Welcome back to a daily technical update on Bitcoin.

The $86,000 region continues to act as high timeframe resistance, and what appeared to be a potential breakout attempt in yesterday’s update has now fizzled, with price falling back below the resistance zone.

There haven’t been major structural shifts on the higher timeframes. The overall picture remains tilted toward the bears, with the $86K–$80K range still intact. As long as Bitcoin trades below this zone, the market remains in a state of consolidation under resistance. A decisive break and close above this area would likely shift focus toward the next high timeframe resistance around $92,000.

Let’s now move into the lower timeframes to see if there’s any short-term structure worth noting.

Intraday View – Bitcoin (1H Chart)

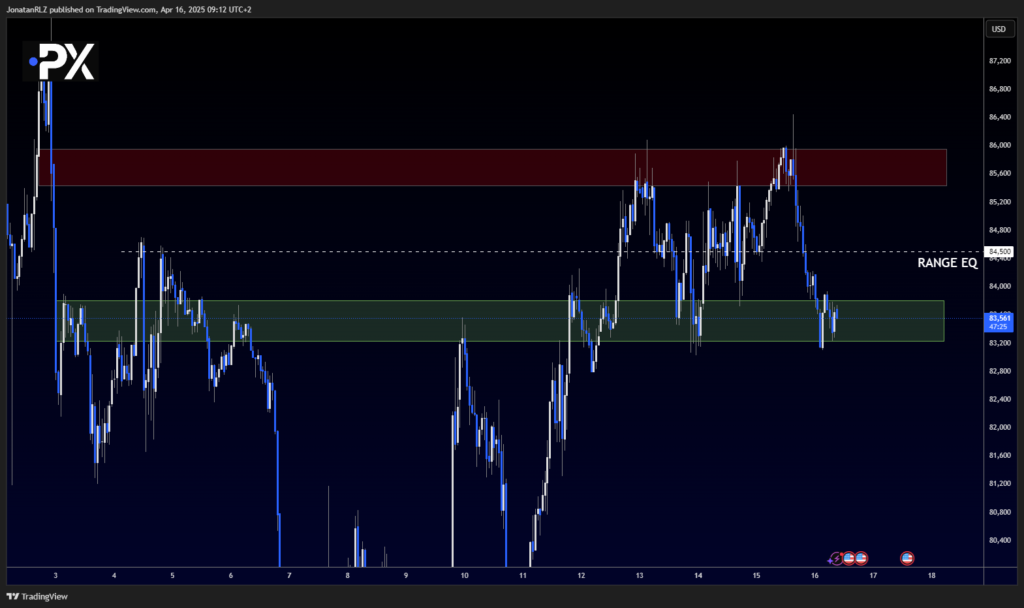

Zooming into the 1-hour chart, Bitcoin is currently testing the range low near $83,500, while the range high sits around $85,600. This short-term structure can be viewed similarly to the S&P 500’s range, with both assets currently trading within key boundaries awaiting a directional breakout.

A break above the $85,600 range high could open the door to a larger move that challenges the high timeframe resistance zone, and potentially shift the structure more decisively in favor of the bulls. On the other hand, a break below the $83.5K support may invite renewed selling pressure and could align with a broader continuation to the downside on the higher timeframes.

For intraday traders, the $84,500 area—serving as the range EQ (equilibrium)—could act as a key level for short-term setups and risk management. These are the primary levels to watch throughout the session.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.