Yesterday, we discussed how Bitcoin briefly broke above the 112,000 level and questioned whether this was simply a temporary fakeout above range highs. However, the market has provided a clear answer. The move continued higher throughout the session, and the daily candle closed well above the previous range highs, confirming a major breakout for Bitcoin.

Since then, the price has shown no signs of slowing down. At the time of writing, Bitcoin is trading above the 118,000 level, pushing further into uncharted territory. With this breakout confirmed and price discovery underway, the focus now shifts to identifying potential areas of interest to the upside.

When an asset trades at new all time highs, previous price action offers no reference points for resistance. In such cases, traders often turn to technical analysis tools like the Fibonacci retracement and extension levels to identify possible zones where the price might encounter resistance.

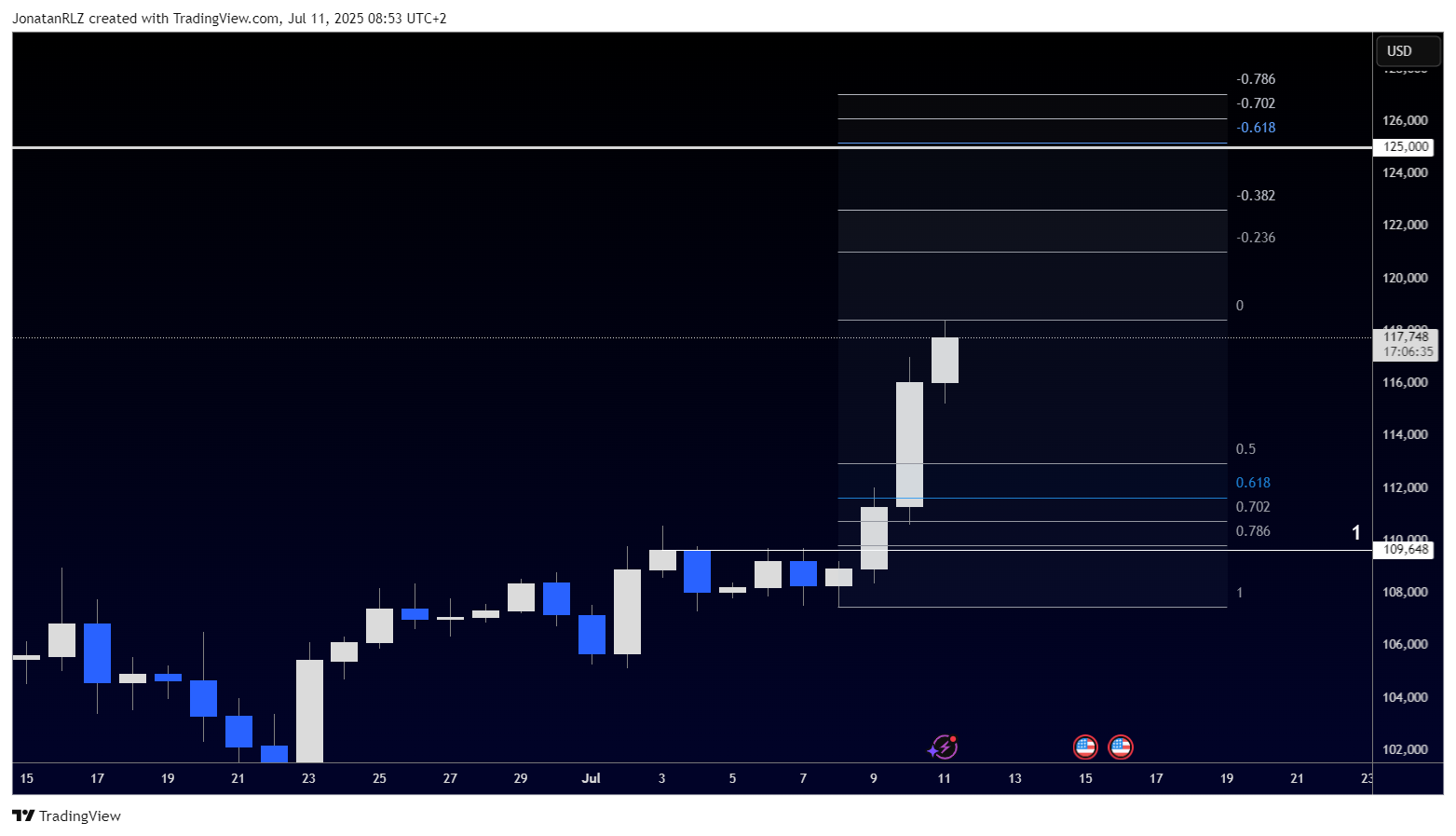

On the daily chart, we can see the Fibonacci extension tool applied to the entire recent move, using the low around 98,000 and the current high of the breakout. This gives us several upside areas of interest, including the -0.236 and -0.382 extension levels, with a particularly notable zone forming around 125,000 USD. This area sits between these two extensions and could act as a psychological and technical resistance if momentum continues.

Additionally, we can refine this analysis by applying the Fibonacci tool to the very latest breakout leg, anchoring from the local low just before the move into new all time highs. This second set of extensions highlights the same 125,000 zone, with the -0.618 extension landing near this level. This confluence strengthens the case for 125,000 as a potential resistance area in the current run.

While there is no way to predict with certainty whether the price will continue climbing or retrace, if Bitcoin does experience a pullback, the previous all time high area around 112,000 would likely act as a significant support zone, offering a potential base for any renewed bullish momentum.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.