Bitcoin was unchanged across the previous week. BTC started the week at 15.8k before rising to a 6-week high of 117.9k following the Federal Reserve rate decision and then easing back to 115.8k at the end of the week. Bitcoin is falling sharply at the start of the new week in a sudden flash crash, taking BTC down to 112k. Bitcoin still trades up 4% so far across September, defying seasonality trends, with just 9 days to go until October.

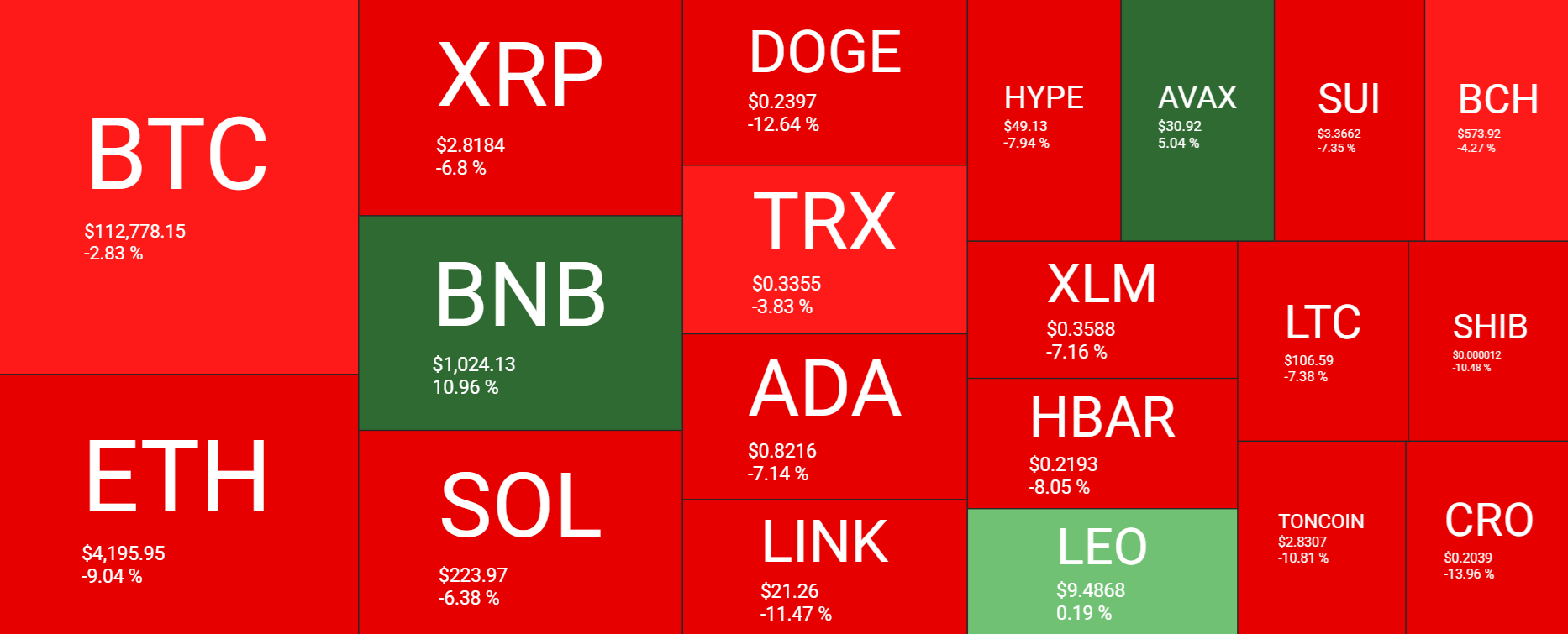

While Bitcoin was unchanged across the week, most major altcoins came under pressure and are crashing lower at the start of the new week. Altcoins are experiencing a bloodbath, with Ethereum down 9% over the past 7 days, XRP and SOL down 6%, and DOGE down 12%. Memecoins are experiencing a deeper crash. However, there have been some areas of positivity. BNB trades +10% across the past 7 days, reaching $1000, and AVAX also holds gains of over 5%.

According to CoinMarketCap, the total cryptocurrency market capitalization has tanked -3.39% over the past 24 hours to $3.89 trillion at the time of writing, down from the peak of $4.04 trillion reached on Thursday, the highest level since mid-August.

Sentiment analysis showed that the mood is neutral. The Fear and Greed Index is at 47, down from 52 last week, but still within the Neutral region. Despite the selloff, the Neutral reading suggests that investors are balanced, neither rushing into risk nor running from it.

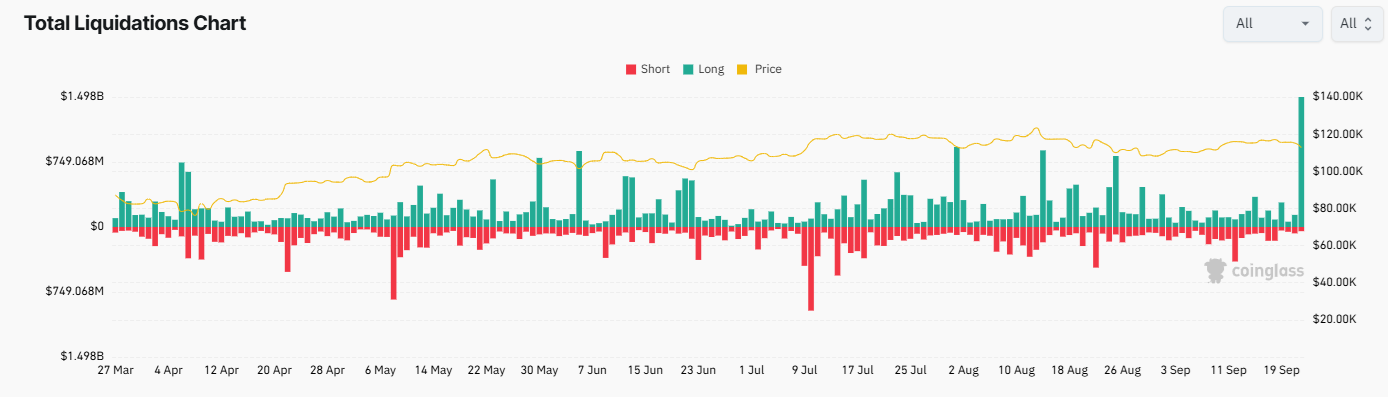

Liquidations surge as crypto bleeds

The volatility seen over the past 24 hours has resulted in a wave of liquidations. Over $1.7 billion in leveraged positions have been liquidated, 89% of which were long positions, which points to overly bullish positioning. This is the largest liquidation event this year. Over 400,000 traders have been liquidated, with the single largest position worth almost $13 million.

Macro Backdrop

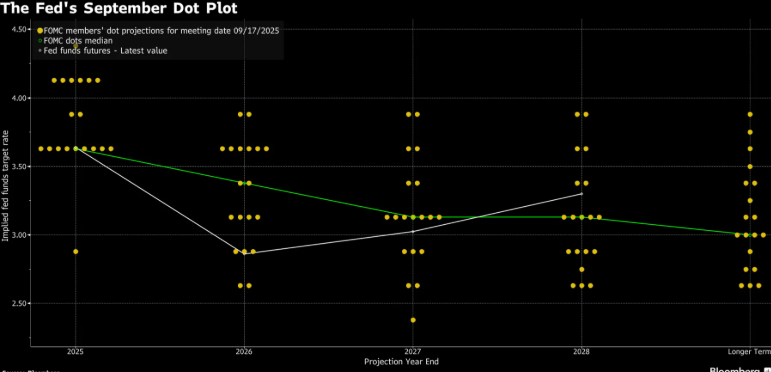

The Federal Reserve delivered a 25 basis point rate cut at the FOMC meeting on September 17 in line with expectations. The Fed’s dot plot also pointed to two additional cuts this year, with a 25-bps reduction expected in October and in December.

The Fed cut rates to support the labor market, which has shown signs of recent weakness, despite inflation rising to 2.9% YoY in August. Fed projections now anticipate unemployment rising to 4.5% PCE inflation rising to 3% and GDP growth rising to 1.6% year on year, with downside risks to employment seen as a growing concern. For now, current conditions support a risk-on stance in the markets at least until new data emerges, which may impact the Fed’s forward guidance.

The market is pricing in a 92% chance of a Fed rate cut in October, meaning that the easing cycle has been priced in and liquidity is on its way. This is the fuel that sends BTC and cryptos higher.

The post-Fed risk-on mood boosted US stocks to new record highs. The Nasdaq rallied 1.2% across the week, as did the S&P 500. Interestingly, also rose 1.1% across the past week, marking the fifth straight weekly rise, while also hitting a fresh record high above 3700, and is extending those gains to fresh record highs on Monday.

This week, attention will be on Fed speakers, including Federal Reserve Chair Jerome Powell. Friday’s core PCE could also prove to be pivotal. Should core PCE, the Fed’s preferred gauge for inflation, come in hotter than forecast, that could dampen further rate cut hopes.

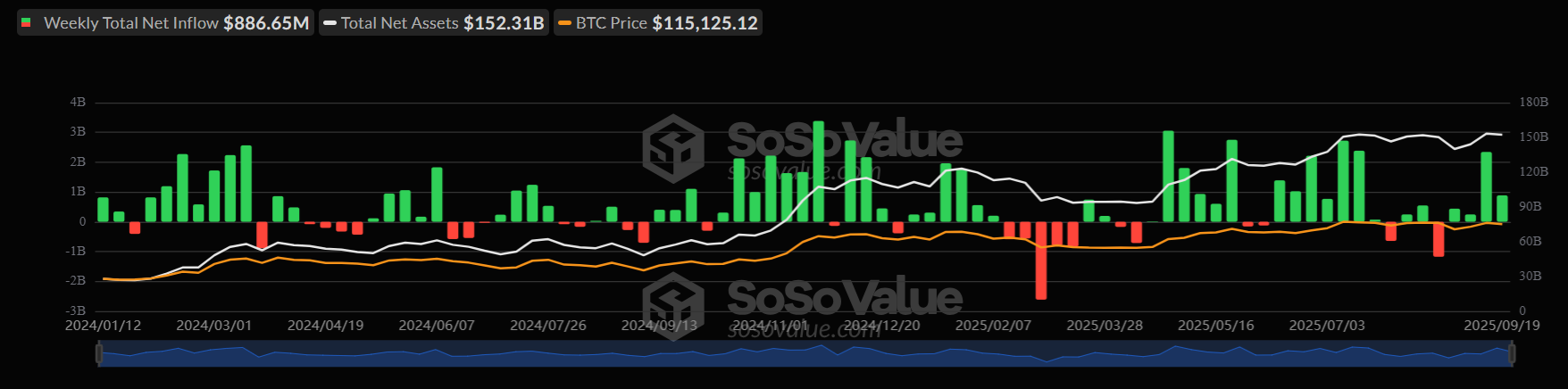

BTC institutional and corporate demand remain strong

Despite the price wobble, Bitcoin is still experiencing strong institutional and corporate demand. Bitcoin ETFs saw solid institutional demand again last week. BTC WTFs recorded $886.65 million in net inflows, marking the fourth straight month of weekly inflows. Meanwhile, September is proving to be a strong month for institutional demand with $3.4 billion in inflows so far this month. Persistent institutional demand supports the price.

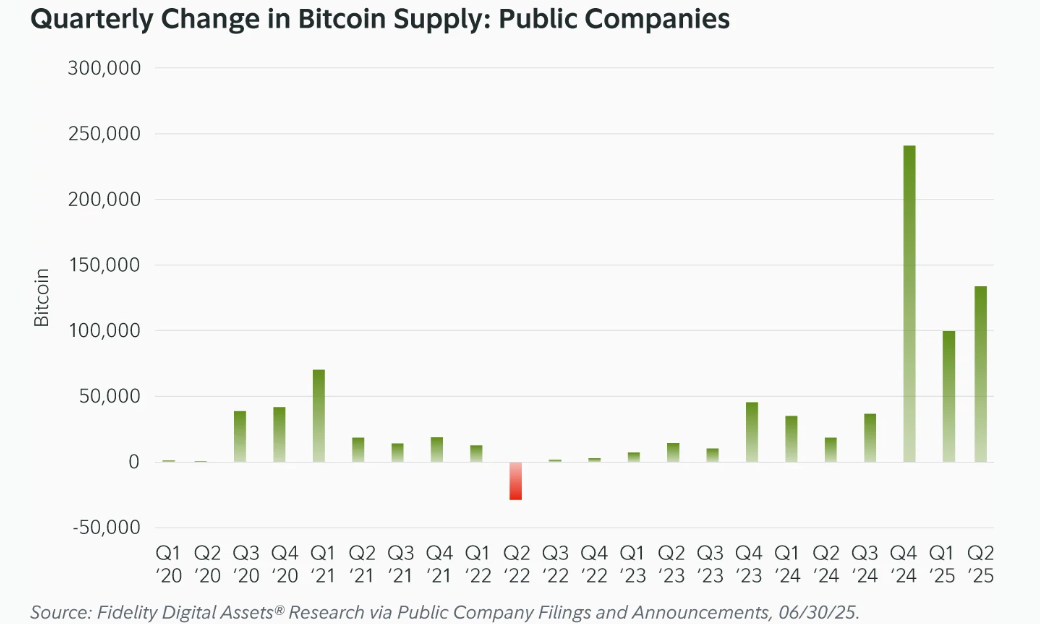

On the corporate front, demand continues to grow as Strategy announced a purchase of a further 525 BTC to its reserve, taking the total holdings to 638,985 BTC. Across the week, other firms, including Capital B and Prenetics, added 88.6 BTC. On Monday, Metaplanet announced it purchased a further 5,419 BTC, bringing the total to 25,555 BTC.

On-chain data is mixed

Despite Bitcoin’s crash to 112k, on-chain data is throwing some mixed signals. According to CryptoQuant’s on-chain data, a recent surge in network activity could have an impact on the BTC price.

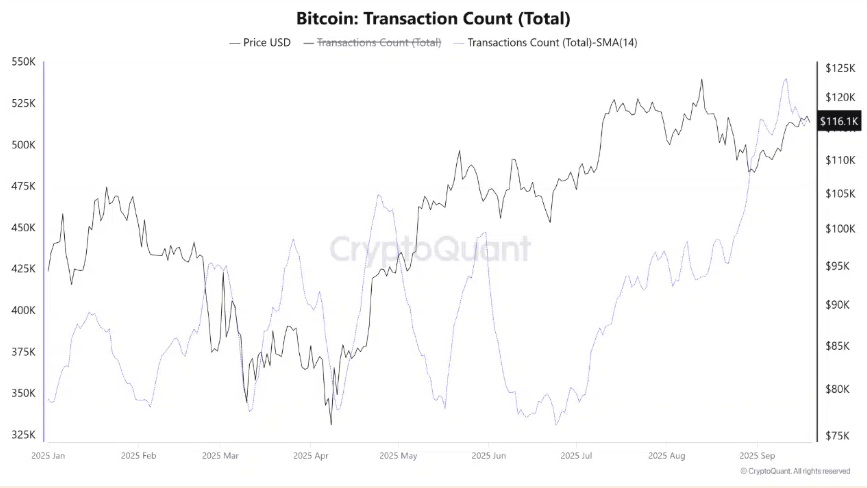

The Transaction Count Metric tracks the number of confirmed transactions on a blockchain network at a given time. According to CryptoQuant, the 14-day simple moving average of the cryptocurrency transaction count reached as high as 540,00, the highest level this year.

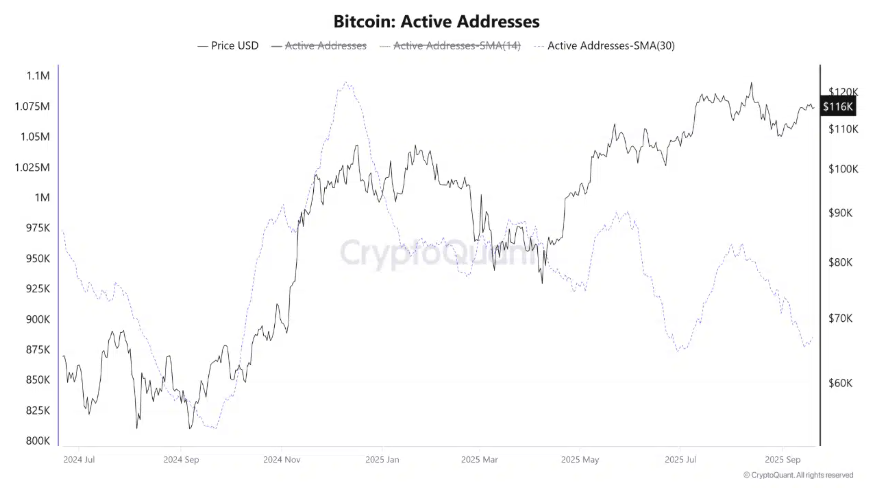

This typically suggests a significant increase in fundamental demand and network usage, which would be bullish. However, it is also worth noting that active addresses have dropped to an 11-month low, even as transaction counts soared.

These mixed messages from the data may stem from the jump in activity being driven by speculative protocols that generate low-quality traffic, thereby inflating network data without actual adoption or meaningful value transfer.

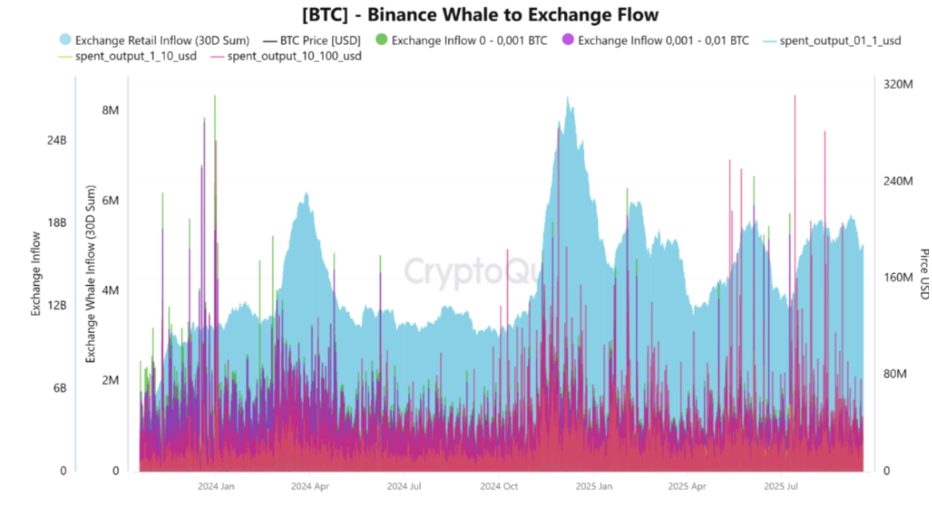

Also supporting the bearish case, the market continues to be driven by individuals rather than larger wallets. Wallets holding 0 to 0.001 BTC recorded 97,000 BTC inflows, while wallets of 0.001-0.01 amounted to 719,000 BTC from the start of the month. This drive-by retail means that a sudden influx of larger accounts or whale activity could trigger a swift correction.

Bitcoin illiquid supply hits a new high

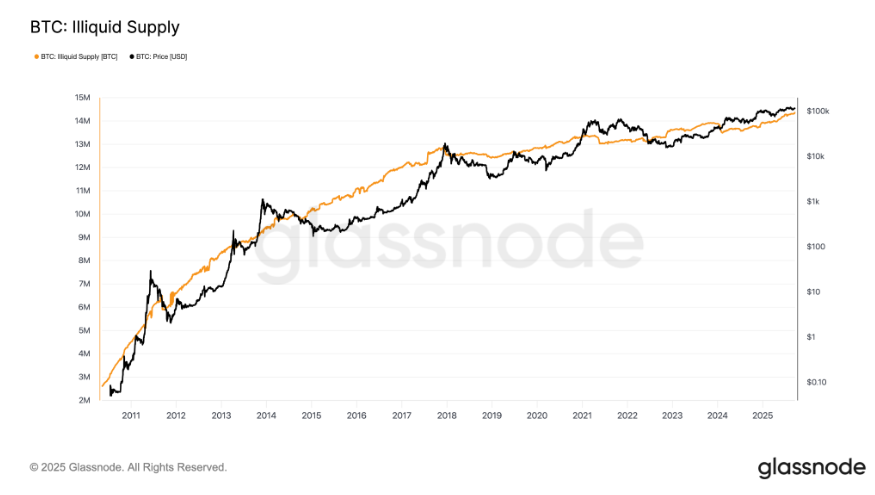

While the price is wobbling near term, the outlook for Bitcoin in Q4 remains strong. Total illiquid Bitcoin supply has reached a new high, bringing a bullish outlook to the largest cryptocurrency. Bitcoin’s illiquid supply refers to the supply that is unlikely to hit the market, given the long-term holding of the investors who own these coins.

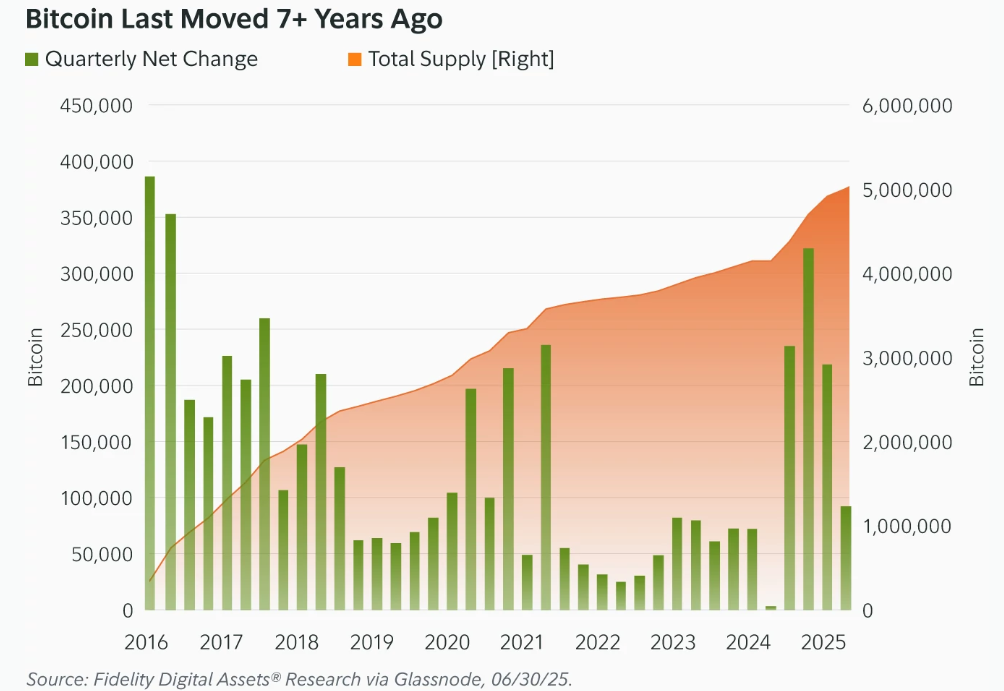

According to Glassnode data, Bitcoin’s illiquid supply has reached a new record of 14.3 million BTC, marking over 72% of the circulating supply (19.92 million). This is held by long-term holders who haven’t moved their coins and have held for over 7 years, highlighting firm conviction in the flagship crypto.

A large part of the BTC supply being in the hands of long-term holders is considered bullish as it reduces the amount of selling pressure on the coin. It could also potentially lead to a supply shock whereby demand outpaces supply.

Asset management firm Fidelity projects that Long-Term Holders (LTHs) and corporate treasuries could lock up over 6 million BTC by the end of this year, which equates to over 28% of the total crypto supply of 21 million, potentially tightening supply and boosting the price higher.

BTC supply held by LTHs has increased quarter over quarter since 2016. Meanwhile, the supply held by publicly traded companies with at least 1000 BTC has increased quarter over quarter since 2020.

The collective holdings of corporate Bitcoin strategic reserves and ETF issuers have risen 30% in 2025 to 2.88 million last week, up from 2.24 million on January 1. This highlights the persistent demand from these players, which, if it continues, could lift BTC higher in October, a typically strong month for Bitcoin and across Q4.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.