Ethereum has recovered from yesterday’s 2865 low, rising 2% towards 3000, boosted in part by improving risk sentiment across the broader market amid Greenland relief and by on-chain data pointing to a brighter outlook.

Bitcoin has recovered to 90k, and the total crypto market capitalisation is rising 1.33% to $3.04 trillion.

Risk sentiment across both traditional and digital markets is recovering after President Trump dialled back his threat of tariffs on European countries over Greenland and ruled out military action to take the territory. He also announced a deal framework, reviving risk sentiment and the TACO trade.

Ethereum, which had fallen sharply amid the risk-off environment, is recovering higher with other risk assets.

On-chain data shows that the recent dip is being used as a point of accumulation for some addresses. A large OTC whale acquired 10,000 BTC worth almost $29 million during this latest market pullback. In a separate transaction, another whale borrowed $70 million in USDT from Aave and used it to purchase 24,555 ETH, worth almost $75 million, suggesting high-conviction dip-buying. These large players are not waiting for confirmation of price action but positioning ahead of a possible structural shift.

Separately, institutional demand has been less convincing. ETH ETFs recorded net outflows of $229.95 million on Wednesday, the largest daily outflow since November 20. This halted the recent inflow momentum.

ETH staking grows

Earlier this month, Grayscale announced its Grayscale Ethereum staking ETF had distributed staking rewards accrued between October 6 and December 31st 2025, to existing shareholders. This was key as it marked the first time a US-based spot crypto trading product had distributed staking rewards to holders, meaning that Ethereum’s yield was packaged into the standardised framework of TradFi.

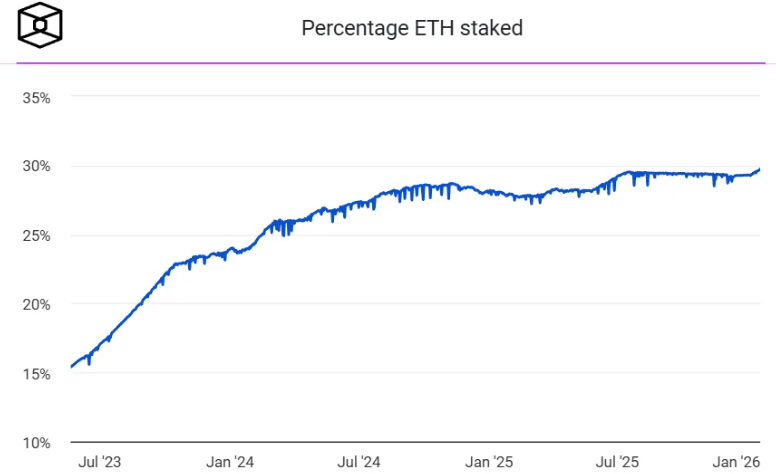

Furthermore, on-chain data shows the Ethereum staking rate continues to increase, reaching a record high of over 36 million ETH (according to The Block data), 30% of the circulating supply. This means that ETH is no longer just a medium of exchange or speculation; it is increasingly a means of production that yields a return.

At the same time, Q4 validator exits are gradually being cleared. The Proof of Stake exit queue is almost empty. In short, Ethereum could be evolving from an asset driven by price volatility to an income-generating asset with a stable yield. This is a long-cycle, stability-focused strategy that locks up supply, likely providing strong price support.

ETH technical analysis

ETH rebounded lower from 3400, breaking below the 50 SMA and briefly spiking to a low of 2865, before recovering to settle on its multi-month rising trendline around 2900. This is also the late December low.

Buyers will need to defend this 2900 support level to stage a recovery towards 3080, the 50 SMA and 3400, the 2026 high. A rise above here creates a higher high.

Should sellers, supported by the RSI below 50, break below the 2900 support, this could open the door to the 2730 support zone, the December low, and the May high.

Open free account

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.