Ethereum’s price has surged almost 20% in the previous 24 hours, pushing above 2000 to a two-month high. ETH is currently trading at 2450, a level last seen in early March and up from sub 1900 on Thursday. The price has rallied 26% in the past two weeks and gained over 50% in the past month as it recovers from its bear market low of 1400.

The surge in Ethereum’s price sparked a wave of liquidations. According to CoinGlass data, over $289 million has been liquidated over the past 24 hours, and of that, $241 million have been short positions.

Pectra upgrade spurs rally

The strong move in ETH comes as the long-awaited Pectra update went live on mainnet on May 7. ETH had been underperforming across this entire cycle amid a lack of demand and increasing supply. However, ETH has turned a corner with the Pectra upgrade a catalyst.

The Pectra upgrade introduced new wallet features, increased staking limits, and scalability improvements. Since the upgrade, the daily ETH burn rate has doubled, and ETH annual inflation dropped to -0.5% from 0.7% prior to the upgrade.

However, the rally in Ethereum has been more than just due to the Petra hard fork. Ether’s price rally has coincided with Bitcoin’s rallying 3.5% over the past 3.59% and 6% over the past 7 days, reclaiming the key psychological 100k level on Thursday.

The crypto market rallied on Thursday after Trump announced a framework for a trade deal with the UK and ahead of “ice-breaker” talks with China this weekend. These developments have boosted sentiment, raising hopes that the worst-case scenario for trade will be avoided.

ETH Seasonality

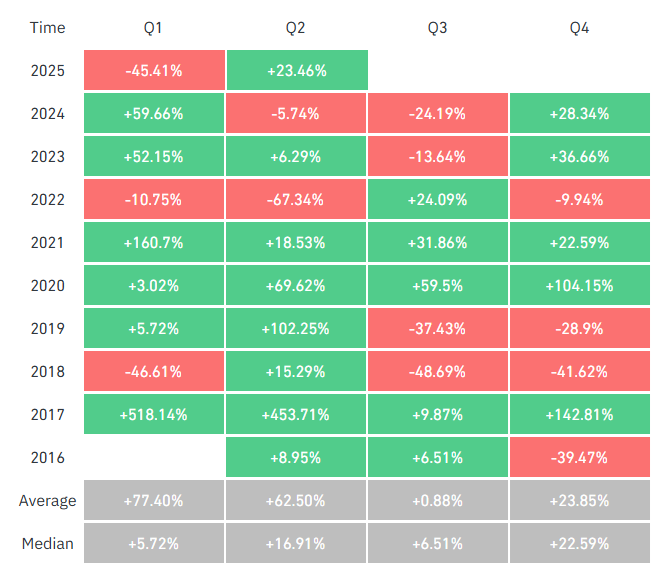

Historical data shows that Ethereum often performs well in Q2. According to data on CoinGlass, ETH booked average gains of 62% in Q2 from 2016. Should ETH track historical gains, this could see the price reach almost $3k by the end of June.

It’s worth noting that Ethereum underperformed by historical measures in Q1. Typically, ETH has booked an average gain of 77% in the first three months of the year. However, in Q1 2025, ETH fell 45%.

ETH ETFs

So far, the increased momentum in ETH has not transferred over into institutional demand. According to SoSoValue data, ETH ETFs have seen net outflows across the past three days and are on track to see net outflows across the week. This comes after two straight weeks of net inflows, the strongest round of inflows since January, around Trump’s inauguration. Should ETH ETF outflows persist, the ETH price rally could be limited.

ETH technical analysis

ETH has broken out of range, surging above 2k and is testing resistance at 3400 the 38.2% Fib retracement of the 4100 high and 1400 low. A break above here exposes the 200 SMA at 2700.

However, the RSI is deeply overbought so a pullback or consolidation could be on the cards. 2k is a key support level.

*Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.