Bitcoin was broadly unchanged last week, edging just 0.6% higher as the cryptocurrency was in consolidation mode following 13% gains in the previous week. The world’s largest cryptocurrency started last week trading at 67,100 and traded in a range between 63,500 and 69,300. Bitcoin has begun on a much stronger footing this week, gaining over 2% over the past 24 hours as it looks to 70,000, the psychological level.

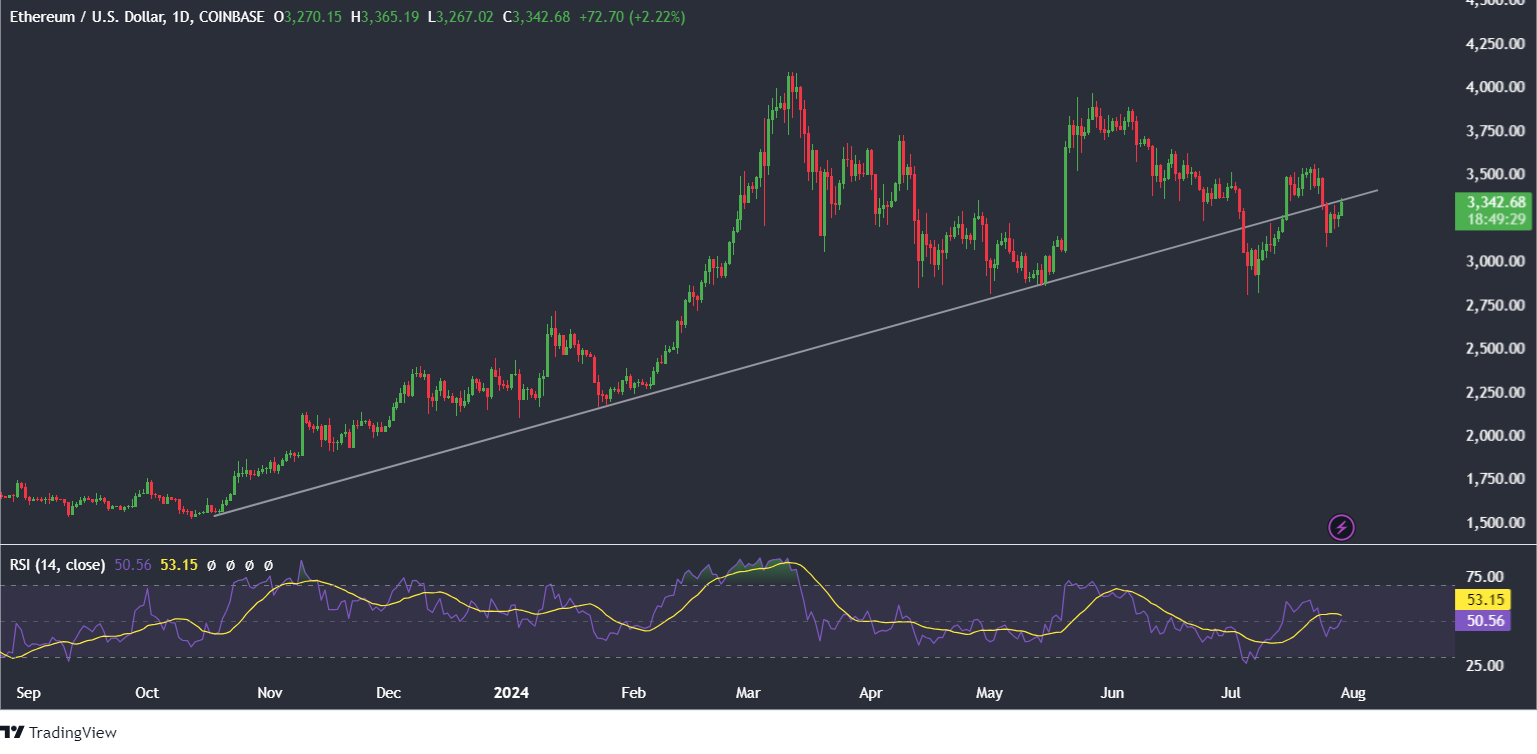

While Bitcoin traded flat last week, this wasn’t the case for altcoins, which saw increased volatility, with the likes of Solana gaining 6% and XRP raising over 2%. However, Ether dropped 7% despite the long-awaited launch of the Ether ETF.

ETH ETF launch

Ether ETF was launched on July 23rd with nine issuers, including BlackRock, Fidelity, and Franklin Templeton.

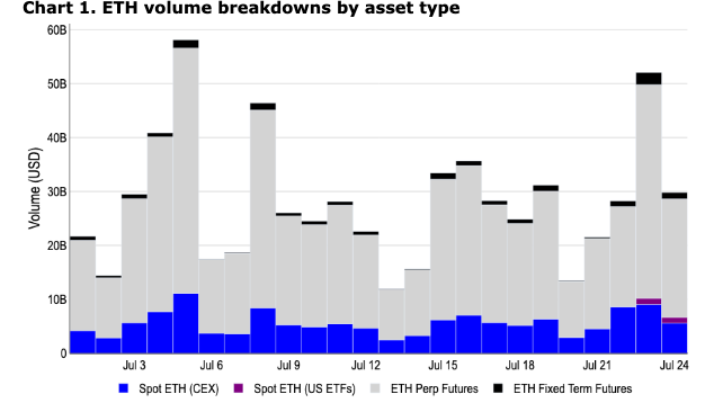

By volumes, these ETFs have performed in line with the upper range of expectations. On its first trading day, ETH ETFs saw $1.1 billion in aggregate turnover and $107 million in net outflows. On the same day, spot Bitcoin ETF traded $2.3 billion, which is approximately double that of spot Ether ETFs. The 0.48 Ether to Bitcoin ratio aligns with the average ratio between Ether and Bitcoin across other instrument types.

For example, on centralised exchanges, spot BTC traded an average of $13.2 billion per weekday, year to date, while spot ETH traded an average of $6.24 billion, which equates to 0.47 ETH to BTC. Similarly, ETH and BTC perpetual futures traded an average of $26.2 billion and $54.7 billion YTD over the same period, which equates to a 0.46 ratio.

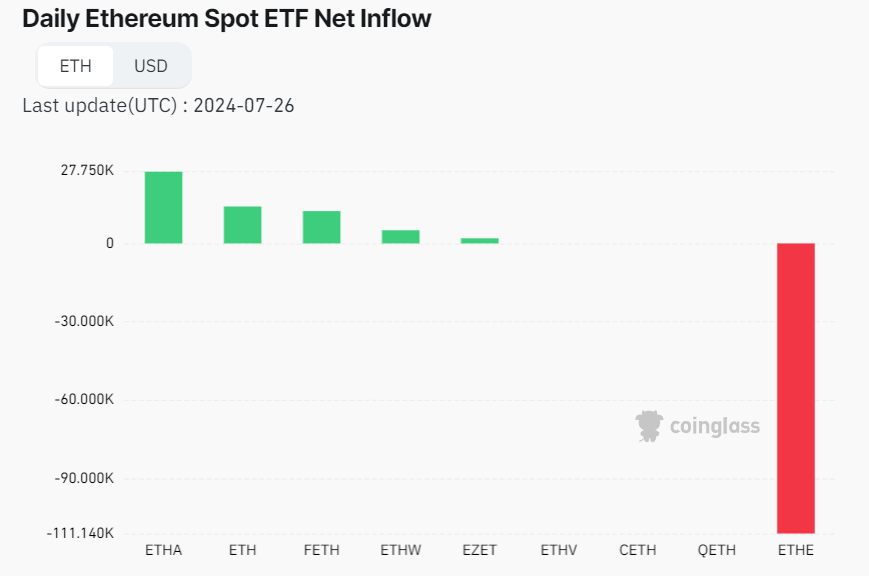

While it is still early days, spot ETH ETF inflows are notably less than those of spot Bitcoin ETF, and the initial outflows from Grayscale Ethereum Trust (ETHE) have been more significant than those from the Grayscale Bitcoin Trust. In its first few days of trading, ETHE experienced outflows of $484 million and $327 million, while the Grayscale Bitcoin ETF (GBTC) saw outflows of $95 million and $484 million.

The larger outflows could point to a shorter, more intense period of outflows compared to the Grayscale Bitcoin ETF, which saw three months of selling post-launch. Bitcoin’s price fell 17% in the weeks following the ETF launch before rebounding to an all-time high.

However, it is also worth noting that Ether has a lower multiplier than Bitcoin. The multiplier is the ratio of the change in market capitalization to the realized capitalization. This means that Ether’s market value responds less to fresh investment inflows than Bitcoin’s. According to QuantCrypto, for every $1 of fresh money invested in Bitcoin, the asset’s market cap has grown by $5. However, Ether’s market cap has increased by $1.34 for every $1 invested.

It is still far too early to draw any conclusion regarding ETH ETF interest based on the first few days of trading. As with Bitcoin ETFs, determining their success requires analysis over a longer time horizon. Even so, we remain positive on ETH and ETH ETF flows despite the 7% Ether price decline last week.

A Delayed Reaction to Trump

Over the weekend president, former President Trump spoke to a huge crowd at the Bitcoin 2024 conference in Nashville. This was the first time a former U.S. President had addressed a BTC-related conference. Trump compared the Bitcoin industry to the US steel industry 100 years ago and highlighted that Bitcoin is currently the ninth most valuable asset globally, predicting it would surpass gold and silver market values. Trump emphasised that the US would lead the future of Bitcoin, reiterating a previous statement that he wanted the US to be first in technology.

Trump warned that a Harris presidency would be unfavourable for the crypto industry; instead, he promised to fire the US Securities and Exchange Commission chair Gary Gensler the day he took office. He said he would establish a crypto council within his administration to develop favourable regulation within the first 100 days. Finally, he emphasised the US government will retain 100% of his reserves and unveiled plans to make strategic national bitcoin stockpiles if elected, in line with expectations heading into the speech.

Interestingly, Bitcoin ended lower after Trump’s speech. However, in what appears to be a delayed reaction, the BTC price is powering higher on Monday.

Bitcoin surged over 13% two weeks ago on rising optimism that pro-crypto candidate Trump could return to the White House. Trump has maintained the pro-crypto stance in the US during his election campaign, raising optimism that a Trump presidency would be beneficial for the cryptocurrency industry. Last week, Bitcoin failed to extend Trump-inspired gains after President Biden confirmed he would no longer be standing for re-election and after he endorsed Kamala Harris. The race between Harris and Trump is looking tighter.

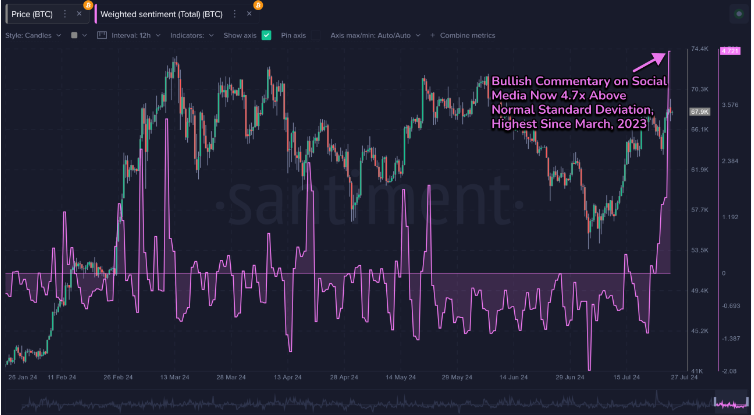

Bitcoin bullish sentiment surges

According to data from Santiment, bullish Bitcoin sentiment is through the roof. Bitcoin’s 20% rally over the past three weeks has left Bitcoin investors much more bullish than they were at the start of the month. The ratio of positive to negative comments has reached its highest level since March 2023, as an all-time high is back on the radar.

Mt Gox distributions

Mt Gox distribution continued across the past week. According to Arkham Intelligence data, the Mt Gox trustee now holds around 80k BTC. Many of the exchanges that are part of the process started to distribute their bitcoin to creditors last week. While it’s difficult to track the selling pressure that these developments are creating, it’s worth noting that removing this supply overhang should be supportive of Bitcoin price over the medium term to long term.

Week Ahead – Fed, BoJ, BoE & big tech earnings

This week is likely the last packed week before things quiet down for the summer. It includes central bank decisions from the Federal Reserve, the BoJ, and the BoE, as well as inflation reports from Europe and Australia. Furthermore, earnings from four more magnificent 7 companies will be released.

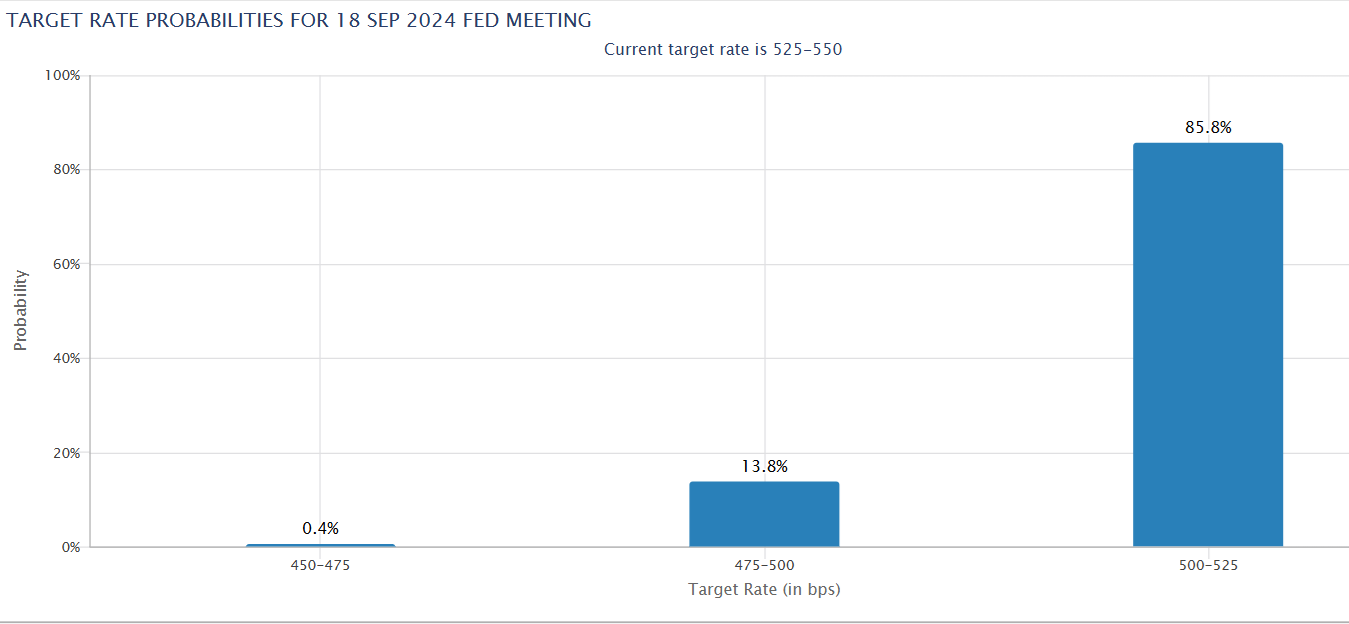

The Federal Reserve is not expected to cut interest rates this week. However, with inflation cooling towards the central bank’s 2% target, the market is convinced that the Fed will use this meeting to prepare for a September rate cut. According to the CME Fedwatch tool, the market is fully pricing in a September rate cut by the US central bank and considers there could be two more rate cuts before the end of the year.

Meanwhile, the BoJ will also be in focus amid expectations that the central bank could hike interest rates by 0.1%. The combination of the Fed expected to sound more dovish and the BoJ adopting a more hawkish tone has resulted in sharp falls in USD/JPY in recent weeks. USD/JPY dropped 2.3% last week, marking its fourth straight weekly decline as it continues to decline away from the 38-year high of 162 reached earlier in the month.

Mega-cap tech earnings

As well as central banks, attention will be on earnings, with four more magnificent 7 companies releasing earnings reports this week. These are the 7 firms that have driven much of the gains in the US stock market in recent quarters., although there are questions over their high valuations and whether fundamentals can support these.

Meta, Microsoft, Apple, and Amazon will update the market. Their results come after underwhelming figures from Tesla and Alphabet last week sparked a rotation out of tech stocks and saw the tech-heavy NASDAQ 100 experience its worst one-day performance since 2022. These earnings can set the tone for the market, and given the tech stock – Bitcoin correlation, this can also influence the Bitcoin price.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.