After falling almost 3% yesterday, Bitcoin is showing signs of stabilizing around 113k following three consecutive days of declines. Cryptocurrency by market cap has fallen from its record high of 124k last week.

The broader cryptocurrency market capitalization has fallen 1.9% over the past 24 hours to $3.81 trillion. This puts declines at 9% from a record high of 4.19 trillion just under a week ago.

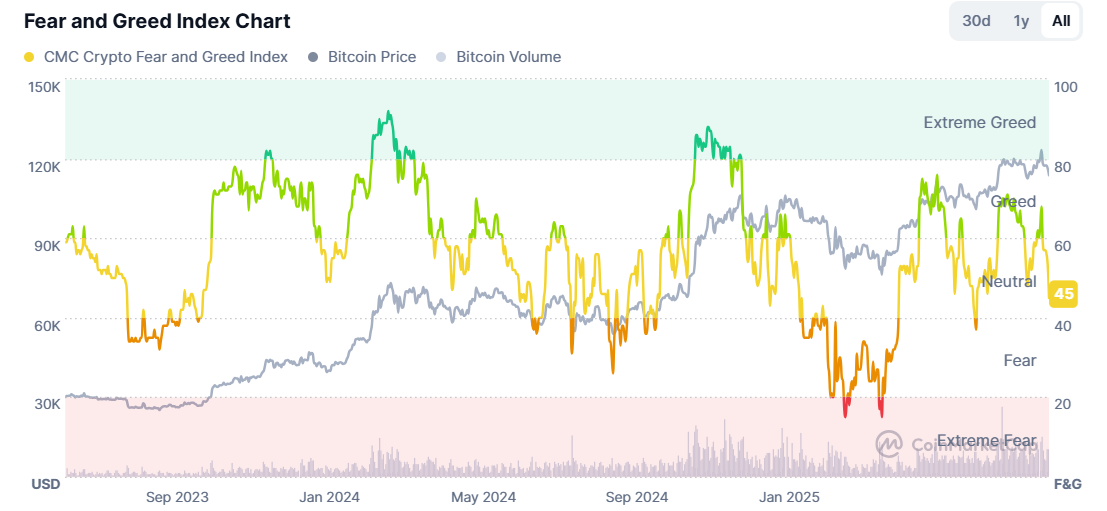

The sentiment gauge, the crypto Fear and Greed Index, has fallen to 45, Neutral, down from 63 Greed last week, indicating a sharp change in sentiment.

The selloff is not just in crypto; US stocks and tech stocks specifically have also been under pressure with the Nasdaq 100 reversing from record levels reached last week, trading down -1.4% this week, hitting a two-week low.

Open interest declines

Crypto Open Interest (OI) has fallen to $195.34 billion on Wednesday, down from $201.80 billion the previous day. Falling OI indicates that capital is flowing out of the crypto market, as investors adopt a wait-and-see stance ahead of the Fed minutes later today and more crucially the start of the Jackson Hole Symposium tomorrow.

Liquidations surge

Amid the risk-off mood, Bitcoin, Ethereum, and Ripple, as well as other cryptocurrencies, have experienced significant downward pressure as liquidations have swelled. Over $500 million in trading positions were liquidated on Monday and Tuesday, with longs accounting for over $440 million on both days. The widespread liquidation could point to a breakdown in confidence among leveraged traders, who await more clarity from the Fed over the outlook for rates.

Attention turns to Fed minutes

The mood remains cautious as attention turns to the release of the Fed minutes to the July meeting. The market is expecting the Fed to cut rates by 25 bps in the upcoming September meeting, although optimism surrounding a cut has cooled following hotter PPI data last week.

Investors will scrutinize the minutes for clues over the Fed’s stance on a possible September rate cut. Any sense that the Fed is set to cut rates next month could boost risk assets, including crypto.

However, the main event this week will be the Federal Reserve’s Jackson Hole Symposium and, more specifically, Fed Powell’s speech on Friday. This will provide a more up-to-date assessment of the US economy and will likely see Powell leave the door open for further rate cuts without cementing a September move. The risk is Powell providing a decidedly hawkish tone which could challenge September rate cut bets and put pressure on risk assets.

Is it time to buy the dip?

BTC has fallen below the 50 SMA and multi-month rising trendline with a bearish engulfing candle, marking a bearish move, which, combined with the RSI below 50, keeps sellers hopeful of further downside. A slightly less dovish tone to the Fed minutes and from Powell on Friday could see the price break below 112.5k and test 110k. A break below here could mark the start of a deeper downturn toward 105k comes into focus.

Should the 112.5k support hold, a level whitch offered support on August 1, buyers could look to extend the recovery above the 50 SMA at 116k towards 124k. This scenario could likely should the Fed minutes and Powell’s speech hint towards a September cut.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.