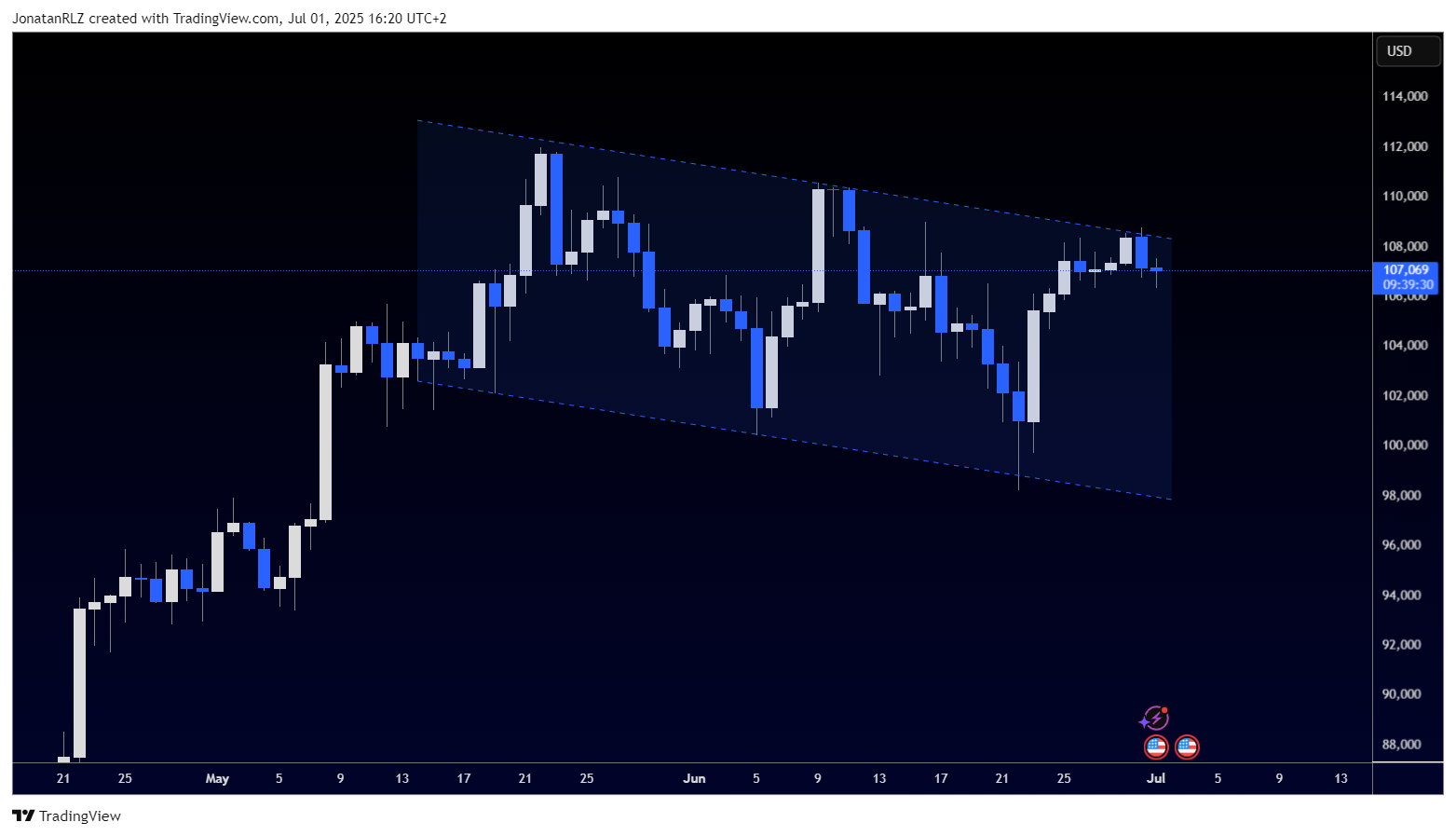

Bitcoin is once again testing the upper boundary of its downward-sloping channel on the daily chart, a structure that has been in play for several weeks. Yesterday’s candle closed as a notable bearish engulfing, hinting at potential weakness in the current move. Unless the price can break above the 108,500 level with conviction, Bitcoin remains confined within this descending structure, which can also be interpreted as a broader range.

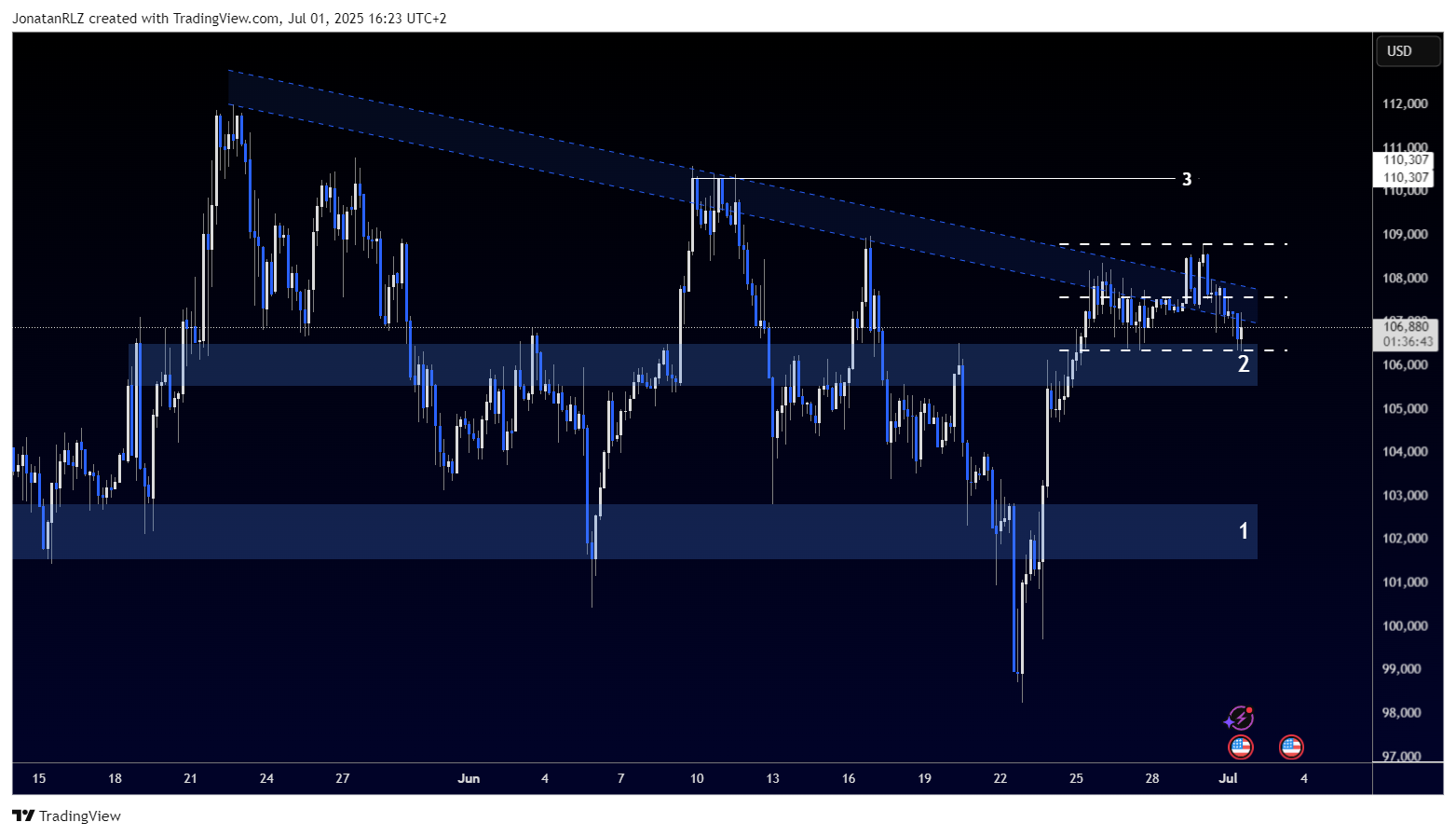

On the 4-hour chart, we can see Bitcoin trading inside a local horizontal range, marked by dotted white lines. The range low aligns with the 106,000 level, marked as level 2, which is a key support zone. A break below this level would likely bring the 102,000 area (marked as level 1) into focus, and potentially trigger a deeper move within the descending structure.

On the other hand, a reclaim of the range EQ around 107,500 would indicate local strength. If bulls can push the price above that level and sustain momentum, we may see a breakout from the high time frame channel on the daily chart, a development that could shift sentiment and open the door to higher levels.

For now, 106,000 remains the key downside level to monitor, while 107,500 and 108,500 are the upside triggers that could lead to a breakout or continuation within the existing range-channel structure.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.