Bitcoin is trading above the crucial 90,000 support level on Wednesday, showing some signs of stabilizing after falling around 25% from its record high 6 weeks ago. The sharp decline in BTC’s value has wiped out all its gains this year, leaving it lagging behind other asset classes, including tech stocks and treasuries.

Other cryptocurrencies have also fallen steeply. Ethereum has declined 13% over the past 7 days, in line with BTC. Meanwhile, XRP has dropped 12% over the past week. The total cryptocurrency market capitalisation has seen over $1 trillion wiped out since the early October high.

Tech stocks valuation worries & Fed concerns hit BTC

The sell-off in crypto comes amid deteriorating risk sentiment, driven by concerns over stretched tech valuations and reduced December rate-cut expectations.

After recent hawkish Fed commentary, the market is only pricing in a 46% chance of a December rate cut, down from 67% last week. Attention will be on the FOMC minutes later today and tomorrow’s non-farm payroll report. Should the NFP report show a sharp cooling in the US labour market, this could revive rate cut optimism and lift risk assets such as Bitcoin, which is particularly sensitive to liquidity. Bitcoin performs better in lower interest rate environments as liquidity is higher.

The lowering of Fed rate cut expectations comes at a time when the market has been suffering from reduced liquidity due to the US government shutdown. While the government reopening means that liquidity should slowly return, the December Fed decision remains the most significant event heading into the end of the year.

Attention will also be on Nvidia’s earnings after the US close, which will be a litmus test for the AI trade, which has helped to power stocks to record levels. There is a close correlation between the tech-heavy Nasdaq index and BTC. Any sense of disappointment from Nvidia could pull the Nasdaq lower, dragging BTC with it.

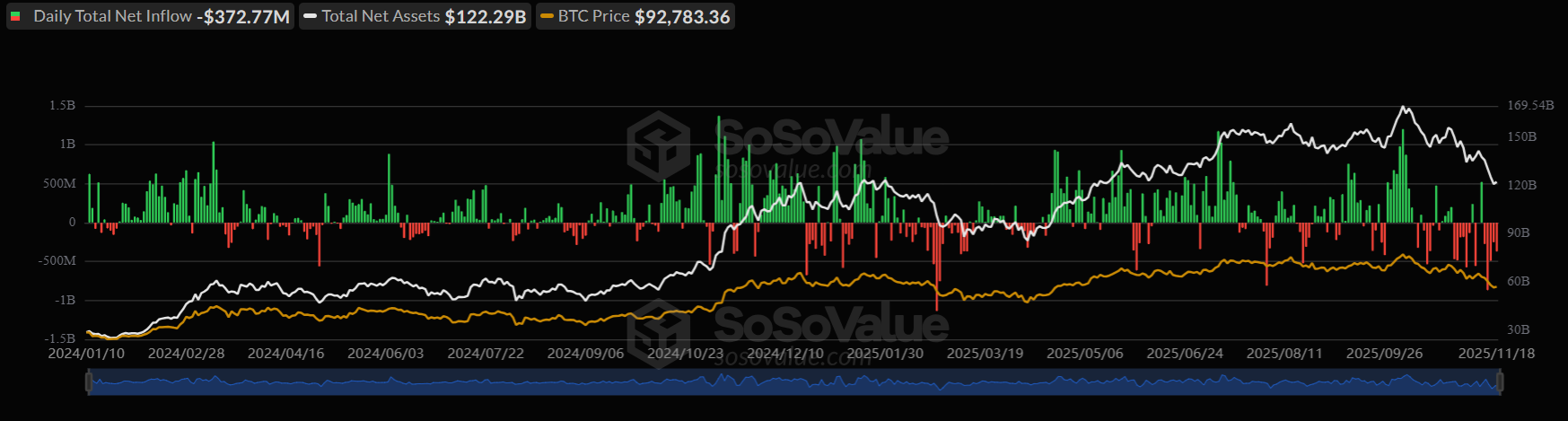

BTC ETFs bleed out

Institutional demand continues to weaken as institutional demand fire showed further signs of fading. According to SoSo Value data, Bitcoin ETFs recorded $372.7 million in outflows on Tuesday, following $254.5 million on Monday, extending a 5-day streak of outflows. Should outflows persist or even intensify, then the BTC selloff could deepen. Any recovery in BTC would likely need a recovery in institutional demand.

The BTC ETF’s cost basis is at 89.6k, a level BTC briefly broke below yesterday, when it fell to 89.1k. During the Q1 downturn, BTC bottomed out at this average BTC ETF entry level before staging a recovery. This makes it a key level to monitor.

Whales accumulate & retail investors sell

Meanwhile, on-chain data showed that whale accumulation accelerated during this latest correction. Now, large Bitcoin holders have increased their position to a four-month high of 1384 wallets holding at least 1000 BTC, this is up from 1354 three weeks ago, marking a 2.2% increase. This is the highest count for large wallet holders in four months, which could be a tentative sign of renewed confidence.

At the same time, wallets holding 1 BTC or less declined to 977,420, down from 980,577 in late October. This marks the lowest level of smallholder participation in a year. This follows the typical pattern of less experienced investors capitulating during price corrections.

Historical trends suggest that while accumulation amid retail selling often precedes stabilisation. Meanwhile, just 7.6% of short-term holder suppliers are in profit, a level which is commonly seen at cycle lows.

Whether the price has bottomed out or not remains to be seen. For now, the key 90k support is holding. A close below this level could signal more downside ahead.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.