Bitcoin is hovering around 105K after falling 2% yesterday as the market awaits the Federal Reserve interest rate decision and the US considers its options for involvement in the Iran-Israel conflict.

Risk sentiment has stabilised across the market as U.S. President Trump, asses his options for direct involvement in the Middle Eastern war. The conflict between Iran and Israel has entered a sixth day and has taken a new turn as President Trump called for the unconditional surrender of Iran. Trump claimed on social media to know the whereabouts of the Iranian leader, who he said is safe for now.

Trump is evaluating all of his options. The US has so far not taken any military action against Iran, which has brought some relief to the markets, allowing risk sentiment to stabilise. US futures are pointing to a higher open, and oil prices are falling, giving back some of yesterday’s 4% jump.

However, it’s still early days, and traders should remain cautious as the markets move from headline to headline. Any further escalation could spark a risk-averse reaction in the markets, immediately lowering Bitcoin and other cryptocurrencies.

What to expect from the Fed?

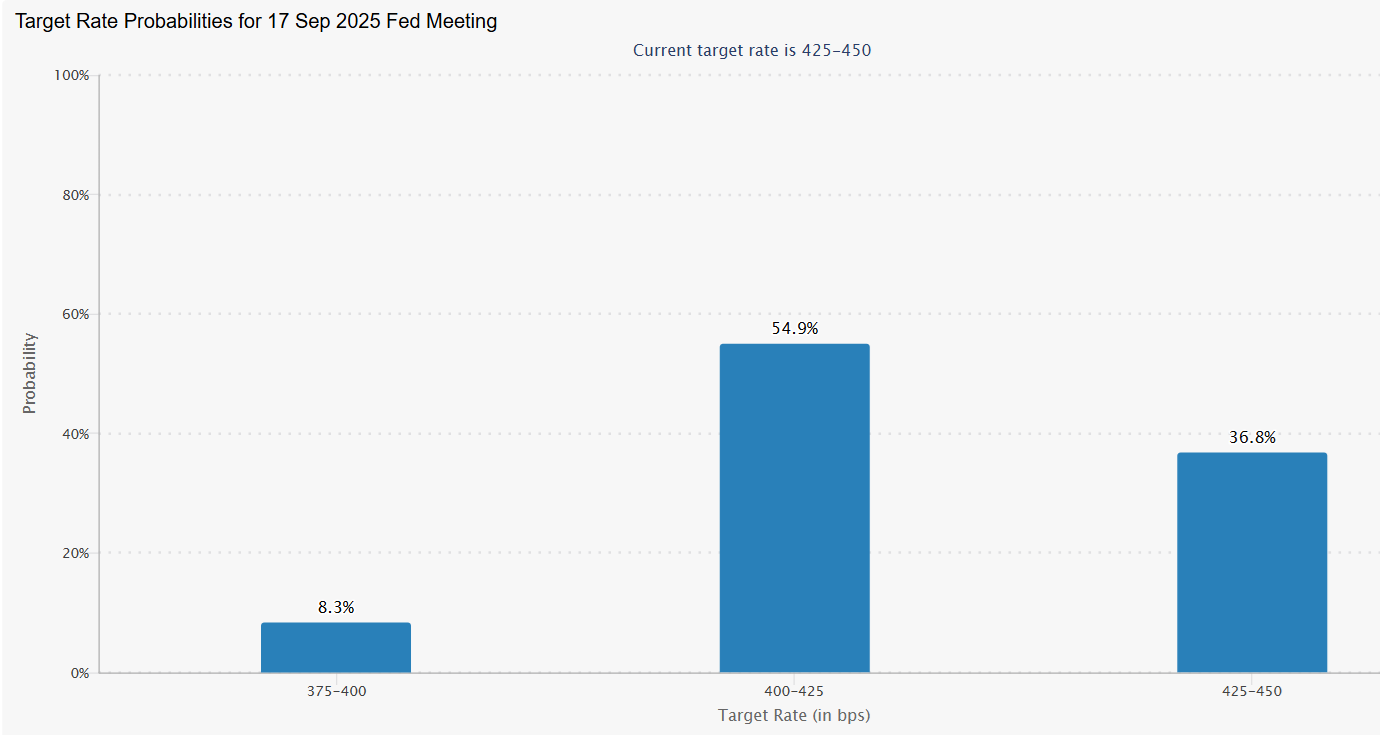

In the absence of any further developments in the Middle East, attention will be on the Federal Reserve interest rate decision. At 18:00 GMT, the Federal Reserve is expected to announce that it will leave interest rates unchanged at 4.25% -4.5% and reiterate its wait-and-see mantra.

With no change expected from the Fed, attention will be on the central bank’s growth and inflation forecasts, the dot plot of interest rate projections, and Federal Reserve Chair Jerome Powell’s press conference.

In the March meeting, the dot plot pointed to 50 basis points of cuts this year, and we expect this to remain unchanged. The market is also pricing in 50 basis points worth of cuts by the end of 2025 and a 56% chance of the next rate cut coming in September.

Fed Chair Powell could adopt a slightly more dovish stance given recent weakness in U.S. data (non-farm payrolls, retail sales). However, ultimately, the Federal Reserve will want to keep its options open given the uncertainty surrounding the inflationary impact from Trump’s trade tariffs and the potential impact of rising oil prices.

How could Bitcoin be impacted?

Should the Fed adopt a slightly more dovish stance, this could boost Bitcoin and other cryptocurrencies. However, the meeting could be overshadowed by geopolitical headlines, which are likely to remain the main driving force behind crypto. This may mean the upside is limited for now. It would take a clear de-escalation in the region for risk appetite to return with vigour.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.