Bitcoin rose 3.5% last week, recovering some of the 4.5% losses from the prior week, and is extending gains towards its 123k record high. The largest cryptocurrency started the previous week at 112k before rising to 117.8k on Friday. BTC has extended gains over the weekend, reaching 121.5k in early trade on Monday.

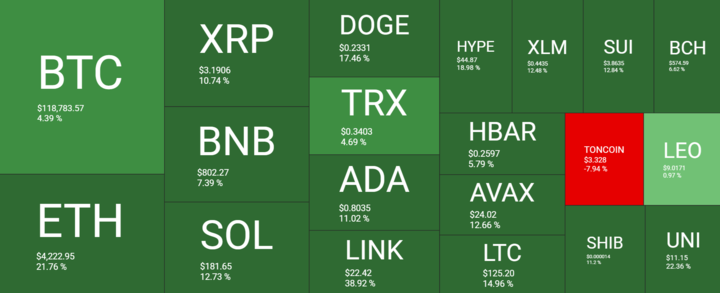

While BTC has rallied 4.5% over the past 7 days, the Broader cryptocurrency market outperformed, with Ethereum jumping over 20% pushing above the psychological $4000 level to $4300, its highest level since 2021. XRP booked gains of 10% after the SEC vs Ripple courtroom battle came to an end, with both sides telling the court that they have dropped their appeals. Meanwhile, Solana has risen 12% over the past seven days. Smaller tokens such as ADA, HYPE, and XLM also booked gains of between 10% and 20%.

The cryptocurrency market capitalization sits at $3.97 trillion at the time of writing, down from a spike of $4.04 trillion on Friday but up significantly from $3.64 trillion a week ago. Meanwhile, the Fear and Greed index is at 59, up from 48 a week ago but remaining in Neutral territory.

Crypto liquidations have been relatively subdued, although Ethereum’s move above $4000 triggered $400 million in crypto liquidations, with 80% from leveraged shorts at $316 million. This was the most significant liquidation of short positions in the cryptocurrency market since mid-July. Over 113,000 traders were affected in a 24-hour period.

BTC ETF inflows return

Spot BTC ETF demand started last week in negative territory, extending outflows from the previous week. However, by Wednesday, demand had flipped positive. Bitcoin posted net inflows of $246 million across the week. ETF inflows are tentatively returning, offering a structural pillar after $643 million in net outflows in the final week of July.

ETH ETF demand surpasses BTC’s

ETH has gained momentum as institutional ETF inflows surpass Bitcoin. ETH ETFs booked net inflows of $3326 million last week, marking a thirteenth straight week of net inflows. On Friday alone, ETH ETFs saw $416 million in net inflows compared to Bitcoin’s $404 million, marking one of the strongest single-day institutional buying waves that ETH has seen this year.

As well as ETF demand, demand for ETH institutional treasury has also soared.

Corporate treasury flows

Corporate treasury flows of crypto surged in the last week of July, with public companies acquiring over $7.8 billion in new crypto investments. In comparison, last week’s activity was more muted, though there were some noticeable purchases in ETH. More than 304,000 ETH worth over $1.3 billion was added by publicly traded companies that have Ether treasuries in the past week.

BitMine Immersion Technologies bought the lion’s share of ETH, buying more than 208k ETH, worth over $900 million. This was followed by SharpLink, which bought $303 million worth of Ether.

Bitcoin treasuries have also surged, reaching 1.86 million Bitcoin. The month-by-month increase highlights the change in sentiment with institutions and corporations taking more interest in Bitcoin.

Macro backdrop

Bitcoin’s rise to within touching distance of its record highs is being supported by steady institutional inflows into corporate treasuries, US spot ETFs, and a shift in sentiment following US tariffs on imported Gold bars. Last week, Trump announced trade tariffs on imports of one-kilo gold bars, which comprise the bulk of Switzerland’s exports to the US. Gold is now facing bottlenecks and policy risk. Given that Bitcoin, Ether, and other cryptocurrencies are borderless, tariff-free stores of value are gaining traction.

On the regulatory side, President Trump signed an executive order that will allow alternative assets like crypto to be included in the 401K retirement plans. This development could have a significant impact on the crypto market by introducing a new wave of mainstream adoption, even if it takes some time for these firms to adjust to the updated rules.

Fed rate cut in September

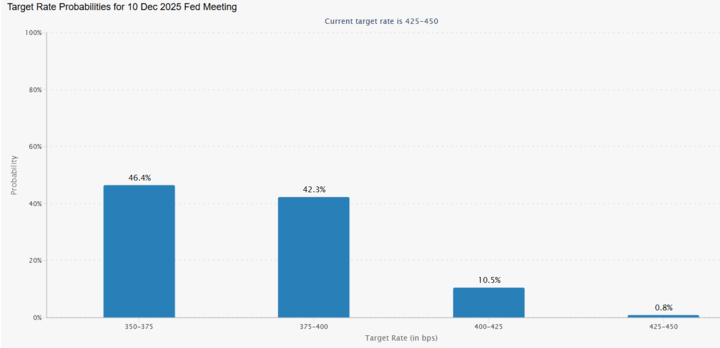

Following the softer-than-expected July nonfarm payroll report, the market is increasingly expecting the Federal Reserve to resume its rate-cutting cycle in September, which is adding some optimism to riskier assets such as Bitcoin.

According to the CME Fed watch tool, the market is pricing in an 88% probability that the US central bank will reduce the interest rate at the September meeting. Furthermore, the market is pricing in two rate cuts of 25 basis points by the end of the year. Looking ahead, this week, US inflation data could keep fed rate cut expectations in play ahead of the Jackson Hole economic symposium on August 21 to 23, which is likely to be the next major event.

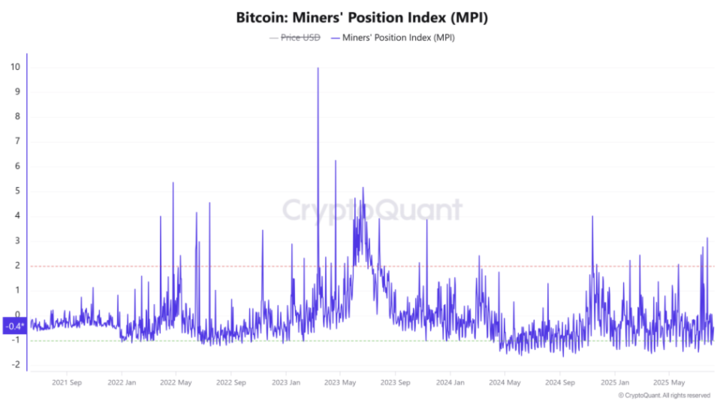

BTC miners reduce selling pressure

Miners could be supporting bitcoin’s price with the Miners’ position input index, MPI at -0.46. This shows that miner outflows remain below the yearly average, suggesting restrained selling behaviour. A reduction in miner-led supply pressure could help maintain market stability or support the price higher.

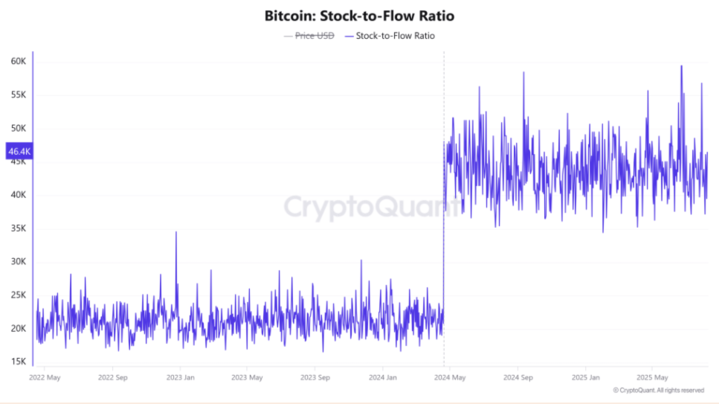

Meanwhile, the stop to flow (S2F) ratio rose to 1.5923 million, marking a 75% jump and reinforcing BTC scarcity appeal. Historically, a high S2F goes hand in hand with bullish phases as a tighter supply lifts investor conviction. Let’s not forget this follows the post-halving decline in issuance, which could amplify scarcity-driven demand for both retail and institutions.

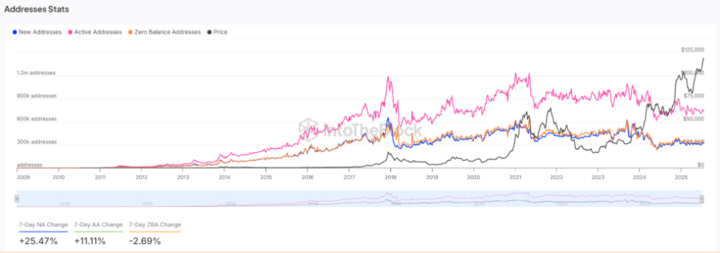

On-chain activity has improved with new addresses up 25% and active addresses up 11.1% over the past week. Meanwhile, zero balance addresses fell by 2.69% meaning that more wallets are holding BTC. This type of growth expands the user base, deepens equity, and strengthens market retail resilience. If sustained, it can reduce the price except the cap and support long-term price gains.

Should fundamentals continue to strengthen through increased interest and activity, bitcoin’s price could head towards record highs.

Ether tops $4300 at a multi-year high

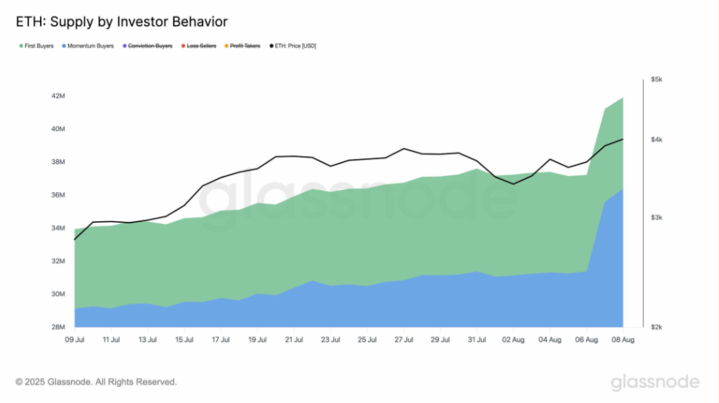

Ether has rallied hard over the past few months, rising from a low of $1383 on April 7 to $4300 at the time of writing. While we noted that soaring institutional and corporate demand are driving gains, on-chain data is also encouraging.

Data from Glassnode shows a sharp rise in first-time buyers and momentum traders, lifting demand.

However, also of note, conviction buyers, those who buy, raising their cost basis despite the multi-year high in ETH price, grew, signaling deeper market commitment. Adding to the mix, fresh inflows and seasoned holder conviction, the stage could be set for an aggressive move higher.

ETH open interest heats up

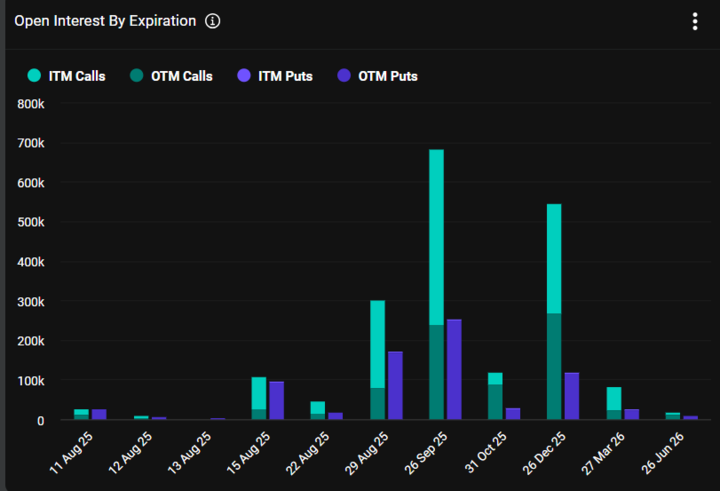

The Ethereum futures market is also heating up with Futures Open Interest at $51.61 billion, close to a yearly high.

The ether options market reflects the bullish sentiment with an overall put-call ratio of 0.40. The highest concentration of call options with a December 26 expiry is at $6000 according to Deribit data.

Ether (and Bitcoin) positioning has been heavily skewed towards September and December calls in line with Fed rate cut timing.

ETH technical analysis

Ethereum closed above the psychological level of 4000 ON Saturday, up almost 22% across the previous week, and trades above 4300. If the altcoin continues its trend higher, the price could reach 4868, its record high from 2021.

On the daily chart, the RSI is overbought and pointing higher, indicating strong bullish momentum. Meanwhile, the MACD showed a bullish crossover, adding more evidence for the bulls.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.