The Price of Bitcoin has been moving very stable throughout the week with there not being much upward, or downward movement. However, there was one significant spike in the price movement as the price dived down closer to $9,000 and ended up with a loss for the week of four percent.

Bitcoin has been pushing hard to try and overcome the all important $10,000 mark, and with the week showing a stillness, there was bound to be a movement one way or the other, and it just so happened that it was downwards as almost $1,000 was taken off.

This fall in the BTC market however came in time with the fall in the global markets as well. The global markets had managed to recover all of their Covid-19 induced panicked losses, but they were due a pullback. However, even with this, there has been less of a correlation between the stocks and BTC in recent times.

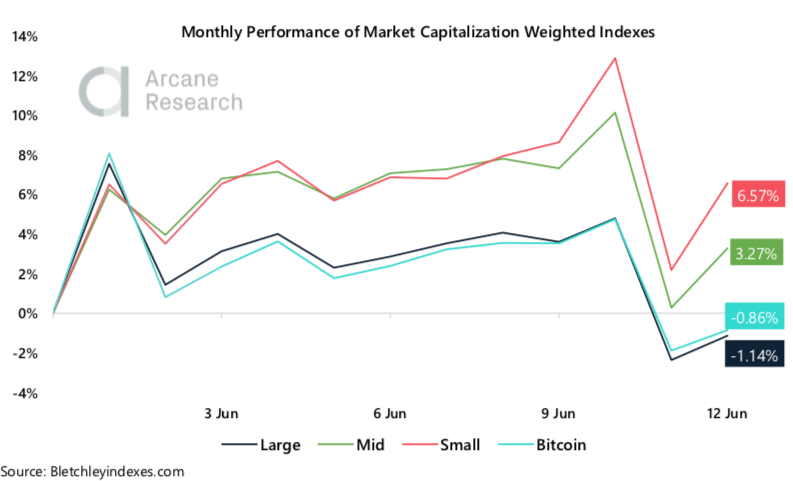

Looking at the overall month, the altcoin market has followed on from a successful May to have a strong start to the June with small caps up nearly 7 percent compared with large cap coins which are running at a loss for June, as is Bitcoin — just.

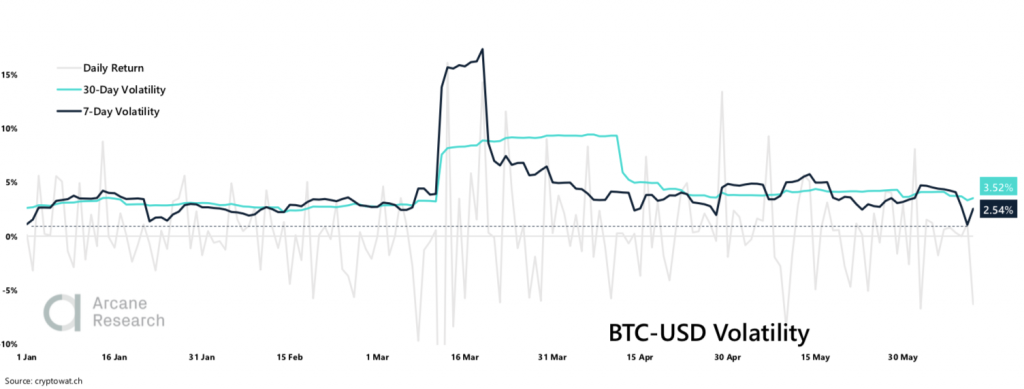

The recent drop in price has however moved some major metrics, and pushed the market straight back into fear taking down with it the Bitcoin volume which showed signs last week of rising. Yet, the spike was not enough to impact the volatility too much as the 7-day volatility fell to a new yearly low.

While the market continues to mostly stay between $9,000 and $10,000 there is a growing interest in the coin from institutions as the futures market is heavily in recovery mode, and CME is showing impressive gains.

A Late Drop

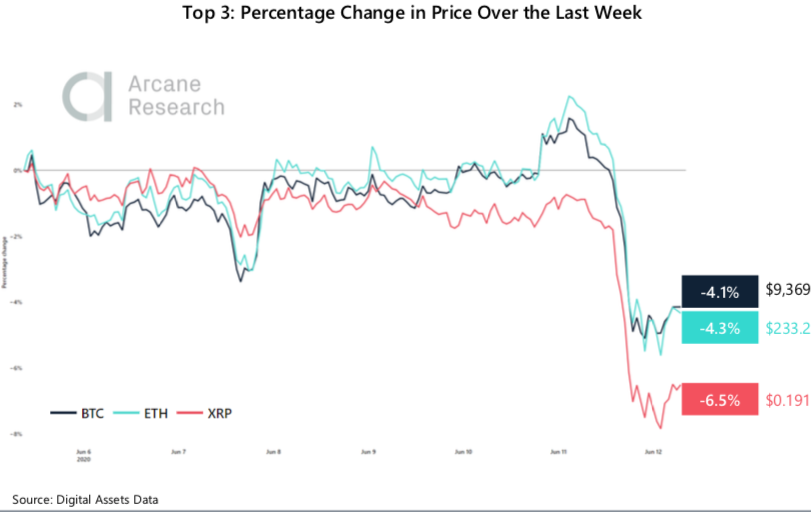

The parallel movement of the Bitcoin market always leaves traders on edge as it often precedes a big movement, but predicting that movement is never easy. This time it ended in a $1,000 loss on the price of the coin and ended up damaging Bitcoin’s stride towards $10,000 as the market closed the week at -4.1 percent. It was however still the better performer in the top three as Ethereum was just under with 4.3 percent losses, but XRP was down 6.5 percent.

There were a number of bigger losses for the week in the border altcoin market with the smaller tokens like HedgeTrade dropping 40 percent this week while Theta Token is still coming down with 25 percent loss.

At the same time, this has also been a good week for some other altcoins like Kyber Network which has had a massive 65 percent gain this week, and Zilliqa is also up over 50 percent.

Some of these bigger performances from smaller coins are showing dividends for the entire small cap space as since the beginning of June, there has been steady growth with a peak for the small caps of as high as a 12 percent gain. The latest dip this week drove down some of those gains, but there is already a climb being seen again.

For the bigger caps and even Bitcoin, the recent drop has already managed to whip out their own gains over the last 12 days of the month and sent them just under the gain line.

Coinbase Makes Trading Difficult

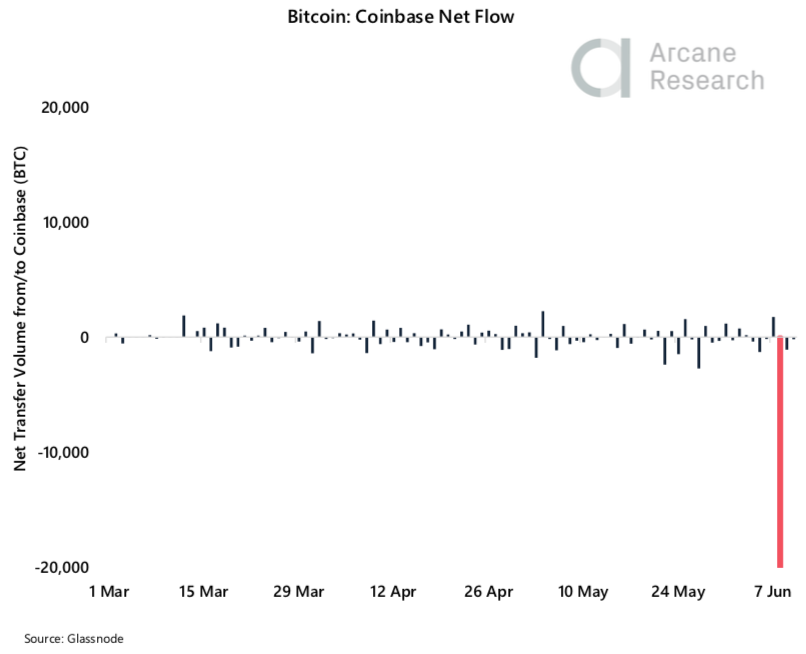

Part of the problem that traders have faced in recent times has not only been the market price moving around, it has been difficulties from some of the bigger exchanges when the price has moved significantly. Outages at Coinbase have caught the ire of the traders as these keep happening at violent price swings.

More so, Coinbase has been getting closer to the US government and people are fearing the loss of privacy that could bring, but this is just the tip of the iceberg for the famous exchange.

This week, Coinbase was also struck with a negative net flow of -20,000 BTC in a day when they saw a massive amount of $31,000 BTC withdrawn. The fears were that this rapid withdrawal had to do with the rumours of Coinbase conceding privacy to the US government.

Fear Up, Volume Down, Volatility Also Down

The latest dip in the market has also caused a few key metrics to move in a direction that probably is not great for the short term future of Bitcoin as fear has certainly returned to the market and it is now leaving an interesting pattern of mostly fear that is punctuated by bouts of greed.

The Fear and Greed Index is now at 39, the lowest level since late April. TO add to this, it is worth noting that the popular VIX index jumped to the highest level seen in over a month, as the stock market tumbled down around 6%. The fear of another big fall as seen in March may well still be in investors’ minds.

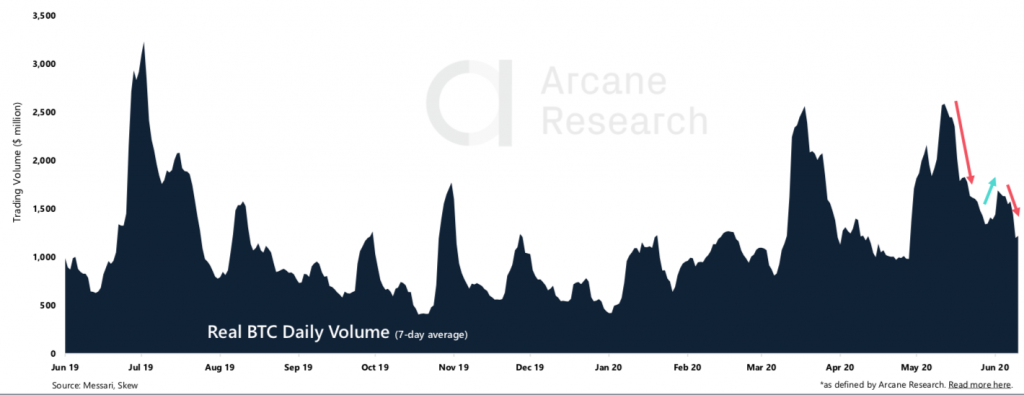

Unfortunately, the return to a fearful market has also put an end to a potential spike in Bitcoin volume that looked to be building last week. Having spiked and then fell towards the end of May, there was a trend developing that looked to be driving volume up — which is often the sign of a bigger price movement in an upwards trend.

However, it was not to be as the volume has fallen off the other end of that peak, and it has actually fallen lower than where it last stopped dropping. Bitcoin volume is often seen as a real indicator of interest and potential for growth as if there is a buzz in the sending and trading of Bitcoin the markets are usually abuzz too.

But, on the more positive side of things, Bitcoin’s volatility is also low, and has in fact dropped to a new low for 2020. Bitcoin volatility being low is a good thing for the general health of the market as not many people enjoy the crazy swings in price both up and then down. However, some traders appreciate these swings.

The low volatility this week of course came from almost a full week of Bitcoin’s price sitting on the range between $9,600-$9,800. And so, the 7-day volatility dropped to the lowest level so far in 2020.

But, it is still possible to see where the latest price drop has impacted the volatility stakes as there is a bit of a sharp turn up. It is not unlike that we see increased volatility going forward, as the stock market looks shaky and BTC has moved sideways for a long time.

A Future For Futures

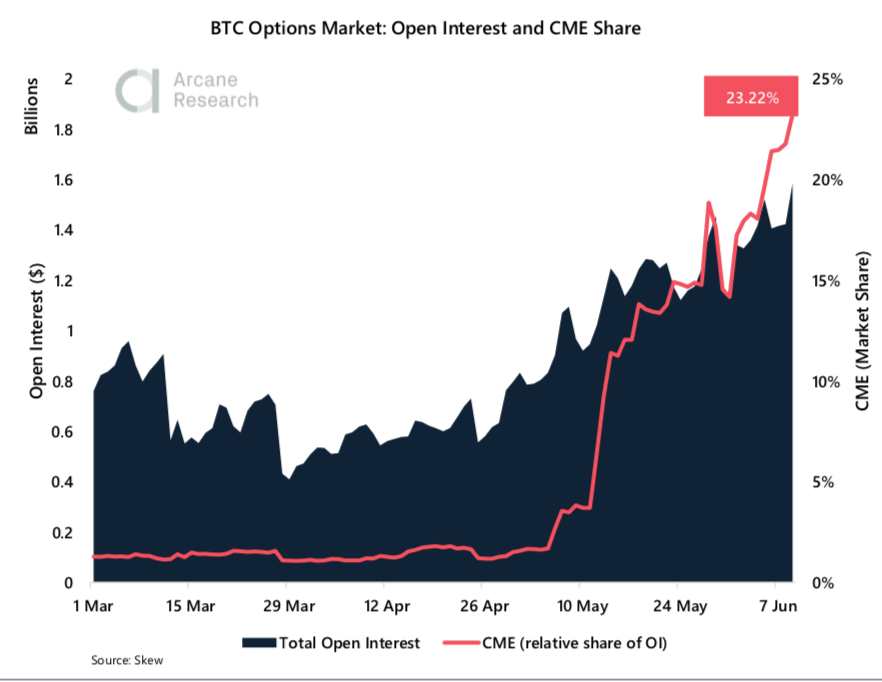

Open interest in the Bitcoin futures market has also reached an important milestone this week as the pre-crash level has been overcome and the open interest is rising again on a good trajectory.

The BTC futures market more than halved in size around the time of the pandemic-inflicted market crash, as the price went from $10,000 to $4,000 within a couple of weeks. That crash sent the overall open interest in the futures market to under $2 billion following that event and has taken almost 3 months to get back up to pre-crash levels.

CME Making Moves

The increase in the market share from CME in BTC markets is pleasing as they are predominantly institutional based and show that there is a hunger for BTC trading from the major institutional traders.

For CME there is also increased interest in option trading as open interest in the Bitcoin option markets has nearly doubled since the beginning of May, with CME and Deribit being the greatest contributors.

Option trading on CME held a share of around 2% of the total BTC open interest coming into May but that figure has skyrocketed to 23% of the market. This was at a time where Paul Tudor Jones made an entrance into the market.

In The News

Fidelity Finds That ⅓ of Institutional Investors Own Crypto

Crypto investment from institutional traders has come a long way as it has now been found by Fidelity Investments that as many as a third of all major institutions own some sort of crypto. Fidelity surveyed around 800 institutional investors in the US. and Europe. More than 25% of those that took the survey admitted that they hold Bitcoin, 11% own Ether. In the U.S. 27% of the respondents had invested in digital assets, while the number was much higher in Europe, at 45%.

Bakkt and Galaxy Digital Cater To Institutional Investors With Joint Custody Service

Baakt, the institutional trading platform that pays out in BTC, as well as Mike Novogratz’s Galaxy Digital, have teamed up to try and get in on the ever growing action of institutional interest in BTC. The two companies have said their new service will offer asset managers and other institutional investors a “white glove” trading and custody solution.

Microsoft Unveil Bitcoin-Based Identification Tool

Microsoft’s Bitcoin-based decentralized identity tool, ION, has gone live through a beta test. This represents the next step in the software giant’s drive towards decentralized identity as part of the Decentralized Identity Foundation (DIF) to fast-track tools anyone can use for COVID-19 crisis response programs.

Information provided in PrimeXBT’s market report includes data provided by Arcane Research, in addition to other internal market research.

The information provided does not constitute, in any way, a solicitation or inducement to buy or sell cryptocurrencies, derivatives, foreign exchange products, CFDs, securities and similar products. Comments and analysis reflect the views of different external and internal analysts at any given time and are subject to change at any time. Moreover, they can not constitute a commitment or guarantee on the part of PrimeXBT. The recipient acknowledges and agrees that by their very nature any investment in a financial instrument is of a random nature and therefore any such investment constitutes a risky investment for which the recipient is solely responsible. It is specified that the past performance of a financial product does not prejudge in any way their future performance. The foreign exchange market and derivatives such as CFDs (Contracts for Difference), Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. PrimeXBT recommends the consultation of a financial professional who would have a perfect knowledge of the financial and patrimonial situation of the recipient of this message and would be able to verify that the financial products mentioned are adapted to the said situation and the financial objectives pursued.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.