2020 has been an incredible year for the crypto market so far. In just 30 days so far into the calendar year, the total crypto market cap has increased by over $70 billion, as a result of strong breakouts and uptrends in Bitcoin, and especially mid-cap altcoins that have outperformed the first-ever cryptocurrency by a wide margin.

Here are the major factors, trends, news, and more influencing the future of the cryptocurrency market in the days ahead.

Crypto Market Grows 40% In January 2020, Most Bullish Since Last August

Since the moment the clock struck midnight and turned into the new year, the crypto market has added over $70 billion in total value to the overall market cap, a 40% rise in the first month of the year.

It’s among Bitcoin’s best Januarys on record, and while it has lagged behind altcoins in terms of overall performance, the leading cryptocurrency by market cap is showing numerous bullish signals on monthly timeframes, and both volume and volatility are increasing – signs of a healthy uptrend beginning.

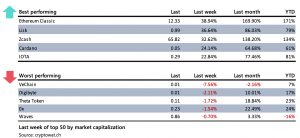

Large-cap altcoins like Ethereum, EOS, and Litecoin outperformed Bitcoin, but it was mid-cap altcoins lower down the top 100 cryptocurrencies by market cap that showed the strongest performance overall during January.

The best performing altcoins include Ethereum Classic, Lisk, IOTA, Cardano, and the privacy-focused Zcash. These assets had grossly underperformed others during 2019 and were due for a rebound.

Worst performing assets include VeChain, Digibyte Token, Theta Token, 0x, and Waves, which all saw losses over the past week.

Mid-Cap Altcoins Rise and Shine; Ethereum, EOS, and Litecoin Outperform BTC

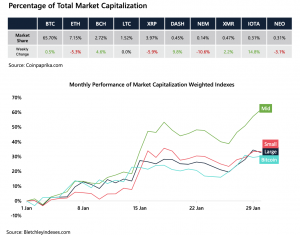

Mid-cap altcoins have led the market in terms of strength and ROI performance according to a comparison of a weighted index of altcoins broken down across large, mid, and small-cap altcoins.

Bitcoin itself has underperformed the three other indexes but has still grown by 30% in January. Mid-caps, however, are up a much as 62% so far during the year.

Year to date, Ethereum is up 33%, Litecoin is up 47%, and EOS has risen by 59%. Oddly, XRP continues to lag behind the rest of the market with just 22% gains during 2020 thus far.

Rising prices have led to an increase in bullish sentiment across the board, with the crypto market fear and greed index tipping into greed territory.

The sentiment level has reached the highest level seen since August 2019, back when Bitcoin had been trading above $10,000.

Bitcoin Lags Behind Alts, But Volume and Volatility Are Finally Increasing

The increase in bullish sentiment has also led to an increase in Bitcoin trading volume and volatility – all signs of healthy price growth.

Bitcoin trading volume has been trending downward ever since the first-ever cryptocurrency topped out at $14,000 in late June 2019. The seven-day average is now finally picking up once again, potentially signaling that a strong uptrend is brewing.

Volatility is also steadily growing since the start of the new year, and research suggests that this will lead to healthier, more stable price growth in Bitcoin in the future, versus the low-volume fluctuations witnessed over the past six months.

Part of the increase in volume can be attributed to a breakout of the downtrend channel Bitcoin has been locked within for the last six months. But for the bull run to really return, Bitcoin must reclaim resistance above $10,000 and hold it as support.

However, Bitcoin is now back above the 200-day moving average, which is significant to institutional investors and traders. However, a return to the moving average or further below it to the point-of-control at $8,000 cannot be ruled out, and would actually be a healthy correction after such a strong rally over the last month.

Retail Trader Expectations Versus Institutional Intent

The expectations gap between retail investors and institutional traders is widening. Retail investors are overly bullish, expecting strong gains in the short-term across Bitcoin markets.

Premium rates on retail platforms are close to 17%, which is the highest over the last quarter and above the normal rate.

Short-term March contracts on CME futures are only at a 12% premium. However, June futures contracts on CME are already above a 5% premium, suggesting that institutional investors are more bullish on the mid-term than the short term.

The difference in expectations between retail and institutions could come down to beliefs around what may happen when Bitcoin’s halving rolls around.

When that happens, the block reward miners receive is cut in half reducing the supply of Bitcoin. As demand rises, this is expected to have a dramatic influence over price.

Retail traders may expect fireworks leading up to the event, but institutional traders may expect a sell the news type event, which leads to a selloff prior to the halving, with the rebound occurring in the mid-term around June.

Bitcoin’s halving occurs this coming May 2020.

HODL Effect? Fewer Coins Are Transacting Across The Blockchain

Blockchain activity has been completely unaffected by the recent growth in price. Active addresses and the number of transactions are down a negligible 1% each.

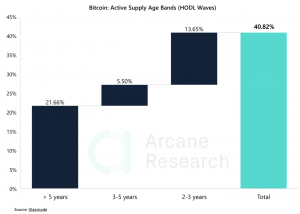

But as more investors believe that Bitcoin’s downtrend has come to an end, fewer and fewer traders are selling their Bitcoin, and instead are holding strong. It’s said that as much as 40% of all BTC in circulation hasn’t moved for at least 2 years. More than half haven’t been moved in a year since the bottom was put in.

20% of all BTC hasn’t moved in over 5 years, however, this could suggest that this Bitcoin is lost on the blockchain due to the mishandling of private keys.

This Week’s Biggest News Stories in Crypto

Bitcoin Beats SP500 and Gold in January Gains

Gold saw strong gains in January, with as much as 6% at the high as the precious metal’s uptrend continues. The S&P500 was up over 3% at the high for the month, meanwhile, Bitcoin has grown by as much as 30% in the same month, making it among the best performing assets in January 2020.

CFTC Says That USA Will Lead Crypto and Blockchain Innovation

Current U.S. Commodities Futures Trading Commission (CFTC) chairman Heath Tarbert claims that he wants the United States to take a leadership role in developing the future of crypto and blockchain.

Digital Currencies To Go Mainstream, Claims Deutsche Bank

In the latest iteration of the Deutsche Bank report, the firm claims that digital currencies have the “potential to radically change payments, banking, central banking, and the balance of economic power,” indicating that they could go mainstream as soon as the next two years.

Switzerland-Based Company Prepares IPO on Blockchain

Thanks to the advent of ICOs, more companies are considering tokenizing shares and releasing their IPOs via the blockchain. The latest is a Swiss-based company called OverFuture SA that’s been approved to incorporate so they can launch their IP on the blockchain.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.