We begin today’s technical update on Bitcoin by looking at the weekly time frame. Despite last week’s bearish close, the broader structure remains bullish, with consistent higher highs and higher lows still defining the trend. The key level to monitor right now is around 107,000, marked as number one on the chart. This level aligns with the previous all-time high support zone.

A pullback here should not be seen as a concern from a high time frame perspective. Bitcoin remains in a clear uptrend, and overall market structure suggests strength.

On the daily time frame, we are currently testing the previous breakout area, near the all-time high zone. One thing to note is the potential shift in short-term structure. Marked as number one on the chart is a potential lower high, while number four may be a lower low. If we view number two as the previous higher low, then this would technically represent a break in daily structure. However, the more significant swing low may actually be number five, and unless that breaks, the broader daily uptrend could still be intact.

If price fails to hold above this area, the next key support to watch is around 95,000 to 96,000, marked as number three on the chart. This would also test a cluster of previous highs and could be a zone for potential demand.

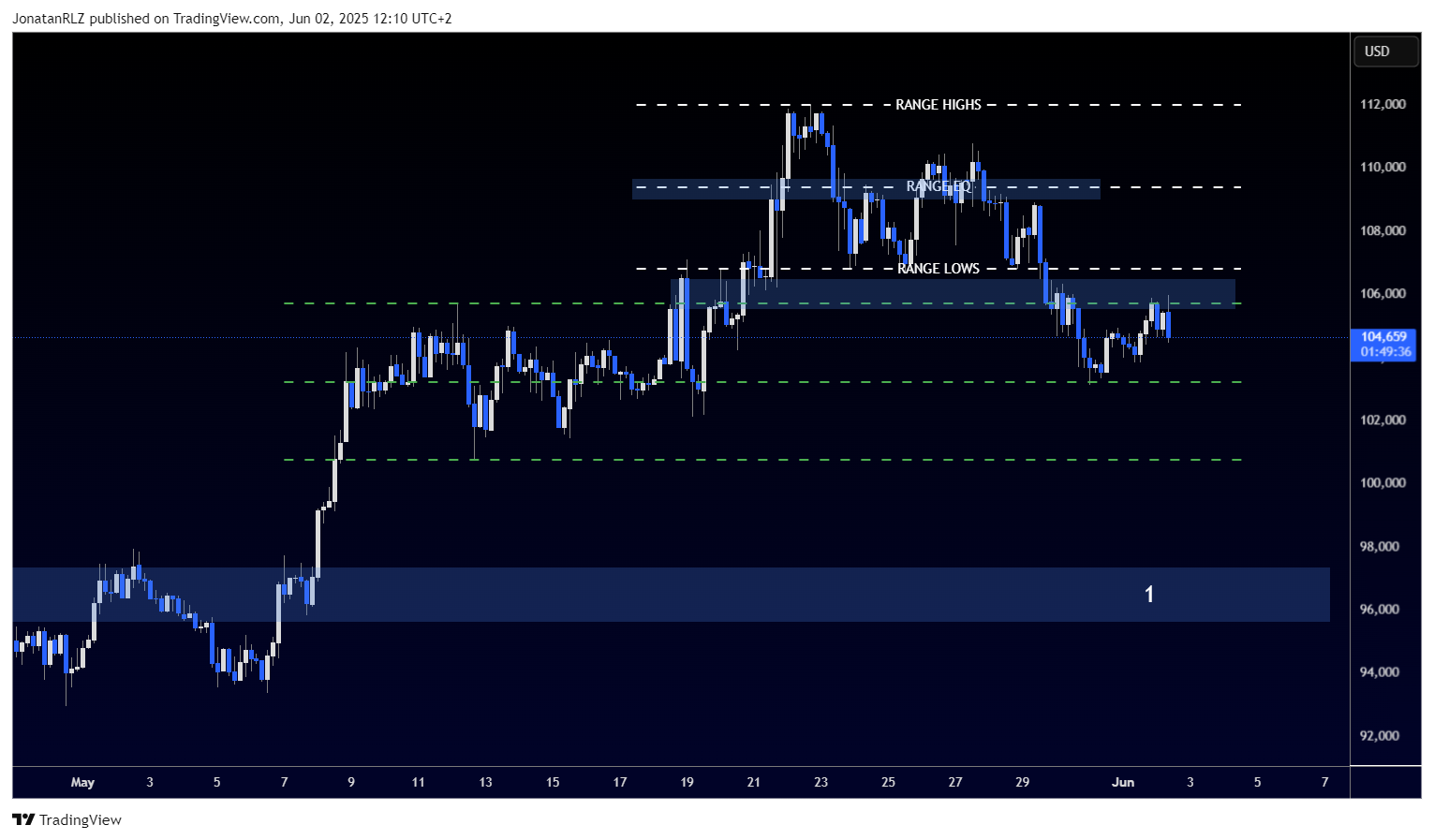

On the 4-hour time frame, we’re seeing a more nuanced picture. Bitcoin has transitioned from a possible distribution range at the top, marked in white, to a re-entry into a previous range marked in green. The range EQ (Equilibrium) of this lower structure held as support, and we are currently testing the top of this green range, which also aligns with the previous range lows from the white zone.

If the green range continues to hold, the bias remains bullish with caution. However, a clean breakdown below 100,700 could signal further weakness and possibly a move towards the 96,000 zone.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.