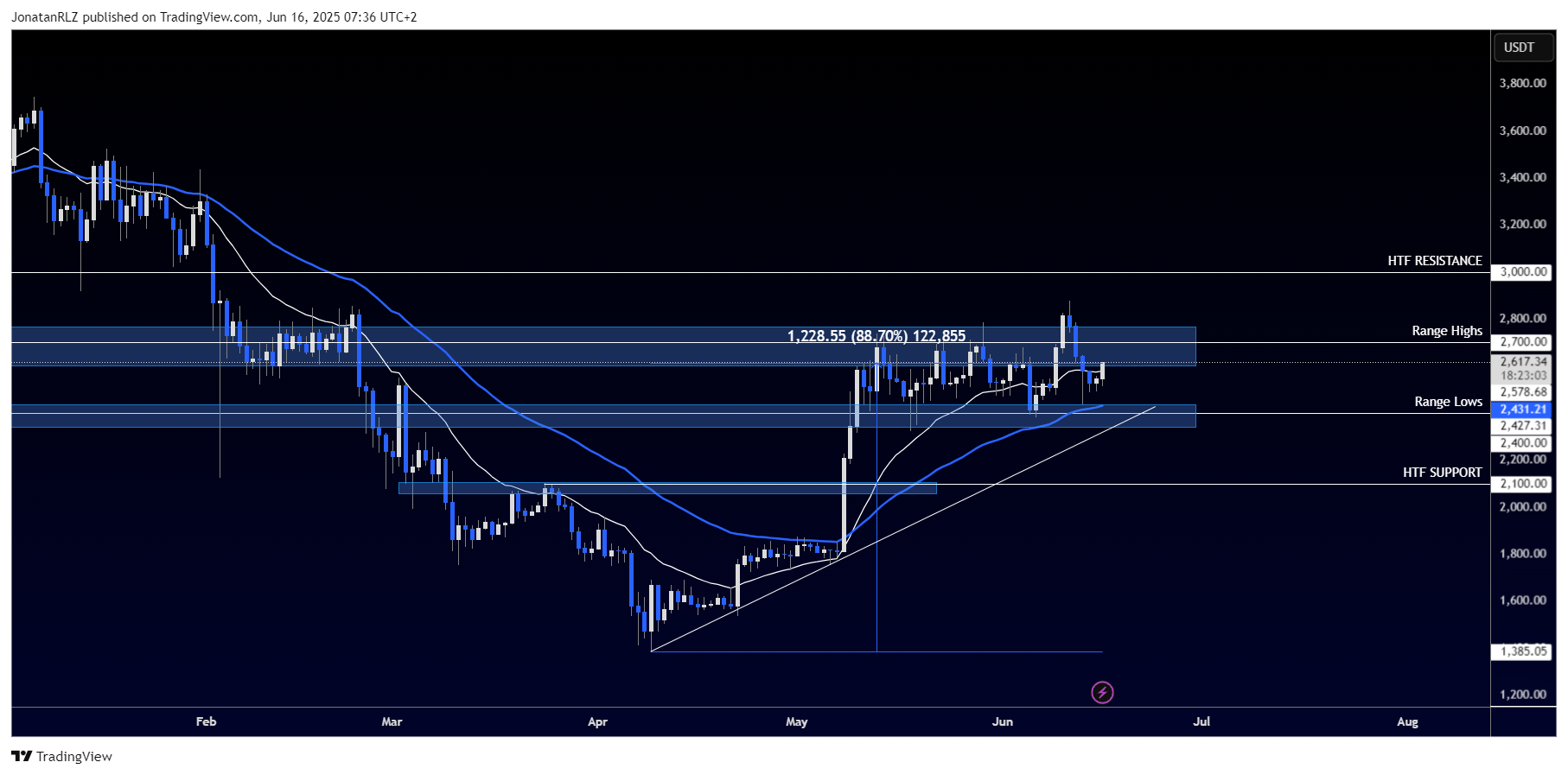

After the explosive breakout in May, when Ethereum surged above the 2,500 level, price has now settled into a well-defined range between 2,400 and 2,700. The breakout we saw on 10 June quickly turned into a fakeout, as ETH re-entered the range following renewed Middle East tensions, with reported strikes by Israel against Iran.

Global events like these tend to trigger a risk-off reaction, pushing investors out of risk assets such as ETH and into safer alternatives. Despite this volatility, Ethereum is still trading firmly within the range and remains up over 88 percent compared to just two months ago.

There are two key high time frame levels to monitor. Below the current range, the 2,100 area stands out as untested breakout support. If the current range breaks to the downside, this is where bulls are likely to step in to defend structure. To the upside, the 3,000 level remains the next significant resistance where bears could potentially look to fade any breakout.

On the 4-hour chart, the structure becomes clearer. We see range lows at 2,400, the range equilibrium at 2,575, and the range highs at 2,750. It’s important to treat range boundaries as zones, not fixed lines. Imagine there’s always a buffer zone around these levels where price may react to.

At the time of writing, ETH is pushing through the range equilibrium, and with little over two hours left in the current 4-hour candle, a close above this level would be a short-term signal of strength. If confirmed, this could open up a move toward the 2,700 to 2,750 resistance zone at the top of the range.

On the 1-hour chart, the 2,579 level stands out as an untested breakout zone. If we see continuation to the upside, bulls will be watching this level closely for a potential bullish retest. The next local resistance begins around 2,700, which also aligns with the local short reload zone.

ETH remains in a consolidation structure for now, but any confirmed breakout, especially amid rising volatility, could set the stage for the next directional move.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.