It has been another rather successful week for the price of Bitcoin after it ended last Friday making single figure gains in what was a volatile market. It has been much of the same this week as gains have been seen by Bitcoin, and other top cryptocurrencies, but there has been just as much volatility.

Exchanges have been seeing more action, and even more new customers as the cryptocurrency market is one of the few positives markets globally at this time of COVID-19. However, despite the interest in the Bitcoin market, there is not too much evidence that the coin has decoupled from the stock market, which was the reason it fell so dramatically in the middle of March.

March’s incredible price shedding is one for the history books, although the recovery from that fall has been impressive and rapid. Still, the general sentiment around the Bitcoin market remains rooted in fear as investing, in general, is not very high on anyone’s list in this time of heightened global financial uncertainty.

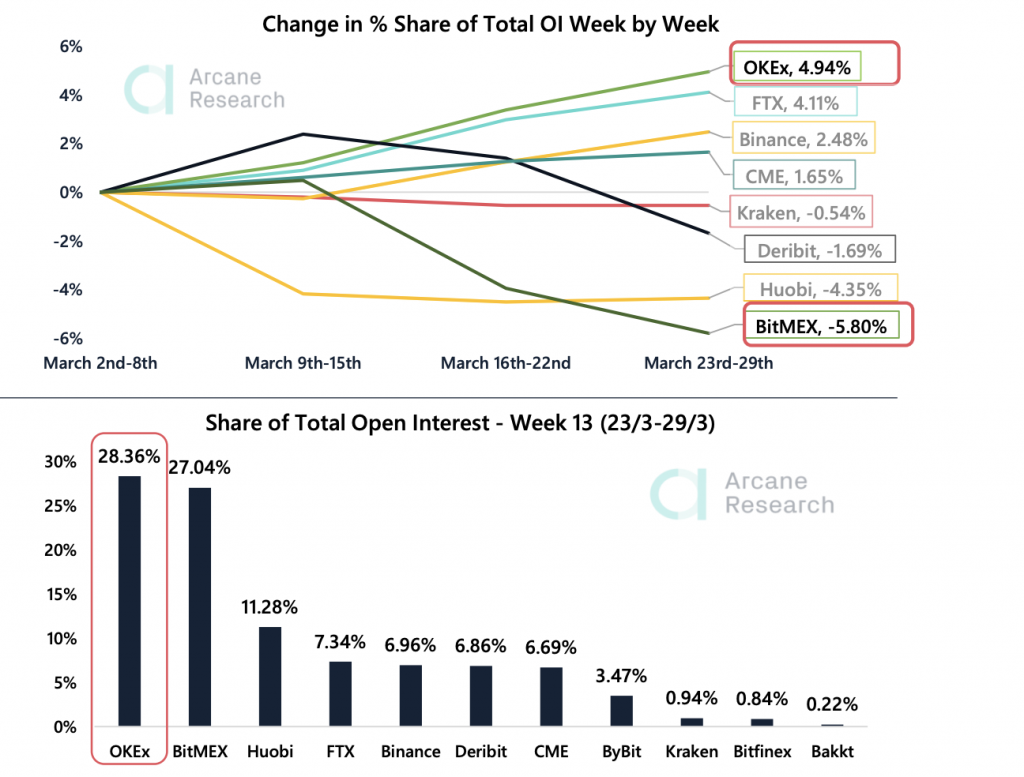

Although, there is some evidence that the futures markets are kicking back into life as their fall looks to have at least halted, and some improvements being made there. In fact, there has been a change at the top in terms of exchange rankings for futures trading as BitMEX was dethroned by close rival OKEx.

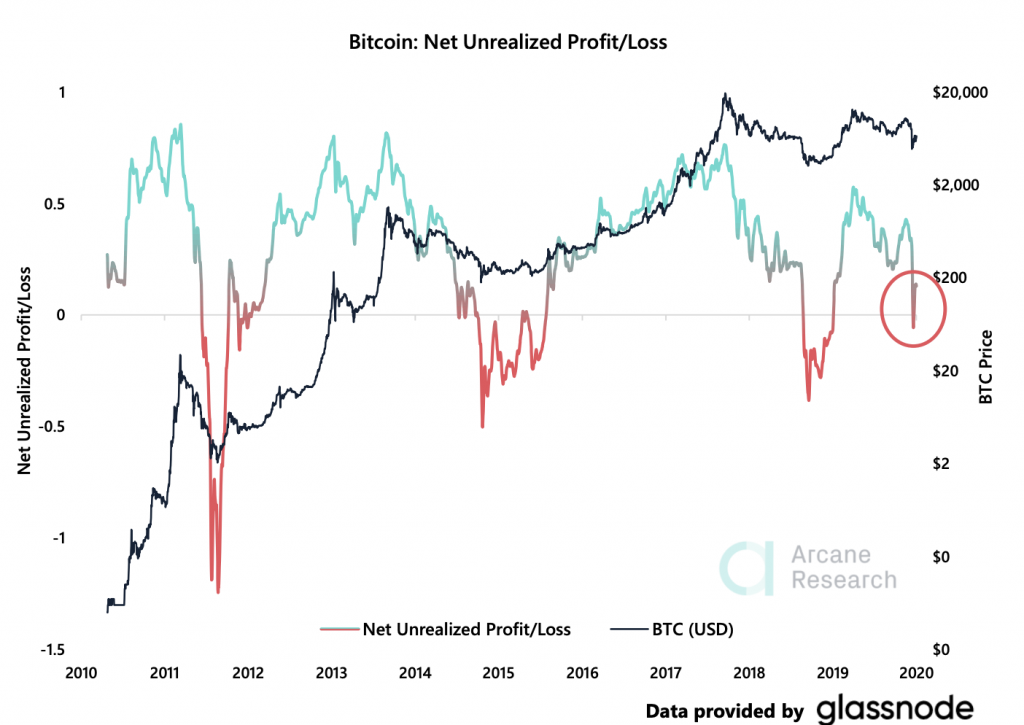

Looking at some on-chain analytics, that point to positivity, it appears as if we may have indeed seen the bottom of this crash, as the Net Unrealized Profit/Loss bounced quickly of the

lows. What is worth keeping an eye on in the next month or so is the Bitcoin mining reward halving set for May as the fees as a percentage of miner revenues lept up rapidly after the price collapse in March and this is a good indication of increased network demand on the Bitcoin network.

Back to Back Gains for Bitcoin

Last week we saw Bitcoin drop below its starting week price and bounce back over it a few times as volatility again punctuated the week. But still, at the end of the seven days, the coin managed to record gains. This week it has been very much the same as Bitcoin increased its value from the previous week by four percent.

However, it was a tightly fought thing as Bitcoin’s price only sunk into the weekly green margin on Friday having lost more than 10 percent of its weekly value on March 30. It appears as if most of the movement we saw from Bitcoin was still tied to its correlation with the poorly-performing stock market.

Negativity in the US economy, and huge job losses and financial pressure will likely keep the stocks down, and this should also have some sort of an effect on Bitcoin.

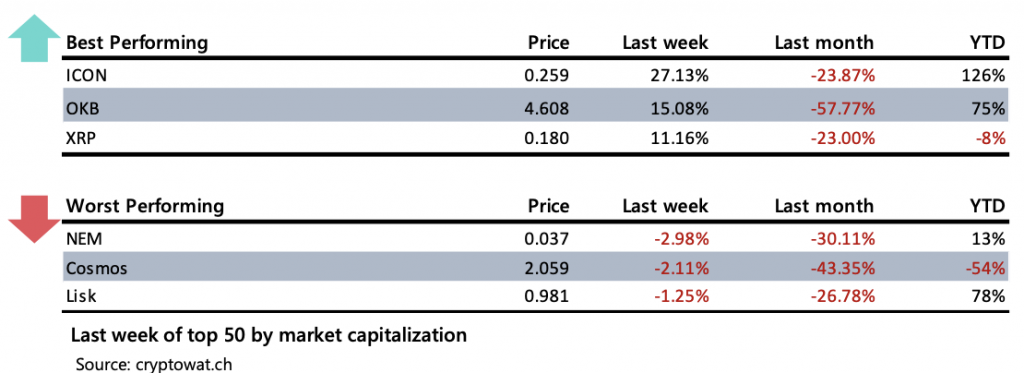

From the graph above, it can be seen that the third largest coin by market cap — XRP from Ripple — had a good week as it climbed above its last week close early on and kept at a good level to record double-digit gains, as well as show a decoupling from Bitcoin and Ethereum.

XRP is the third-best performing crypto asset this week with its 11 percent gain, sitting behind OKB, which managed to climb15 percent, and ICON which had an extraordinary week with nearly 30 percent in gains.

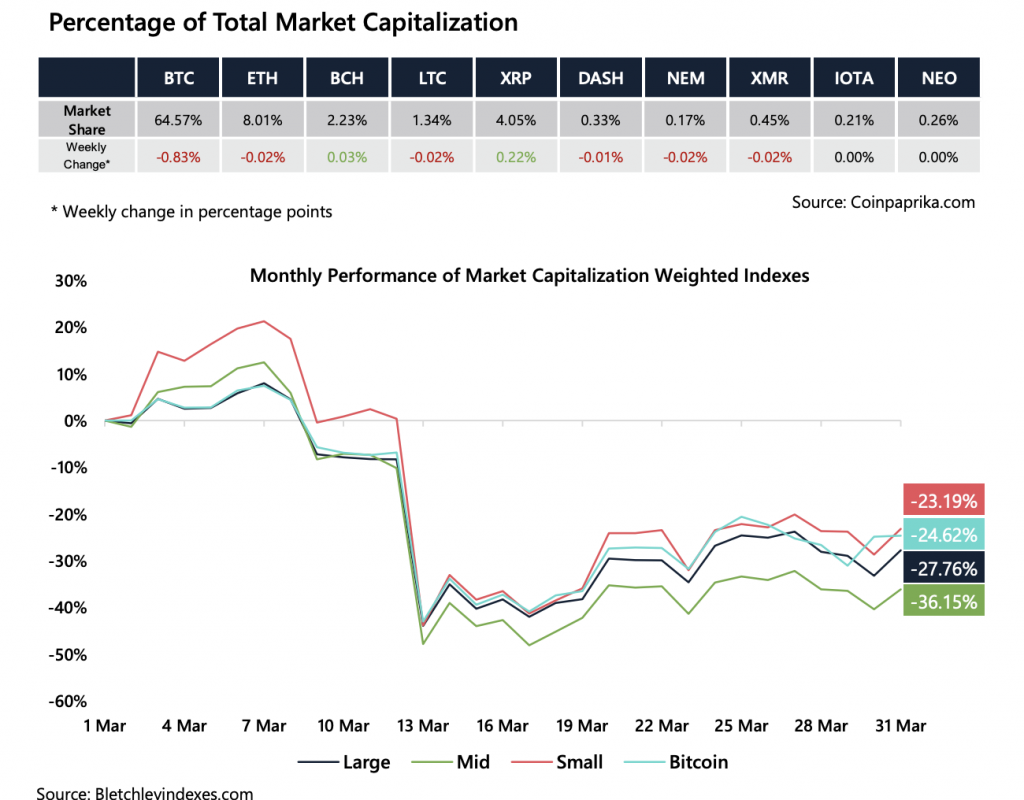

Despite all the positivity in the last two weeks, it is important to look back at March as a whole because the months saw a dramatic fall in the value of the overall cryptocurrency market. Indeed, the crash, and subsequent bounce back, ranked as one of the most volatile months for crypto ever.

Grouping the coin into small, medium and large market cap coins against Bitcoin for the month of March, we can see it was the smaller capped coins that fared the best. Their losses amounted to 23 percent. Bitcoin was the next best performing with losses for the month coming in at 24 percent. Medium capped coins suffered the most as they lost as much as 36 percent in the third month of the year.

A Market of Fear and Low Volume

Small Bitcoin price gains over two consecutive weeks does paint a picture of progress for the general cryptocurrency market, but some indicators point to long term bearish signs.

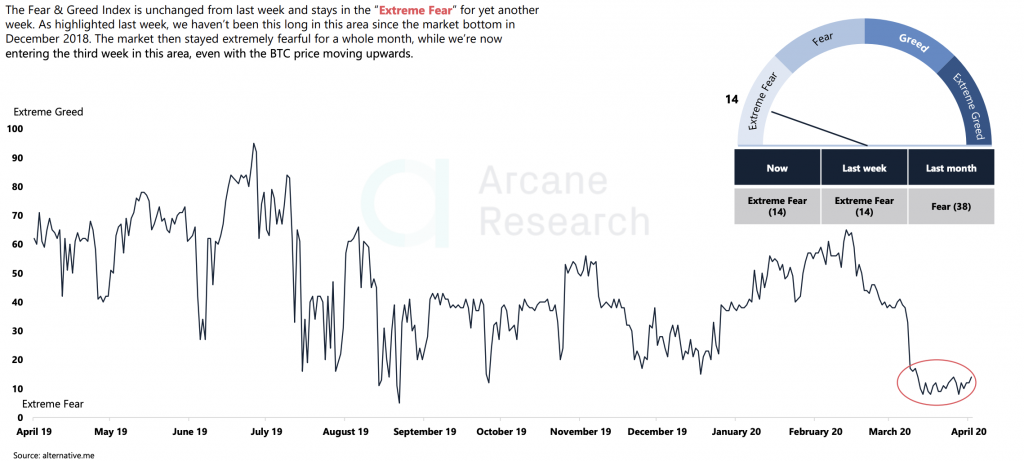

Unsurprisingly, the confidence in the Bitcoin market is right down and is entrenched in ‘extreme fear’ when looking at the Greed and Fear index. This is expected though, and it is not solely a cryptocurrency thing, as the entire global economy and market are in a state of turmoil that has all investors fearful.

This Fear and Greed Index has not seen the market so low down, for so long since the 2018 market crash after Bitcoin reached its all-time high. In that fall, the market stayed in extreme fear for a month as Bitcoin entered its third week here during this crash, and despite prices rising.

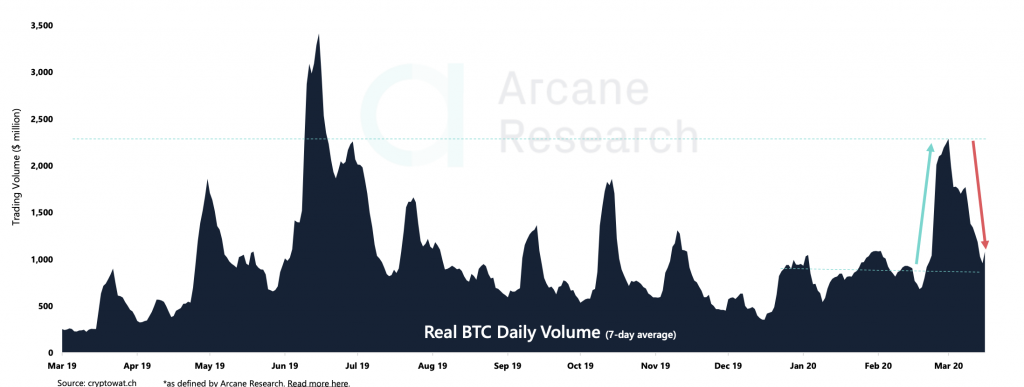

Bitcoin trading volume is also on a downward trend, but it is dropping from a massive spike that was kicked off by the market collapse which led to a selloff and increased trading volume. What is more concerning is that while the price is going up, and the trading volume is going down, this is often seen as a red flag for bearish times.

Yet, it was never going to be the case that the volume would maintain at the level of the selloff, and in fact, the trading volume is at the 2020 average and that level is still a lot higher than the 2019 average — so trading is up year on year.

As mentioned above, the biggest take away for the way in which Bitcoin has moved this week is not the small price gains made over seven days, it is the heightened volatility that has raged now for over two weeks.

In fact, the 30-day volatility as a percentage has grown since last week and is now at 9.3 percent. This is however down to the general global market sentiment which is in a dire space and is flowing over onto the supposedly separate and anti-correlated Bitcoin market.

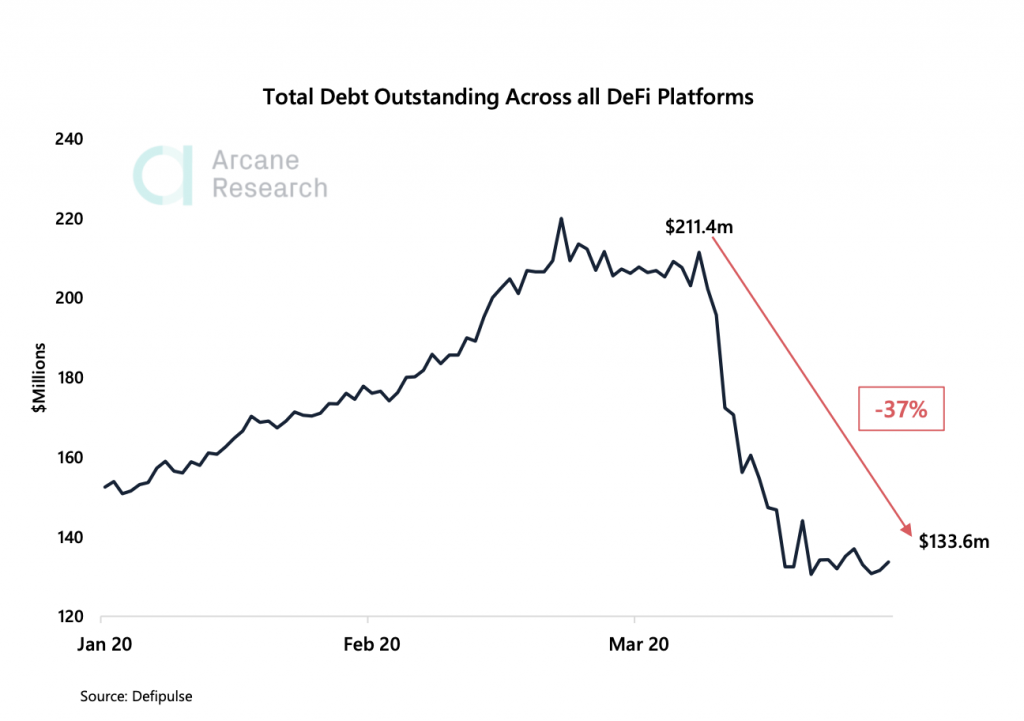

Another indicator of the cryptocurrency market in general being under pressure — and its continued growth and progress being halted — is the fall in DeFi lending.

The outstanding debt on these DeFilending platforms has shrunk through the march collapse and only amounts to #133 million, having fallen from just under double that — $211 million. In regards to the centralized lending platforms, such as Genesis, Celsius, BlockFi and Nexo, their outstanding loans account for more than all the DeFi loans out there currently.

This is also despite the fact that DeFi lending remains the most widely used application of the industry thus far.

Long Live The New Futures King

For the longest time, BitMEX has been the leading futures trading platform in the cryptocurrency space with OKEx often close behind it and Huobi making up the ‘Big three’. However, following the long squeeze and the liquidation loop of March 12, BitMEX has fallen behind its close rival OKEx in regards to the share of total open interest.

In January, BitMEX had over 34 percent of the total open interest in the market, but last week, its share of this figure had fallen more than seven percent to 27 percent. OKEx now has the lead, but it will be interesting to see if this is a brief flip or the start of a new era for both OKEx and BitMEX.

A little lower down the pecking order of market share, FTX and Deribit have recorded impressive Q1’s of 2020. At the start of the year FTX had a 1.2 percent market share, but in March that has risen to 4.7 percent share, which actually represents an increase in the market shares of 270.8%

Meanwhile, Deribit started the year holding 6.5% of the total open interest in the market. Their shares of the total open interest has now grown to 9.0% in March.

Waiting For $7,000

Looking at the technical analysis for Bitcoin, the market is in a precarious position where it could launch into bullish trends if it can breach $7,000 and stay there, but it could also find support as low as$5,800.

Bitcoin recovered well after that extraordinary crash, but it has remained stuck in a range between $5,800 and $6,800 meaning that it is still mostly stuck under $7,000 despite topping that figure once or twice.

How the week has ended now however does leave the coin at that upper ceiling that it needs to break through and that feels like the more likely route at the moment. If it was to find support back down at $5,800 there would be a dramatic fall in price that could lead to a rather large sell-off just before the Bitcoin mining reward halving.

What does become more worrying though is if the market does crash back to the support of $5,800, it may have enough momentum to go falling even harder again. The metric, provided by Glassnode, for Net Unrealized Profit/Loss (NUPL) went below zero after the crash three weeks ago.

NUPL is essentially profit and loss calculated by taking the difference between the current price and the price at the time the Bitcoin last moved.

So, even though it reached zero, it did bounce back rapidly, but this still leaves it in a red zone which historically has been labeled as the market bottom and led to a shift in the market sentiment to more positive things.

In the News

New Users Flood Into Cryptocurrency Exchanges in March

Five major cryptocurrency exchanges, namely Kraken, OKEx, Bitfinex, Paxful, and Luno, all reported a surge in sign-ups from new members, as well as trading volume. The level of sign-ups, in some cases, doubled, or even tripled, as the recovery for the Bitcoin market seems to be attracting investors in.

Binance Acquires CoinMarketCap

Binance, one of the world’s largest cryptocurrency exchanges, has acquired one of the world’s biggest resources for cryptocurrency data, for an undisclosed fee. The acquisition has however called into question issues of conflict of interest as the data site is supposed to operate independently and neutrally.

French Central Bank Shows Its Interest In Cryptocurrency

The Central Bank of France — the Banque de France — has published requests for proposals surrounding central bank digital currencies experiments. These projects are intended to help the bank assess and understand the risks and mechanisms of the digital currency space as well as for them to be able to contribute to the desire of the eurozone to move to digital cash.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.