Brent crude oil has surged to six-month highs this week as escalating tensions between the United States and Iran inject a fresh geopolitical risk premium into the market. Reports suggest Washington is moving closer to potential military action after nuclear talks stalled, raising concerns over Iranian supply disruptions and broader risks to flows through the Strait of Hormuz.

However, the longer-term fundamental backdrop remains bearish, with global production growth expected to outpace demand throughout 2026. That creates a tension between short-term geopolitical momentum and structural oversupply, and the weekly chart appears to reflect exactly that.

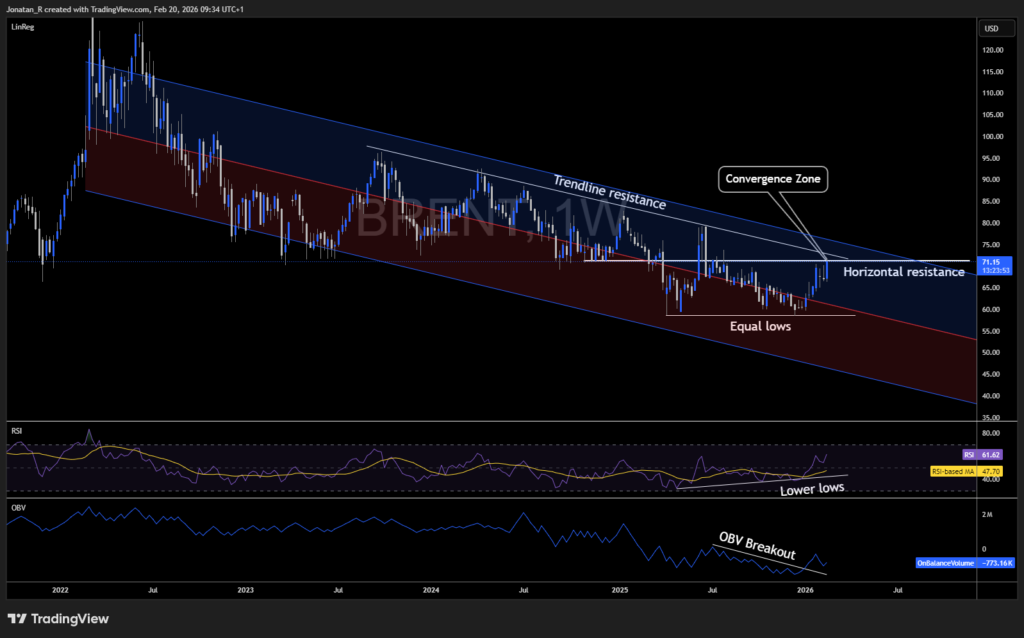

Weekly technical analysis

On the weekly chart, Brent crude has been trading within a well-defined downtrend since the summer of 2022. Price action has been contained inside a descending channel, with both lower highs and lower lows defining the structure over the past three and a half years.

However, there are signs that momentum may be shifting, at least in the short term. Price printed equal lows in the $58-62 zone during late 2025, while the Relative Strength Index (RSI) printed higher lows over the same period. This bullish divergence between price and RSI suggests that selling pressure was weakening even as price tested its lows.

Adding to the bullish case, On Balance Volume (OBV) has broken out of its own downtrend, suggesting that this rally is backed by genuine buying volume rather than simply a lack of sellers. The combination of bullish RSI divergence and an OBV breakout on the weekly timeframe is a meaningful signal that may not be easily dismissed.

That said, the broader structure demands caution. Brent is now trading directly into a convergence zone where multiple layers of resistance appear to overlap:

- Horizontal resistance around the $71-73 area, a level that has acted as both support and resistance multiple times over the past year

- Descending trendline resistance, connecting the series of lower highs from the September 2023 peak

- The upper two standard deviation boundary of the linear regression channel that has contained this entire downtrend

This convergence zone could be the critical area to watch. A confirmed weekly close above it may signal the beginning of a structural trend reversal, potentially opening the door toward the $78-80 region. On the other hand, a rejection at this zone would be consistent with the prevailing downtrend and could send price back toward the $62-65 support area.

Until this resistance cluster is decisively broken, the weekly chart suggests that this may be a counter-trend rally within a structural downtrend, and traders may want to treat it accordingly.

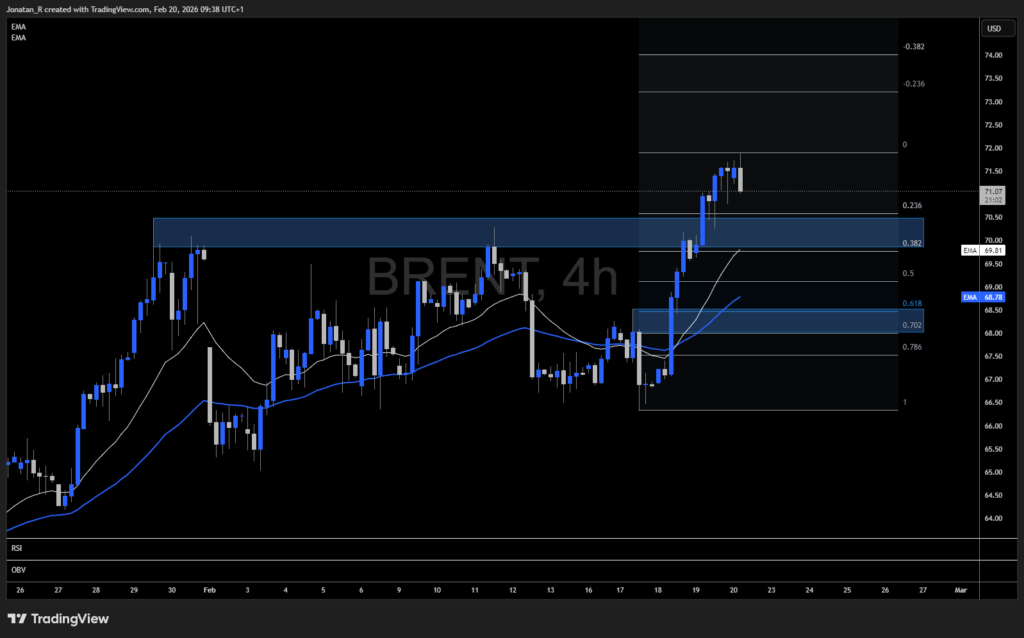

4-hour technical analysis

Brent broke cleanly above the $70 resistance zone yesterday, a level that had capped price for several sessions. This breakout sits between the 0.382 and 0.236 Fibonacci retracement levels and could now act as support on any retest.

Below that, a deeper support zone sits between $68 and $68.50, aligning with the 0.618 to 0.786 Fibonacci retracement area. This could be considered the optimal reload zone for buyers during a pullback.

The 20 EMA and 50 EMA on the 4-hour chart are both trending higher and well spaced. Together with the bullish structure on the MACD, this suggests strong short-term momentum behind this move.

A bullish reaction from any of these levels, particularly the $70 breakout zone, could signal a broader shift in structure. However, the weekly convergence zone discussed above remains the key overhead barrier.

Trade Now

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.