This past week has once again proved to be a rather good one for Bitcoin and its associated market as the coin has climbed up from its lows in March and is showing a 5 percent year to date increase from the end of 2019.

This recovery is picking up steam and comes off the back of a number of positive, if not too spectacular, weeks as the major cryptocurrency prepares for the mining reward halving to take place in the middle of next month. This, tied in with the ongoing troubles in the traditional markets and the Federal Reserve’s ongoing money printing could be a perfect storm for Bitcoin.

However ,even with all this positivity abound, there is still low confidence in the market as a whole. The performance of Bitcoin should not really be faulted for this, rather it’s alarming drop in March and the ongoing financial fear surrounding the general markets amid the Covid-19 pandemic sweeping the globe.

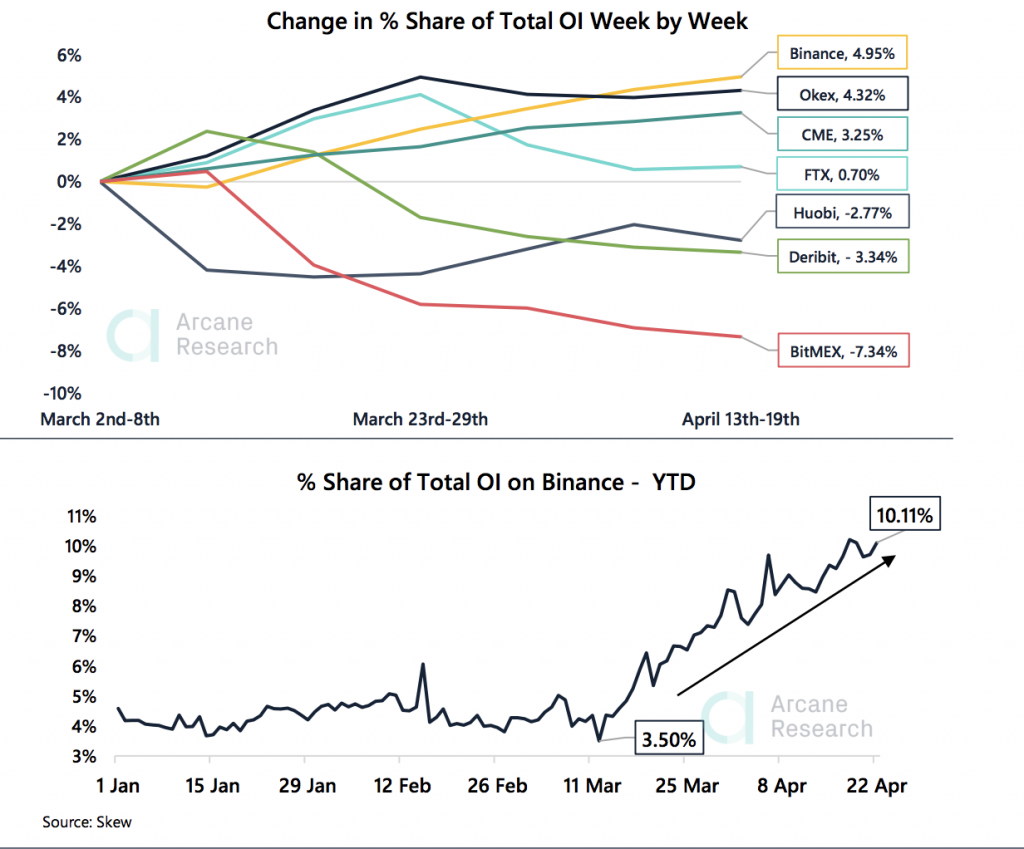

There has even been a change in the normality of the Bitcoin derivatives markets as BitMEX is no longer top dog and Binance is making ground falling after the market collapse in March. This week also saw the second largest liquidation of short contracts on BitMEX in 2020, thus far.

So, while confidence remains low, there is positivity in more than the price as both the volatility levels, and the volume charts are settling down somewhat, and this could mean a return to more mature market movements.

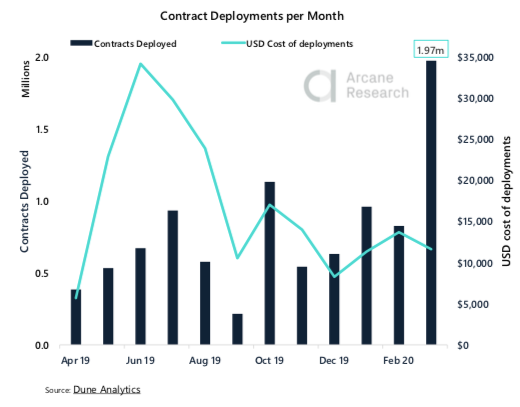

In news away from Bitcoin, there were also positive steps taken in Ethereum, notably with DeFi. This week there were a record number of smart contracts deployed which looks to be linked to increased usage of DeFi applications — that said, the DeFi space has also been rattled by hacks and vulnerabilities recently.

Strong Finish to the Week

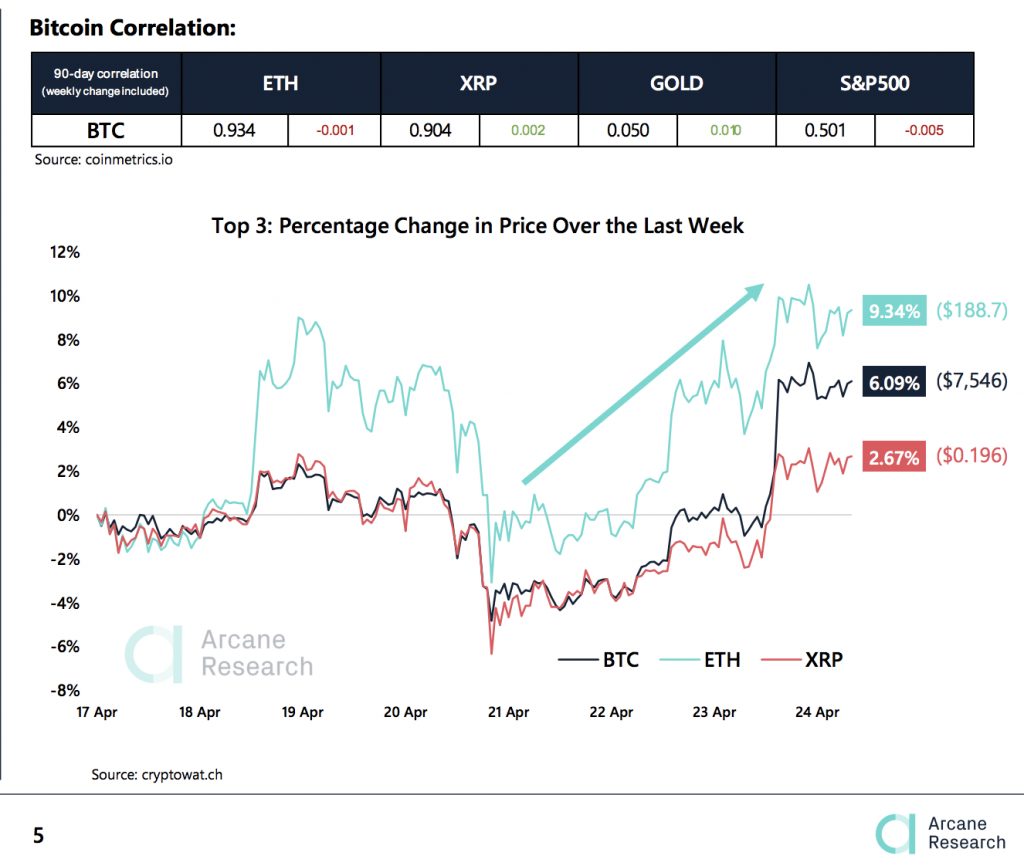

Generally, volatility levels across the markets seem to be easing, but it was still quite a volatile week for the top three major coins in the market. Bitcoin and others started falling below their week opening on April 21 before a late rally in the weke managed to push Bitcoin up $188 this week as it recorded almost 10 percent gains.

This takes Bitcoin back to levels last seen before the market collapse, astounding given that it has been less than two months and the ongoing global panic is still affecting other markets. There appears to be a new, quite solid, resistance floor in for Bitcoin, but the bullish momentum is obvious.

While bulls are in control, and volatility low, there is still a lot to be cautious with in the current financial global climate and even Bitcoin is susceptible to a fall or collapse despite growing for nearly six ongoing weeks.

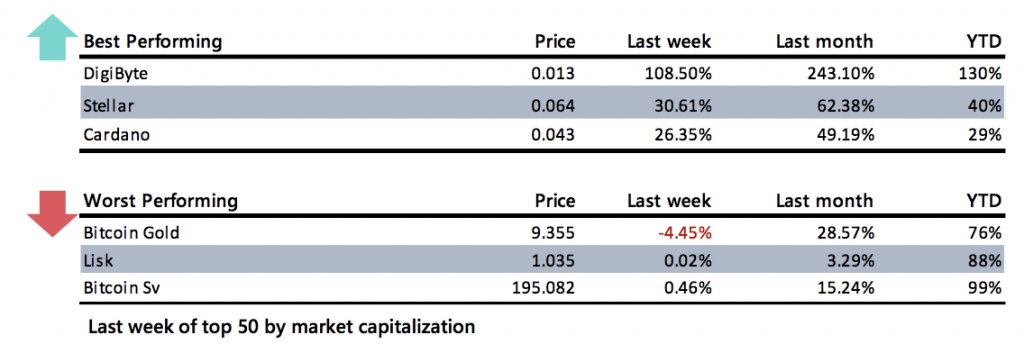

Bitcoin may be on the rise, and bringing the market with it, but it was not nearly the best performer this week as DigiByte had a truly successful week to add on to a generally good year despite the market collapse. The coin is up 108 percent this week, and an astounding 243 percent for the month leaving it more than double its value since 2020 started — up 130 percent.

However, to put into context the generally good market week, the worst performing coin was Bitcoin Gold with a loss of around 4 percent, but it was the only loser in the top 50 coins.

What is Bitcoin Building To?

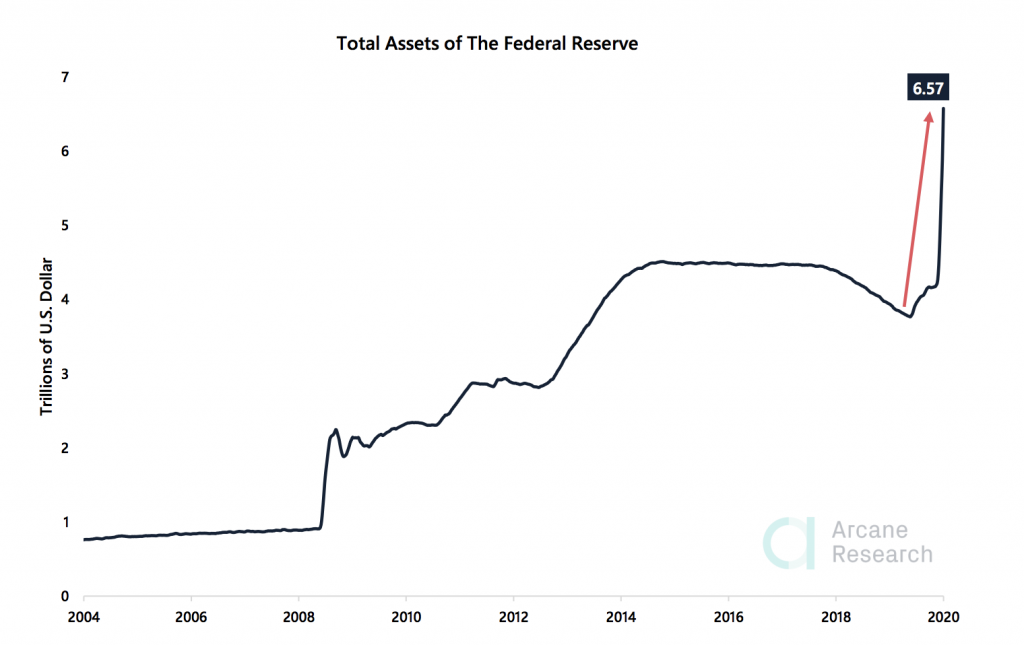

While Bitcoin is known for its anti-correlation properties, it is still odd to witness it growing in value at a time when the world is facing an unprecedented market collapse. However, this is exactly the reason why Bitcoin may be on the rise, tied in with its halving.

The Federal Reserve — as just one central bank printing money — sees its balance sheet topping more than $6.5 trillion, expanding an additional $205 billion just this week. This added money in the economy is to stimulate spending and liquidity, but it could lead to inflation.

Meanwhile, Bitcoin is about to go the exact other way and lessen how much of it enters the circulating market by halving the mining rewards. Investors and traders may be looking at what the Fed is doing and the damage it could cause the dollar and note that Bitcoin is working counter to this, making it a more attractive option.

Extreme Fear Remains, But It Is Easing

If the past six or so weeks were seen in any other time in Bitcoin’s history, the Fear & Greed Index would probably be much more inclined towards greed, or even extreme greed predicated on the halving event. But, as it stands, it is rooted in extreme fear.

It fell to their region in mid March at the time of the market collapse which was so violent and drastic that it shook the markers. But, to accentuate how much fear is around, this is the longest that the indicator has been stuck in extreme fear since it was created in February of 2018.

However, the good news is that there is a move away from extreme fear and simply into fear as investors grow in confidence and six weekly green candles seem to suggest good moves ahead.

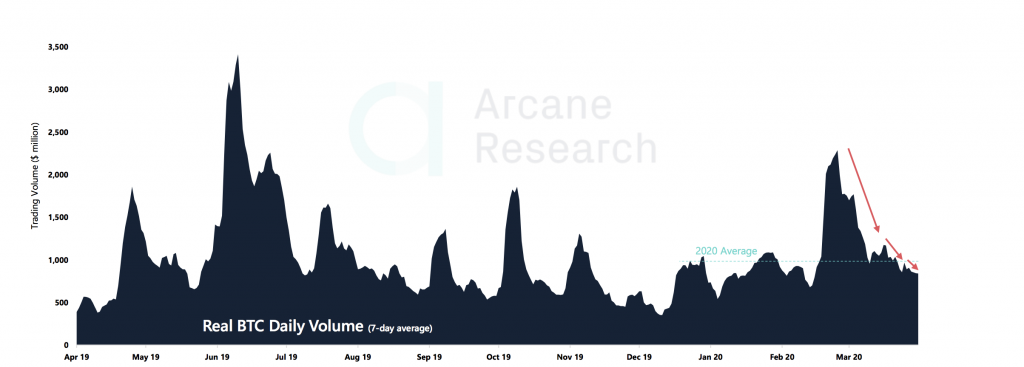

Other smaller indicators that things are getting back to normal and the market is less affected by that collapse is the face that Bitcoin’s volume is once again stabilizing. The 7-day average real trading volume is moving its way downwards still.

This has become a market trend since the crash in March but the manner in which it is lowering has slowed and is stabilizing. However, it does show that the meter is below 2020’s average volume and a momentum change in volume would provide more confidence for investors.

On top of the volume levels returning to something resembling normality and shifting away from extreme volatility, so the Bitcoin volatility metric itself is also getting back to understandable levels.

The 30-day BTC volatility graph looks to be dropping further down this week. It shows that normal, and expected, levels are returning — even though there are still bouts of big price movements. A level of 3% is seen as tolerable. Lower volatility indicates a market that is stabilizing, and that it may be past the worst uncertainty for now.

Binance Bettering In The Futures Market

For the longest time, BitMEX was the go-to for futures trading in the cryptocurrency sphere, but the market collapse seems to have caused a bit of a shake up with investors losing faith in the former favourite.

BitMEX’s share of the total market open interest has dropped from 33 percent to 26 percent in these last seven weeks, it’s balance sheets are also down 32 percent since the March 13 top. It was OKEx that first dethroned BitMEX last month with a market share of 28 percent but Binance has grown the most since the beginning of March.

This growth has seen Binance have 3.5 percent of the market to 10 percent in less than two months. Binance has the opportunity to keep expanding in this space as it has a well established spot trading market share and this could attract more users who are weary of the competition.

What To Expect From The Charts

The fact that Bitcoin has had six green weeks in a row in such market conditions is astounding, and something that has not been seen since the beginning of 2019 which was the beginning of the bull run last year.

A look over some analysis of key resistance and support levels show that bitcoin is now at a vital level in deciding how it next moves. The bulls seem to be in full control right now with the ongoing momentum, but the current resistance level may take time to get through.

This price level has acted as a support both in June and September of last year, and was a level that the BTC price struggled to overcome for almost seven weeks in November and December. But, a weekly close above around. $7,700 would mean there is a strong case for the bulls.

At the same time, the bears are looking for a close below the same level, and the first red weekly candle since the market crash in mid March to set them on their way to lower BTC prices.

DeFi Able To Weather The Storm?

Away from Bitcoin, it is also interesting to see how the Ethereum smart contract situation is progressing as it seems to signal there is increased usage of DeFi platforms.

In March, smart contracts deployed on Ethereum reached an all time high, which was an astonishing 75 percent higher than the former record set in October 2019. This represents, as data from Dune Analytics shows, that almost 2 million smart contracts were deployed on the Ethereum network in March.

This is huge, and to understand it better, the last 12 months have only seen one other month featuring more than 1 million smart contracts deployed which was in October where 1.1 million were deployed.

Still, even with this high activity, the dollar value of the ETH spent to deploy these March contracts came in at $11.00, far below its peak of June 2019 where $34.13 was seen. Evidence suggests the growth in smart contract deployments might indicate that more users find utility in the growing DeFi solutions being developed.

However, there has also been a spate of vulnerabilities found, and hacks felt, on DeFi platforms over the last month or so as their increased reputation attracts nefarious actors.

This week, we saw the dForce Lendf.Me market pool of $25 million get attacked with interesting consequences. At first the hacker gained control of the entire pool of $25 million, but he later returned the entire lot with it expected that his methods may have given him away.

Then, later this week another attack took place — this time on Factoms PegNET platform where $6.7 million worth of pUSD stablecoins where fraudulently created.

In the News

Renaissance, a $166 Billion Asset Manager Looking To Bitcoin Futures For New Fund

Renaissance Technologies’ Medallion fund is casting its eyes to bitcoin futures according to recent regulatory filings. The firm, known for its reliance on quantitative analysis, has “permitted” the Medallion fund to enter the Chicago Mercantile Exchange’s (CME) cash-settled Bitcoin futures market — a well known institutional gateway to crypto.

Bakkt Loses Another CEO As Mike Blandina Steps Down Four Months After Taking Role

Bakkt CEO Mike Blandina has said he will step down as CEO of the crypto asset platform and will be replaced by David Clifton, vice president of M&A and integration at Bakkt parent company Intercontinental Exchange (ICE). Blandina replaced the initial CEO, Kelly Loeffler, when she announced she would take a seat in the Senate.

Hong Kong’s First Regulator-Approved Bitcoin Fund Looks to Raise $100 Million

Hong Kong’s securities regulator has given its approval to its first-ever Bitcoin index fund which targets institutional investors. Arrano Capital, the blockchain investment arm of asset management firm Venture Smart Asia, made the licensing requirements from the Securities and Futures Commission (SFC) allowing it to begin dealing in cryptocurrency.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.