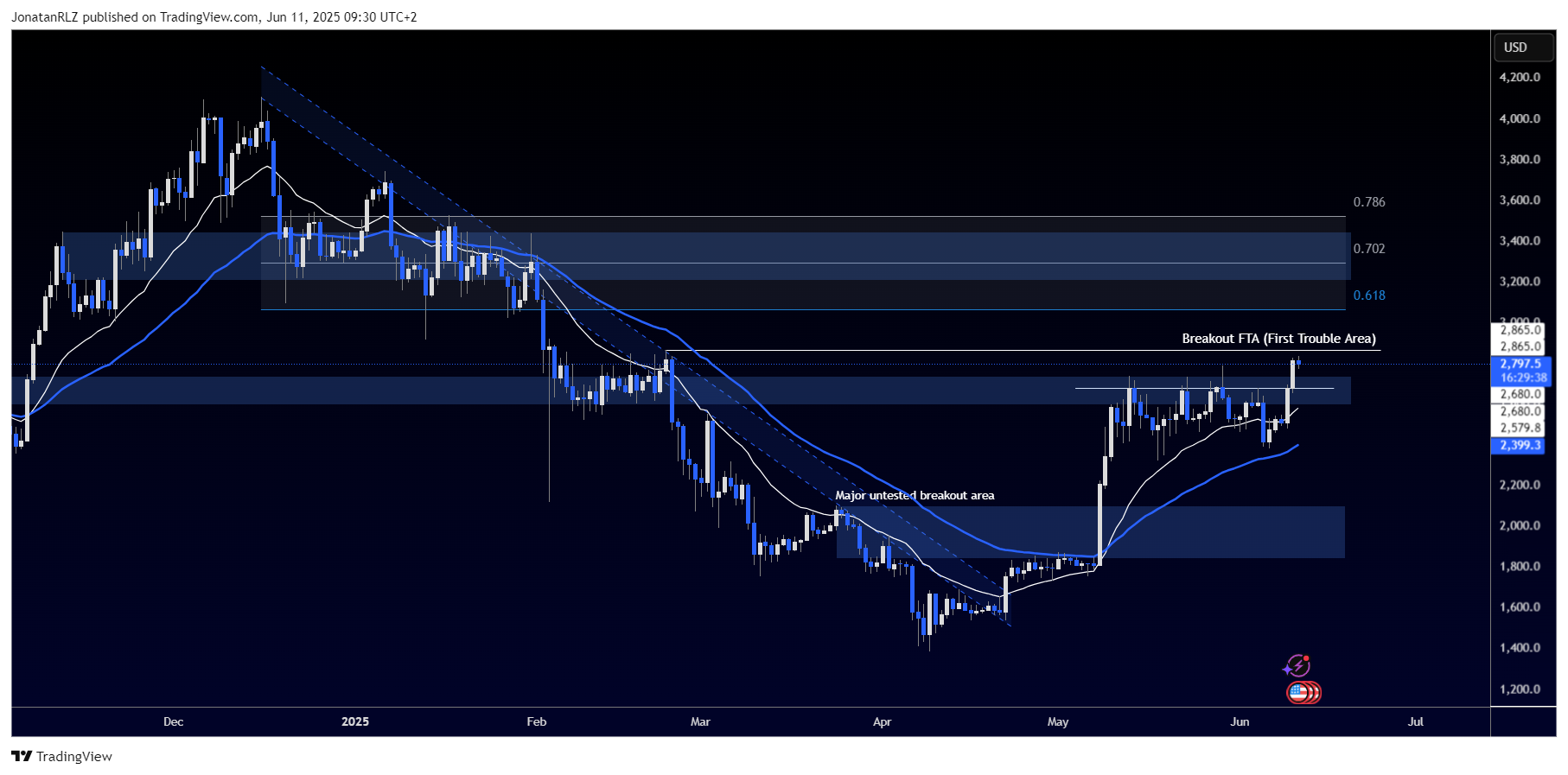

Ethereum (ETH) has confirmed a significant breakout after weeks of consolidation. Following the break above the major resistance around 2,000 in early May, price established a clear consolidation range just below the next high time frame resistance near 2,700.

Yesterday’s strong bullish daily candle closed well above this 2,700 level, confirming the breakout and pushing price directly into the next resistance zone. ETH is now testing the area around 2,850, which marks the first trouble area of this new leg higher.

The two most important levels to monitor right now are the breakout area at 2,700, and the current resistance zone around 2,850. A successful hold above the breakout level would keep the structure bullish, while a rejection at the current highs could set up a temporary range.

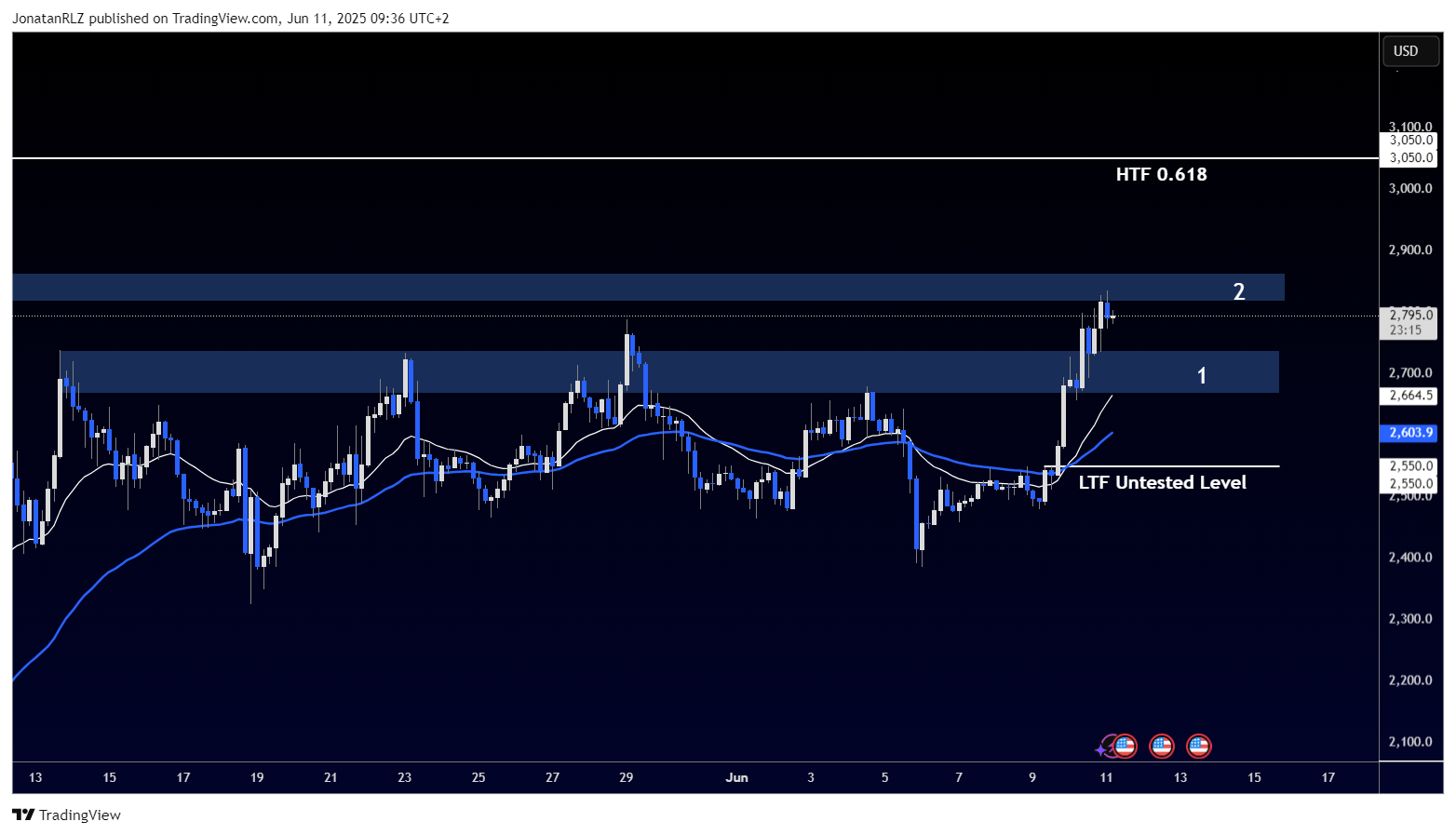

On the 4-hour chart, we can see this more clearly. Ethereum has broken above the 2,700 resistance, marked as number 1, and reached the FTA (First Trouble Area) level around 2,850, marked as number 2. This move aligns with the expected post-breakout behaviour, where price often pauses at the next resistance before determining direction.

If ETH fails to break cleanly above 2,850 and loses momentum, we could see the formation of a short-term range between number 1 and number 2. A breakdown below 2,700 may open a move toward the untested breakout zone around 2,550, which sits inside the previous consolidation range.

On the flip side, if we get another bullish push and break above 2,850, the next level to watch is the high time frame 0.618 Fibonacci level, which aligns with the 3,050 region. That would likely act as the next significant resistance and potential target for bulls.

Ethereum is currently trading with a bullish structure on both daily and 4-hour charts, and price action around 2,850 will likely dictate the next move.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.