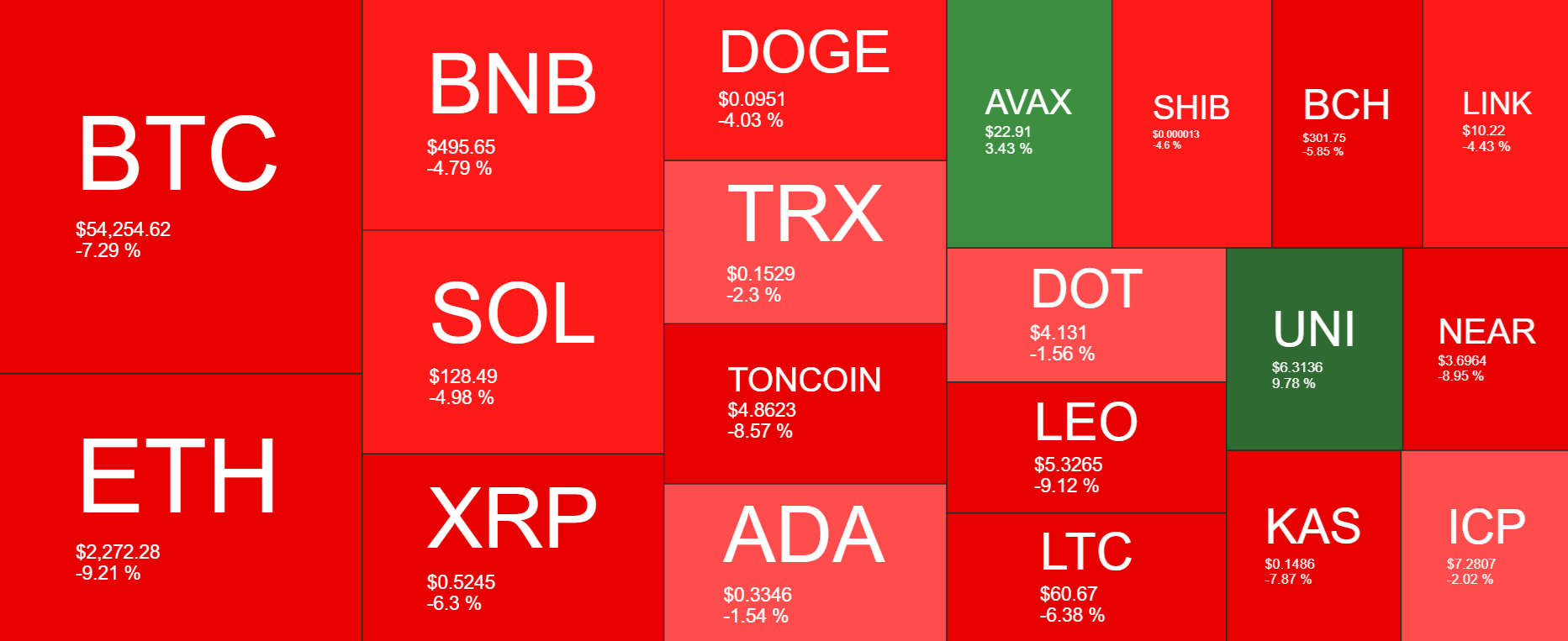

Bitcoin slumped over 8% last week, its worst weekly performance since the end of July. This puts Bitcoin losses at 16% over the past two weeks alone. The world’s largest cryptocurrency started the previous week at 59k, inching higher to a peak of just below 60k before dropping to a low of 52,750. The price has recovered from 53k at the start of the new week and trades at 54k heading into the European session.

The bleedout in Bitcoin wasn’t unique; it was seen in cryptocurrencies across the board. Ether fell 9%, Solana dropped 5%, and Tonne Coin, which had risen the previous week, was down 10%.

There were few signs of positivity, although UNI, which rose 9% across the week, was a standout performer.

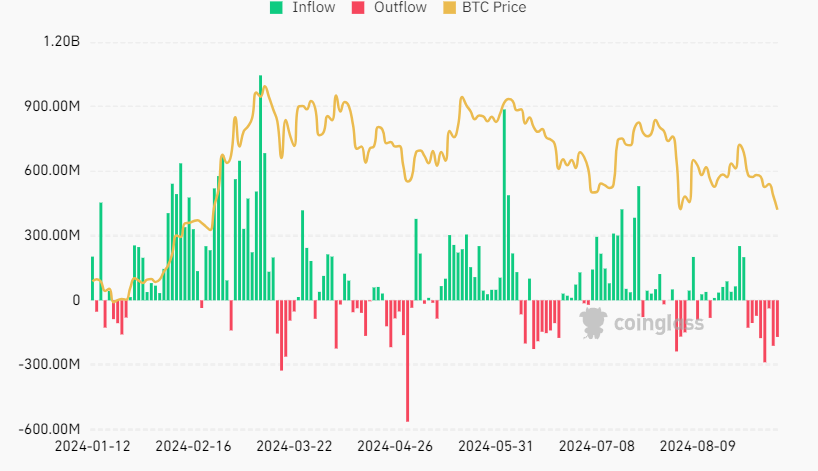

Bitcoin ETF sell-off

Bitcoin price also tumbled as Bitcoin ETFs experienced massive outflows last week. The Bitcoin price faced significant challenges as ETFs recorded massive outflows. Over the past seven days, Bitcoin ETFs saw a collective loss of over $1 billion, sparking concerns about the market’s trajectory. BlackRock shares Bitcoin trust recorded its second-ever outflow since inception, adding to fears that the ETF demographic is losing confidence.

US stocks plunge over 4%

Meanwhile, U.S. stocks ended the week decidedly lower, with the S&P 500 slumping 2% and the tech-heavy Nasdaq100 falling 2.5% on Friday. On a weekly basis, the S&P 500 lost 4.3%, its largest weekly sell-off this year, while the NASDAQ 100 index experienced a weekly drop of 5.7%.

Given the sharp sell-off in riskier assets such as Bitcoin and stocks, market participants appear to be trimming risk at the start of September, a traditionally bearish month for both stocks and Bitcoin.

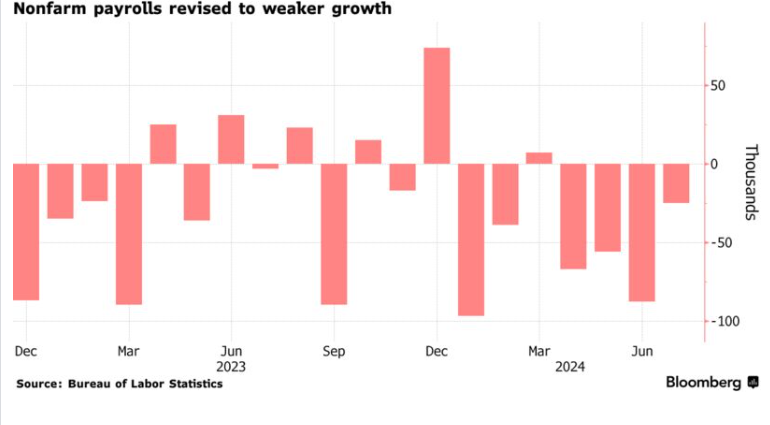

US recession risks rise after weak NFP report

The drop in risk appetite and the deteriorating market mood come amid concerns over the health of the US economy. On Friday, US payrolls showed weaker than expected jobs creation in August of 142,000 below the 165,000 forecast; meanwhile, the previous two months’ figures were revised lower by 86,000. Following the data, the markets continue to weigh up the likelihood of an outsized rate cut from the Federal Reserve in the September meeting.

While the data showed that the US labour market is weakening, it also calmed fears that the jobs market is collapsing, which supports the view that the Fed will cut rates by 25 basis points rather than 50. It’s also worth keeping in mind that a 50-basis-point rate cut would be a dramatic move that could spook the markets, and this data wouldn’t have given the Fed sufficient reason to make such a move.

While the prospect of a rate cut will improve the liquidity environment, generally seen as good news for risk sentiment, the market is also fretting about the potential for a recession.

While the non-farm payroll report was the main focus this week, there were plenty of other data points for investors to digest, including job openings, which fell to their lowest level for 3.5 years at 7.7 million, below expectations of 8.1 million. Meanwhile, the US ISM services data suggests the economy appears to be resilient, which could offer some support.

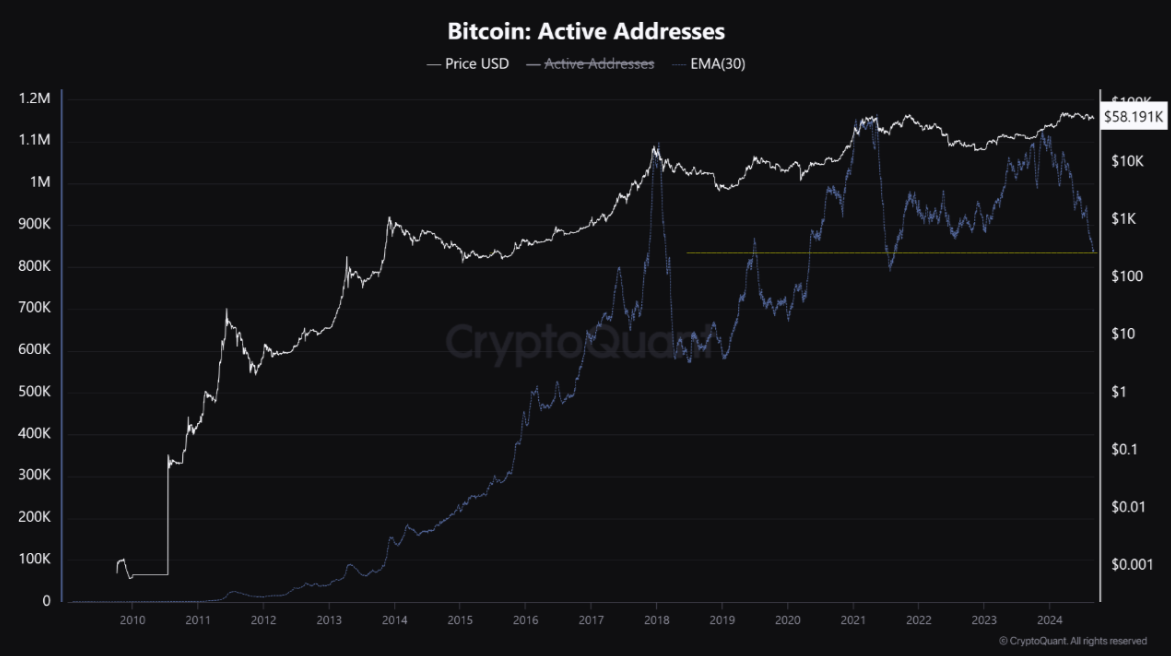

Bitcoin active addresses fall to a 3-year low

Bitcoin active addresses reached a notable low this week, matching figures from three years ago when the Bitcoin price was around $45,000. The distribution of active addresses is decreasing, meaning there is less activity in the network and, therefore, fewer transactions.

Less activity on the network also usually means less volatility, which can lead to periods of price stability. This is what we’ve seen for Bitcoin over the past 180 days, with Bitcoin trading in a range of 71,000 – 50,000.

The decline could be because people are no longer interested in actively using Bitcoin, which could be unfavorable for BTC prices, particularly when accompanied by signs of lower trading volumes. Furthermore, the decline in active addresses could be considered a measure of weakness or the absence of demand in the market, which could put more selling pressure on Bitcoin. Meanwhile, others believe this is an opportunity to buy Bitcoin in anticipation of a future rally.

Week ahead

1. US CPI (inflation)

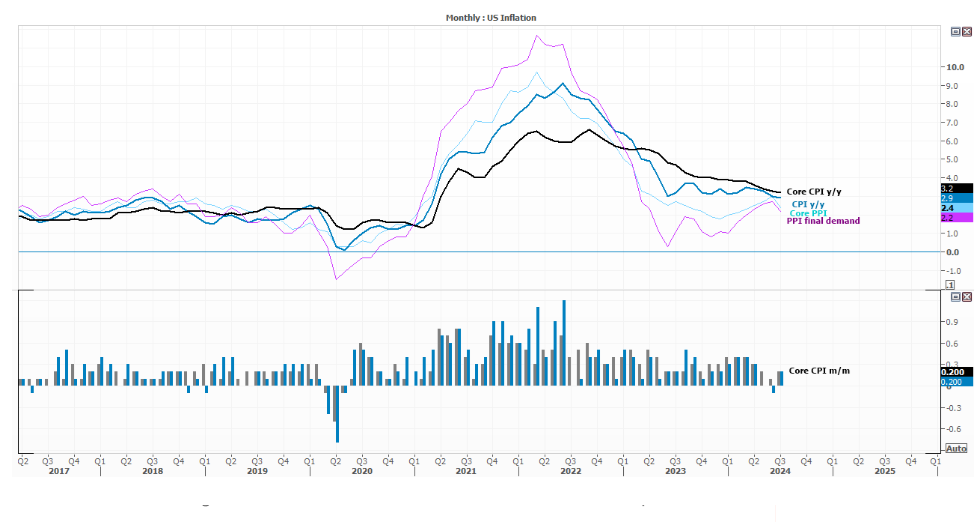

US inflation data, as measured by the CPI, will be released on Wednesday. It is the final piece of the jigsaw ahead of the Fed’s September interest rate decision and could provide more clarity over what to expect from the meeting.

The headline CPI eased to 2.9% YoY in June and is expected to ease again to 2.6% in August, although the core interest rate is expected to remain unchanged at 3.2%. If the numbers align with expectations, the Fed is more likely to deliver a dovish cut of 25 basis points. Meanwhile, a significant downside surprise could increase the chances of a 50 basis point reduction and could make a jittery marker more nervous.

The data comes as the US dollar has been falling steadily since the end of June. The US dollar index, which measures the dollar against its major peers, has fallen in eight of the past ten weeks, dropping to a 13-month low. Cool inflation could send the USD lower and support risk assets, but if inflation is too low, it could spark domestic demand worries and recession fears.

2. ECB interest rate decision

The ECB is expected to cut interest rates by 25 basis points further after starting its rate-cutting cycle in June.

The start of the ECB’s rate-cutting cycles was slightly awkward, given that the central bank had cornered itself into a June cut even as last-minute data showed an increase in inflation.

Since then, the deteriorating outlook for the eurozone economy, particularly Germany, and a further cooling in inflation have supported the view that further policy easing is needed. The market is widely expecting a 25 basis point rate cut.

The ECB could also potentially downwardly revise its quarterly inflation and GDP predictions, which are also due to be published on Thursday, the day of the meeting.

ECB president Christine Lagarde could adopt a slightly more dovish stance. However, the stronger-than-expected services CPI in August, 4.2%, the highest since October 2023, could mean that she will maintain some caution in her press briefing.

Should she signal a rate cut path shallower than what investors have priced in, the euro could resume its uptrend, particularly if the US dollar slips on weaker inflation data.

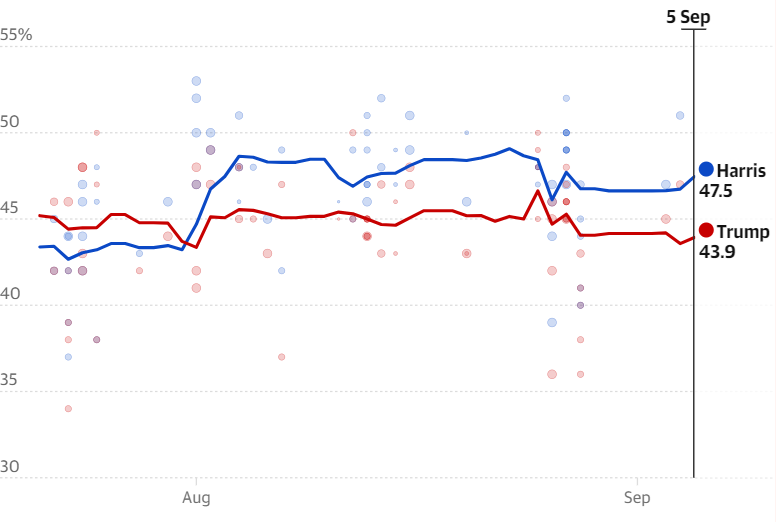

3. Presidential election debate

The US presidential election campaign could heat up this week when Democrat nominee Kamala Harris and Republican candidate Donald Trump go head to head in a televised debate. The economy is likely to be a key issue, with Trump promising tax cuts and government funding, while Harris is looking to increase taxes for the wealthy alongside help for smaller businesses. The debate will take place as Commander Harris has a slight lead in the polls; however, a strong performance will be seen as vital for both candidates.

The crypto world will watch closely to see whether candidates will be asked about their plans for endorsing the blockchain industry. Trump has been pro-crypto throughout his campaign, making a big pivot on cryptocurrency this year and doubling down since then. For vice president, Kamala Harris may be the only way to shed some light on how she leans on the topic.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.