Bitcoin gained 14% last week, adding to gains of 10% in the previous week, and rose to a fresh all-time high of 93.5k. The price started last week at 90.5k before rising to 93.5k on Wednesday, November 13, and then consolidating around 90k throughout the remainder of the week. Bitcoin booked its best weekly performance since February 25 and is heading higher at the start of this week towards 92k.

Interestingly, the picture was more mixed across the altcoin space, with some tokens outperforming Bitcoin and others booking losses across the week. For example, Ether fell over 3.5%, and BNB was also in the red. However, DOGE surged 47%, and XRP booked gains of almost 80%.

BTC ETFs

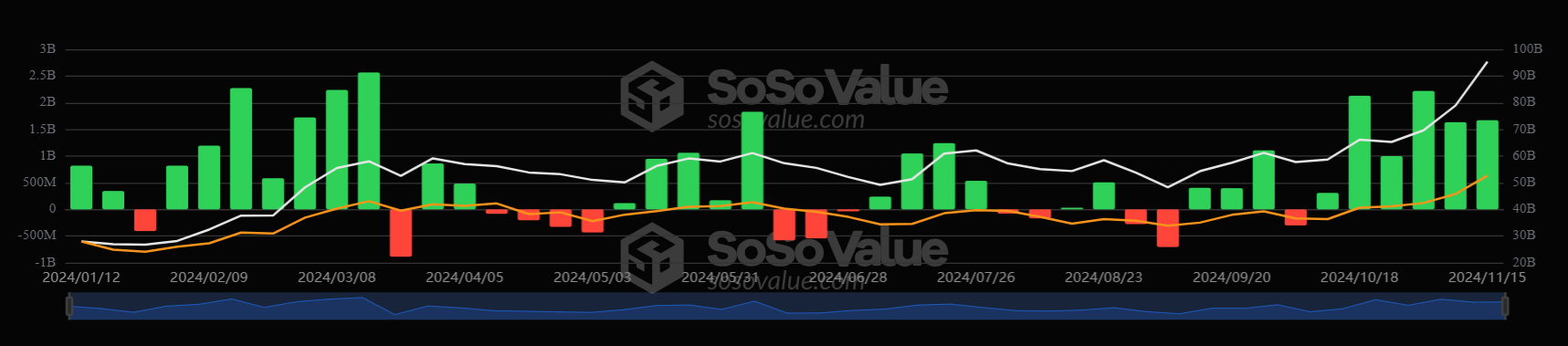

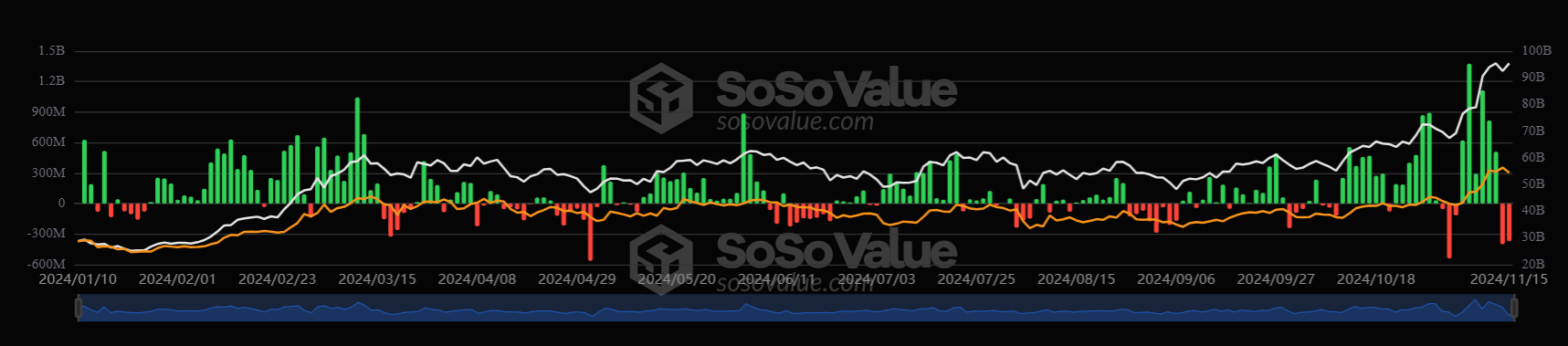

Spot Bitcoin and Ether ETFs have picked up significantly since the election on November 5, with $4.73 billion and $796 million in net inflows, respectively.

Bitcoin booked a sixth straight week of inflows. According to SoSo Value data, BTC ETFs saw net inflows of $1.67 billion, slightly up from the $1.63 billion in inflows in the previous week but below the record $2.57 billion in inflows seen in March, when the price reached 73,750.

Breaking the figures down, on a daily basis, spot BTC saw record inflows of $1.3 billion on Monday, with positive inflows also seen on Tuesday and Wednesday when the price shot up and peaked at its all-time high. The landscape then changed as investors pulled out $400 million on Thursday and $239.6 million on Friday, marking the first outflows since Trump won the election, an event that sent Bitcoin soaring.

Perhaps more surprising was the largest influx of capital into ETH ETFs since they launched in July. Cumulative inflows into ETH turned positive on November 12th for only the second time since its launch.

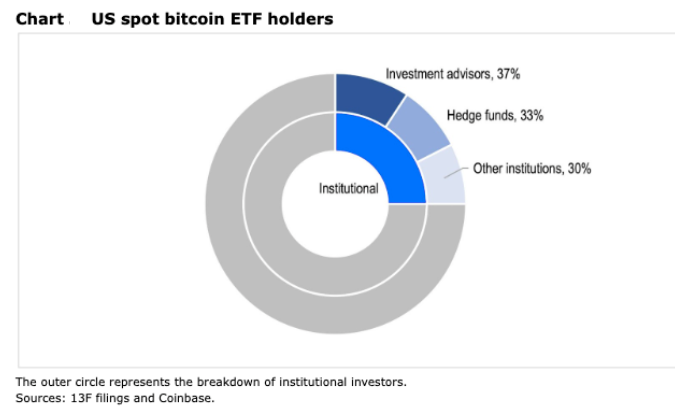

13F filings

The Q3 2024 13 F filings deadline also occurred on November 14th, revealing the institutional ownership of ETS as of September 30. The data doesn’t show positioning following the recent rally but sheds light on the growing institutional interest in crypto. This was also the first 13 F filing since the ETH ETF—354 unique institutions filed for ownership of ETH ETFs.

In comparison, BTC ETFs have seen numbers greater than 1308 different institutions, up slightly from 1266 in the previous quarter. This includes investment advisors and hedge funds and highlights growing institutional interest.

Macroeconomic backdrop

Price action that began with the US election outcome continued into last week amid elevated volumes. Bitcoin has jumped 30% since the US election, far outpacing the move seen in US equities over the same period. Average daily volumes across global centralized exchanges totaled $26.8 billion in the spot market and $88.8 billion in the futures market month to date, almost double the activity that was seen in October. This contributed to a surge in stablecoin market cap from $174 billion dollars to $281 billion as of November 13th, highlighting improved liquidity in the sector.

Chart showing BTC & ETH outperforming Nasdaq in risk-adjusted terms:

Over the last week, the Republicans were confirmed to have won the House, meaning that Trump and the Republicans have a Red sweep, sending crypto and the USD higher as traders sought to understand how serious Trump has been about his campaign pledges. Should his cabinet appointments be anything to go by, then he seems serious. The crypto markets eagerly await Trump’s appointment as the Treasury Secretary and SEC chair to better understand the outlook for economic policy and crypto deregulation.

Inflation rises & the Fed turns more hawkish

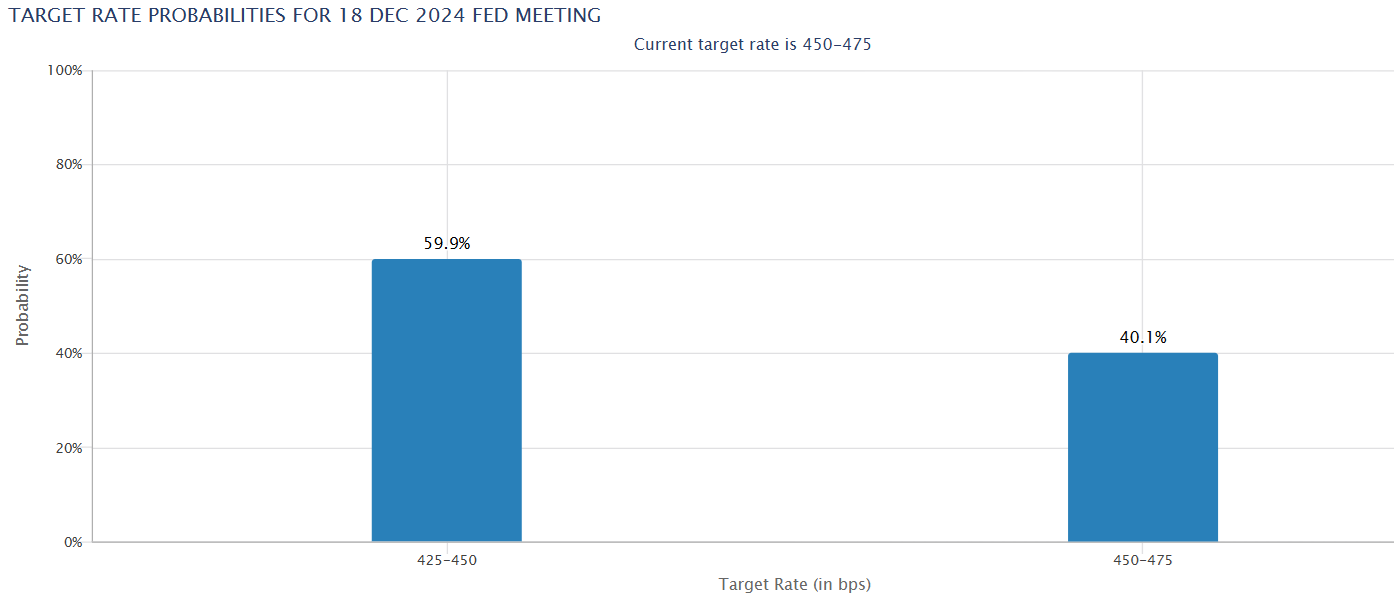

Traditional economic data was mostly in line with expectations, with consumer price inflation and producer price inflation rising, while retail sales were also stronger than forecast. Perhaps what was most notable, though, was the chorus of Federal Reserve speakers, including Federal Reserve chair Jerome Powell, who are leaning toward a slower pace of rate cuts. In his speech last week, Powell noted that the central bank was in no hurry to ease monetary policy.

Following these comments, the market is pricing in 60/40 odds of a rate cut in December, and investors are pricing in just 71 basis points worth of rate cuts until the end of 2025.

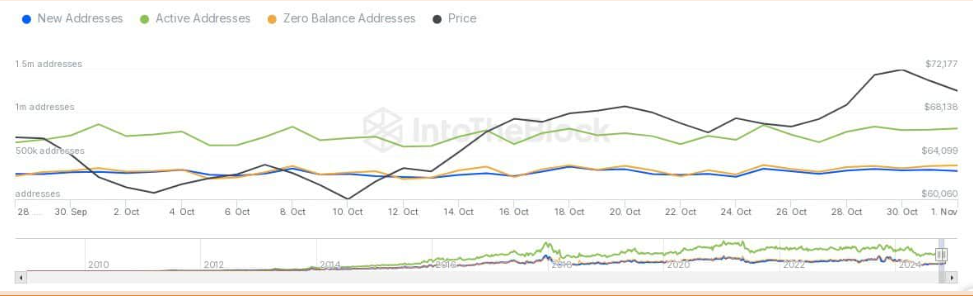

Network activity points to growing adoption

The rise in Bitcoin’s price correlated with an increase in network activity. Data shows an increase in both new addresses and active addresses, which is a sign of heightened participation. New addresses have increased steadily, reflecting an inflow of users into the ecosystem, and active addresses representing daily transactions also climbed to 1.1 million, showing persistent network engagement.

Furthermore, the number of 0 balance addresses is steady, suggesting no noticeable increase in dormant or abandoned wallets.

Meanwhile, on Friday, net inflows of $128.46 million were recorded, which could indicate an increase in selling pressure. Historically, higher inflows to exchanges have been linked with short-term corrections as traders look to capitalize on recent gains, although there are few signs of this as the new week starts.

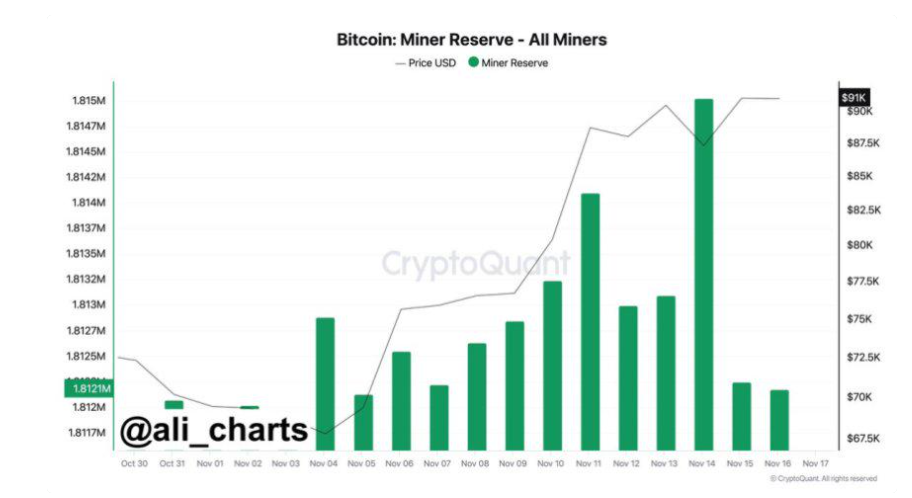

Miners selling could point to near-term consolidation

Key data from Crypto Quant revealed that Bitcoin miners have sold over 3000 bitcoins in the past 48 hours. This wave of selling and miner profit-taking often points to a cooling phase, bringing additional supplies to the market. This could lead to short-term consolidation below the all-time high of 93.4 K seen last week.

Minus selling is a normal market dynamic; however, sustained selling could signal a shift in sentiment and bring Bitcoin toward lower demand zones.

XRP rises above $1

XRP surged last week, rising over $1 to $1.26, its highest level since 2021, after spending most of the past three years around $0.6. The rally has been driven by Trump’s election victory and by specific holder activity.

The XRP rally comes amid expectations of a leadership change at the SEC under the Trump administration. According to Santiment, data showed that large XRP holders (between 1 million to 100 million tokens) have played a key role in this breakout.

XRP whales and sharks have increased their holdings by 453.3 million XRP tokens over the past week, reaching 18% of the total supply. Large-scale acquisitions by market participants often point to bullish sentiment and can precede a rally.

Interestingly, the rise in whales and sharks comes as retail trades have been selling XRP over the past week.

Looking Ahead

Trump appointments

Lookout across the weak crypto traders will be keeping an eye on the latest appointments made by President-elect Donald Trump to assess potential policies from the incoming administration.

Economic data & Nvidia

The economic calendar is quiet this week as far as US releases are concerned. A focus will likely be US PMI figures due at the end of the week; however, even these are less market-moving than the ISM figures.

Nvidia is due to release earnings on Thursday after the close, and given the stock’s ability to provide insight into the AI trade, its earnings often affect sentiment. That said, the 20-day Nasdaq 100 Bitcoin coalition is just 0.57, suggesting that there isn’t a strong correlation between the two asset classes currently.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.