Despite choppy trade last week, which saw Bitcoin rise to a high of 110.7K before falling to a low of 102.7K, the largest cryptocurrency ended the week almost unchanged, at 105.6K. BTC is starting the new week off on the front foot, rising above 107k.

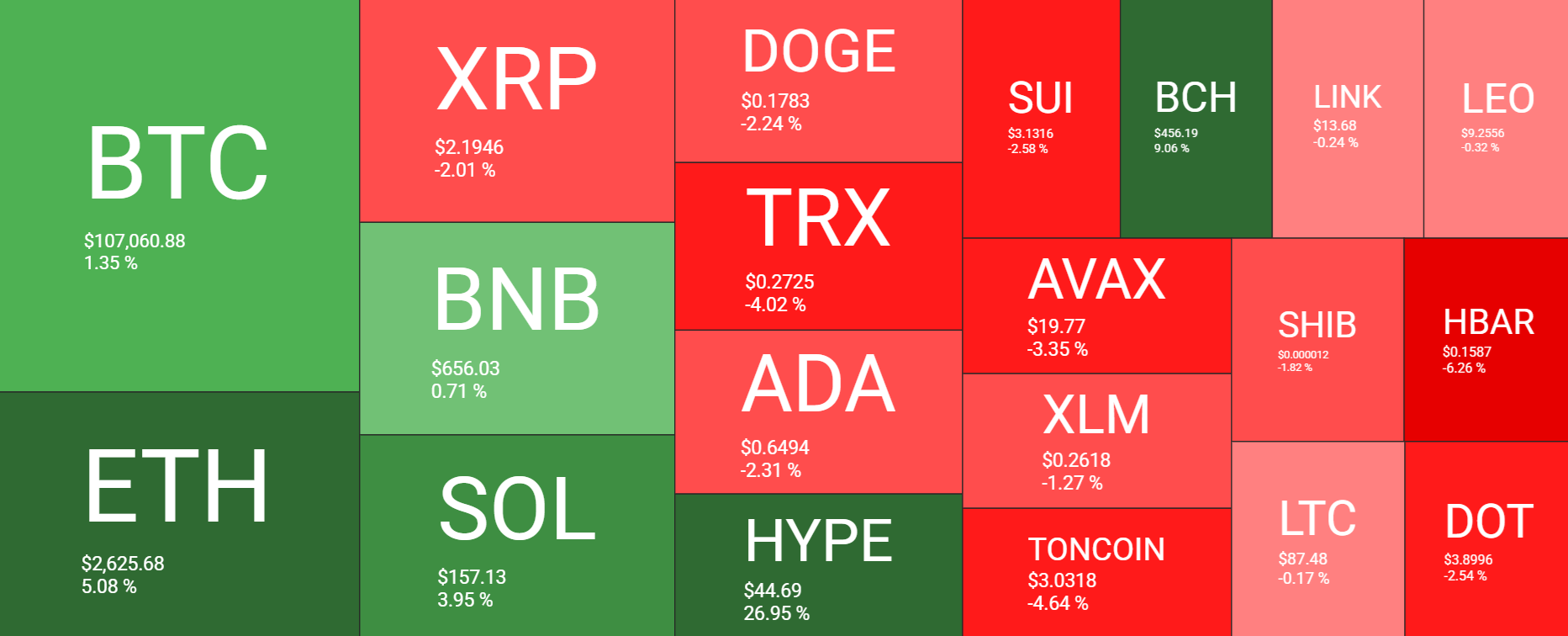

While Ethereum outperformed Bitcoin, rising 5% over the past seven days, other altcoins, such as XRP, underperformed, falling over 2%. DOGE and TONCOIN also underperformed, whilst HYPE jumped over 25%.

Last week, the global crypto market capitalisation was virtually unchanged at $3.29 trillion. However, this was down from a peak of $3.47 trillion mid-week and down from $5.53 trillion just three weeks ago.

Meanwhile, the Fear and Greed index is at 61, in Greed territory, in line with last week’s level. This level supports continued gradual gains in the cryptocurrency market.

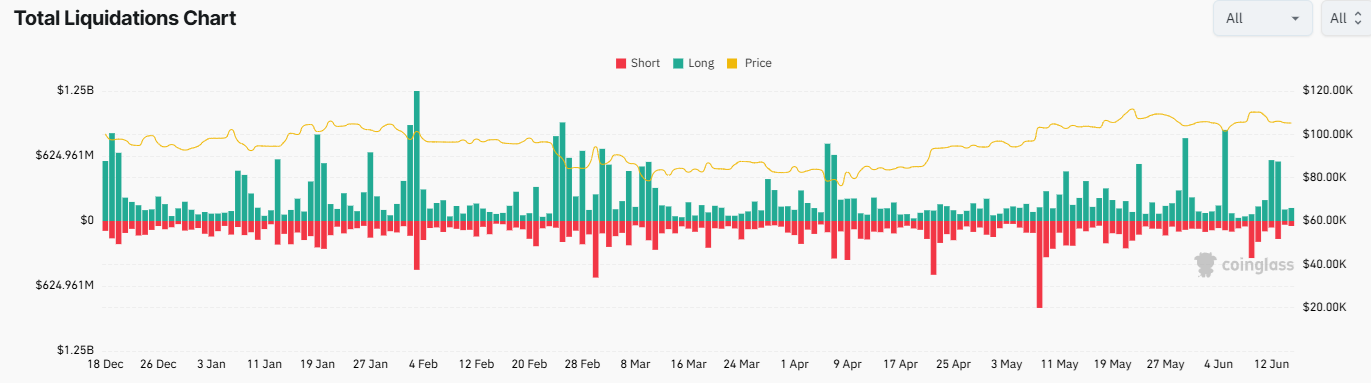

The BTC price falling from 110k to 102.7 last week sparked a liquidation event. The cryptocurrency market experienced over $1.3 billion in crypto liquidations across a 2-day period, wiping out over $1 billion in long positions.

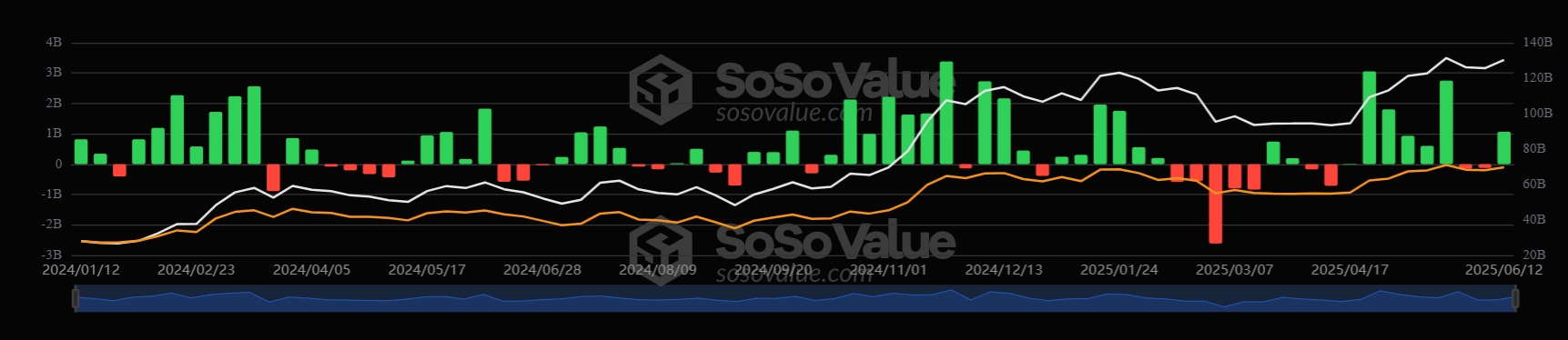

BTC ETF demand returns

After two straight weeks of net outflows, Bitcoin ETFs experienced solid net inflows of $1.07 billion last week. Breaking this down, BTC ETFs experienced net outflows last Monday, followed by four straight days of net inflows, suggesting that institutional demand picked up again after a small lull at the end of May and beginning of June. Interestingly, the influx of capital into Bitcoin ETFs came despite increased geopolitical tensions in the Middle East.

Panning out, Bitcoin ETFs are recording net inflows of $939.4 million in June, marking the third straight month of net inflows.

Persistent Bitcoin ETF inflows support the BTC price and could help it recover to 110k and fresh record highs.

ETH ETFs outperform

ETH ETFs have recorded their strongest weekly inflows since December 2024. Total weekly ETH ETF inflows reached $528.1 million last week, five times the weekly average. By comparison, BTC ETF inflows are only modestly above average but far below May peaks. By this metric, ETH ETFs are far outperforming BTC ETFs amid substantial inflows from asset managers, signalling growing confidence in their unique position as a yield-generating asset.

Last week, ETF staking reached an all-time high of 34.6 million. With nearly $90 billion now locked into Ethereum’s proof-of-stake system, this represents almost 28% of the ETH supply, which is currently 120.72 million. This could help ETH break out of range above 2700

Corporate optimism

Corporate demand for Bitcoin has remained resilient. Last week, Mecurity Fintech Holding announced plans to raise $800 million to establish a long-term Bitcoin treasury reserve.

Meanwhile, GameStop added 4710 Bitcoin between May 3 and June 10, following a $1.3 billion convertible note offering in March.

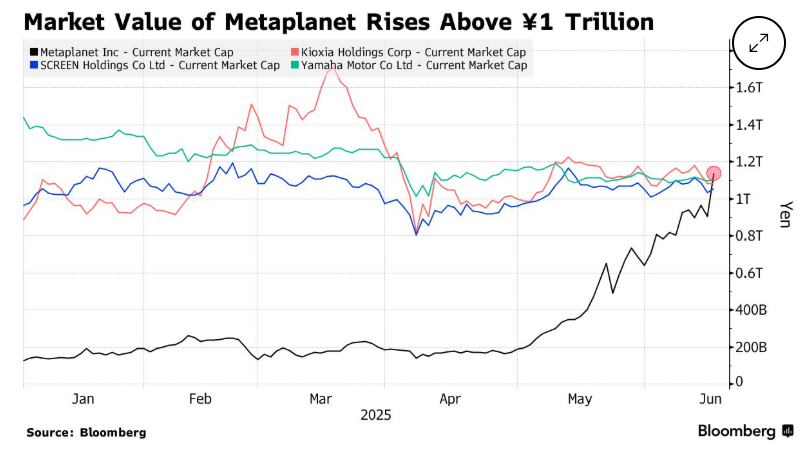

Metaplanet has also reached 10,000 BTC holdings, overtaking Coinbase with its latest 1,112 BTC. The firm’s shares jumped over 17% after it announced its latest acquisitions, pushing its market cap above 1 trillion yen, overtaking big names such as Yamaha.

Corporate interest in Bitcoin indicates growing acceptance of the cryptocurrency as a strategic asset. Corporate holdings comprise 3.9% of Bitcoin supply, and ongoing interest could further reduce supply.

Macro Backdrop

After some volatility last week, the price of Bitcoin has managed to stay afloat over the past few days despite the growing conflict in the Middle East. On Friday, Israel launched attacks against Iran’s nuclear and ballistic missile facilities. Iran retaliated over the weekend as tensions continue to ramp up in the region. Initially, Bitcoin tumbled below 103k on Friday as news of the attacks broke, However, the price quickly recovered to the 105k level. US stocks dropped over 1% on Friday, and safe-haven Gold surged to a peak of $3444, nearing its $3500 record high.

BTC investors are undeterred by geopolitical events

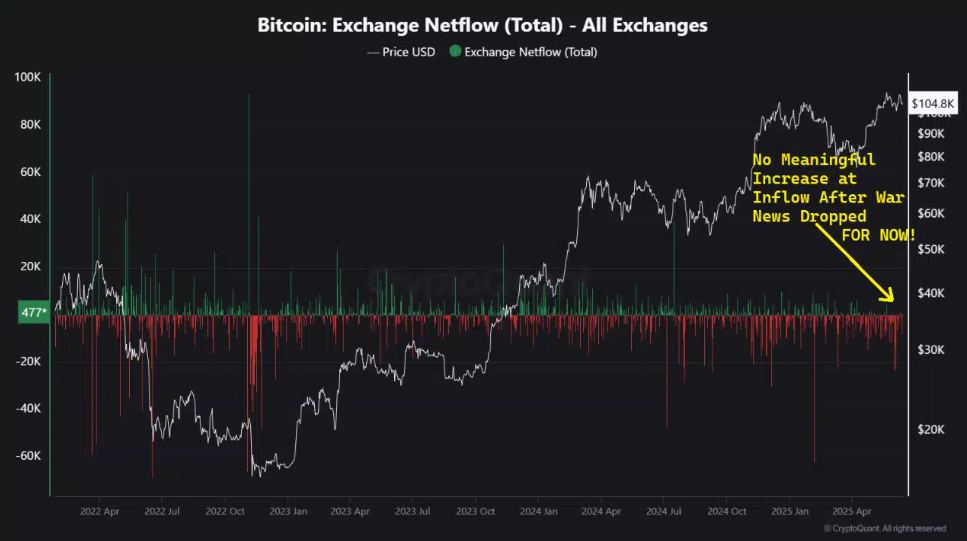

Despite the ongoing geopolitical events, BTC investors are still holding. The BTC Exchange Netflows measure the difference between bitcoins sent to and withdrawn from centralised exchanges. Typically, this metric helps to gauge selling pressure on Bitcoin. When BTC is moved onto an exchange, it is often considered a bearish signal. According to CryptoQuant, Netflows have not changed significantly, suggesting investors are not looking to offload their assets, which is a positive sign.

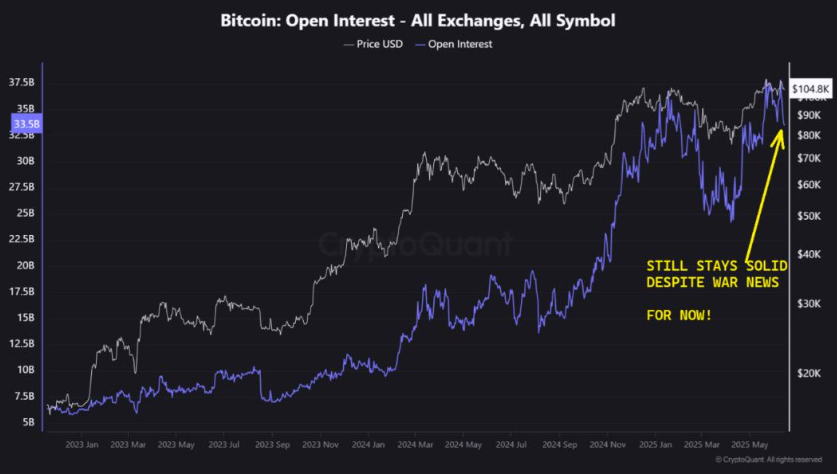

Meanwhile, open interest in centralised exchanges, which estimate the amount of capital flowing to a cryptocurrency at any given time, is still strong, and investors are keeping their positions open for now despite the latest geopolitical tensions.

Together these pointers suggest that investors are not in panic mode for now. Should political tensions continue to ramp up across the week, there’s no telling what may happen, which means investors may want to adopt a cautious stance over the coming days.

Is BTC becoming a store of value?

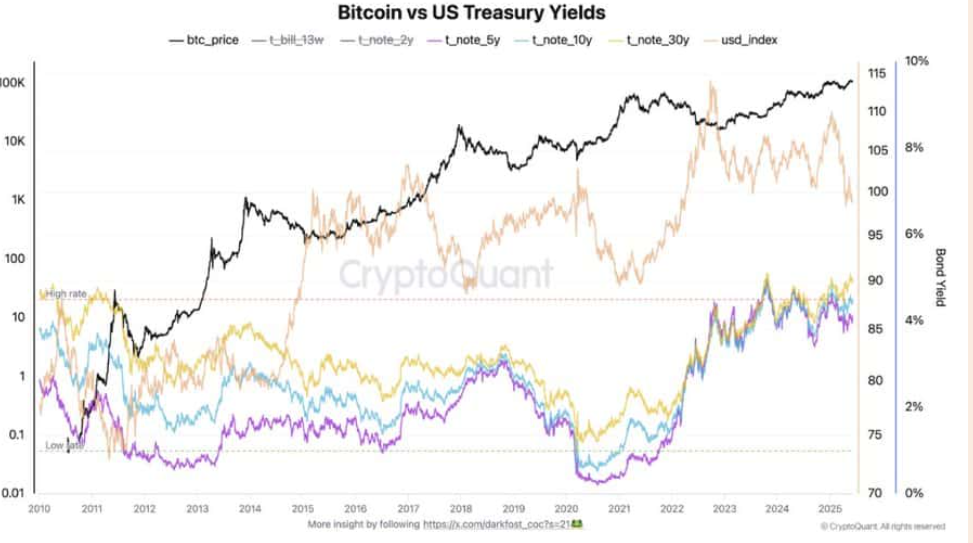

Historically, Bitcoin has declined when bond yields rise and vice versa. However, recent data suggests that Bitcoin is continuing to rally alongside the 510 and 38 U.S. Treasury yields. This marks an unusual trend in Bitcoin’s correlation with macroeconomic indicators and could imply that investors are starting to see Bitcoin as a store of value offering protection during periods of uncertainty or quantitative tightening.

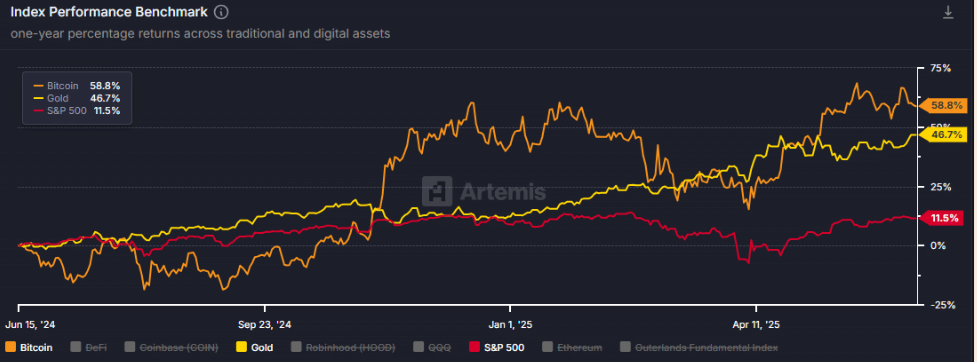

The fact that Bitcoin is outperforming gold and the S&P 500 in yearly returns supports this narrative. According to optimistic data, Bitcoin has risen 58.8%, outpacing Gold’s 46.7% and S&P’s 11.5%.

The idea of Bitcoin becoming more like an asset in its own right and a store of value could explain the rapid recovery in BTC’s price on Friday from the initial 102.7k selloff. Despite rising geopolitical tensions, concerns over Trump’s trade tariffs, and expectations that the Fed will keep rates unchanged, BTC has risen to the 107k level on Monday and is less than 5% from its record high.

Fed rate decision

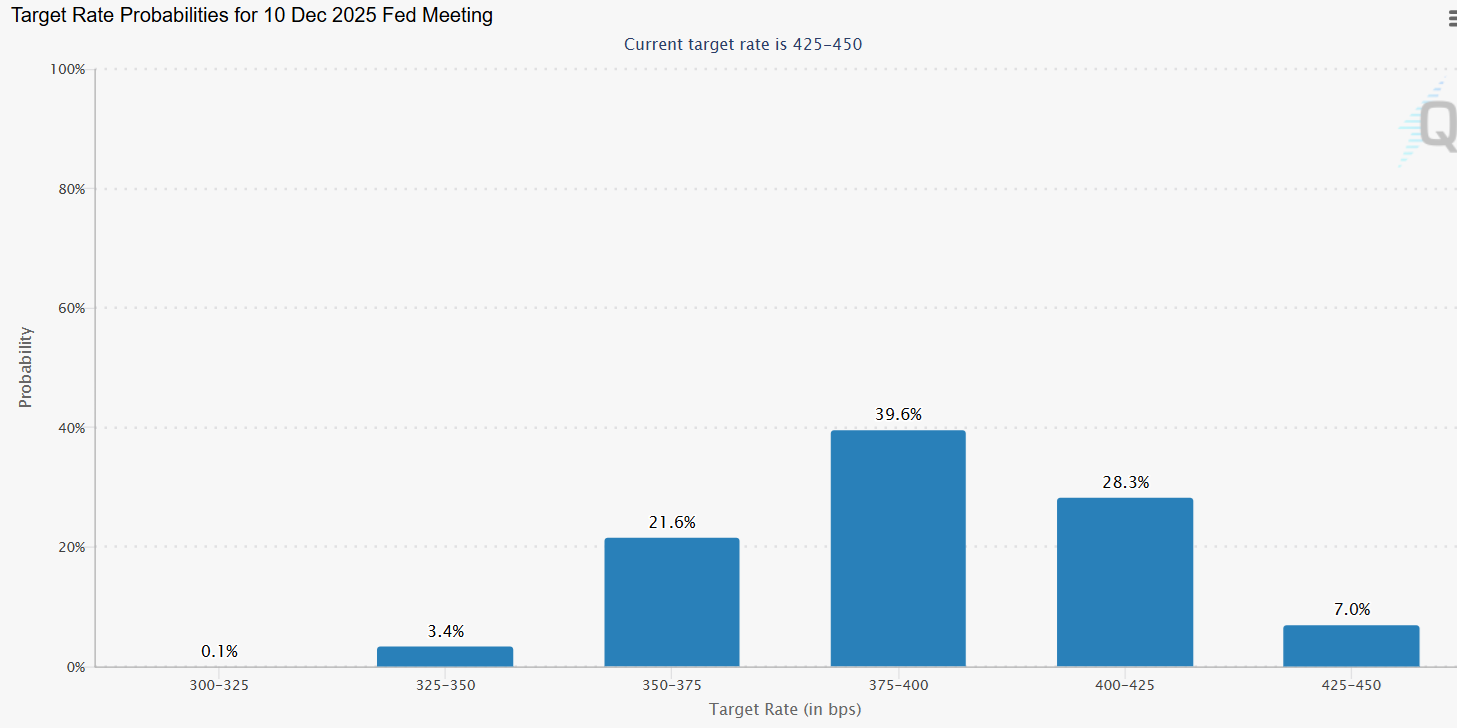

On Wednesday, the Federal Reserve will announce its interest rate decision. The central bank is expected to leave interest rates unchanged at 4.25%—4.5%. The Fed has left rates unchanged since December 2024, when it cut rates by 25 basis points.

The meeting comes as the US jobs markets show some signs of slowing. US inflation was weaker than forecast at 2.4%, up from 2.3%. However, consumer prices are expected to rise further due to Trump’s trade tariffs. The Fed is expected to reiterate the need to be patient to see the impact of the tariffs on inflation and the US economy.

With no rate cut expected, the focus will be on the Fed’s updated growth and inflation projections and the dot plot, which sets out the Fed’s expected path for interest rates. Back in the March dot plot, the Fed guided to 2 more rate cuts this year, which is in line with what the market is pricing in. Any changes surrounding these expectations could drive short-term volatility in BTC.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.