As one of the top performers of the day and currently showing one of the cleanest structures in the altcoin market, BNB stands out and is worth taking a closer look at.

Starting with the daily timeframe, we can clearly see a structural shift with BNB breaking above a long-term descending trendline. A parallel channel has been used to mark this trend area, creating a more dynamic visual buffer zone around the trendline. On 8 May, BNB broke above this channel and subsequently formed a bull flag pattern, which was then broken to the upside again on 21 May. Since then, we’ve seen the formation of higher highs and higher lows, giving BNB a distinct bullish structure compared to many other altcoins currently in corrective or sideways trends.

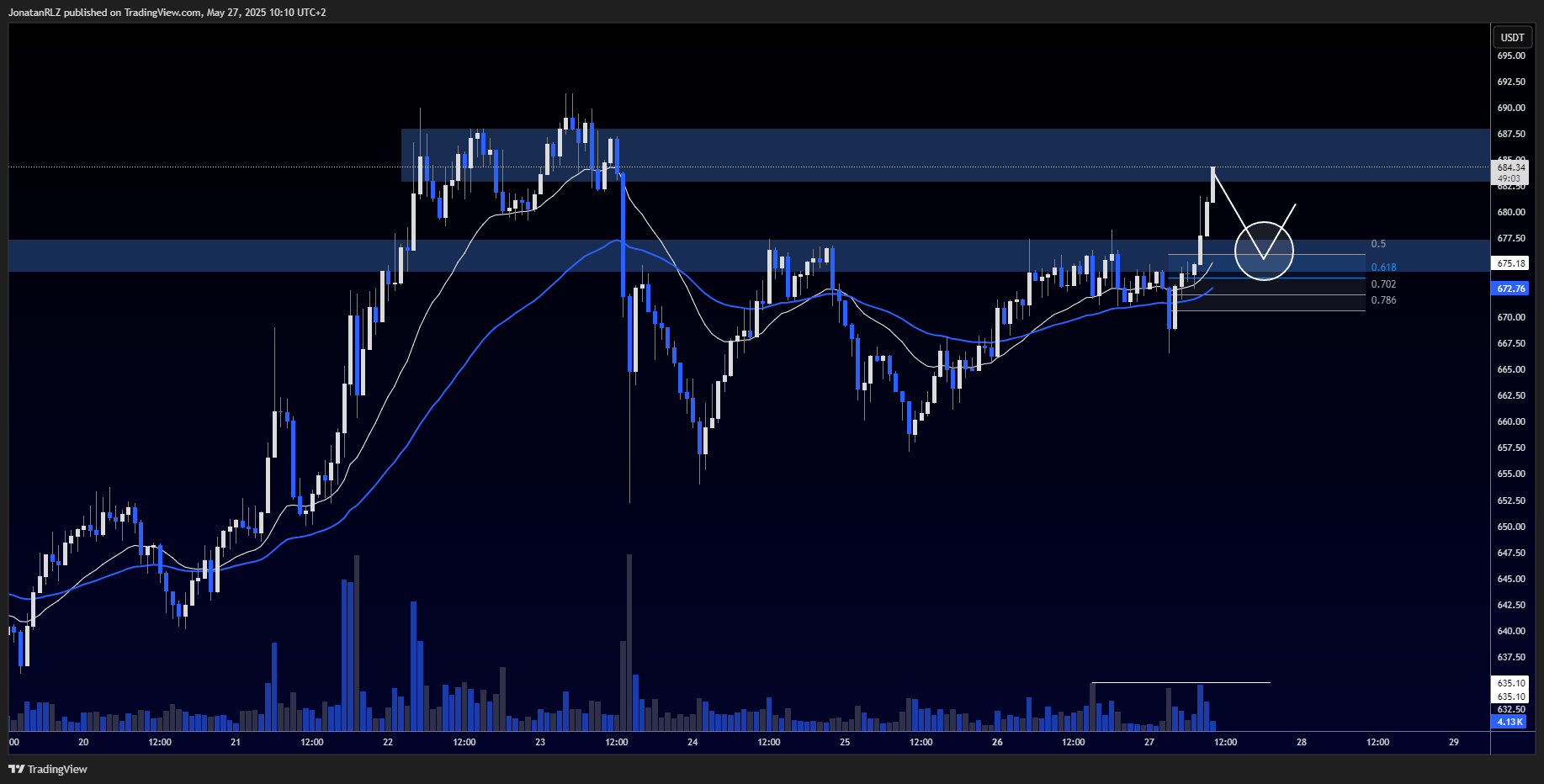

Dropping down into the 1-hour timeframe, BNB recently broke above the key 677 level and is now trading just beneath a local resistance zone. The momentum behind this move appears strong, with two hourly candles now closing above the breakout level. There was a volume spike on the breakout, confirming initial strength, but it’s worth noting that the volume was not significantly higher than previous tests of this level. For greater conviction, we would ideally want to see another spike in volume that surpasses the previous peaks.

Using the Fibonacci retracement tool from the low of this current breakout move to the midpoint of the resistance area, we find the 50% fib aligning closely with the 677 level. This level also aligns with both the 20 and 50 EMA on the 1-hour chart. If price retraces from the current resistance area, this is the zone we will be watching for a potential bounce. A strong reaction here could confirm the breakout and suggest continuation to the upside.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.