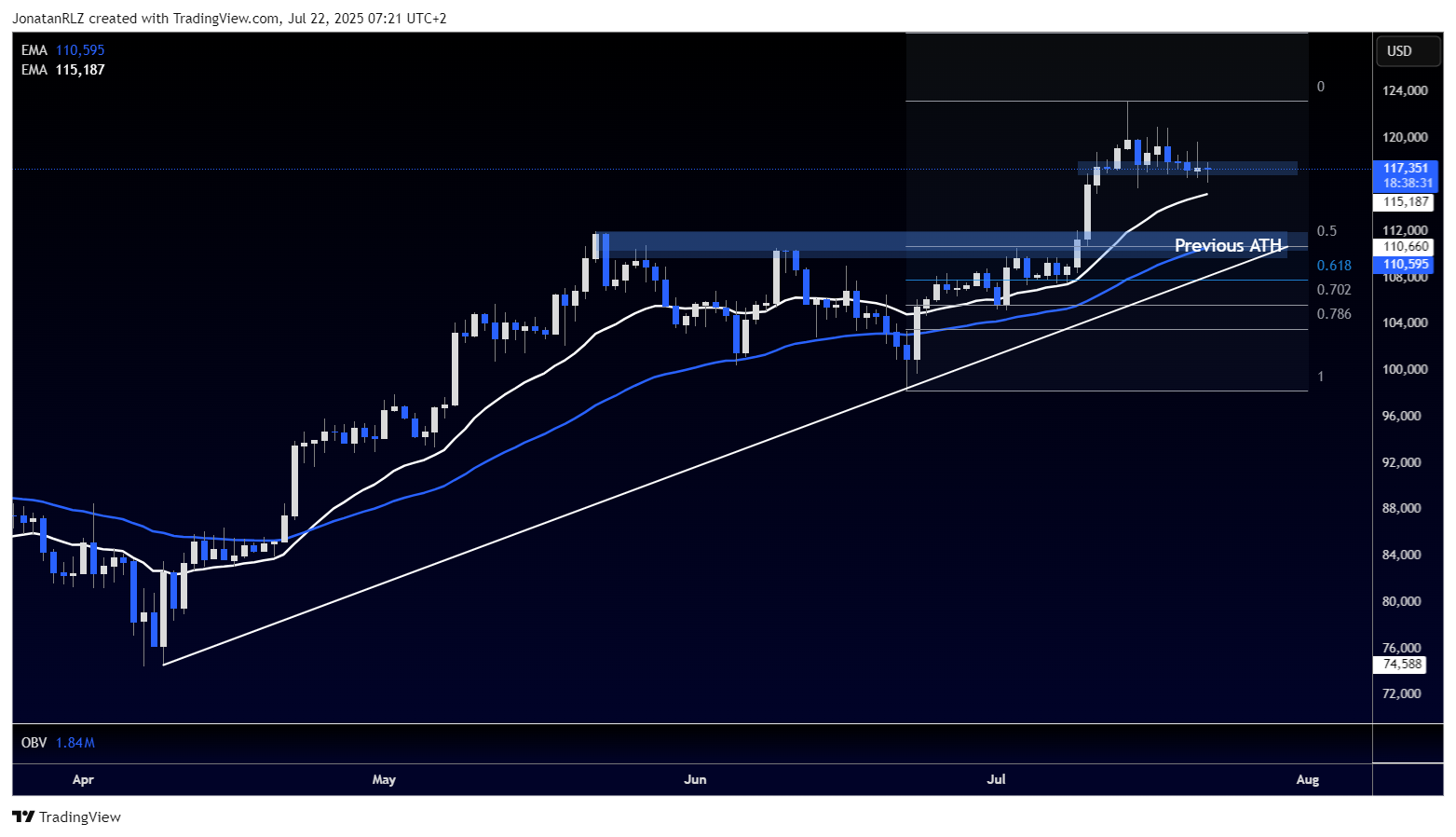

After breaking into new all-time high levels on 10 July, Bitcoin is now consolidating above 116,000 USD. This pause comes after an impressive move that pushed price into price discovery territory. For now, the focus shifts to identifying key technical levels that could influence the next major move.

On the daily chart, we are watching the previous all-time high area around 112,000 as a potential zone of technical confluence. This level aligns with the Daily 50 EMA, the 50 percent Fibonacci retracement of the most recent breakout, and a longer-term ascending trendline that has supported price action over the past months. This clustering of technical factors makes 112,000 a critical area to monitor if Bitcoin retraces further.

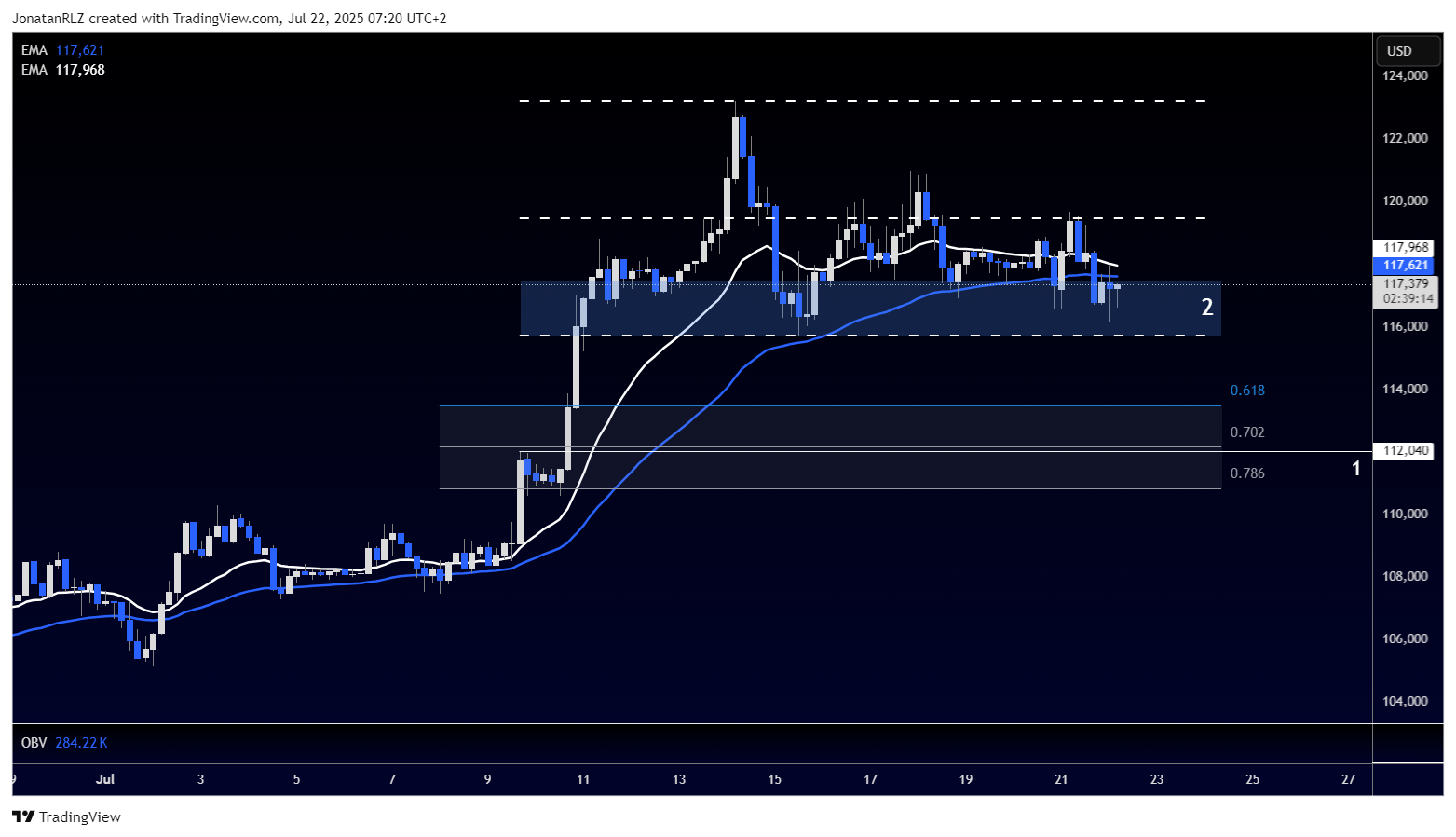

Zooming into the 4-hour chart, the price is currently holding above a horizontal support slightly above 116,000, which can be viewed as the range lows of a potential short-term consolidation structure. This range, marked with white dotted horizontals, could develop into either a distribution phase or a re-accumulation range before higher continuation.

A break below these range lows could trigger a move down towards the previous all-time high area at 112,000, where the daily confluence zone lies. On this 4-hour chart, an additional Fibonacci retracement has been applied, showing the long reload zone overlapping this area (0.618 – 0.786), further adding to the importance of 112,000 as a potential support.

On the other hand, a reclaim of the range EQ near 119,000 to 120,000 would be an encouraging sign of local strength. This could open the door for another attempt at price discovery and continuation of the broader bullish trend.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.