Following the US attack on Iran over the weekend, Bitcoin initially responded with a sharp drop, briefly breaking below the 100,000 level, the current range low on the daily chart. However, the move was short-lived. Price quickly pulled back within the boundaries of the range and closed the daily candle firmly back above 100,000.

Despite the initial risk-off reaction, Bitcoin has recovered back into its consolidation zone and is now printing a bullish daily candle. Attention now shifts to the 105,000 to 106,000 area, which marks the range EQ and the next major point of resistance on the daily chart.

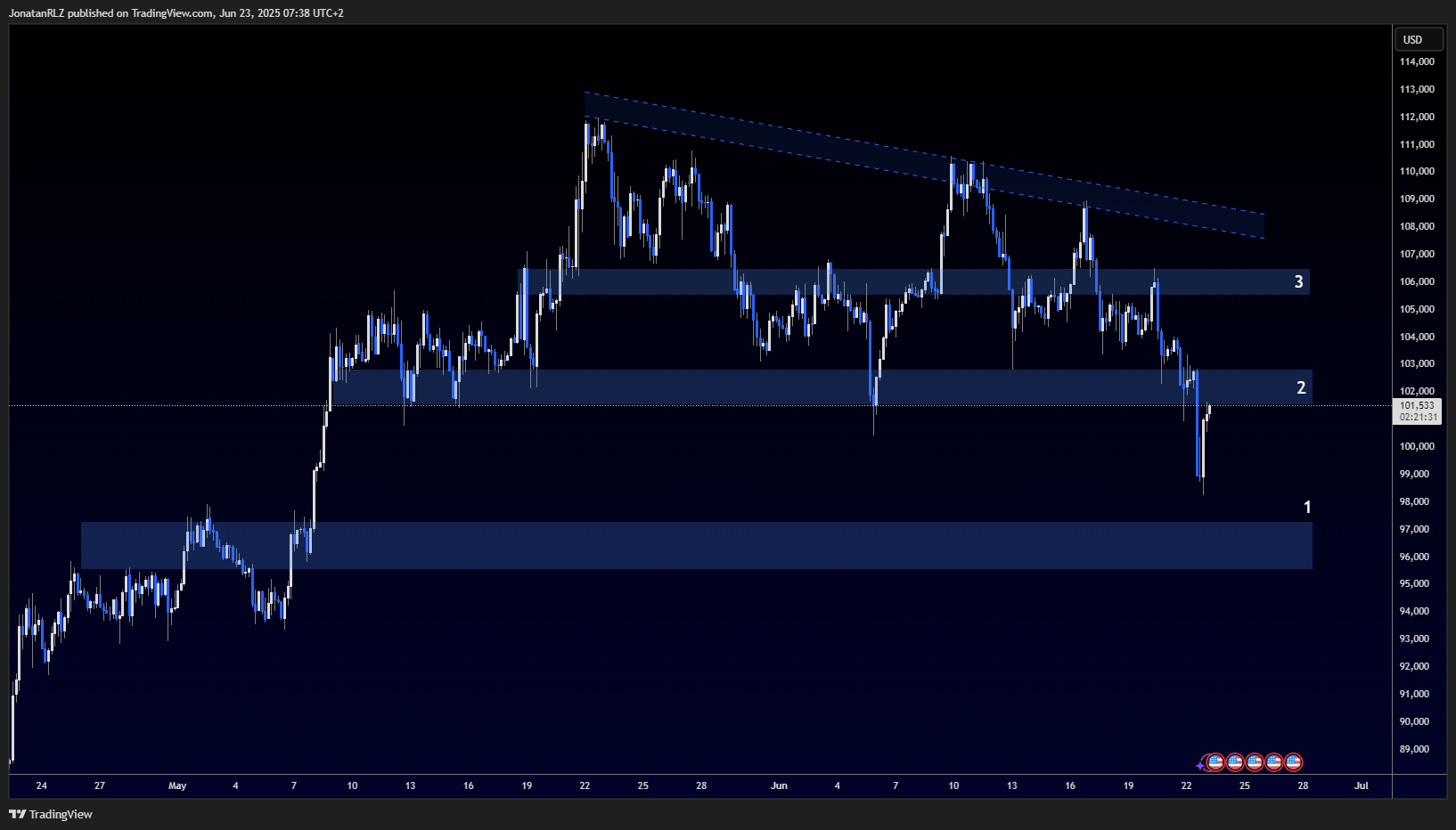

If price fails to hold within the range and breaks lower again, the next major support to watch is the high time frame level near 96,000, marked as number 1. This area could become the key zone where bulls attempt to step in and defend the broader structure, particularly if geopolitical tensions continue to escalate.

From a daily perspective, the two most important levels right now are the range low at 100,000 and the range EQ zone between 105,000 and 106,000.

On the 4-hour chart, the recent move becomes more detailed. While the daily chart showed only a wick below support, the 4-hour chart reveals how close price came to the high time frame support zone between 96,000 and 97,000, marked as number 1. This could be viewed as a front-run of that level, as price bounced before directly touching it.

Currently, price is trading around 102,000, marked as number 2, which is acting as local resistance. This area now resembles a bearish retest of a former support zone. If Bitcoin fails to reclaim this level, we may see another push lower, increasing the probability of a deeper test of the 96,000 zone.

To regain strength, the 4-hour chart needs to see a confirmed reclaim of the 102,000 level. That would bring short-term structure back in line with the daily chart, signalling that bulls may still be in control. However, failure to reclaim it may pull the daily structure into a more bearish alignment.

With ongoing Middle East tensions continuing to drive global volatility, Bitcoin’s price action remains highly sensitive to headlines, and we’ll continue to monitor key levels and updates on a daily basis.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.