Bitcoin rose 5% last week, marking a second week of gains. BTC recovered from 110.3k at the start of last week to 116.6k on Friday, a three-week high. BTC trades above 116k at the start of the new week ahead of the FOMC rate decision, as institutional demand returns and stablecoin exchange reserves reach a record high. But with a whale offloading and altcoin season here, will BTC struggle to reach 120k?

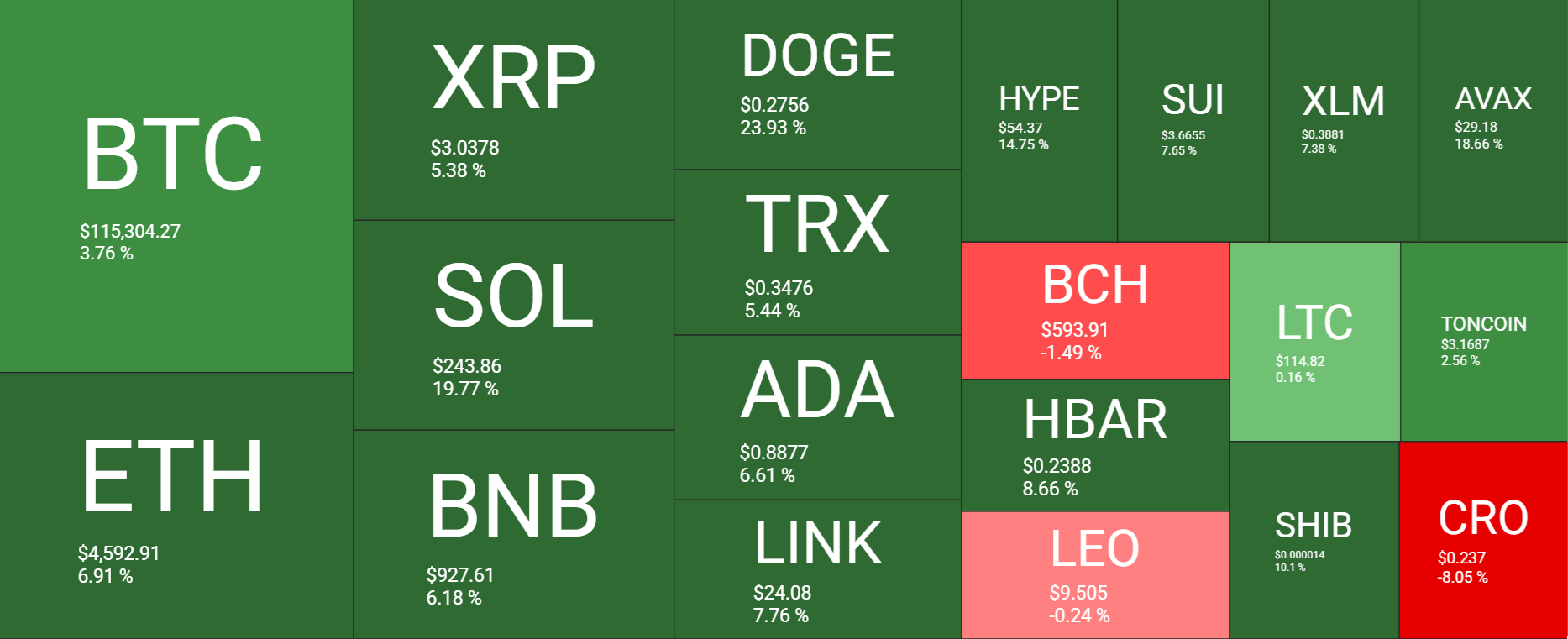

Over the past 7 days, major altcoins stole the show, outperforming Bitcoin. Ethereum, the second-largest crypto by market cap, rose almost 7%, hitting 4760 on Saturday. XRP was up 5% whilst SOL jumped 20% to 250, a level last seen in January. DOGE gained almost 24% across the period. BCH, LEO, and CRO were among the few decliners.

The crypto market capitalization rose to a peak of $4.09 trillion on Saturday, up from $3.79 trillion a week ago. This level was last seen a month ago when BTC reached its record high.

Sentiment analysis shows that the mood towards crypto is neutral at 51, up from the 40 level last week. However, the steady state means that traders are still cautious and hesitant to commit heavily until there is a stronger signal.

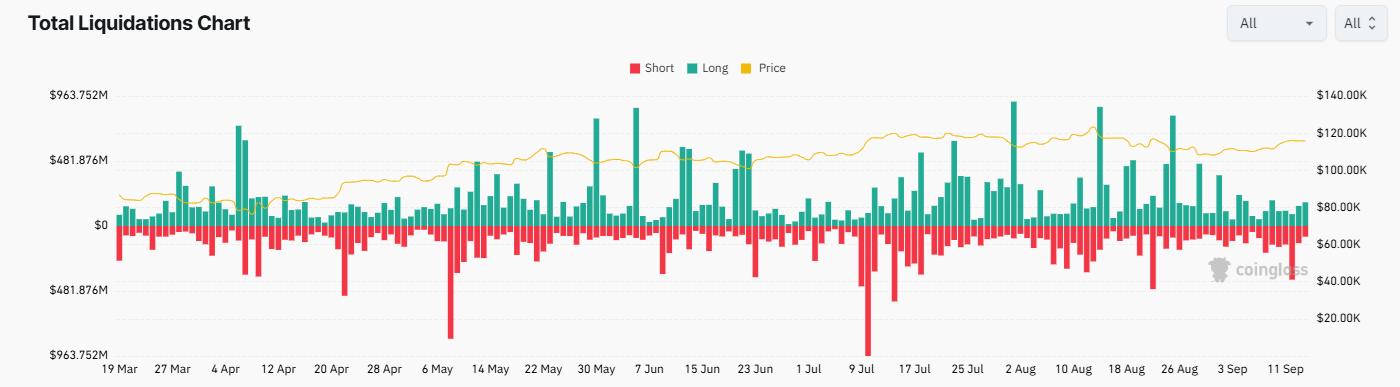

Liquidations

Liquidations were relatively muted across the week, except Friday, when BTC jumped to 116k, sparking a wave of short liquidations. A total of $484 million in crypto was liquidated, with $397 million of that amount being short positions. This marked the largest short liquidation event since August 22.

Macro Backdrop

Bitcoin and the crypto market rose, along with US stocks, which reached fresh record highs, as risk appetite picked up on expectations that the Federal Reserve will cut interest rates at the FOMC meeting this week.

The US producer price index (PPI) rose to 2.6% YoY in August, down from 3.1% in July. On a monthly basis, PPI fell for the first time since April. Week PPI pressures, despite Trump’s tariff, could be seen as a sign of softening domestic demand. Meanwhile, the US CPI inflation rate was in line with forecasts at 2.9% YoY in August from 2.7% in July.

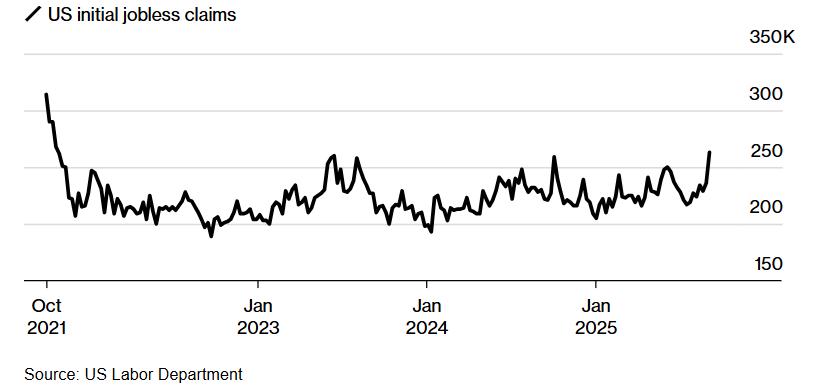

However, the positive tone in the markets came amid signs of the US labour market weakening. The Bureau of Labour Statistics downwardly revised payrolls for the 12 months through to March 2025 by 911,000. Separately, US weekly initial jobless claims jumped to 263,000, the highest level since October 21. These data points come after a weak NFP earlier in the month, supporting the case for more aggressive policy easing by the Fed.

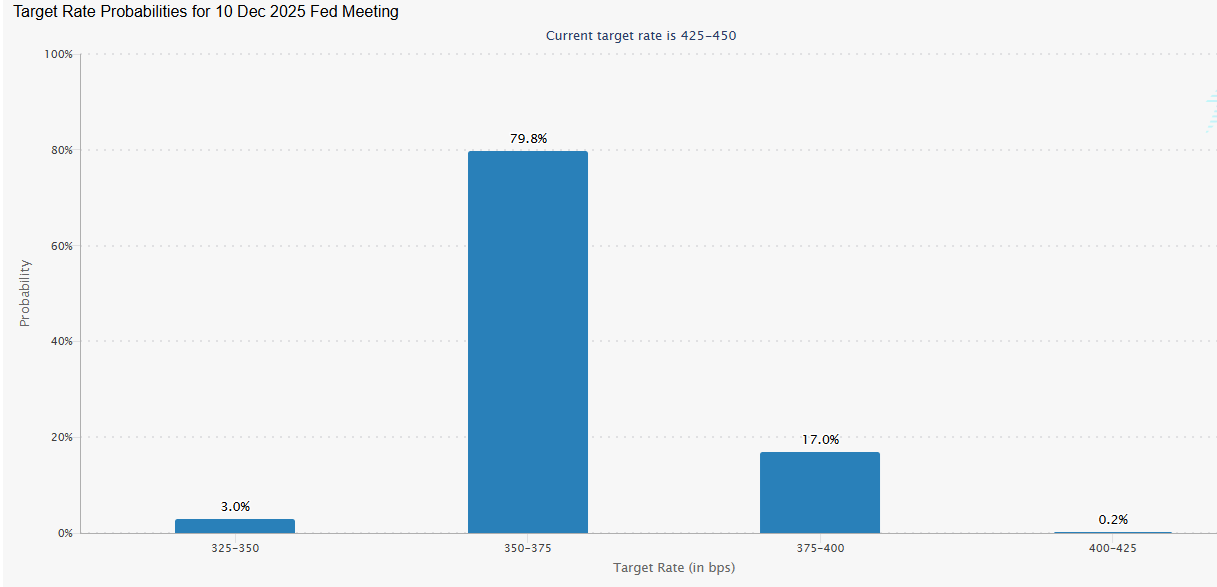

FOMC rate cut

The market is fully pricing in a rate cut on Wednesday – 97% chance of a 25 basis point rate reduction and a 3% chance of an outsized 50 basis point cut. We expect the Fed to opt for a 25 bps move given that CPI remains sticky. The focus will be on the Fed’s projections and dot plot, which will provide clues about the Fed’s plans for the rest of the year. The market is pricing in 70 basis points of cuts before the end of the year, more than what the Fed has guided for previously. However, given recent data, the Fed could point to more rate cuts coming. A dovish-sounding Fed could boost Bitcoin, Gold, and US stocks. Bitcoin often performs well in low-interest-rate environments due to increased liquidity.

BTC institutional demand jumps

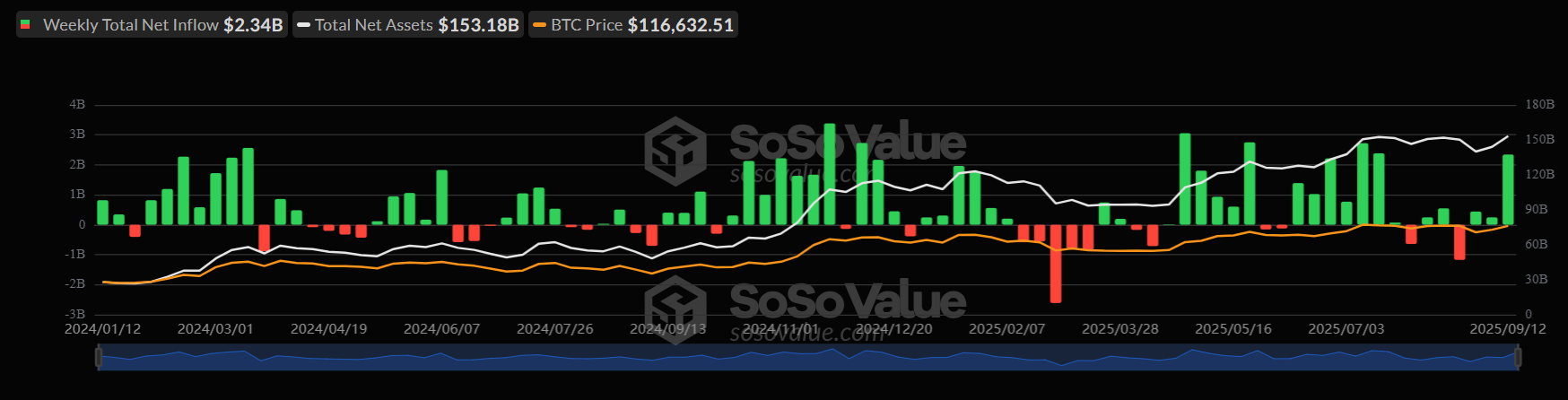

The recovery in BTC’s price has also been supported by institutional investors last week. According to SoSo data, BTC ETFs recorded five straight days of net inflows. Across the week, inflows reached $2.34 billion, a level last seen in mid-July, signaling renewed institutional demand. Should inflows remain persistent, the BTC price could continue to rise.

On the corporate side, demand remained strong. Strategy announced a further 1955 BTC acquisition for $217.4 million at the start of last week, and on the same day, Japanese Metaplanet purchased 136 BTC. Corporate purchases of BTC and other cryptocurrencies increase demand; however, those firms are no longer reaping the rewards. Companies that accumulate and hold Bitcoin and other cryptocurrencies have seen their share prices fall recently, even as BTC and the crypto market gained.

Investors had been snapping up their shares, encouraged by Bitcoin’s rise and Trump’s embracing of the sector. However, Meta Planet is trading down 60% from its peak in June, its weakest level since May, whilst Strategy has also dropped to April lows, pointing to a level of caution.

Bitcoin whale renews selloff

A long-term Bitcoin holder, who sold $4 billion of his BTC holding for Ether last month, has started selling Bitcoin again as it crossed the 116,000 level. Two Bitcoin wallets tied to the address deposited 1,176 BTC worth over $136 million on the trading platform HyperLiquid on Sunday and are starting to sell.

Whale movements can provide clues as to where the Smart Money interest is shifting.

Data indicates that recent price action has been driven by retail, as whales have stepped back, potentially explaining bitcoin’s sideways drift. Between early April and late May, both big and small whales repositioned while volumes were high. Since then, retailer traders have been more in control. This isn’t unusual, and whales often appear at strong support zones or when a new trend is about to take shape.

Stablecoin reserves on exchange reach record level

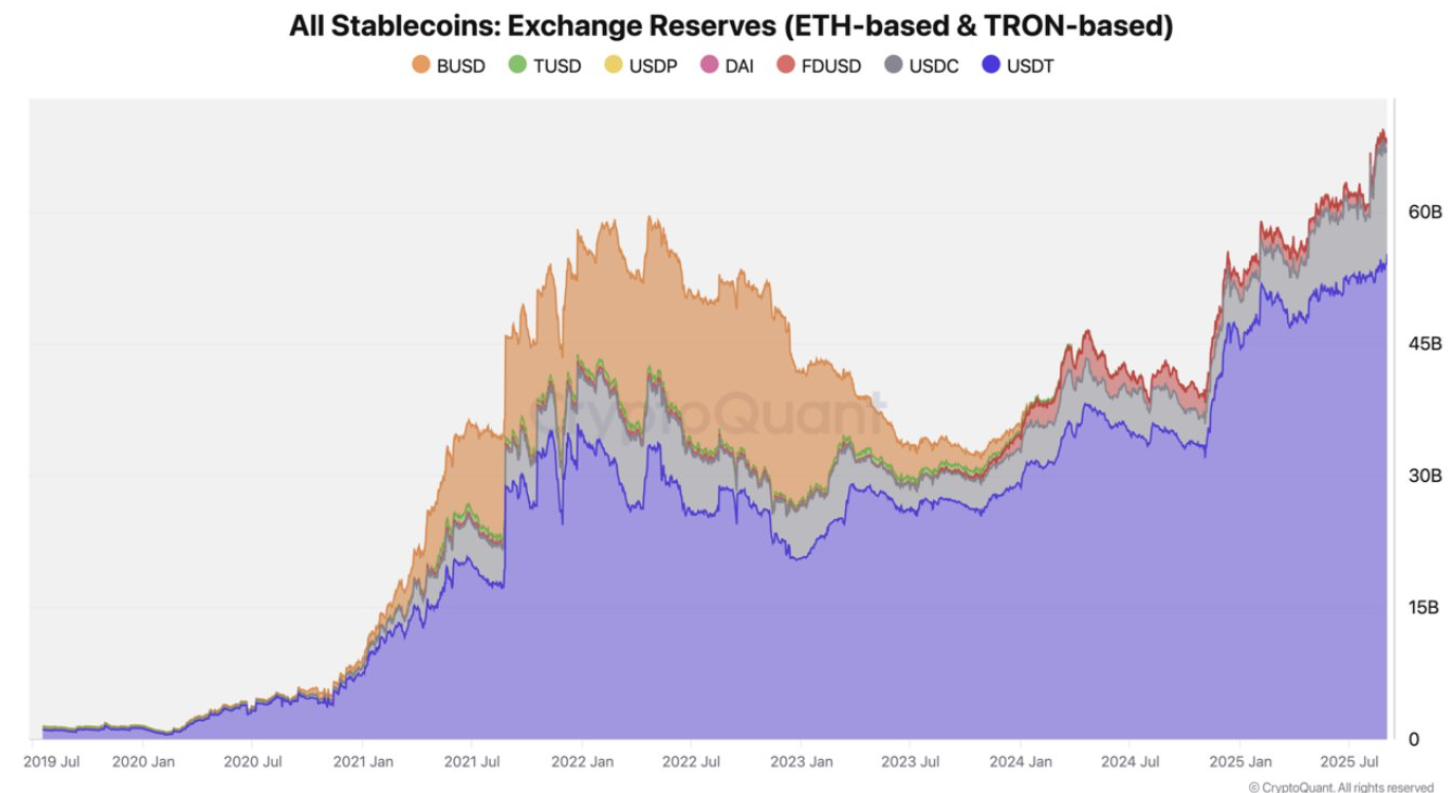

Stable coin holdings at an exchange hit a record level of over $70 billion, surpassing the 2021 bull market peak of approximately $60 billion. Stablecoins are generally considered a form of dry powder for buying crypto. This represents a massive pool of liquidity ready to deploy, which could support Bitcoin and crypto prices higher.

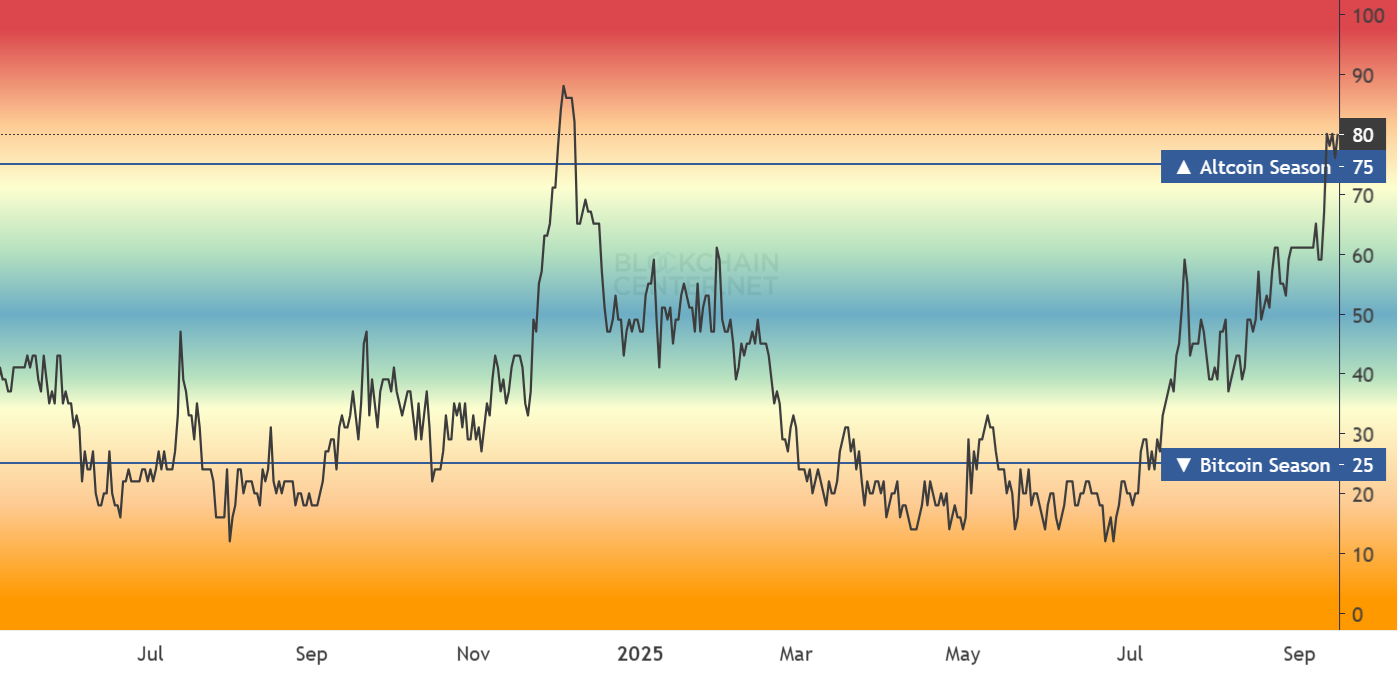

Altcoin season is arriving

According to the altcoin season index from blockchaincenter.net, the altcoin season officially kicked off this week. The Altcoin Season Index broke past the 75 mark on September 10. Altcoin Season officially begins when the ASI is above 75, meaning that three-quarters of the top 50 altcoins have outpaced Bitcoin’s market performance over the past 90 days. Whether this marks a lasting shift or another fleeting burst, like that of December 2024, remains to be seen.

BTC dominance falls

Bitcoin dominance, a key metric that is used to understand how capital is distributed across the crypto market, has fallen to 57% -58%. This means that Bitcoin is still the primary focus for many investors; however, there is also plenty of room for capital to rotate into altcoins. A drop below the support resistance level for 2020-21 could be a positive development for altcoins.

Meanwhile, the TOTAL3 gauge, which measures the crypto market capitalization excluding BTC and ETH, neared a weekly close above $1.13 trillion. This was a level first reached in November 2021 and retested in December last year when the price failed to settle above this level, underscoring its importance. Therefore, a weekly close above this level could be a sign of strength for the altcoin market. This does not signal a full-blown altcoin season, but it does show a high chance of altcoins seeing solid gains in the coming months.

Major altcoin narratives build

Not all altcoins are guaranteed to perform well. However, certain coins are already seeing notable gains. SOL has been an impressive performer, boosted by growing treasury plays from institutions and rising ETF optimism. SOL treasury accumulation over the past month was over 2.6 million SOL bought.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.