Gold (XAU) smashed through $4,700 per ounce and silver (XAG) broke $95 today, both hitting all-time highs as investors piled into safe-haven assets. The catalyst? The deepest US-Europe crisis in decades, with Trump’s push to acquire Greenland now backed by tariffs on eight European nations.

This is all unfolding as the World Economic Forum (WEF) meets in Davos, where attendees named “geoeconomic confrontation” as the number one global risk for 2026.

What’s happening at Davos?

The WEF’s annual meeting kicked off yesterday under the theme “A Spirit of Dialogue” – though dialogue seems in short supply. Denmark’s government skipped the event entirely due to the Greenland standoff.

Treasury Secretary Scott Bessent arrived with the largest-ever US delegation, delivering a blunt message: “America First does not mean America alone,” but warned that “the worst thing another country can do is escalate against the United States.”

European Commission President Ursula von der Leyen fired back, saying Europe will “unequivocally respect the sovereignty of Greenland and of the Kingdom of Denmark.”

The mood is tense. The WEF’s Global Risks Report found that 50% of respondents expect a “turbulent or stormy” world over the next two years. Only 1% expect calm.

The Greenland situation has escalated dramatically

Trump announced 10% tariffs on eight European countries on 17 January – Denmark, Norway, Sweden, France, Germany, the UK, the Netherlands, and Finland. These jump to 25% by June unless Europe agrees to sell Greenland.

A leaked text message to Norway’s Prime Minister linked the whole thing to a grudge over the Nobel Peace Prize, with Trump writing that since Norway “decided not to give me the Nobel Peace Prize,” he no longer feels “an obligation to think purely of Peace.”

Danish PM Mette Frederiksen responded that any US attack on a NATO ally would be “the end of everything” and that “Europe will not be blackmailed.” Denmark has deployed around 160 troops to Greenland in what it’s calling “Operation Arctic Endurance.”

The EU is preparing countermeasures including retaliatory tariffs on $108 billion worth of US goods.

Gold and silver surge on safe-haven demand

The numbers tell the story. XAU is now up 72% year-over-year, its best performance since 1979. XAG has done even better, climbing an astonishing 210% over the past 12 months – its strongest rally on record.

Exchange-traded fund (ETF) flows have been massive. Global gold ETF holdings hit a record 4,025 tonnes after $89 billion in inflows during 2025, the strongest year ever. The iShares Silver Trust has delivered a 206% one-year return.

Central banks keep buying too. 95% of central banks surveyed expect global gold reserves to increase over the next 12 months – the highest reading ever recorded.

Investment banks are bullish. J.P. Morgan sees gold reaching $5,055 by Q4 2026. UBS targets $5,000 “in coming months” with upside to $5,400 if risks intensify. For silver, Bank of America suggests the metal could peak anywhere between $135 and $309 based on historical patterns.

Technical outlook

On gold, the break above the $4,600-$4,650 area has confirmed strong momentum. The daily 20 EMA is sloping higher and sits well above the daily 50 EMA, signalling a healthy trend. We’ve marked out the $4,640 zone as previous support, which also aligns with a key Fibonacci retracement level. A pullback into this area could attract bulls and intraday traders looking to join the move. A break below would have traders potentially eyeing the high timeframe uptrend line for a shallower retrace, but for now momentum shows no signs of slowing.

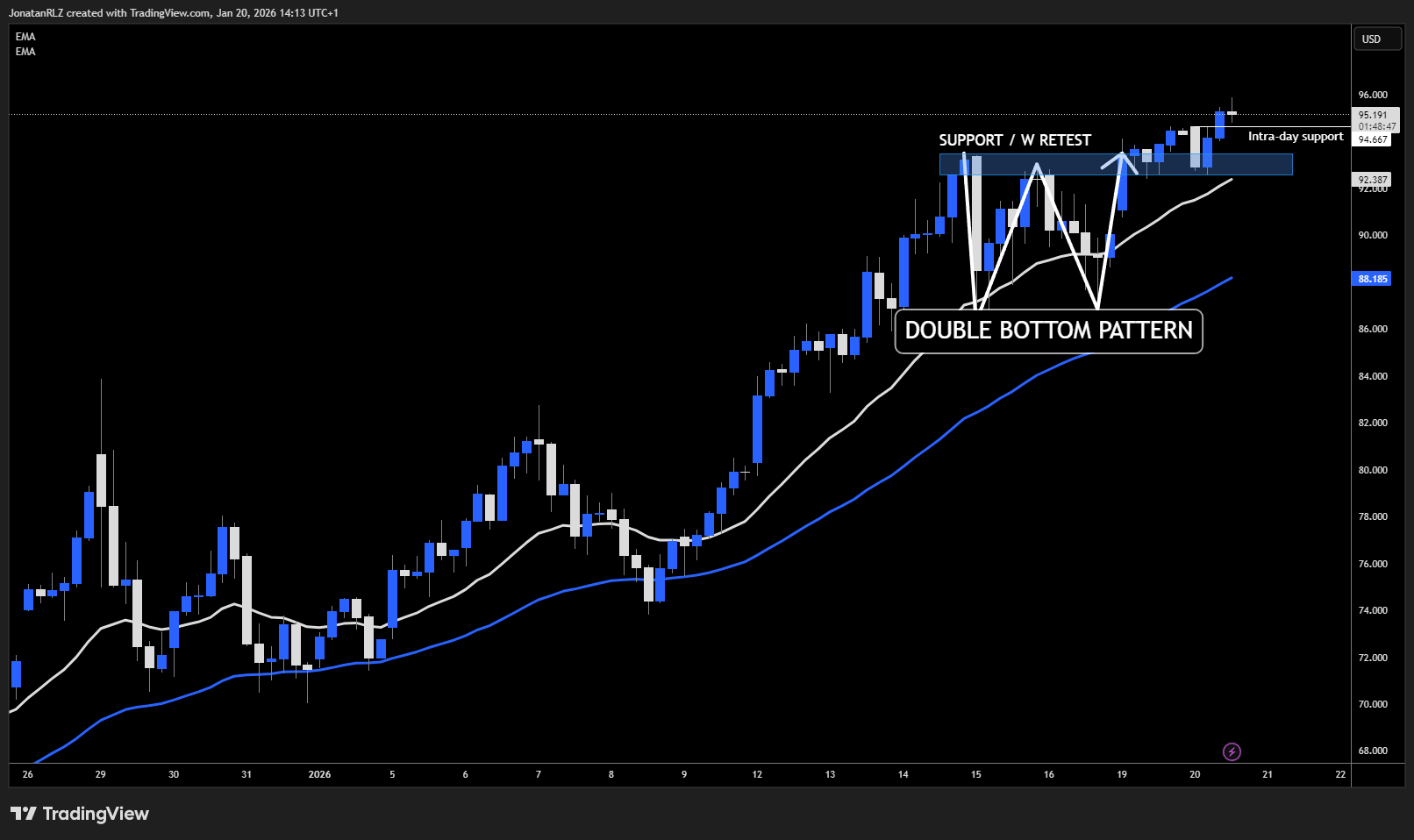

Silver has broken out above $94 after printing a double bottom pattern on the 4-hour chart, with price now deviating significantly from the 20 and 50 EMA. After breaking above the neckline, we saw a successful retest of support around $93 before the push above $95. Intraday support sits at $94.6, while the $93 area remains crucial for longer-term continuation.

What to watch

This is no longer about whether Trump’s Greenland comments are serious – he’s now backing them with actual tariffs. The question is how far both sides are willing to go.

For gold, watch the $4,640 support zone on any pullback. As long as that holds, the path of least resistance remains higher toward the $5,000+ targets from J.P. Morgan and UBS. For silver, the $93-$94.6 range is key – bulls will want to see that area hold to maintain the current momentum.

With central banks at record buying levels and geopolitical tensions escalating, safe-haven demand shows no signs of exhaustion. We’re watching the worst transatlantic crisis in generations unfold in real-time, and gold and silver remain the clearest beneficiaries.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.