Bitcoin is rising, recovering from session lows and has turned positive on the day, rising 0.5% to 104k. However, the recovery in BRC was not seen across the board, with other cryptocurrencies remaining in the red.

Ethereum has shown more resilience than most, dipping just 0.4%. However, SOL, XRP, and DOGE fell 1.5%, 2.2%, and 2%, respectively. Owing to BTC’s resilience, the cryptocurrency market capitalisation fell 4% but remained above the $3.4 trillion level.

Bitcoin is on track to remain above the 100k psychological level for an eighth straight session as institutions and corporations remain bullish on Bitcoin and miners accumulate, reversing a distribution trend that has been in place since 2023.

US ETF inflows hit $400 billion

US ETFs’ net inflows reached $400 billion year to date on Thursday, which equates to an average of $4.4 billion per day. According to Bloomberg analyst Eric Balchunas, this could take ETF inflows above $1 trillion for a second consecutive year.

Demand for ETFs spilled over into the BTC ETF market, which booked strong inflows on Thursday. BTC ETF inflows reached $2.26 billion in May, after $2.9 billion in April.

Is a Ukraine National Bitcoin Reserve coming?

Meanwhile, Ukraine could be the first country in Europe to establish a Strategic Bitcoin Reserve as it aims to boost financial resilience amid its ongoing war. A draft ill has moved to its final stages, as confirmed at the CRYPTO 2025 event in Kyiv. These developments come as global interest in Bitcoin and crypto is rising. In the US on March 7, President Trump signed an executive order to establish a US National Bitcoin Reserve, which has been funded by BTC confiscated from criminal cases.

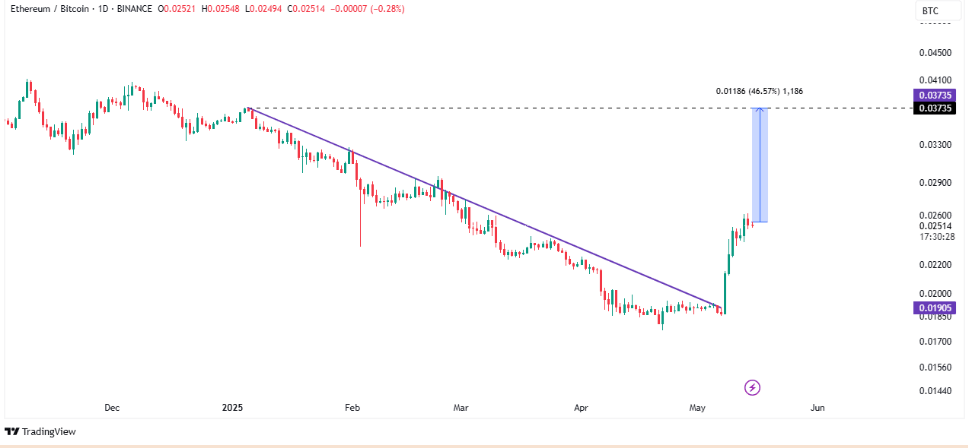

ETH steadies after a 50% rally. Is 4000 next?

While ETH was slightly underperforming BTC today, it has outperformed over the past few weeks. The price surged from a 2025 low of $1385 in April to a peak of $2730, driven by broad gains in crypto and its Pectra upgrade.

ETH ETF demand is also showing early signs of improving. ETH ETFs are rising for a second straight day, booking total net inflows at $63.47 million. ETH ETFs are set to rise this week, and are rising across May, month to date. Rising inflows imply stronger investor activity supporting the price.

ETH corporate interest is also ramping up. BTCS a publicly traded company in Maryland, America, signed a $57.8 million funding round with ATW partners. The funds raised will be used to buy more Ethereum as it follows the Strategy model.

However, for ETH to rally towards 4000, it’s critical for ETH to attract more liquidity than BTC. While the ETH/BTC chart suggests this is underway, peaking at 41%, the trend must continue.

Open free account

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.