The past week has been another one categorized by different bouts of volatility, and this is especially evident with the month coming to an end, but overall it has been a rather productive month for the price of Bitcoin as the coin has climbed over 10 percent. This has also helped the altcoin market which has been riding its coattails.

Looking a bit border, it is surprising to see how well the stock market has performed in the last 12 months, but a closer look at the impact of the Covid-19 induced market collapse shows that year to date, Bitcoin has performed better and is further distancing itself from the traditional markets and making a better case for being a hedge.

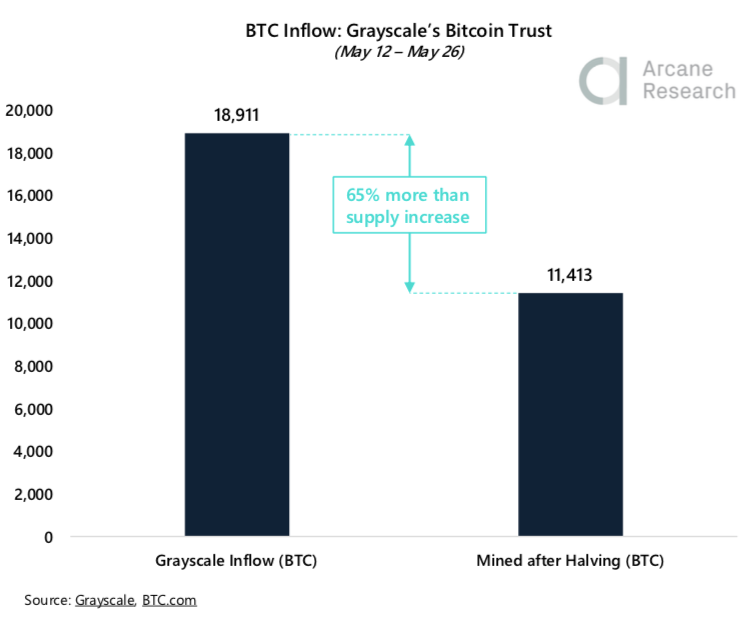

With the narrative of Bitcoin benign a possible hedge on the up, it is also interesting to note how The Grayscale Bitcoin Trust, a digital currency investment product that individual investors can buy and sell in their own brokerage accounts, has been accumulating Bitcoin rapidly after the halving, scooping up as much as 65 percent of all newly minted coins since early May.

The latest moves from Bitcoin look like the coin is once again trying to test the barriers of the all-important $10,000 mark after a late-week rally that came off the back of some pretty negative comments from Goldman Sachs that stated Bitcoin was not actually an asset class.

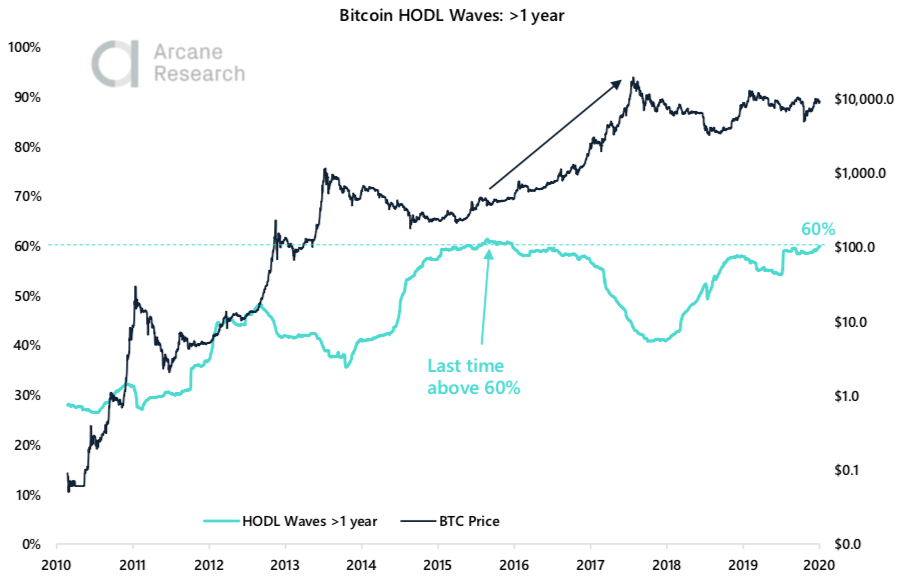

More bullish news, but not so measurable, is that 60 percent of Bitcoin has not moved off the chain for at least one year. The last time this was seen was in 2016, just before Bitocin took off on a year-long Bull run that culminated in the price of the coin reaching an all-time high.

Bitcoin Market Shines Late In The Week

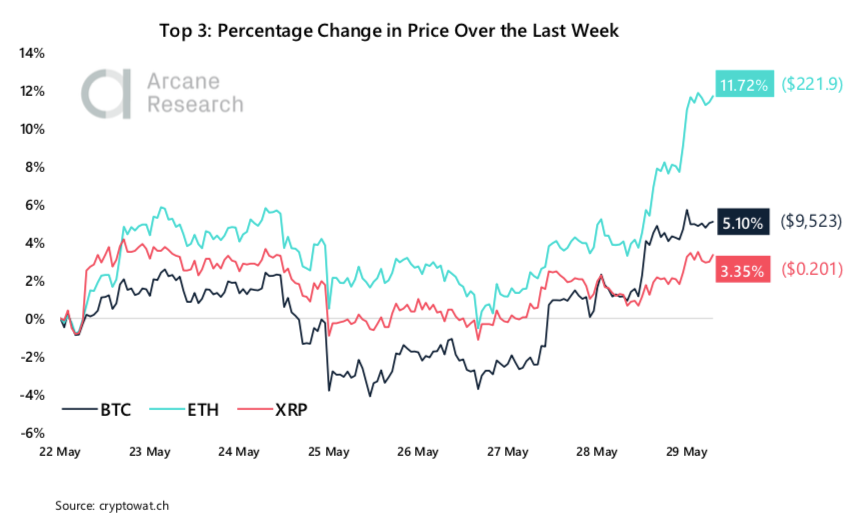

Bitcoin has been under a bit of pressure in the past few weeks, ending in the red buy a few percents. But, this last week has seen an impressive rally from the major coin as the price of Bitcoin gained nearly six percent from last week, after dropping into negative numbers halfway through.

The price is up, but then so is the volatility as the price has swung up and down, but this is not too unexpected as the month is drawing to a close and on CME, almost 50% of all open interest will expire today which could drive up the volatility for the BTC price even further.

Bitcoin’s rise late on in the week has also helped some of the altcoins shine as Ethereum is up 12 percent and looks to have broken late away from Bitcoin’s correlation towards the end of the week. Ethereum is coming to grips with its ETH 2,0 upgrade soon and interest is bubbling.

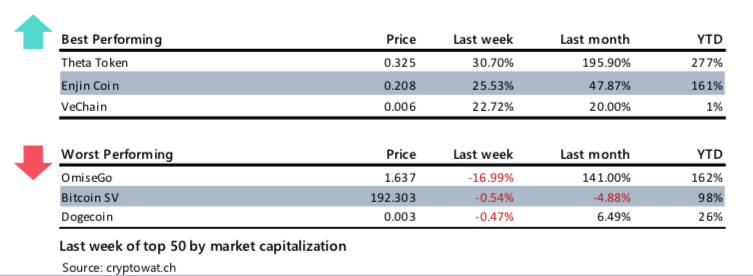

Yet, despite a good rally by Ethereum, there is a lot of action for Theta Token, which is up 30 percent on the week after an announcement of a partnership with Google. This token has rallied nearly 200 percent in the last month.

Stock Market Shines, But Bitcoin Well Positioned

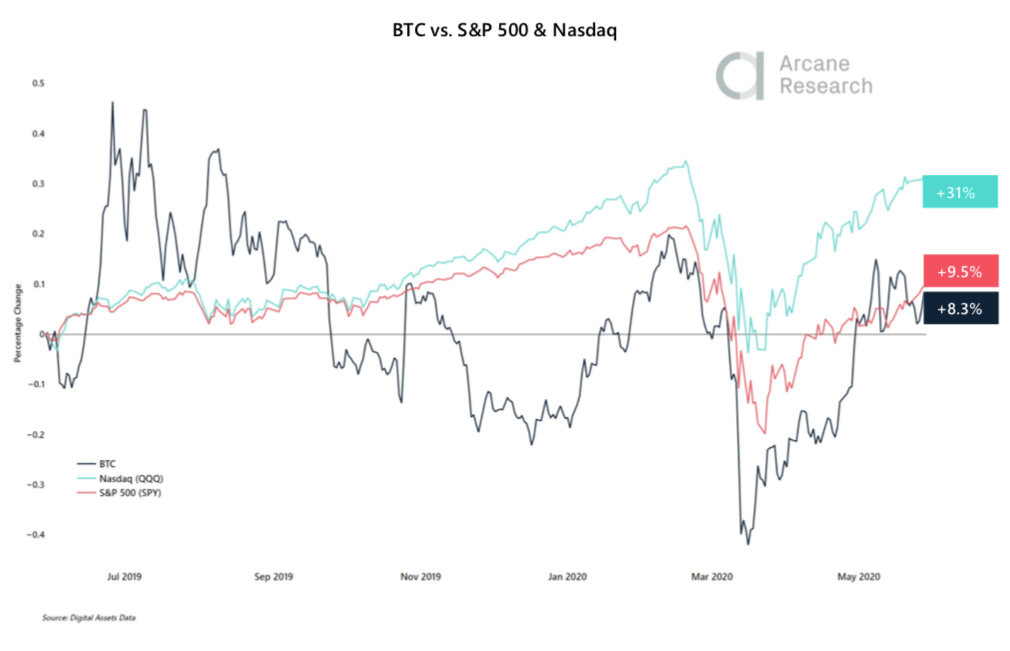

Interestingly, Bitcoin has not been the best asset for investment in the past 12 months with the stock market, particularly the NASDAQ shining as it rallied towards March. But, Bitcoin has shown that it has the potential to be uncorrelated and shine in a time of a crisis.

Looking at the graph below, the stock market, using the NASDAQ and the S&P 500 as key measures, has had a steady growth path for most of the last 12 months before suffering at the hands of the Covid-19 market collapse. But, at the same time, Bitcoin has also had better days, and worse ones, with high volatility.

This does not necessarily mean Bitcoin is the worst investment, and in fact, Bitcoin has outperformed the stock market by a good margin so far in 2020. More so. Bitcoin has historically performed significantly better than the stock market, with a higher Sharpe Ratio as well

More so, the recent seemingly uncoupling of Bitcoin to the stocks makes Bitocin even more attractive because it seems that the traditional markets are not out of the woods.

Bitcoin Market Getting Greedy, But Volume Dipping

The recent growth over this week in the Bitcoin market has helped the coin push towards a more neutral, or even greedy market, as the Fear & Greed Index is once again increasing, getting close to a neutral state.

For the third week, it has been seen that the sentiment is pushing towards a greedy state and out of the fearful arena. Furthermore, and following the market crash, the metric has now stayed out of the “Extreme Fear” are for more than a month — this indicates a more confident market in general.

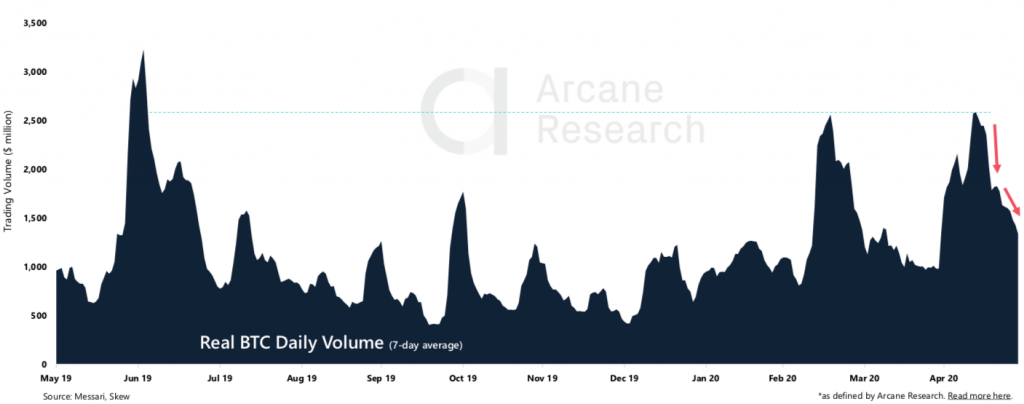

What is a little concerning is that the positive metrics — like the price of Bitcoin and the move towards a greed market, are not being backed up by the volume of trading. Usually, the movement of price is solidified when Bitcoin’s volume also follows along.

The 7-day average real trading volume is still trending downwards and has looked weak ever since we started ranging in this $9,000-$10,000 area. This coupled with the recent late-week move has the possibility of it being a false trend and that things could soon be reversed.

Greyscale Greedy For New Bitcoin

The Bitcoin mining reward halving that took place earlier this month has not had too much of an impact on the price or the health of Bitcoin, but what has been seen is that the institutional hunger for Bitcoin after the halving has increased incredibly.

Grayscale Bitcoin Trust, which is one of the prime examples of an institutional Bitcoin investment product, has been snapping up Bitcoin after the halving and has seen an incoming of 18,910.5 BTC in private placements. This equates to about $177.5 million.

Looking at the same period, roughly 11.400 BTC was mined, and that means that Grayscale is absorbing as much as 65 more bitcoin than the new supply that is being mined.

The question is though is this being done because there are new institutional investors?

Looking at early May, six months of shares from private placements got unlocked because Grayscale changed from a 12-month to a 6-month holding period. This means that the new inflow could very likely be arbitrageurs collecting profits from the premium of the publicly traded shares, and then buying directly into the trust again with that money.

Even if this is the case and it is a quick profit-making, there is still positivity for the market as institutional interest spikes heavily.

Bitcoin Still Eyeing $10,000

This week’s late rally has seen the coin fall, but then rebound back and yet still not reach the key $10,000 mark. However, this position is under threat and there is a chance it may be breached soon if a few things can happen.

The price of the coin managed to jump above the upwards trendline again and got close to flipping last week’s resistance level to support. From here, the next palace the bulls will be looking for is the yearly high around $10,500.

At the same time, Bears are looking for weakness in this $9,500 zone, and even a potential down to the support zone in the lower $8,000 area.

Bitcoin ‘Hodling’ On The Rise

More data this week has shown that Bitcoin that has remained stagnant and held for the last year is also reaching a new level. According to Glassnode, 60 percent of Bitcoin’s active supply has not had a transaction around it for the last year.

The last time anything like this was seen was in 2016, and this was just before the biggest rally that BTC had ever witnessed, that took it to $20,000. It is again a positive sign this time around as it points towards a bigger long term investor base who are happy to hold.

Also, over 2,3 million BTC are held on exchanges this time around whereas only 350,000 were being held back in 2016 on the exchanges. That equates to 12 percent compared to just two percent back then.

In The News

Goldman Sachs Labels Bitcoin As Not An Asset

Major bank Goldman Sachs, which has ties in cryptocurrency, has held an investor call where it has said that Bitcoin is not considered an asset class when discussing current policies for bitcoin, gold, and inflation in the context of the COVID-19 crisis. This shows a poor attitude to the new asset class and in response, Bitocin rallied as much as five percent on the news.

Regulated US Exchange Gemini Has Integrated With Samsung’s Blockchain Wallet

Gemini, the exchange run by the Winklevoss twins, has become the first U.S. crypto exchange and custodian to partner with Samsung, This means that Samsung users in the US and Canada are able to connect to Gemini’s mobile app to buy, sell and trade crypto.

India’s Central Bank Provides More Clarity On Banking For Crypto Firms

Confusion in India’s view on crypto has led to services in the country facing confusion, but it has been cleared that India’s commercial banks can provide banking services to traders and firms dealing in cryptocurrencies.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.