We’re now halfway through the second month of 2020, and the cryptocurrency market is still rising in value with each new day.

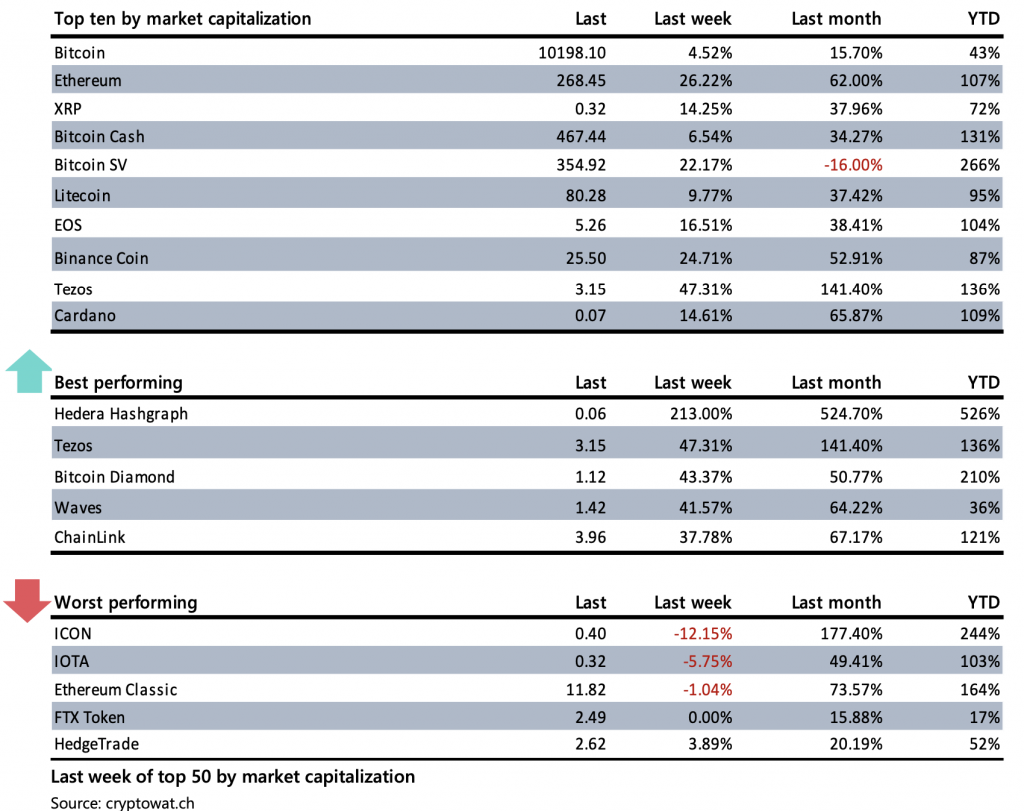

Bitcoin is up over 40% year-to-date, while many altcoins are up well over 100% in the same timeframe. Most analysts agree – the cryptocurrency bull market is back on and investors are paying close attention.

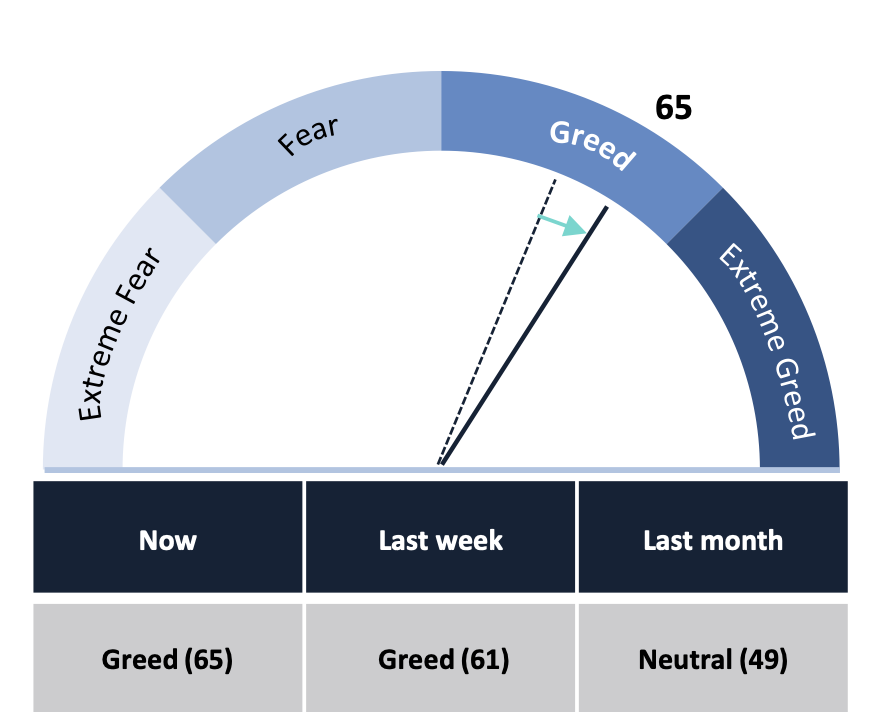

However, investor sentiment is reaching levels of extreme greed, so a temporary pullback may be in order to stifle irrational exuberance following the recent massive rallies.

But as selling decreases and both retail and institutional interest in the emerging asset class rises, any pullbacks are likely to be bought up quickly with the expectation of continued uptrend and a new all-time high on the horizon.

Bitcoin Bull Run Shows No Signs of Slowing, New All-Time High in September

This past week, Bitcoin broke back above $10,000 – a critical level that in the past has caused FOMO amongst retail traders. It was this level that once breached in 2017 that led to Bitcoin doubling in price just a month later.

Bitcoin rose yet another 4.5% week over week, taking prices to as high as $10,500. Upside targets remain at $10,700 where monthly resistance lies. Above there, the final resistance level before a retest of June 2019’s high would require a break of the $11,500 level.

If Bitcoin can break above those two key resistances, a retest of the all-time high may be possible. However, according to data, this may take until June or September 2020 before a new high is set.

In the case of Bitcoin reversing at current prices, a fall to support at $9,300 could be bought up quickly in anticipation of the Bitcoin halving coming this May. Each halving, the block reward miners receive is reduced, causing demand to greatly outweigh supply.

However, despite Bitcoin’s continued rally, the first-ever cryptocurrency has only further lost market share and dominance to altcoins that are ferociously outpacing Bitcoin.

Ethereum and Tezos Shine Among Top Ten Cryptos

Ethereum has led the latest charge across the altcoin market, bringing total gains for the year to as high as 100%. In the last week alone, the number two cryptocurrency by market cap has risen 26%.

But the cryptocurrency known as Tezos has eclipsed the rest of the market. Tezos is up 141% in the last month, and over 45% in the last week.

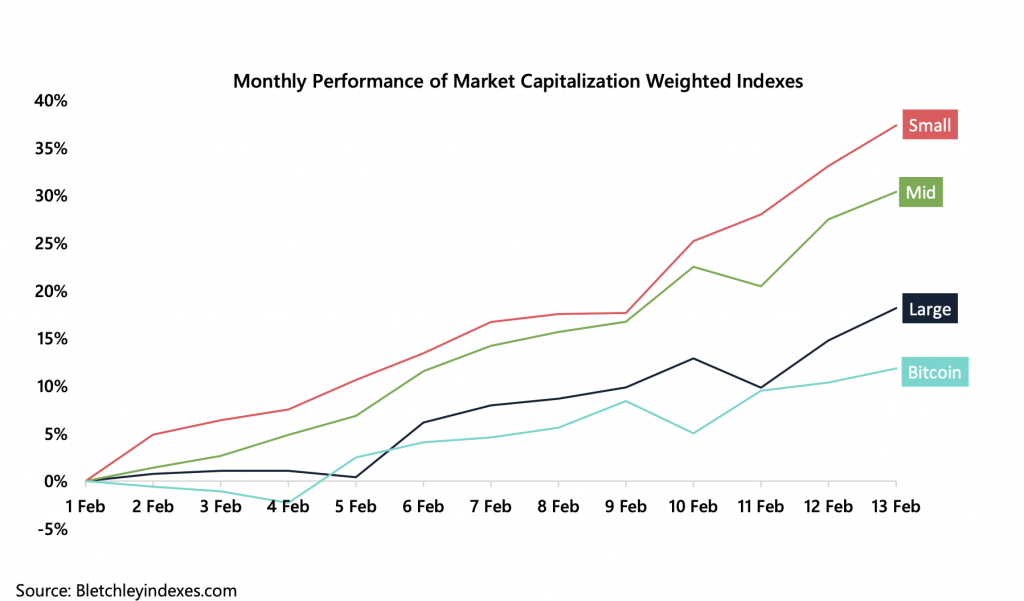

Small-cap altcoin Header Hashgraph absolutely exploded over the last week, pumping an insane 213% in just a week. Over the last month, it’s risen by over 500%, showing just how much money can be made across the crypto market in just a short amount of time. Small-cap altcoins continue to bring more returns to investors than mid- or large-cap altcoins, or even Bitcoin itself.

Sentiment Inches Closer Toward Extreme Greed

Money being made across the market hand over fist has caused the sentiment to tip even closer toward levels of extreme greed, according to the cryptocurrency industry Fear and Greed index.

Greed is now at the highest level of the year, and the largest value witnessed since August 2019 after Bitcoin had topped out its previous parabolic rally.

The strength in sentiment is largely driven by extreme returns throughout small-cap altcoins, that have not only outperformed Bitcoin but have largely outperformed large-cap altcoins like Ethereum and XRP, and even mid-cap altcoins like NEO and IOTA.

Demand Outweighing Supply: Retail Investment Increases As Selloff Ends

The current prices across the cryptocurrency market appear to be attractive to investors of all types, including retail investors that drove the last bull market, and new interest from institutional investors.

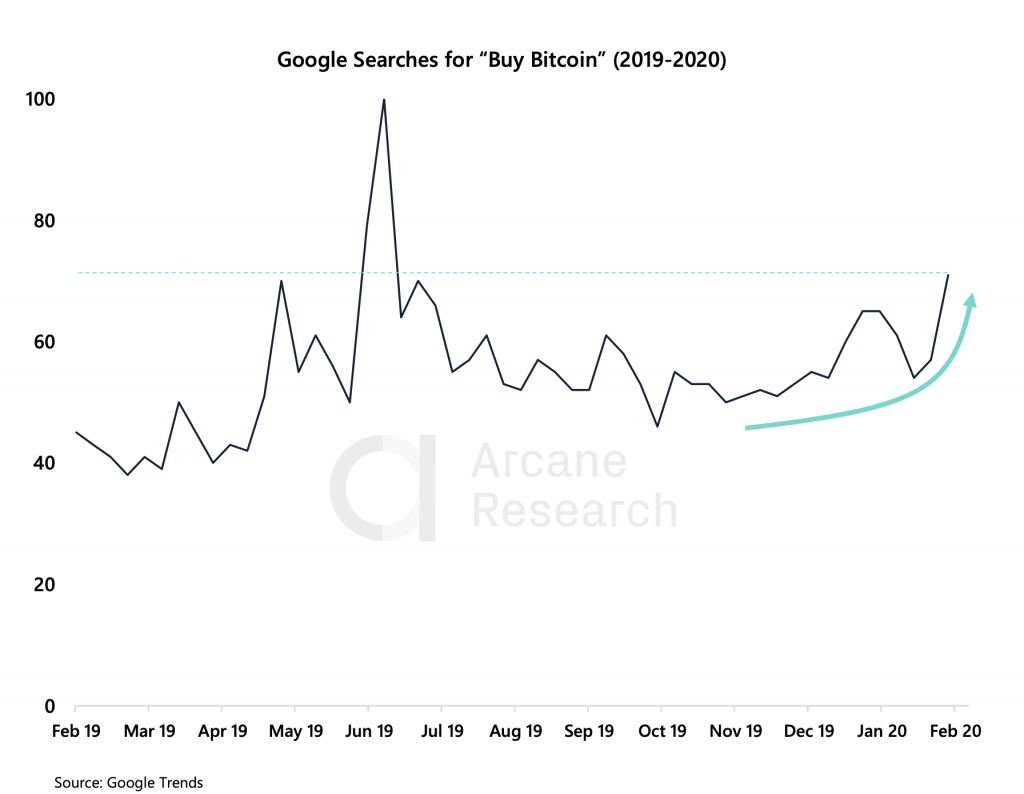

Google search interest in Bitcoin has risen to the second-highest level over the past year, with the only higher reading thing the June 2019 top when Bitcoin breached above $13,000.

Data concludes that this time may be different, however, as the search volume grows, it comes after a period of strong, organic growth in asset prices.

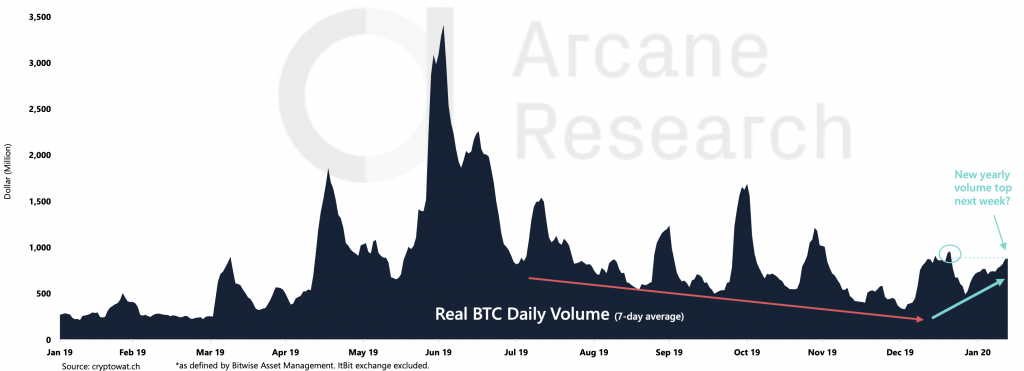

The trading volume of Bitcoin also continues to show healthy growth and could reach new highs in the coming days.

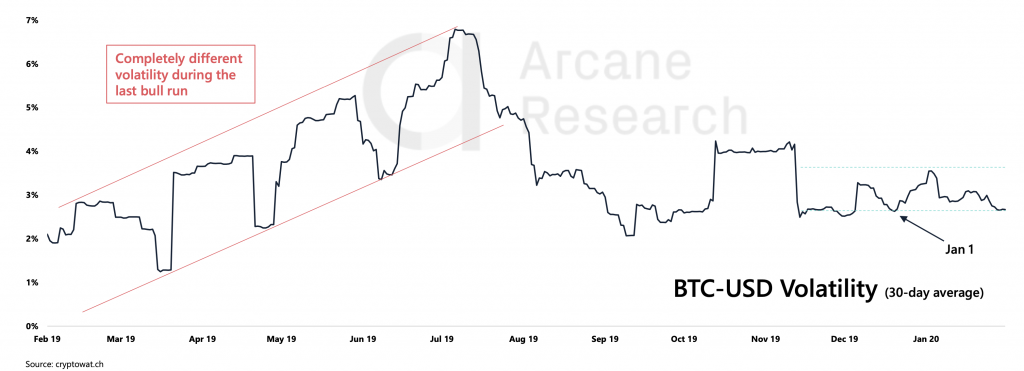

Meanwhile, volatility continues to range back and forth since the cryptocurrency bottomed out in late November and early December 2019. Once the volatility breaks out, an exceptionally powerful move is expected.

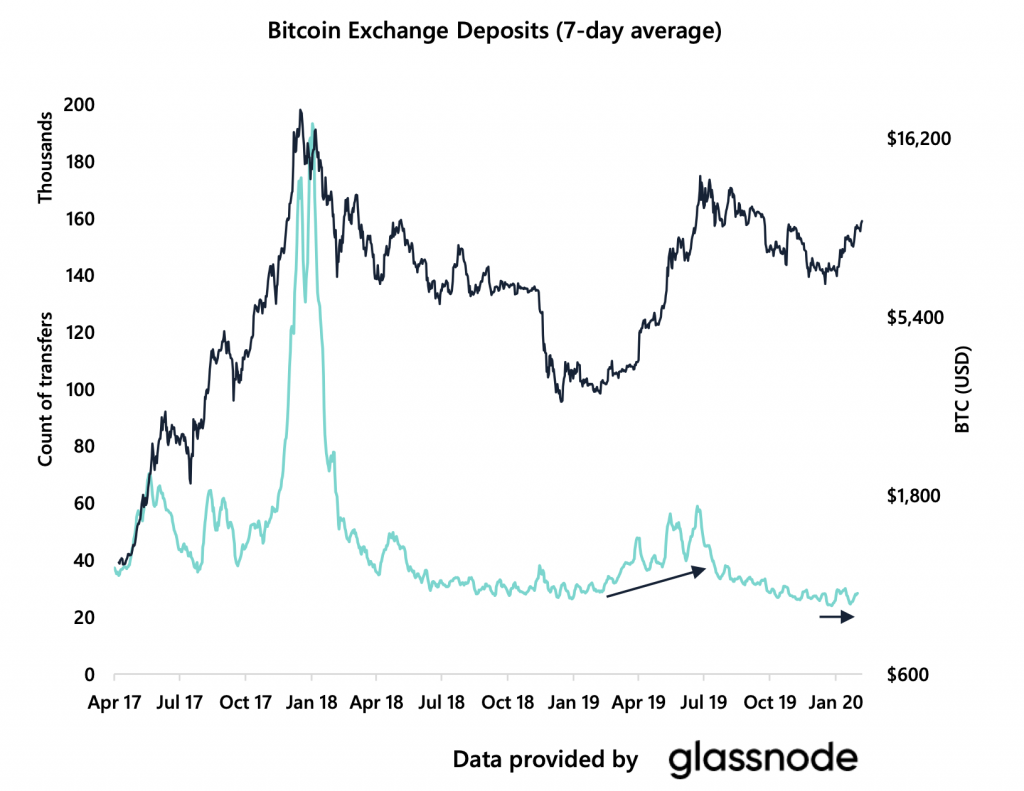

Crypto investors appear to be holding strong and aren’t ready to sell the current rally, according to inflow to exchanges from Bitcoin addresses. Deposits have remained flat in recent weeks as well across crypto exchanges.

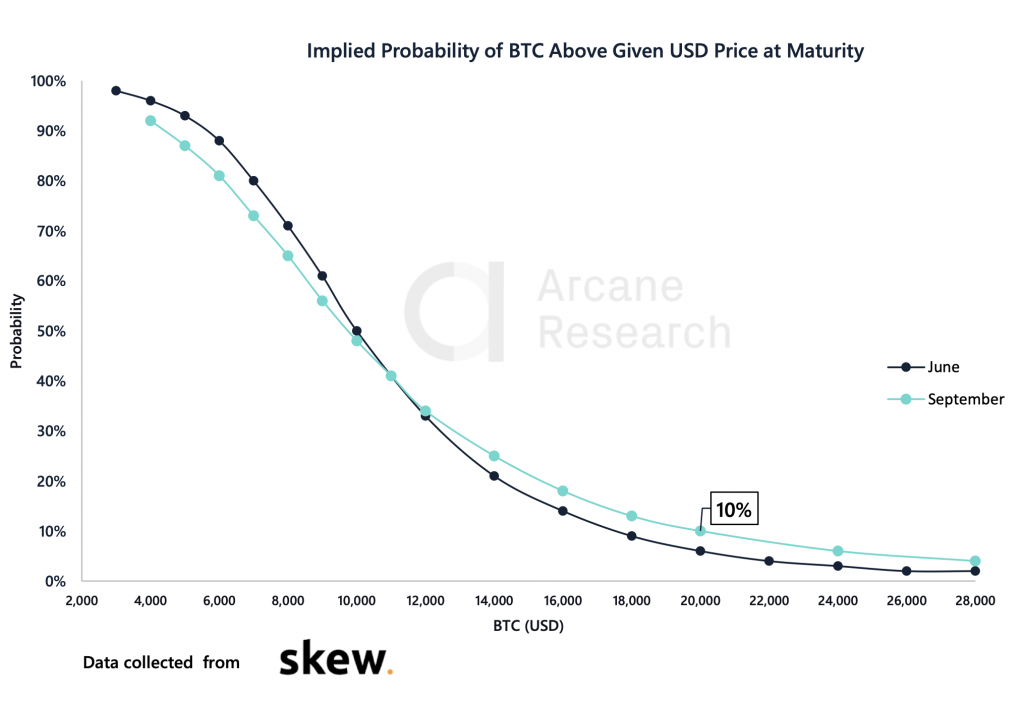

The reason crypto investors may be holding exceptionally strong could be due to the high probability that Bitcoin could reach a new all-time before the year’s end. There’s a 10% probability that Bitcoin reaches above $20,000 by September, and is at a 6% probability to occur by June 2020.

With Bitcoin potentially doubling in price in just a few months, crypto holders are expecting strong upside. The last time Bitcoin broke above $10,000 in 2017 – where the asset is currently trading – it took just one month later to reach $20,000. A break in 2019 took Bitcoin to $14,000. This time around, a new all-time high may be set.

This Week’s Biggest News Stories in Crypto

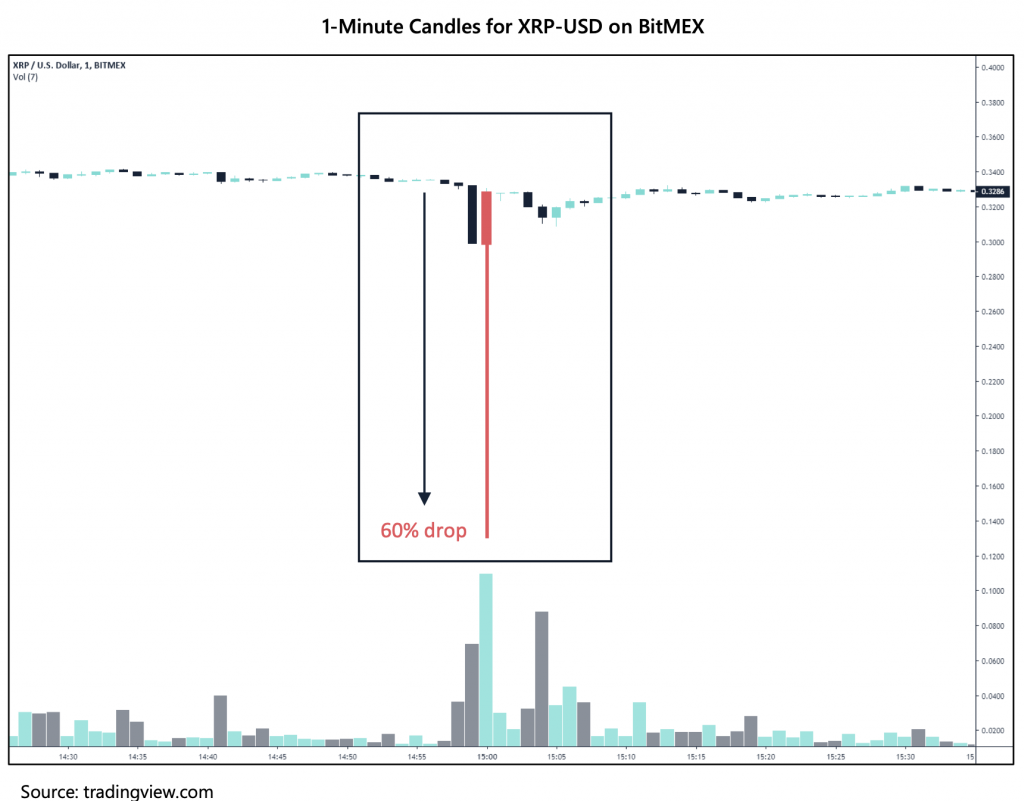

XRP Flash Crashes on BitMEX

The cryptocurrency derivatives platform recently introduced a new XRP-based contract. Within the first week of trading, the platform experienced a flash crash that took the price per XRP from 32 cents per token to as low as 13 cents per token in a matter of seconds.

Customers of the platform were liquidated as a result, causing widespread outcry across the crypto community. BitMEX has taken zero responsibility for the crash and offered no help to its customers.

BlockFi Raises $30M in Series B

Crypto bull and legendary investor Peter Thiel and his Valar Ventures firm have led a Series B funding round for BlockFi. The total investment raised tops $30 million.

Wells Fargo Invests $5M in Crypto Connecting Startup

Retail banking powerhouse Wells Fargo has invested $5 million in a startup aimed at connecting cryptocurrency exchanges with banks worldwide. The startup is a blockchain forensics firm named Elliptic.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.