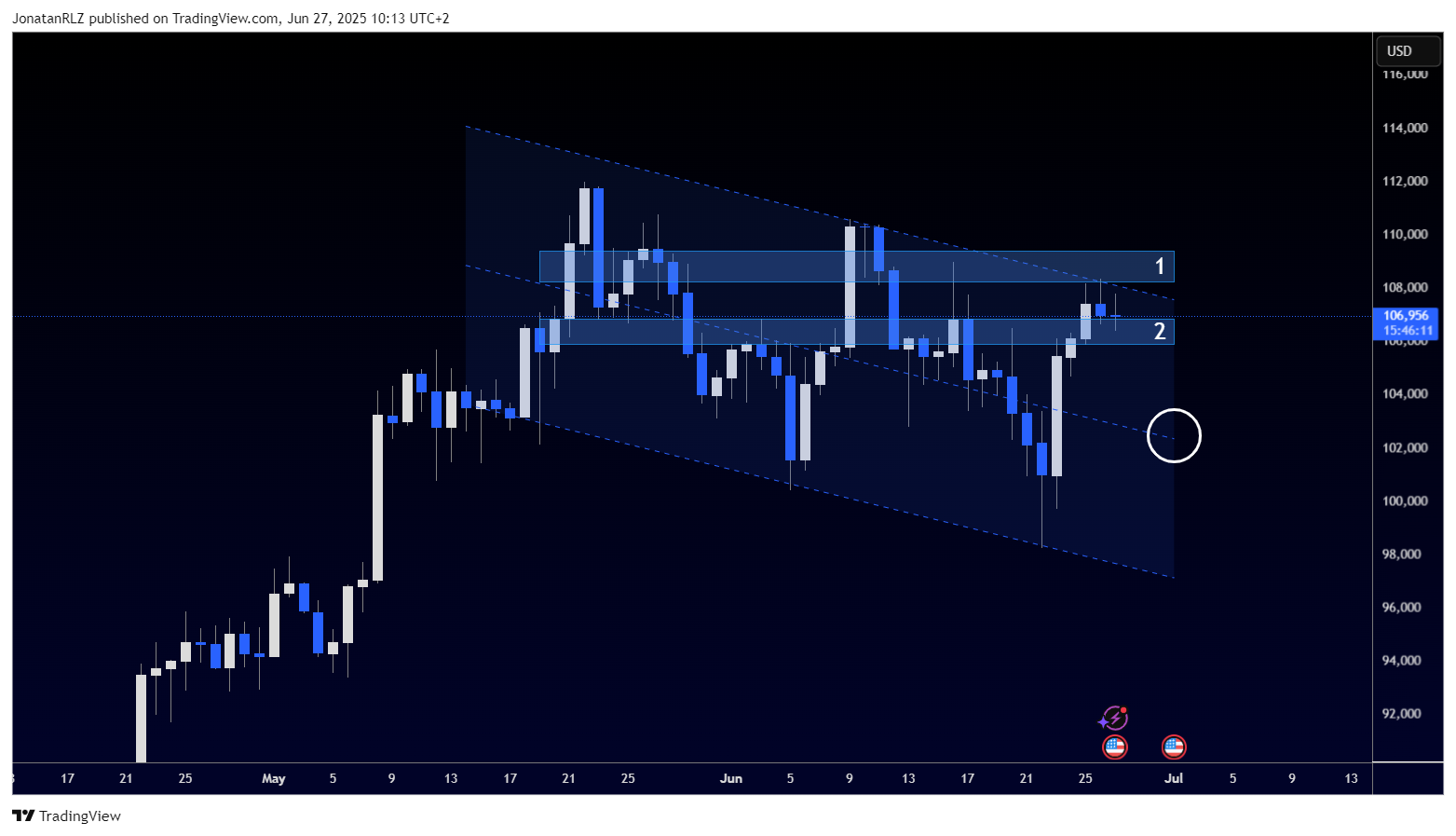

Bitcoin is currently trading within a descending channel on the daily time frame and is now testing the upper boundary of that structure. This move aligns with a significant horizontal resistance zone, marked as level 1, around the 109,000 area. A breakout here would mark a potential shift in trend and bring the recent range highs into play.

At the same time, the price has reclaimed and is currently holding above the 106,500 area, marked as level 2, now acting as support. This level will be important to monitor in the coming sessions. A failure to hold this zone could encourage sellers and potentially trigger a move lower, targeting the channel midline, which currently aligns with the 102,000 to 103,000 region. This area is also marked with a white circle and represents the next probable support in a continued downside move.

Zooming into the 4-hour chart, price action remains compressed between support at 106,000 and the descending trendline acting as resistance. This is creating a short-term squeeze that could resolve with increased volatility.

If 106,000 fails to hold, the 102,000 region becomes the next logical downside support. Conversely, a confirmed break above the descending trendline would open the path toward 110,000, viewed as the first trouble area (FTA) for a potential breakout.

Should Bitcoin break above 110,000 with momentum, the chances increase for a continuation toward new all-time highs, especially if risk sentiment remains supportive across broader markets.

For now, all eyes are on how Bitcoin behaves between 106,000 and 109,000, a key decision zone that could shape the next leg.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.