Bitcoin is holding steady below 113k, while other cryptocurrencies were also broadly unchanged as investors remain cautious following the largest deleveraging event of 2025.

Bitcoin trades down 0.1% over the past 24 hours, while Ethereum is 0.3% lower, Solana is down 3.3% and XRP has risen 0.4%. The total cryptocurrency market capitalization remains approximately unchanged over the past 24 hours at $3.89 trillion.

Bitcoin and its crypto peers are yet to recover from the steep losses on Monday, when digital assets were hit by one of the biggest selloffs since the beginning of the year. This reflected a buildup of excess leverage following last week’s 25-basis-point rate cut from the Federal Reserve. Liquidation events, such as the one on Monday, often signal market imbalances.

Following the selloff, short-term holders’ Spent Output Profit Ratio (SOPR) fell sharply below 1, indicating that recent buyers are selling at a loss. According to CryptoQuant data, investors moved 30,000 BTC worth $3.39 billion at $113k per BTC to exchanges, incurring a loss.

BTC momentum fades

For now, BTC is holding above the 112k support. However, momentum has faded, and a close below this level could fuel a deeper selloff by short-term holders who tend to have less tolerance for net losses than long-term crypto bulls.

On the macroeconomic front, Federal Reserve Chair Jerome Powell struck a cautious stance on further rate cuts, emphasizing that a balance must be struck between job creation and inflation. The market is pricing in a 90% probability of a 25-basis-point rate cut in October. Bitcoin and other risk assets tend to perform well in low-interest-rate environments as liquidity rises.

Will BTC catch up with global M2 growth?

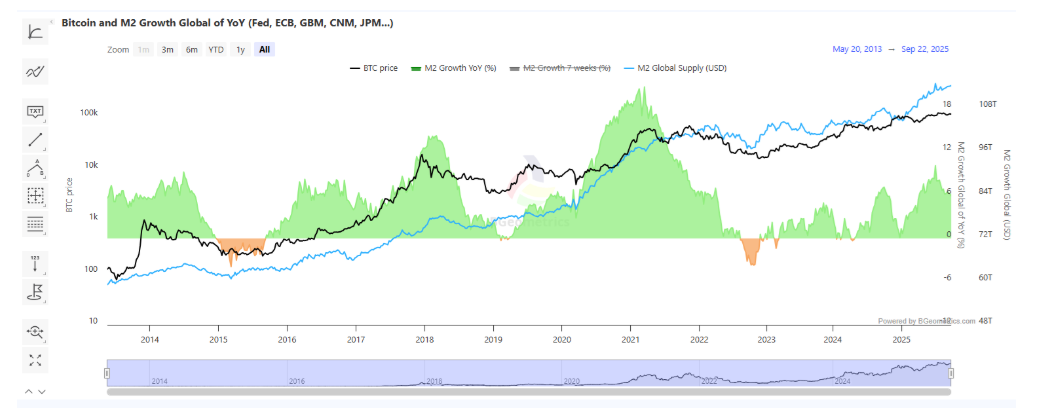

Notably, the global M2 money supply expansion has accelerated since January, outpacing BTC. As of the year-to-date, global liquidity has surpassed $114 trillion, while US broad money reached an all-time high of $22.19 trillion at the end of August.

In past cycles, M2 expansion has been one of the factors behind Bitcoin bull runs. Therefore, the current M2 accelerated expansion raises expectations that BTC will continue to follow the M2 chart higher, as it has done in the past. The current gap and the lag time between M2 expansion have fueled forecasts that Bitcoin will reach 160k to 250k by the end of the year.

Interestingly, Gold has closed the gap with M2 growth more rapidly. Gold has reached an all-time high of $3830. US stocks are also trading at record highs.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.