Bitcoin is building on a strong performance in Q3, extending gains above 116k on Wednesday, the first day of the new month and the new quarter. BTC trades up 3% over the past 24 hours and is around 7% off its record high reached in August.

Altcoins are also rising, with Ethereum gaining 2.9% and Solana jumping 5% over the past 24 hours. The total cryptocurrency market capitalization has risen 2.9% to $3.99 trillion.

US government shutdown uncertainty boosts crypto

Bitcoin, along with the broader crypto market, appears to be benefiting from the uncertainty surrounding the US government shutdown. The Republicans and the Democrats failed to reach a last minute deal to fund the government. A prolonged shutdown tends to weigh on the USD, and investors see crypto as a hedge. Gold is also trading at record highs today.

However, should the shutdown drag on, Bitcoin could come under pressure. The keenly anticipated US jobs data and inflation figures wouldn’t be published, at a critical time when the Federal Reserve is weighing up whether to cut rates again. The Fed has emphasised that it is data-dependent, so the lack of data may mean that rate cuts could be delayed. Bitcoin and its peers tend to perform better in low-interest-rate environments, thanks to improved liquidity.

Why BTC could rally in October

The largest cryptocurrency rose 5,1% in September, typically a weak month for BTC, to bring gains across Q3 to 6.1%.

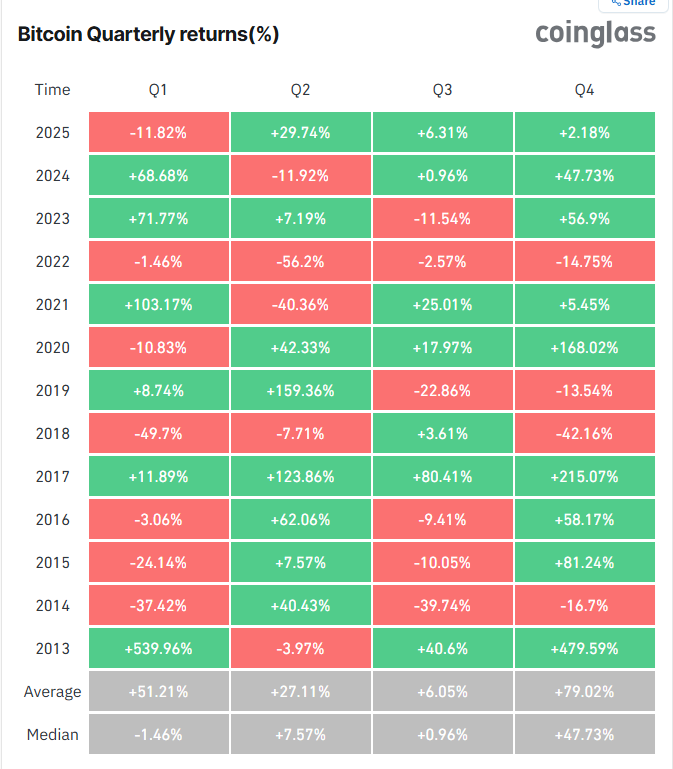

Seasonality supports further upside in October, also known as “Uptober”, given that it is historically one of the strongest months for BTC, with average gains of 20% according to CoinGlass data. Furthermore, Q4 has historically been the best quarter for BTC, with an average gain of 79% across the quarter.

Institutional demand returns

Bitcoin’s recovery from last week’s lows has been aided by renewed demand from institutions. According to SoSoValue data, BTC ETFs recorded a second straight day of net inflows on Tuesday of $429.9 million, putting inflows this week already at $951.9 million, recovering from net outflows of $951.9 million last week. Should institutional demand continue the BTC price could recover further.

BTC rises above a key resistance

The BTC technical picture also supports further gains as the BTC prices breaks above key resistance. BTC has risen above 115k, the confluence of the 50 and 100 SMA as well as the falling trendline dating back to the August 124.4k record high. The next test for buyers will be the 117.9k September high, before 124.4k comes back into focus.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.