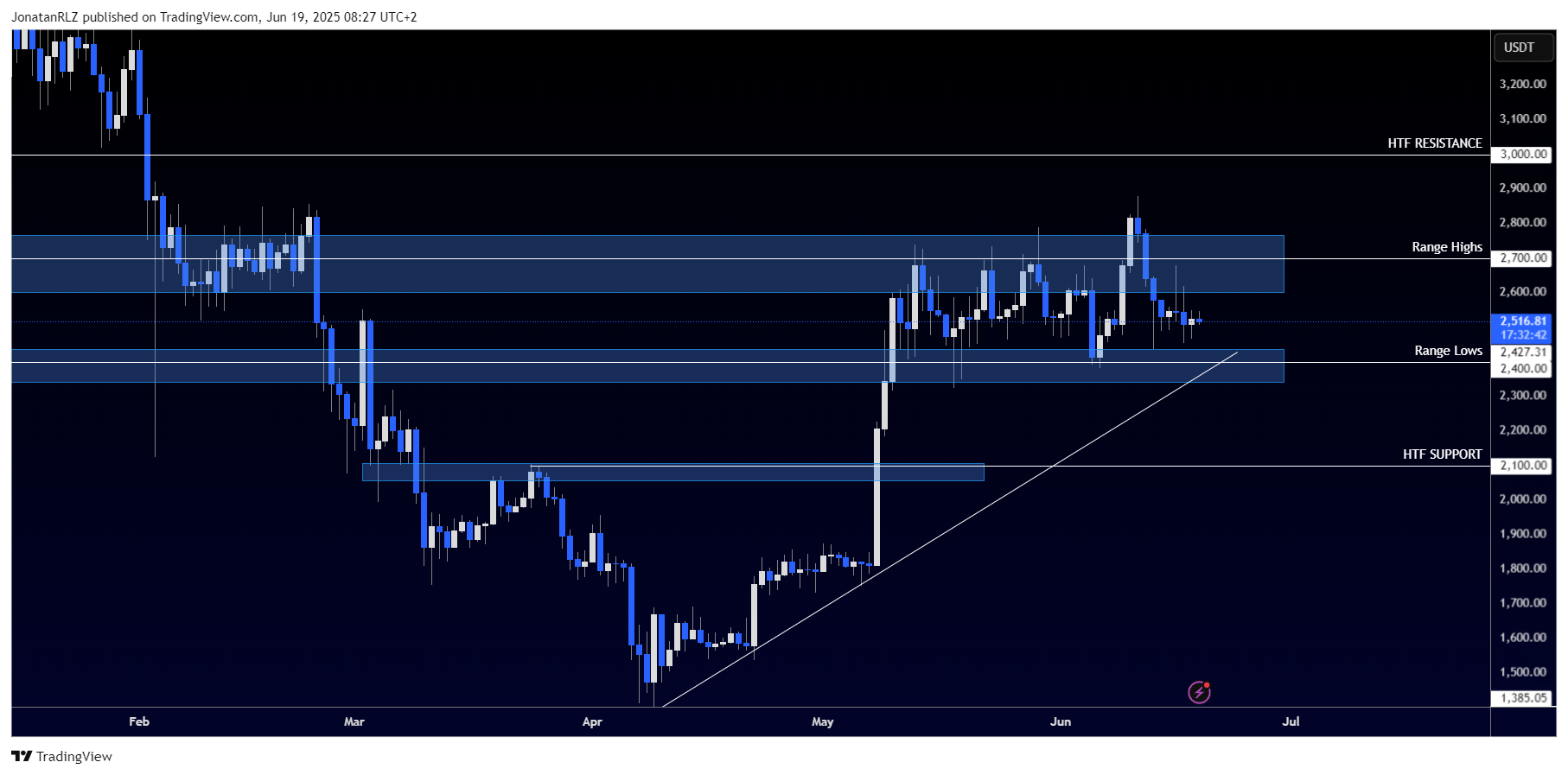

On the daily timeframe, Ethereum continues to trade within a clearly defined range structure, with range lows around 2,400 and range highs near 2,700. What stands out is the ascending trendline now intersecting with the range lows, adding confidence that this level may act as a bounce zone if tested again.

Below the current structure, we have high time frame support at 2,100. This area also served as the untested breakout level from early May and would likely be the next major zone for bulls to defend if the current range breaks to the downside. To the upside, any breakout would put the 3,000 resistance level into focus, a high time frame zone where sellers may look to fade the move.

Zooming into the 4-hour chart, the range becomes even more clearly defined. Despite the sideways structure, volatility within the range remains elevated, offering opportunities for traders to engage. While longer-term investors may be waiting for a breakout before committing capital, short-term traders and especially intraday participants are likely viewing this range as an opportunity to catch directional moves from the edges.

The 2,400 range low area and 2,700 range high area remain key areas for risk management, offering clean invalidation points in both directions.

On the 1-hour chart, consolidation becomes even more apparent. Two key levels stand out — number 1 at 2,480 and number 2 at 2,535. If price breaks above the 2,535 level, there is a clean gap of approximately 1.5 percent with little to no clear horizontal resistance until we reach the range EQ around 2,580, as marked on the 4-hour chart.

This stretch of untested price action could become a fast-move zone, where intraday traders might look for a breakout continuation targeting the range midpoint. If momentum is strong and price can break through the range EQ, the next logical move would be a retest of the range highs closer to 2,700.

However, given the current geopolitical backdrop and rising Middle East tensions, the market may remain locked in a range until global uncertainty begins to ease. For now, ETH continues to offer structured volatility within its established boundaries, and traders will be watching closely for a breakout in either direction.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.