Welcome back, everyone, to another technical update on Bitcoin.

We begin today’s report by zooming out to the weekly timeframe to highlight just how strong the broader bullish trend still is.

When looking at the major swing points on the weekly chart, we continue to see a consistent structure of higher highs and higher lows—the hallmark of a healthy uptrend.

The most recent higher low came from a bounce off the weekly 50 EMA, which has historically acted as dynamic support in bull markets.

Some traders even use the 50 EMA as part of a broader indicator known as the Bull Market Support Band, further emphasizing its relevance.

This successful retest of the 50 EMA reinforces the idea that Bitcoin’s primary trend remains intact.

Looking ahead, Bitcoin is now approaching a significant resistance area on the weekly chart, and a clean break above this zone could open the door to a new phase of upside continuation.

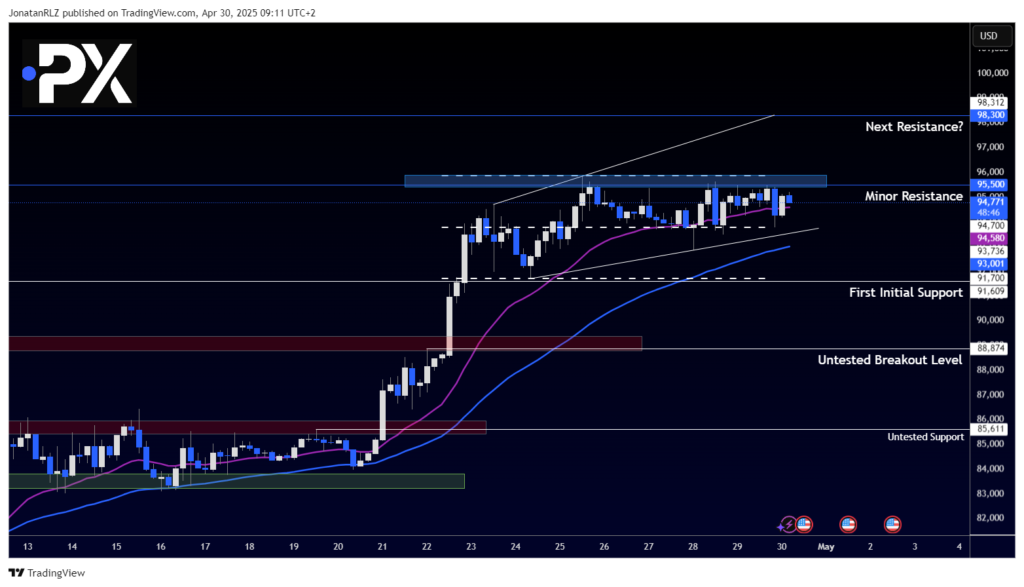

4H Chart – Range Forms as $95.5K Caps Momentum

Now shifting focus to the 4-hour timeframe, we see a different story developing: compression and indecision.

Earlier, we were tracking a broadening wedge (megaphone pattern), but recent price action—especially the repeated rejection at $95,500—suggests we are instead forming a clear range structure.

Although the upper trendline of the wedge remains on the chart, it now serves more as a visual anchor, since it aligns closely with the $98,300 resistance zone, a potential target if the current range breaks upward.

The current structure looks like this:

- Range Highs (Resistance): ~$95,500

- Range EQ (Midpoint): ~$93,800

- Range Lows (Support): ~$91,700

At the time of writing, $95.5K continues to act as resistance, and a break above that level could set up a move toward $98,300.

On the other hand, a break below $93,800 puts the $91,700 support back in focus.

While the weekly trend remains clearly bullish, the lower timeframes show short-term hesitation, with Bitcoin needing a decisive breakout from this range to unlock the next major move.

Open free account

Your capital is at risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.