Bitcoin is climbing higher after testing the key 200 SMA support. BTC is rising from a low of 106K to 109K as investors consider resurging US-China trade tensions, stimulus measures in Japan, and look ahead to the US CPI report.

US-China trade tensions, which had significantly weighed on risk sentiment earlier in the month, are resurfacing with reports that the White House is considering curbs on various software-powered exports to China. The market reaction to the news has been muted, suggesting that market participants remain optimistic that a meeting between Trump and Xi Jinping at the end of the month could extend the trade truce.

Meanwhile, Japan’s announcement of economic stimulus measures designed to ease the impact of inflation on households could support BTC. Prime Minister Sanae Takaichi unveiled the package, which includes subsidies for electricity and grants to support small and medium-sized businesses. BitMEX co-founder Arthur Hayes sees this as a signal of future BoJ monetary easing, which could drive capital flows into Bitcoin.

Attention will now turn to the US CPI release tomorrow. Expectations are for CPI to rise to 3.1% YoY in September, up from 2.9%. On a monthly basis, CPI is expected to rise 0.3% MoM in line with August. A softer reading of 0.2% could help fuel the soft-landing narrative driving expectations of Fed rate cuts and lift BTC.

Ethereum Rises After Three-Day Slide Amid Mixed Signals

Ethereum is also rising, snapping a three-day losing streak. ETH fell to a low of 3716 on Wednesday before rising to a peak of 3900 today. The second-largest cryptocurrency by market cap is being supported by the cautiously positive mood across the cryptocurrency market, even as institutional demand declines.

ETH ETFs posted $18.77 million in net outflows on Monday amid more signs that demand is fading from the summer months. ETH ETF inflows in October were just $775 million, down from $3.87 billion in August and $5.43 billion in July. That said, inflows are remaining positive for a seventh straight month.

Corporate demand is also ticking over. Japan-listed Quantum Solutions has become the listed company with the largest Ethereum holding outside of the US. The company aims to purchase 100,000 ETH. It currently holds 3866 and is steadily purchasing at a rate of 150 yen per day.

Meanwhile, on-chain data shows that whales are also accumulating. Between October 21 and 23, Ethereum whales added roughly 170,000 ETH, lifting the collective holdings from 100.30 million to 1000.47 million ETH. This marks one of the most significant 48-hour whale upticks this month.

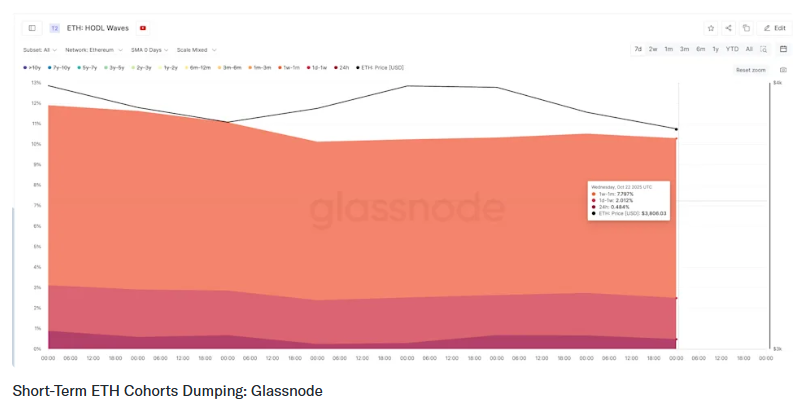

However, as large players step up, short-term holders have been moving in the other direction. According to HODL Waves, three fast-moving cohorts have been reducing their holdings since mid-October. This dynamic keeps Ethereum in a range. Until the smaller holdings regain confidence, ETH may struggle to sustain a rebound.

ETH technical analysis

ETH trades within a potential bull flag pattern. The recent recovery ran into resistance at the mid-point of the falling channel, which, combined with the RSI below 50, suggests more downside first.

Sellers would need to close below 3600—the lower band of the channel—to invalidate the bullish continuation pattern. Buyers need to rise above the 4000 level and 4240, the 23.6% Fib retracement of the 2113 low and the 4955 high. A rise above 4580 is required to break out above.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.