Bitcoin rose 1% last week, recovering from a low of 107.2k on Monday to a high of 113.4k on Friday before falling 3k to 110k. The price has found support at 110k and is rising at the start of the new week. Month to date, BTC trades 2.5% higher, showing resilience in the typically red month of September.

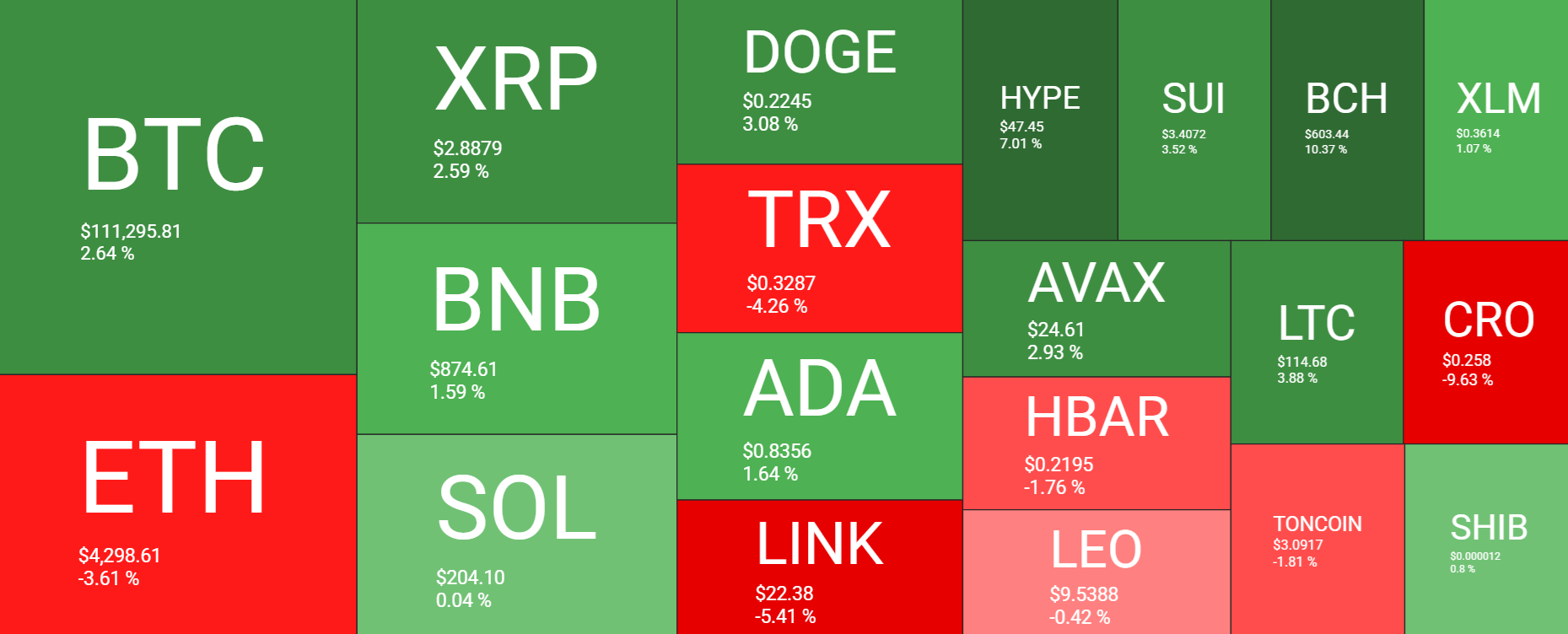

Over the past 7 days, the picture was more mixed across the broader crypto market. While BTC gained 2.6% across the past 7 days, Ethereum, the second-largest crypto token by market cap, fell 3.6%. Meanwhile, XRP and DOGE posted gains between 1.6% to 3% while HYPE jumped 7%. On the other hand, TRX, LINK, HBAR, and TONCOIN were among those that posted losses over the past 7 days.

The total crypto market capitalisation is $3.84 trillion at the time of writing, up slightly from the $3.80 trillion market cap recorded a week earlier but still down from the $4.19 trillion record reached on August 14.

Sentiment analysis shows that the market remains in neutral territory at 40 on the Fear and Greed Index, unchanged from the previous week and down from Greed territory a month ago.

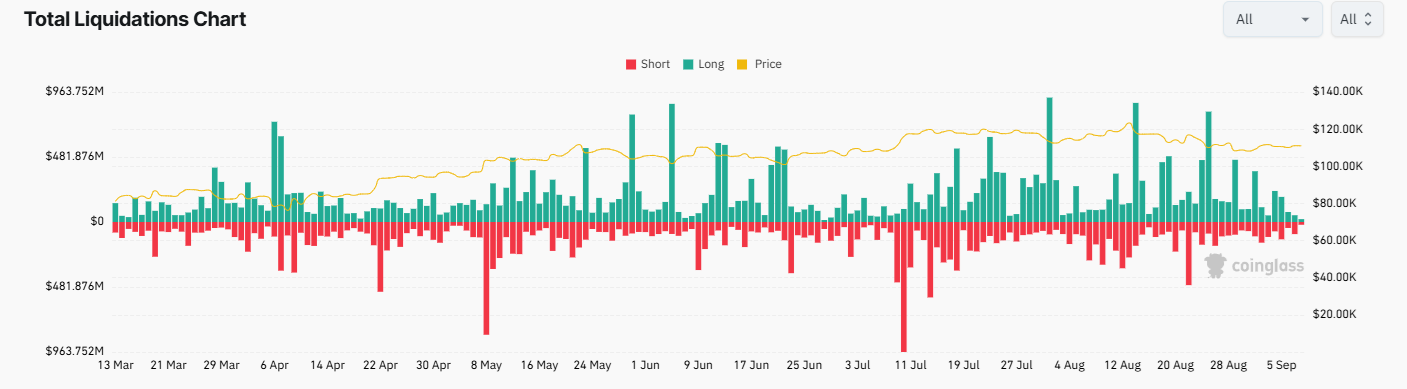

Liquidations

Total crypto liquidations were $1.63 billion across last week, of which 62% were long liquidations, totaling $1.02 billion. This compares with $1.8 billion in liquidations the previous week, with more than 74% of positions being long, suggesting that the overly bullish positions have been flushed out.

Macro Backdrop

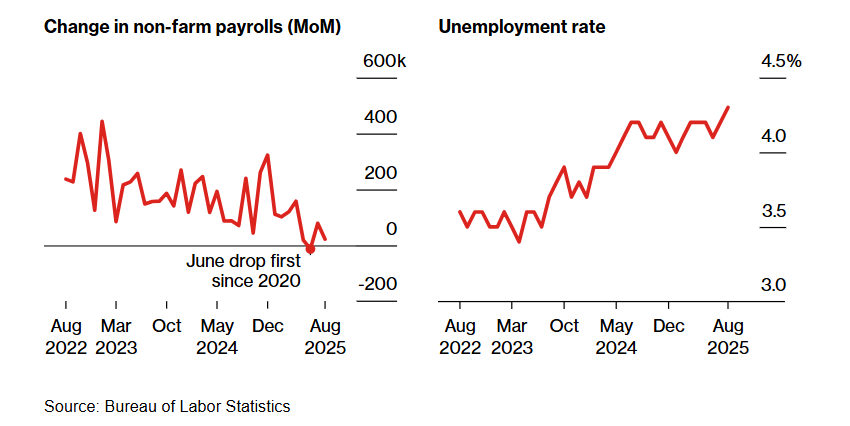

Macro factors were back in the driving seat last week as data cemented September Federal Reserve rate cut expectations.

Friday’s non-farm payroll report showed that 22,000 jobs were added in August, well below the 75,000 forecast, and a revision to June’s data showed that employment fell in June for the first time since 2020. This was also the fourth straight month that job creation was below 100k. Meanwhile, unemployment ticked higher to 4.3% from 4.2%.

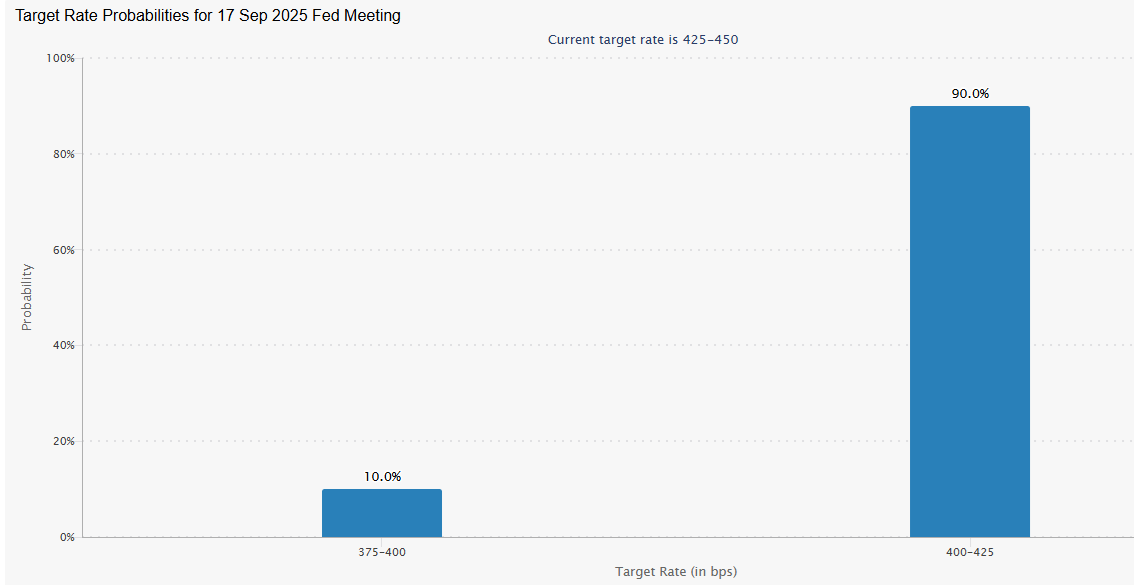

The US labour market is starting to crack, which cemented September rate cut expectations. The market is fully pricing in a 25 basis point rate cut and is pricing in a 10% probability of a larger 50 basis point cut. The market expects to see up to three rate cuts before the end of the year.

Attention this week will be on the US CPI inflation data for further insight into the health of the US economy. Federal Reserve Chair Jerome Powell spoke at the Jackson Hole symposium about the upside risks to inflation owing to Trump’s trade tariffs. CPI is expected to rise to 2.9%.

However, a weakening labour market is also likely to mean wage disinflation, which typically passes through to super core prices with a 10-month lag, implying inflation relief in 2026 if this lag persists. This could mean that higher inflation from the tariff effects could be offset to a degree by the weaker jobs market, providing cover for consecutive rate cuts.

Bitcoin, along with other risk assets, often performs better in low-interest-rate environments given the increased liquidity.

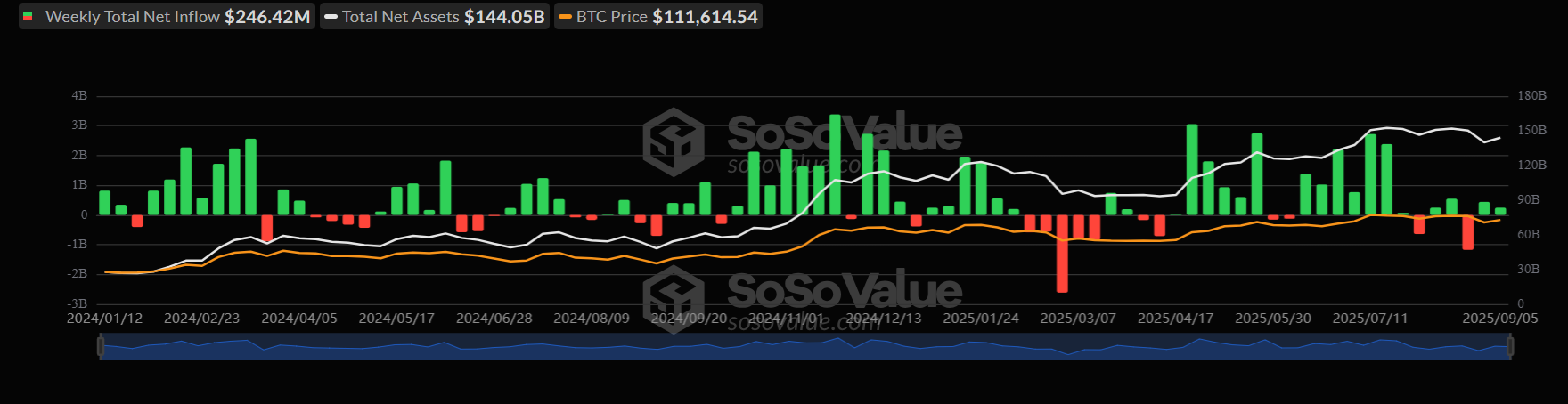

BTC ETF inflows battle outflows

Bitcoin ETFs recorded a second straight week of net inflows totaling $246.4 million. However, breaking this down, BTC ETFs saw solid net inflows on Tuesday and Wednesday, of over $300 million on each day, marking the strongest net inflows since early August. However, these were offset by net outflows on Thursday and Friday. ETF flows could be decisive as to whether BTC sees a Red September. If strong net inflows are lacking, the price could struggle.

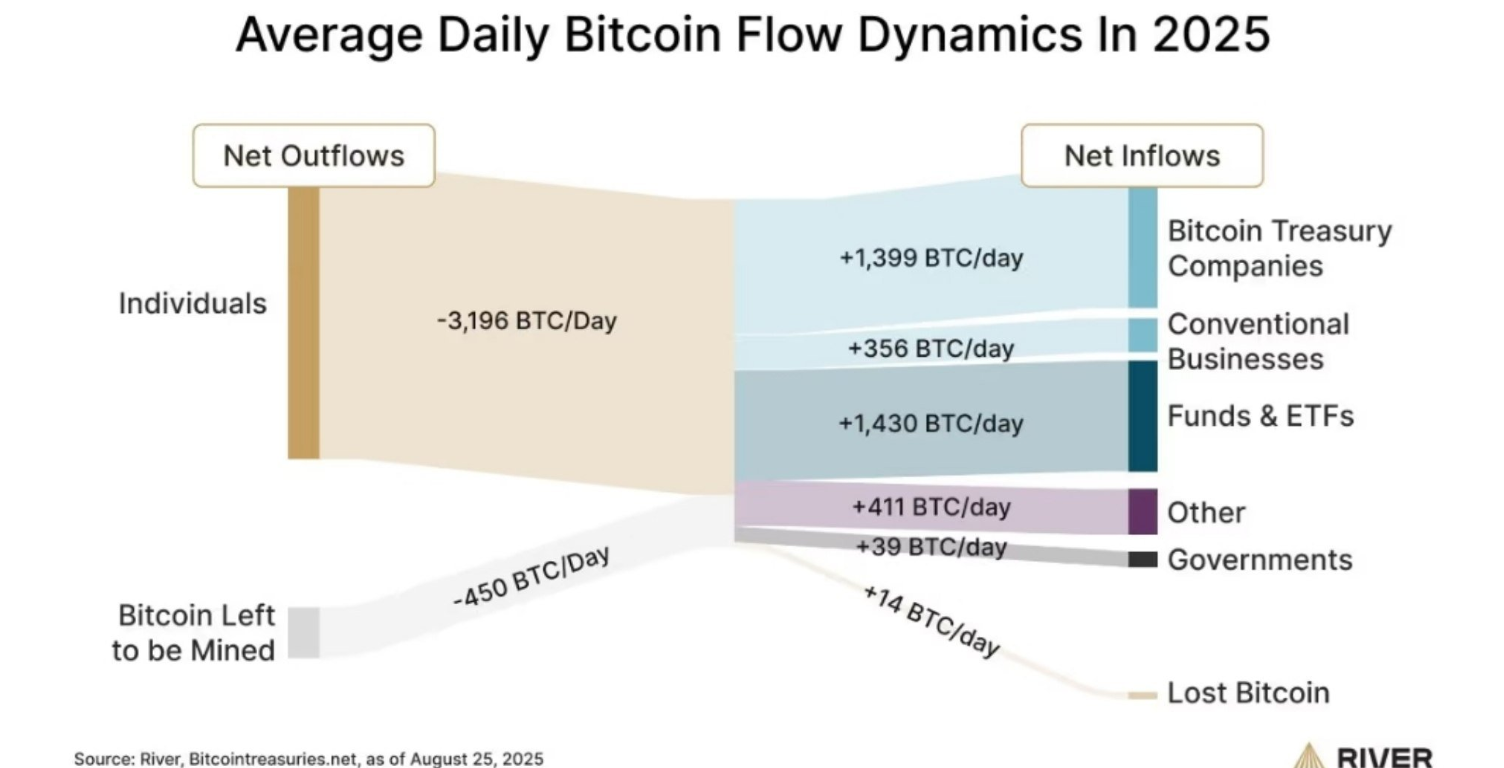

Corporate demand surpasses miner output

According to data from River, businesses across major industries are buying up Bitcoin at a rate of 1755 BTC a day (worth $195.2 million), contributing $1.3 trillion to Bitcoin’s market cap over the past 20 months.

Daily BTC purchases exceeded 1755 BTC from corporations and 1430 BTC via ETFs. Meanwhile, daily Bitcoin mining output is around 450 Bitcoin per day, creating supply imbalances and sending exchange reserves to multi-year lows. Should this steady investment flow continue, BTC moving above 125k is a realistic target.

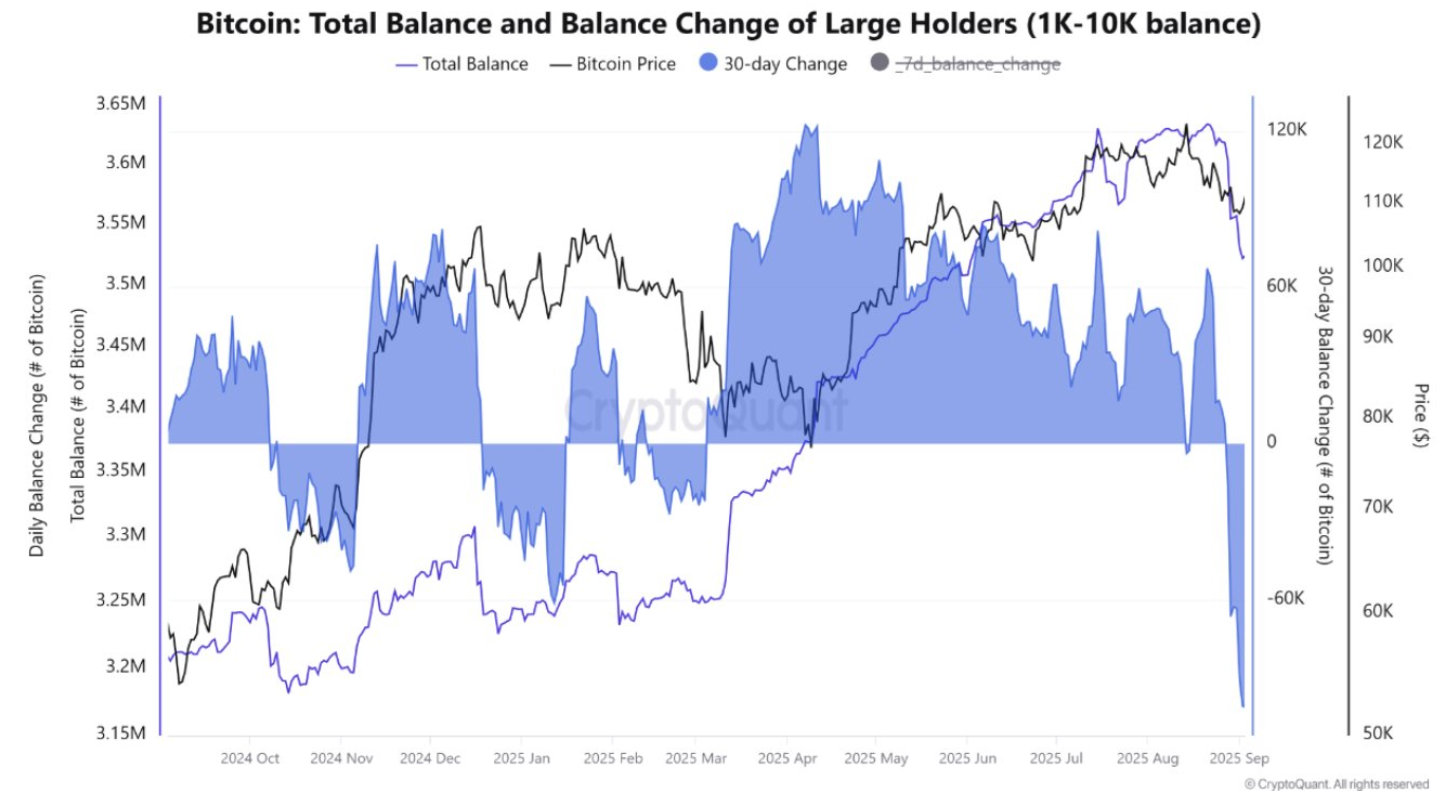

Whale selling hits 2022 high

On-chain and derivative indicators have been flashing a striking divergence in Bitcoin’s short-term and long-term outlook. According to CryptoQuant, large Bitcoin holders have engaged in the largest selling of their reserves since 2022. Across the past 30 days, whales have offloaded 100,000 BTC, signaling intense risk aversion among large investors. The 7-day daily change balance reached its highest level on September 3 since March 2021, with more than 95,000 being shifted by whales that week.

The selling pressure has weighed on the price structure, pushing Bitcoin’s value below 108k last week. The good news is that aggressive selling appears to have slowed, with the weekly balance change dropping to around 38,000 BTC.

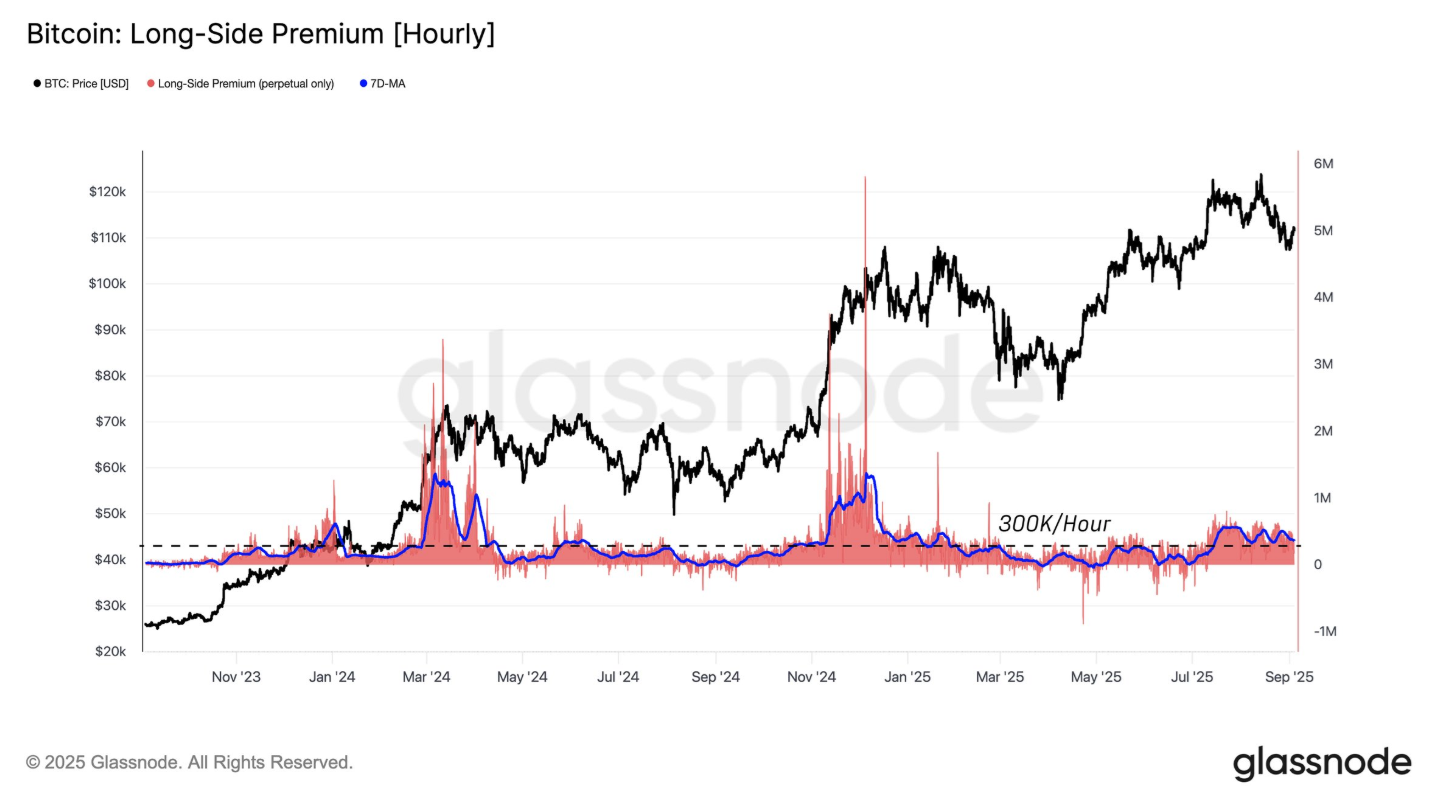

Adding to near-term bearish sentiment, Bitcoin’s future funding rates are cooling according to Glassnode data, to approximately $366/hour, near the neutral threshold of 300K/hour. A drop below this level would signal fading demand and a deeper correction.

However, zooming out, the picture is healthier. Bitcoin has only corrected 13% from its record high, which is much shallower than recent pullbacks.

Signs of a recovery?

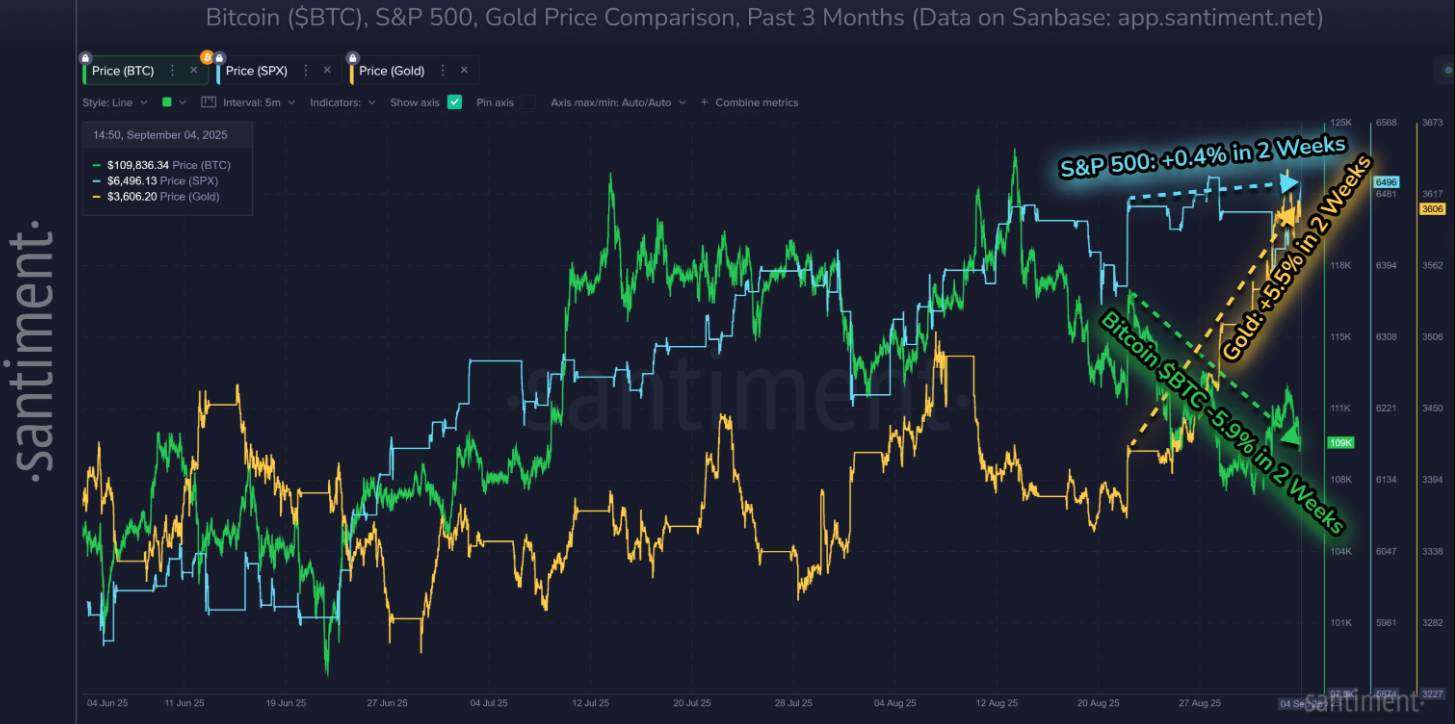

A significant divergence over the last two weeks between BTC, the S&P 500, and Gold could be a bullish signal emerging.

Over the past two weeks (since August 22), Bitcoin’s price has dropped 6%. The S&P 500 has risen 0.4% across the same timeframe, and Gold has risen 5.5% rising to fresh record highs above 3550. These divergences point to an argument for an upcoming bounce in BTC.

Historically, when crypto lags equities and commodities for a long, sustained period, the probability of a catch-up rally increases. The larger the gap, the stronger the argument for rebalancing.

This comes as stablecoin supply is near record highs, signaling reserves are ready for potential rallies.

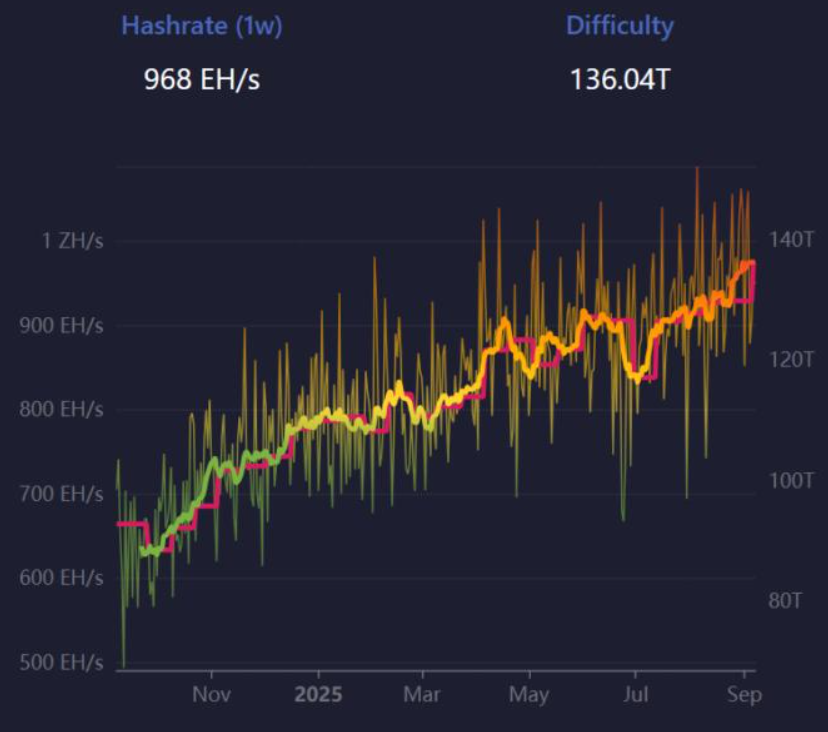

Bitcoin mining difficulty reaches a record level & miner revenue falls

Bitcoin’s network difficulty has risen to a record high above 136 trillion, creating more challenging conditions for miners, who were already dealing with shrinking revenue. This adjustment block height, 913,248, marked a 4% increase and extended a run of five consecutive increases since June.

Difficulty levels are recalibrated every 2016 blocks, which equates roughly to once every two weeks, to keep block production close to the 10-minute target. A rise signals more computer power and a drop reflects miner exits. The rising threshold comes at a tough time for BTC miners.

Data from Hashrate Index shows the hash price, which is the benchmark for miner revenue per unit of computing power, has fallen $51. This marks the weakest level since June, underscoring how revenue pressure his building even as competition intensifies. The August number shows that Bitcoin’s hash price average across the periods settled 5% lower than in July.

Furthermore, the Hashrate index noted that BTC miners collected just 0.025 BTC per block on average, a 19.6% decline from July and the weakest performance since late 2021. In dollar terms, this equates to $2904.00 average daily fee income, which had dropped almost 20% month on month.

Miners are in a challenging position amid a combination of record difficulty levels and weaker revenue streams, which could leave their operations on tight margins. In such instances, miners could be forced to sell near-term to remain solvent. However, over the long term, this could be considered a positive as it roots out inefficient miners and sees increased investment in mining infrastructure.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.