Despite rallying over 3.5% on Friday, Bitcoin fell 1.7% last week. The price dropped to a low of 112k before rebounding to 117.5k on Friday. The price then slipped lower over the weekend and is trading around 112k at the start of the new week, some 8% below its record high of 124.4k.

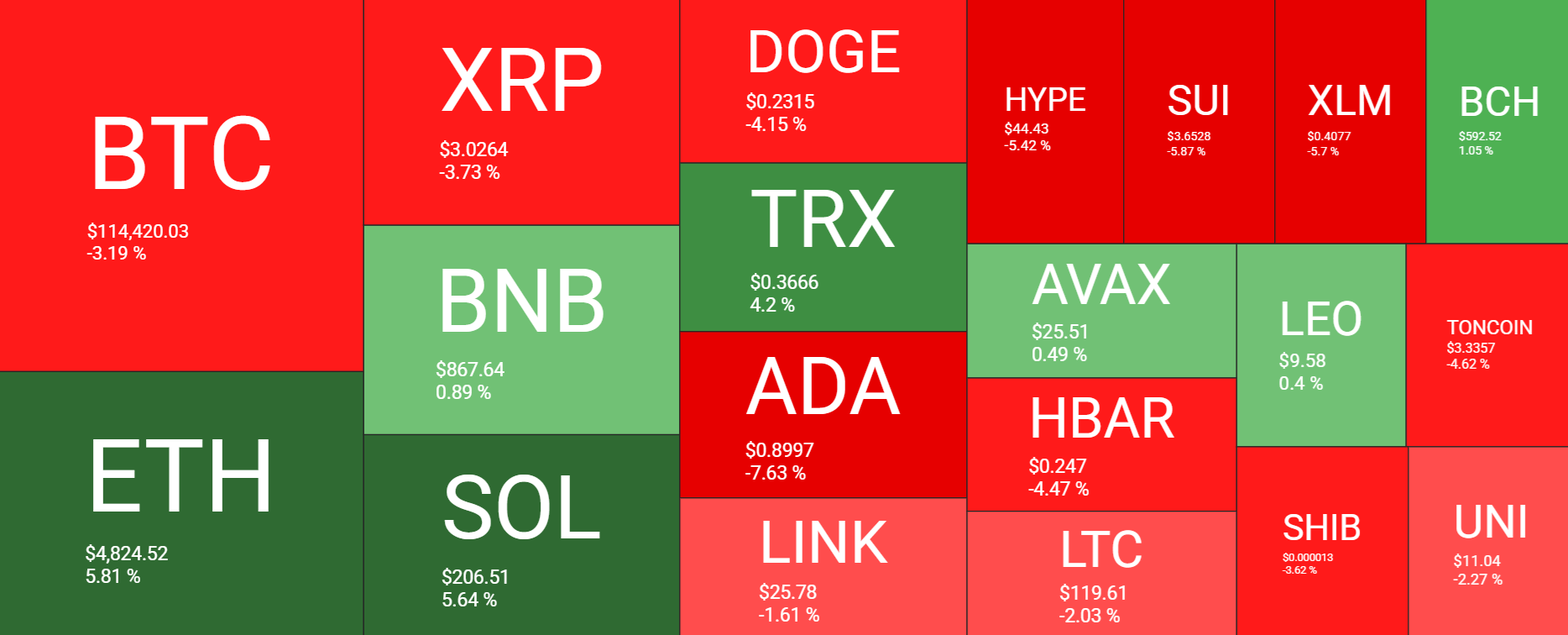

The picture across the broader crypto market was more of a mixed bag. While BTC was down 3% over the past 7 days, Ethereum jumped 5%, as did Solana, highlighting the ongoing divergence between ETH and BTC. However, XRP fell 3.7% across the week, Doge dropped 4% and ADA fell 7.6%.

The broader cryptocurrency market capitalisation is at $3.9 trillion at the time of writing, down $4.04 trillion on Friday and from $4.04 trillion a week earlier, and down from the record $4.20 trillion reached 10 days ago. The Fear and Greed Index is at 53, showing sentiment to be Neutral. This was slightly lower than 57 (Neutral) a week earlier and 67 (Greed) last month.

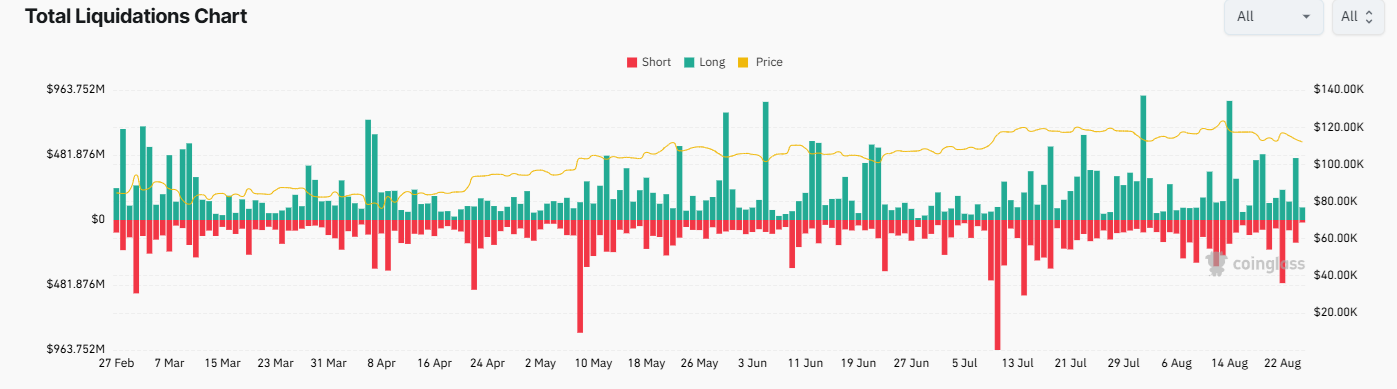

Liquidations

Crypto liquidations surged on Sunday as Bitcoin fell away from its recent 117k high to a low of 111k. The crypto market experienced $717 million in liquidations over the past 24 hours, with the majority of those being long positions. $555 million of long positions were liquidated as the market tumbled, signaling extreme volatility and shifting market sentiment.

Bitcoin faced the most severe impact, with $236.43 million in liquidations reported in a day, of which 94.9% were long positions. This suggests a sudden and significant price move caught bullish traders off guard.

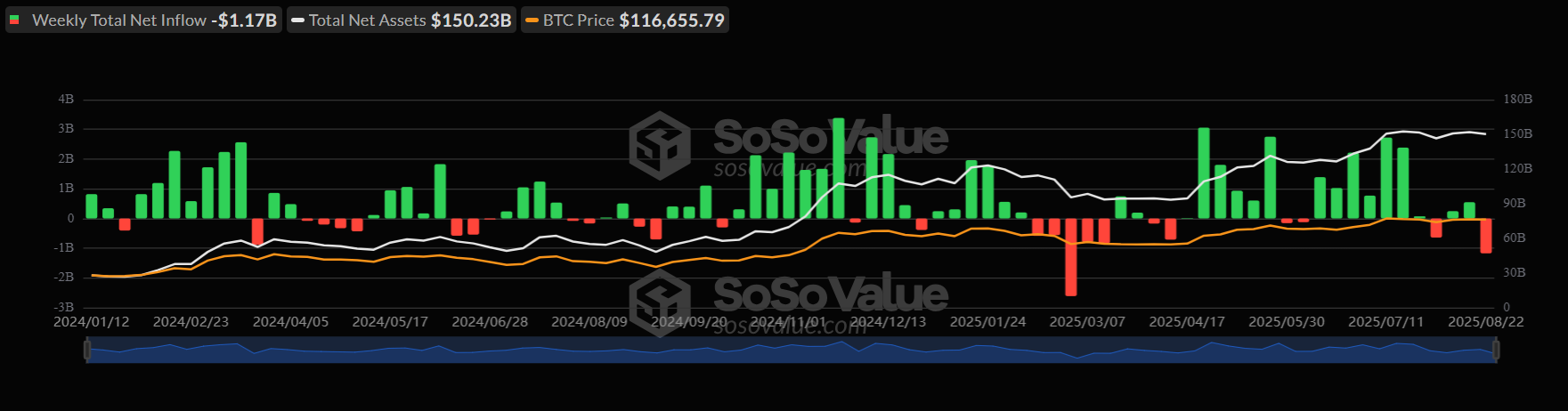

Bitcoin ETFs recorded over $1 billion in outflows

Bitcoin spot ETF demand tumbled last week, with BTC ETF recording outflows $1.17 billion, the first weekly decline after two weeks of net inflows. This also marked the largest net outflows since late February, when the Bitcoin price plunged 10% across the week to a low of 78k.

The spot BTC 30-day net purchases hover around 11,000, a level not seen since April.7

Corporate demand

Despite BTC struggling last week and elevated institutional outflows, corporations added to their crypto treasuries. Metaplanet and Strategy added a total of 1,185 BTC on Monday last week, buying the dip. However, institutional buyers have slowed the pace of purchases. Strategy has seen its purchase fall from a November peak of 171,000 to 27,000 over the past 30 days.

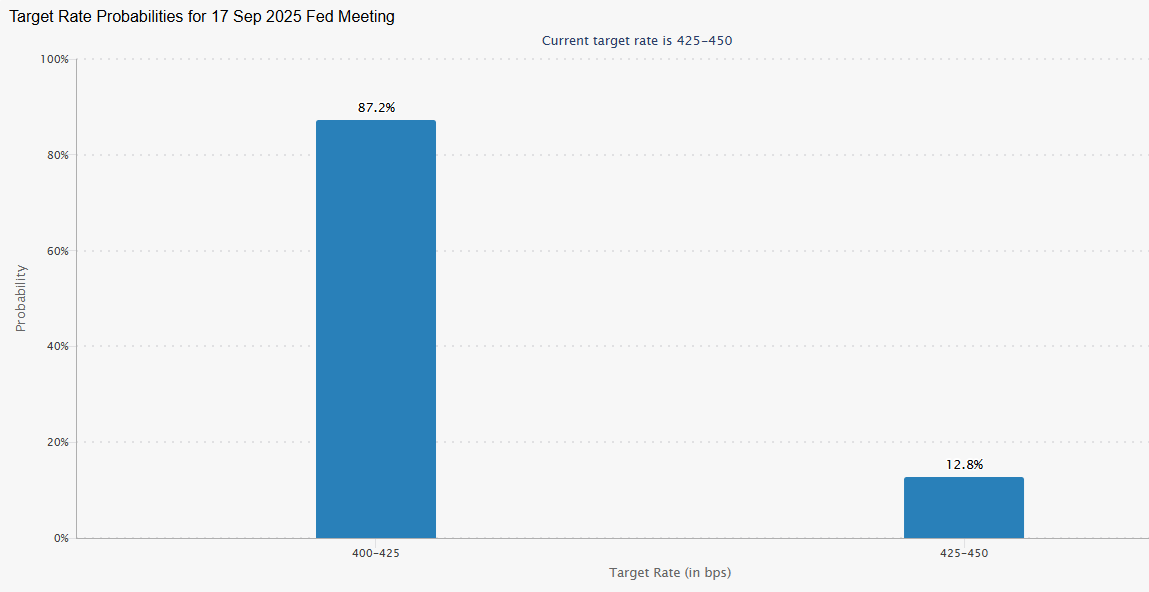

Macro backdrop – Fed rate cuts are coming

The market was almost solely focused on Federal Reserve Chair Jerome Powell’s speech at Jackson Hole on Friday, and Powell didn’t disappoint. The Federal Reserve chair opened the door to a Federal Reserve rate cut in September, saying a softening US labour market could offset risks that Trump’s tariffs will worsen inflation.

Powell noted that this shifting balance of risks may warrant adjusting policy stance, signalling that he could support a 25 basis point rate cut at the central bank’s next meeting in September.

The highly anticipated speech was met with enthusiasm as investors ramped up rate cut expectations. The market is now pricing in an 87% probability of a 25 basis point rate cut next month. A lower interest rate environment is considered beneficial for risk assets such as crypto. US stocks also rebounded firmly higher, closing in on record levels.

BTC gains are short-lived amid whale movement

Bitcoin’s price dipped over the weekend following the short-lived Powell-inspired rally, suggesting that large holders are shifting their positions away from Bitcoin. BTC’s spike after Powell’s speech was driven by thin liquidity rather than lasting conviction. Once leverage had unwound and in the absence of a fresh catalyst, momentum quickly faded, pulling BTC back to lower levels.

According to WhaleWire, a single whale also sold over 24,000 BTC over the past several days, triggering a panic cascade within the market. Most of the money, according to WhaleWire, is being moved to Ethereum.

BTC’s profit-taking phase

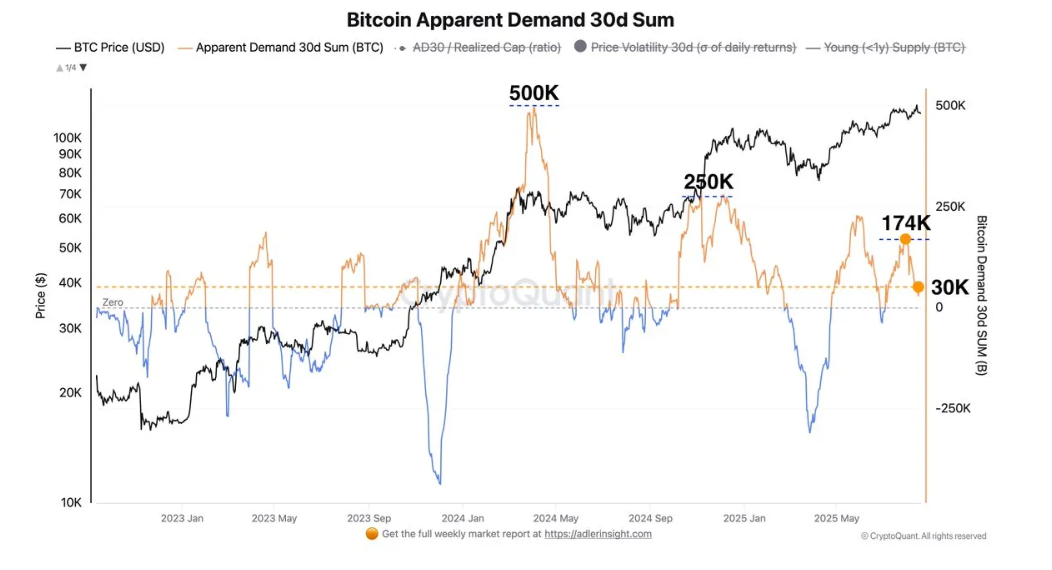

Bitcoin’s momentum has slowed in recent weeks as investors continue to lock in profits. Slowing demand is contributing to the slowdown. According to CryptoQuant, the Bitcoin market has moved from extra bullish to a bullish cooldown phase.

During this cool-down phase, BTC’s apparent demand has dropped from a July peak of 174,000 BTC to 59,000 BTC, which likely contributed to the recent price correction. Should demand continue to soften, BTC could fall lower.

Furthermore, new whale investors have also been booking profits. This cohort of investors had led a move that realized at least $74 billion in profits since July 4. Since then, the market has relentlessly booked profits.

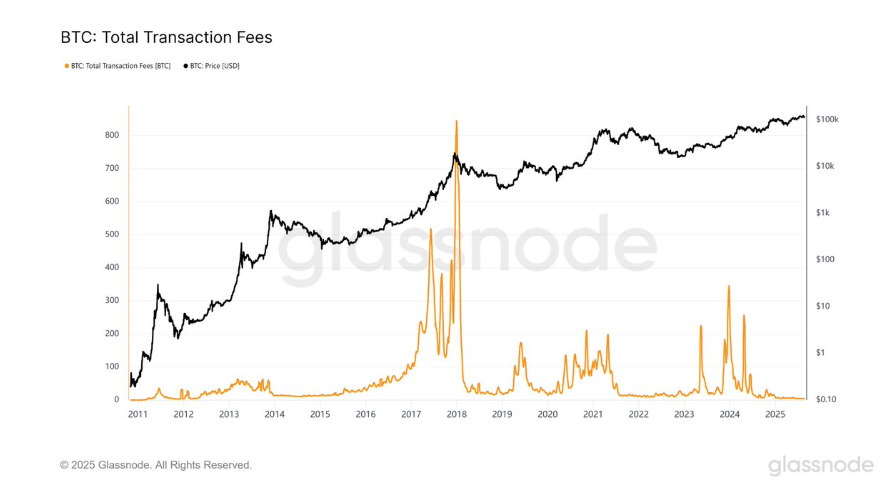

According to data from Glassnode, the daily transaction fee on the BTC network recently dropped to 3.5 BTC, marking the lowest level since late 2011. The decline usually suggests a lack of demand and could hint at a price drop in the foreseeable future.

ETH hits a record high

Following Federal Reserve chair Jerome Powell’s speech, Ethereum pushed above 4800 for the first time in 4 years, surpassing the November 2021 high of 4868 to reach a new record high at 4955. ETH has rallied over 100% since July and more than 200% since early April as it recovered from a low of 1500.

Institutional & corporate treasury demand

The explosive growth has been driven by sustained accumulation by Digital Asset treasuries (DATs) and institutional investors. Since early July, institutional investors have purchased almost 3 million ETH, led by BitMine Immersion and SharpLink Gaming.

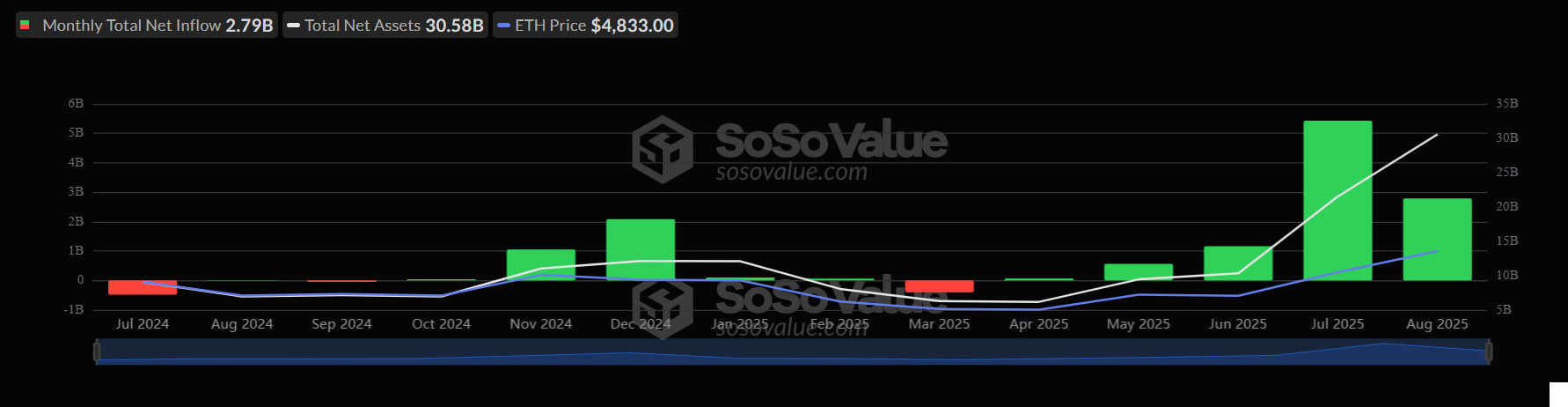

Meanwhile, institutions have also shown persistent demand, with ETH ETFs seeing over $9 billion in net inflows since June. August is on track to be the fifth straight month of net inflows, with $2.79 billion in net inflows this month, clearly outperforming BTC, which has seen $-1.19 billion in net outflows in August, its first month of outflows since March.

Whale migration to Ethereum

Adding to Ethereum momentum, major Bitcoin whales are shifting billions from BTC into ETH. According to Lookonchain, a whale sold 4000 BTC worth around $460 million U.S. dollars to accumulate 179,448 ETH worth around $806 million.

Delving deeper into Ethereum’s rally

Ethereum’s outperformance has been evident in recent weeks. The ETH/BTC ratio surged through 0.04 resistance, and the setup points to rotation out of Bitcoin into Ethereum. However, there could be signs of structural divergence.

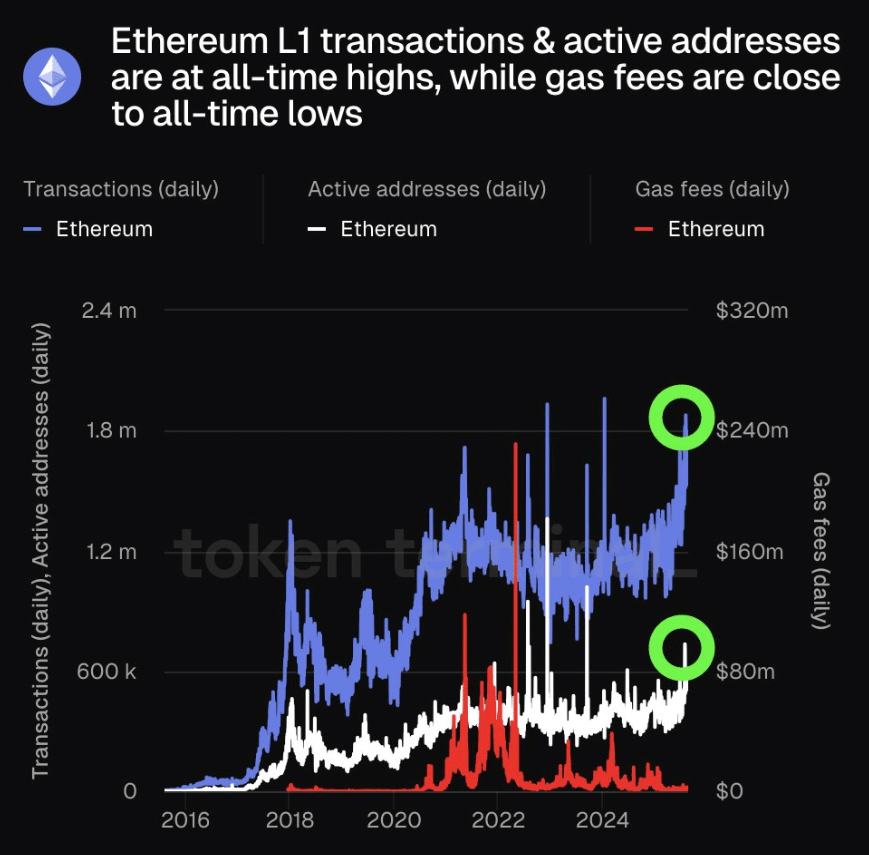

ETH’s daily transactions have soared past 2 million, and active addresses are near 700k, marking levels that used to trigger gas blowouts. This cycle, however, fees remain compressed, anchored near cycle lows. Following protocol upgrades, EIP-1559 and L2 settlement, Ethereum is scaling horizontally.

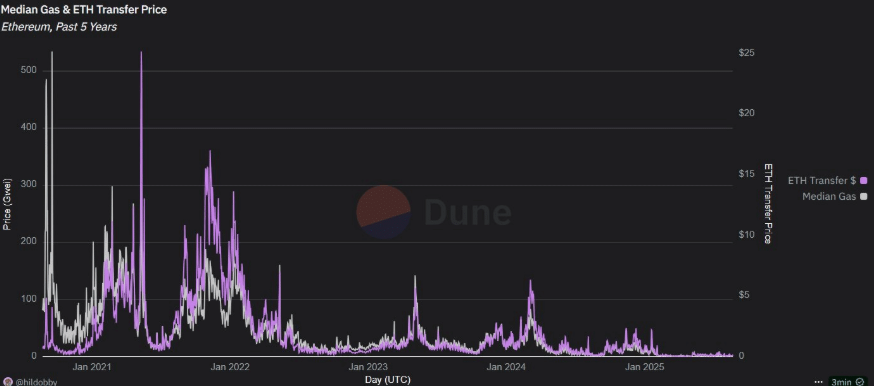

Historically, ETH transfer prices have spiked during congestion, especially in the 2021-2022 NFT and DeFi booms. However, as the chart below shows, these spikes are now smaller and less frequent.

Over the past week, ETH’s median daily gas stayed sub-1 gwei. Furthermore, mid-August daily gas hit its lowest levels in 5years.

Why does this matter? In previous cycles, the ETH rally has often stalled when gas spiked. In 2021, ETH topped out at 4.8k as median gas and transfer costs soared as the network hit throughput limits.

Now, ETH is in price discovery mode, yet the fees and transfer metrics haven’t moved, meaning there is plenty of bandwidth for more on-chain activity and potentially a move towards 5k and higher.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.