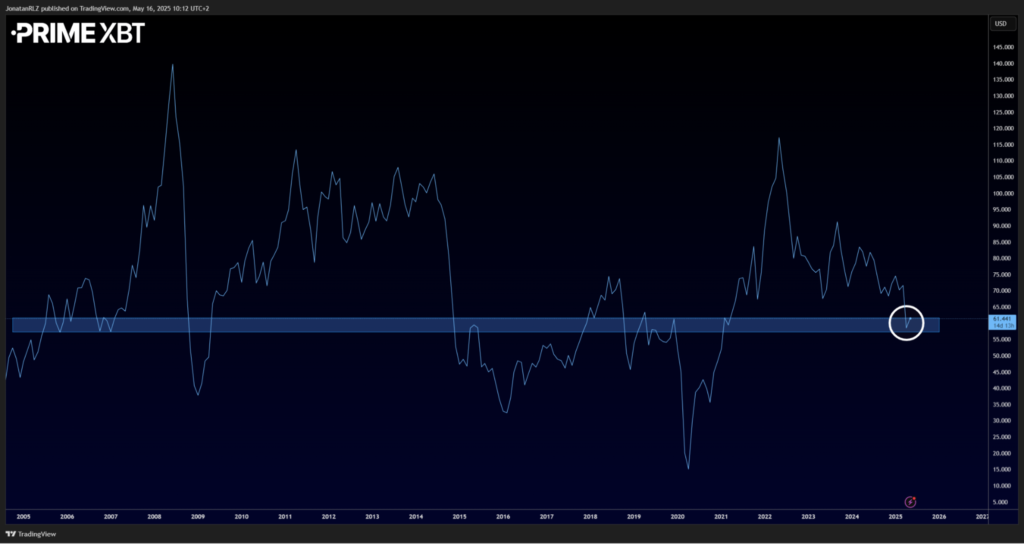

Crude oil is currently testing a long-term support level that hasn’t been touched since it was first broken to the upside back in 2021. This level has been in play for over 20 years, making it one of the more significant price zones in the market. Despite the bearish local structure seen on shorter timeframes, it is critical to recognise that price is sitting at a major high timeframe support zone, something swing traders and investors will want to keep in focus.

On the daily chart, we are seeing an interesting pattern unfold. Oil appears to be forming a classical double bottom right at this long-term support. Adding to the case for a potential reversal is the RSI, which is showing early signs of a bullish divergence. While price is creating equal lows, the RSI is creating higher lows, and while price action is printing slightly lower highs, the RSI is clearly forming higher highs. This combination suggests a potential momentum shift and weakening of bearish pressure.

The key level for confirmation sits around 66. A reclaim and daily close above this area would place oil back into the previous trading territory, potentially opening the door for upside continuation. This development, paired with improving global sentiment and easing trade tensions, especially between the US and China, could support a broader risk-on move. If such a backdrop holds, oil may find fresh momentum from these historically significant levels.

Trade Crude Oil

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.