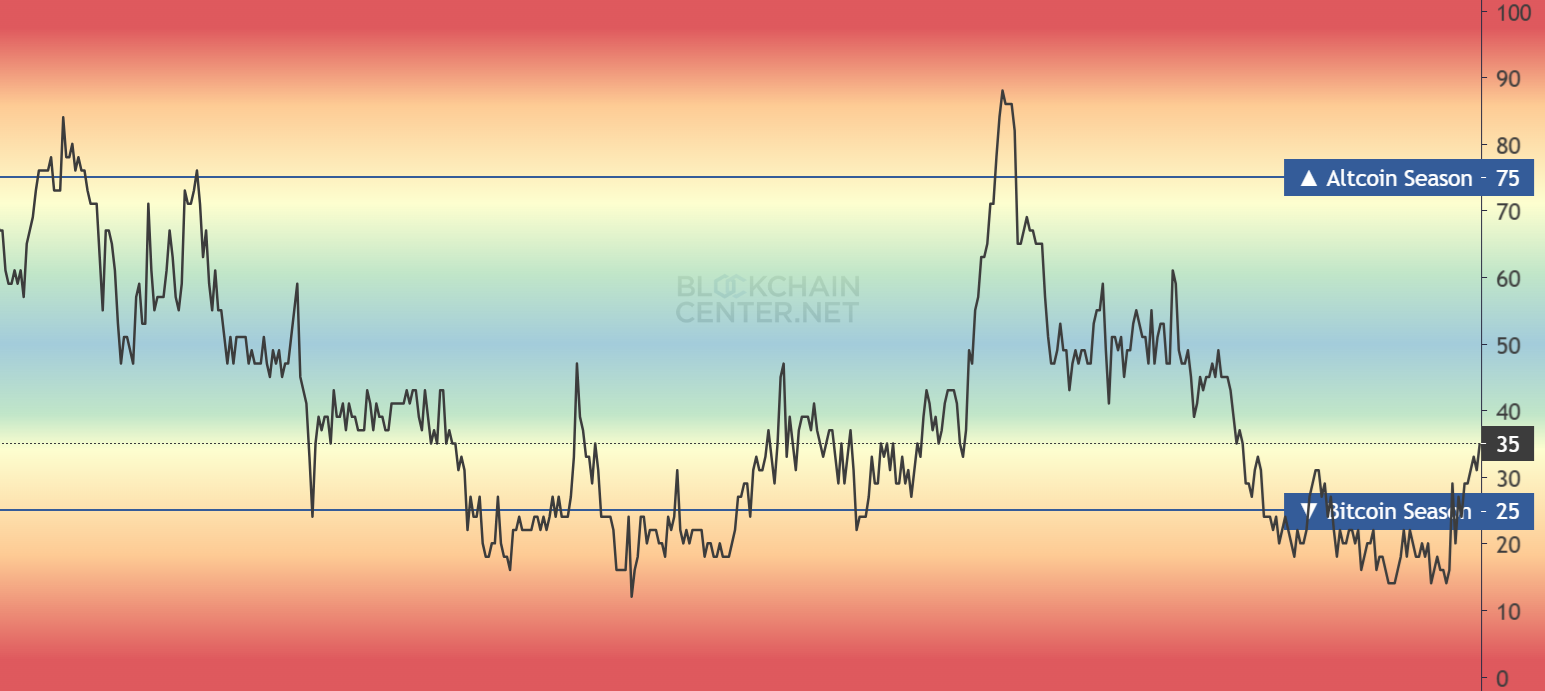

Signs of altcoin season?

Altcoins are seeing impressive gains. Ethereum has outperformed following its Pectra upgrade, and PI has surged over 30% a day. Yet despite these substantial gains, altcoin season is still some way off.

Bitcoin dominance rose to 65% last week, its highest level since 2021, up from 55% at the end of last year. The 65% level represents a significant technical resistance, historically signaling a peak for Bitcoin dominance. Upon reaching this resistance, BTC dominance dropped sharply to 62%, testing its 100 SMA.

When altcoin season does arrive, the first cryptocurrencies to benefit are typically the dinosaurs, such as Ethereum, XRP, Cardano, BNB, and Litecoin.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.