Bitcoin (BTC/USD) has been under relentless selling pressure since its all-time high above $126,000 in October, and is now trading around $67,000, a drawdown of roughly 47%. However, two signals are converging that have historically marked significant turning points. On-chain data shows that whale wallets have just completed their largest weekly accumulation since November, scooping up 53,000 BTC worth more than $3.6 billion. At the same time, Bitcoin’s weekly Relative Strength Index (RSI) has plunged to levels only seen twice before in the asset’s history, in 2015 and 2022. Both of those instances marked the beginning of a bottom formation, with significant returns in the months that followed.

Adding to today’s volatility, the delayed US Non-Farm Payrolls (NFP) report is finally due for release at 1:30 PM (UTC), with consensus expecting just 70,000 new jobs and annual benchmark revisions that could reshape the entire 2025 employment picture.

On-chain data reveals whale accumulation

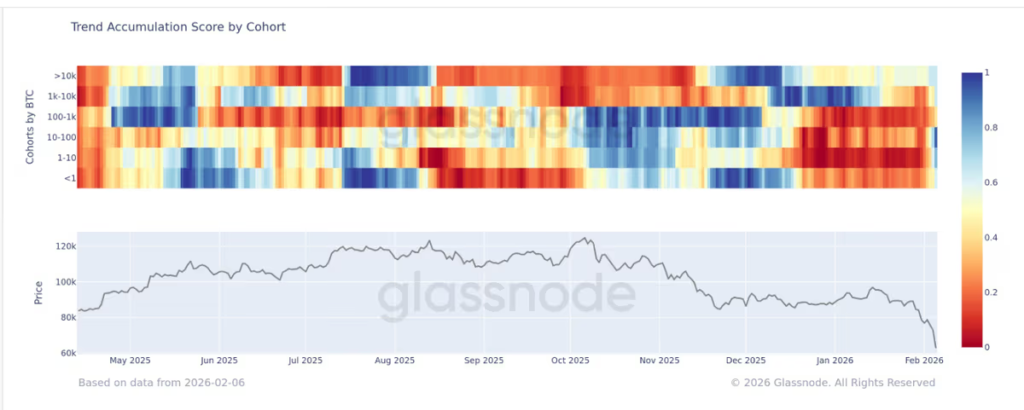

While retail investors have been hitting the sell button, the largest Bitcoin holders appear to be doing the opposite. According to Bloomberg, and confirmed with on-chain data from Glassnode, whale wallets accumulated roughly 53,000 BTC in the past week, their biggest buying spree since November, with wallets holding more than 1,000 BTC adding over $4 billion worth of the token. This reversal is significant given that these same large holders had offloaded more than 170,000 coins, worth approximately $11 billion, since mid-December. The Glassnode Trend Accumulation Score by Cohort chart below illustrates this shift clearly, with the largest wallet cohorts transitioning from deep red (distribution) through late 2025 to blue (accumulation) in early February. Notably, the number of entities holding at least 1,000 BTC has climbed from 1,207 in October to 1,303, suggesting large players have been steadily buying into this correction.

The accumulation isn’t limited to on-chain whales. US spot Bitcoin exchange-traded funds (ETFs) attracted $371 million in net inflows last Friday and a further $145 million on Monday, while Strategy, formerly known as MicroStrategy, purchased another 1,142 BTC for approximately $90 million. However, this buying remains concentrated among large holders, with smaller cohorts in persistent selling mode. As Brett Singer, head of sales at Glassnode, noted, the whale buying “does slow down any downfall,” but “we still need to see more money coming into the market” for a sustained recovery to take hold.

No new sellers, but no new buyers either

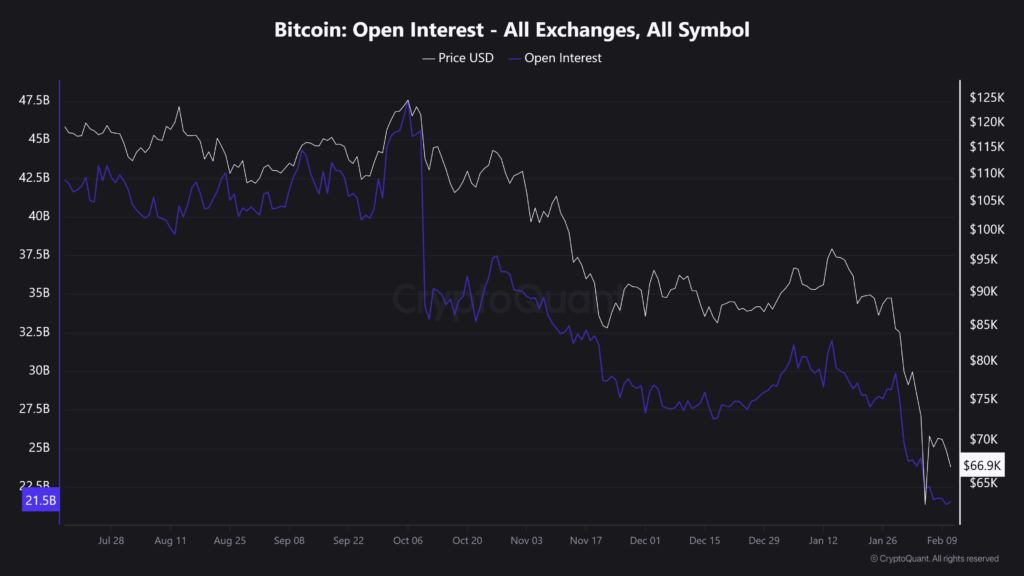

One important signal from the derivatives market adds context to the current sell-off. Bitcoin’s futures open interest (OI) has collapsed from roughly $47 billion at its October peak to approximately $21.5 billion, a decline of more than 50%. The CryptoQuant chart below shows that OI has been falling in lockstep with price, and this is actually a meaningful distinction.

When price falls alongside rising open interest, it typically means new short positions are being opened and fresh bearish conviction is entering the market. That’s not what’s happening here. Instead, the decline in OI tells us that existing long positions are being liquidated or voluntarily closed, rather than new aggressive sellers piling in. The October leverage flush alone wiped out more than $19 billion in positions, and subsequent waves of liquidation have continued to thin out speculative positioning. In other words, the selling pressure is coming from capitulation, not from conviction. This matters because once the forced selling runs its course, there are simply fewer sellers left to push price lower. However, as we’ll explore later in this article, the flipside is that there’s also a lack of new buyers stepping in to fill the void.

Weekly RSI hits levels seen only twice before

The weekly chart paints a picture that’s hard to ignore from a momentum perspective. This is only the third time in Bitcoin’s history that the weekly RSI has reached such extreme oversold levels, with the previous two occasions being 2015 and 2022. On both of those instances, it marked the beginning of a bottom formation. While past performance is no guarantee of future results, the rarity of this signal deserves attention.

Adding weight to the current setup is the 200-week simple moving average (SMA), which price is now testing. This level is confluent with the 2021 cycle highs and the area from which Bitcoin staged its major breakout in October last year, creating a significant zone of technical support. When multiple historical reference points converge at the same price area, it tends to attract buying interest, and the combination of an extreme oversold RSI with a test of this confluence zone is worth watching.

However, there’s an important detail we can’t ignore. In both previous instances where the weekly RSI reached these extremes, the eventual bottom formation coincided with a weekly RSI bullish divergence, where price made a lower low while the RSI printed a higher low, signalling that downside momentum was fading even as sellers pushed price to new depths. It’s obviously too early for that pattern to develop right now, but it’s worth keeping in mind over the coming weeks to months. A bullish divergence on the weekly timeframe could be one of the strongest confirmation signals that a durable bottom is in place.

Key levels to watch on the 4-hour chart

Zooming into the 4-hour chart, we can get a clearer picture of where the next opportunity could emerge. The blue rectangle highlights the high timeframe support zone discussed in the weekly analysis above, and within that area we’ve marked out the local reload zone between the 0.618 and 0.786 Fibonacci retracement levels. This is traditionally viewed as a high-probability area for markets to find a bottom, as algorithmic trading systems frequently execute around these levels, making it a zone where buying interest could concentrate.

Right now, the structure on this timeframe remains bearish, with price printing a series of lower lows and lower highs beneath both the 20 exponential moving average (EMA) in white and the 50 EMA in blue. However, if price begins to form a higher low within this reload zone and develops some form of bullish local structure, it would add to the case that this area is being used for accumulation rather than simply a pause before further downside.

One relationship worth watching closely is between the 20 and 50 EMAs. A bull cross, where the 20 EMA crosses above the 50 EMA accompanied by a sustained local uptrend, would be a meaningful confirmation signal. At that point, price action would be aligning with what the on-chain data and the weekly support zone are already suggesting, that a potential bottom could be forming. The only missing piece of the puzzle at that stage would be a compelling narrative to drive fresh demand, and that’s what we’ll explore in the next section.

Bitcoin’s narrative problem

While the technical and on-chain signals we’ve outlined could point to a forming bottom, there’s a broader structural challenge that may prevent any recovery from gaining momentum quickly. Unlike previous cycles, Bitcoin currently lacks a compelling narrative to drive fresh demand.

US spot Bitcoin ETFs have shed roughly $6.18 billion in net outflows since November, the longest sustained redemption streak since these products launched in January 2024. CryptoQuant reports that institutional demand has “reversed materially,” with ETFs now net sellers in 2026. Total ETF assets under management have fallen from a peak of $128 billion in mid-January to approximately $97 billion, and around 62% of all ETF inflows are now sitting on losses with an average cost basis near $85,000, making those holders less inclined to add aggressively.

Part of the issue is that Bitcoin appears to be struggling with what Galaxy Digital chief executive officer (CEO) Mike Novogratz described at the CNBC Digital Finance Forum yesterday as a market without a clear catalyst. “This time, there’s no smoking gun,” Novogratz said. “You look around like, what happened?” While equities continue to attract retail capital through the artificial intelligence (AI) narrative, and gold has surged on geopolitical risk, Bitcoin currently lacks a comparable story to drive fresh demand. Market maker Wintermute highlighted this dynamic in its latest over-the-counter (OTC) review, noting that retail investor attention remains “currently focused on artificial intelligence, equities and commodities,” and views a rotation of that mindshare back to crypto as the least likely path to recovery. The initial excitement around a crypto-friendly Trump administration and the establishment of a Strategic Bitcoin Reserve has largely faded, with Novogratz noting that “crypto is all about narratives” and “those stories take a while to build.” He added that the October leverage flush “wiped out a lot of retail and market makers” and that “Humpty Dumpty doesn’t get put back together right away.”

The takeaway for traders is that the technical setup could be historic, but a sustained recovery likely requires more than just oversold readings and whale buying. It needs a story that brings new participants to the market, and right now, that story hasn’t arrived yet.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.