The crypto market is managing to hold key levels ahead of Federal Reserve chair Jerome Powell’s speech at Jackson Hole later today. Bitcoin is trading at 113K after dropping to 112K overnight. Ethereum remains near 4.3K, little changed over the past 24 hours, and Ripple trades at 2.85. The market is in a wait-and-see mood after steep declines across the week.

Across the week, the crypto market capitalisation has fallen to $3.83 trillion, down from $4.03 trillion across the week, as traders booked profits following recent highs. Leveraged liquidations have added pressure, and ETF inflows have been significantly slower.

The selloff hasn’t been confined to crypto; US tech stocks have also fallen sharply from record highs last week as investors questioned elevated valuations. The tech-heavy Nasdaq trades -2.4% so far this week.

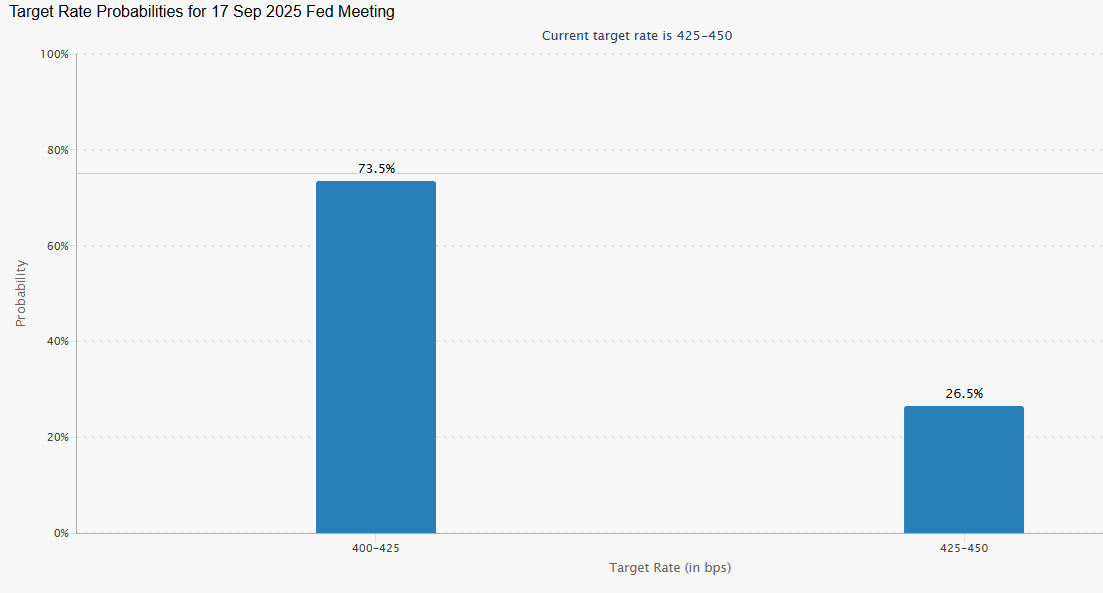

The deterioration in risk appetite comes as the market has steadily reined in Federal Reserve September rate cut expectations. According to the CME FedWatch tool, the market is pricing in a 73% chance of a September cut, down from almost 100% early last week.

The Fed minutes released this week showed a hawkish bias, with the majority supporting leaving rates unchanged to wait for further clarity on how tariffs are impacting inflation.

Fed Chair Powell will speak today at 10:00 ET. The market will be looking for any signs that Powell will press ahead with a rate cut in September. In recent speeches, Powell has remained cautious regarding further rate cuts. However, those speeches were before the weak non-farm payroll report. Although other data, such as PMI figures, have pointed to resilience in the US economy.

This will be Powell’s seventh speech at Jackson Hole. According to Reuters research, in the month following Powell’s speech, the USD has on average gained 1.4% and the S&P 500 has lost 2%, suggesting the speeches have leaned towards a hawkish bias compared to market expectations.

Should Powell’s speech temper Fed rate cut expectations further, risk assets such as Bitcoin could fall further and test 110k.

Trading involves risk.

Ripple faced rejection at $3 amid profit-taking.

XRP fell 3% to 2.85 dollars on Thursday with investors booking over $300 million in profits following the hawkish FOMC minutes and ahead of Fed Chair Jerome Powell’s speech.

As the risk of sentiment continues to impact the crypto market, XRP investors have realised significant profits totaling $300 million since Wednesday, according to sentiment data. The selling activity has come from both long-term and short-term holders.

According to CoinGlass, net inflows to the exchange rose to $76.8 million, its highest level since July 19—an increase in exchange net inflows signals rising selling activity.

Recent on-chain data showed that large XRP holders have been reducing their positions, although there are signs that selling pressure is approaching exhaustion. A similar wave of selling was seen in Q2, coinciding with XRP’s broader correction.

The 90-day moving average of while net flows points to a peak distribution, which could flip positive as prices move lower.

While activity has played a critical role in shaping market direction, and in the second half of 2024, significant accumulation occurred between the $2.00 and $2.50 levels as whales built significant positions ahead of XRP’s rally.

XRP forecast – technical analysis

XRP/USD broke out of its symmetrical triangle pattern and the 50 SMA, finding support at around 2.85. The recovery from 2.85 failed to retake the 3.00 psychological level and the 50 SMA, adding to the bearish picture.

Sellers will look to break below 2.85 to extend losses to 2.75 the August low. A break below here creates a lower low and brings the 2.60 support zone as well as the 200 SMA into focus.

Buyers would need to rise above 3.00 and the 50 SMA to extend gains towards 3.10, the rising trendline resistance.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.