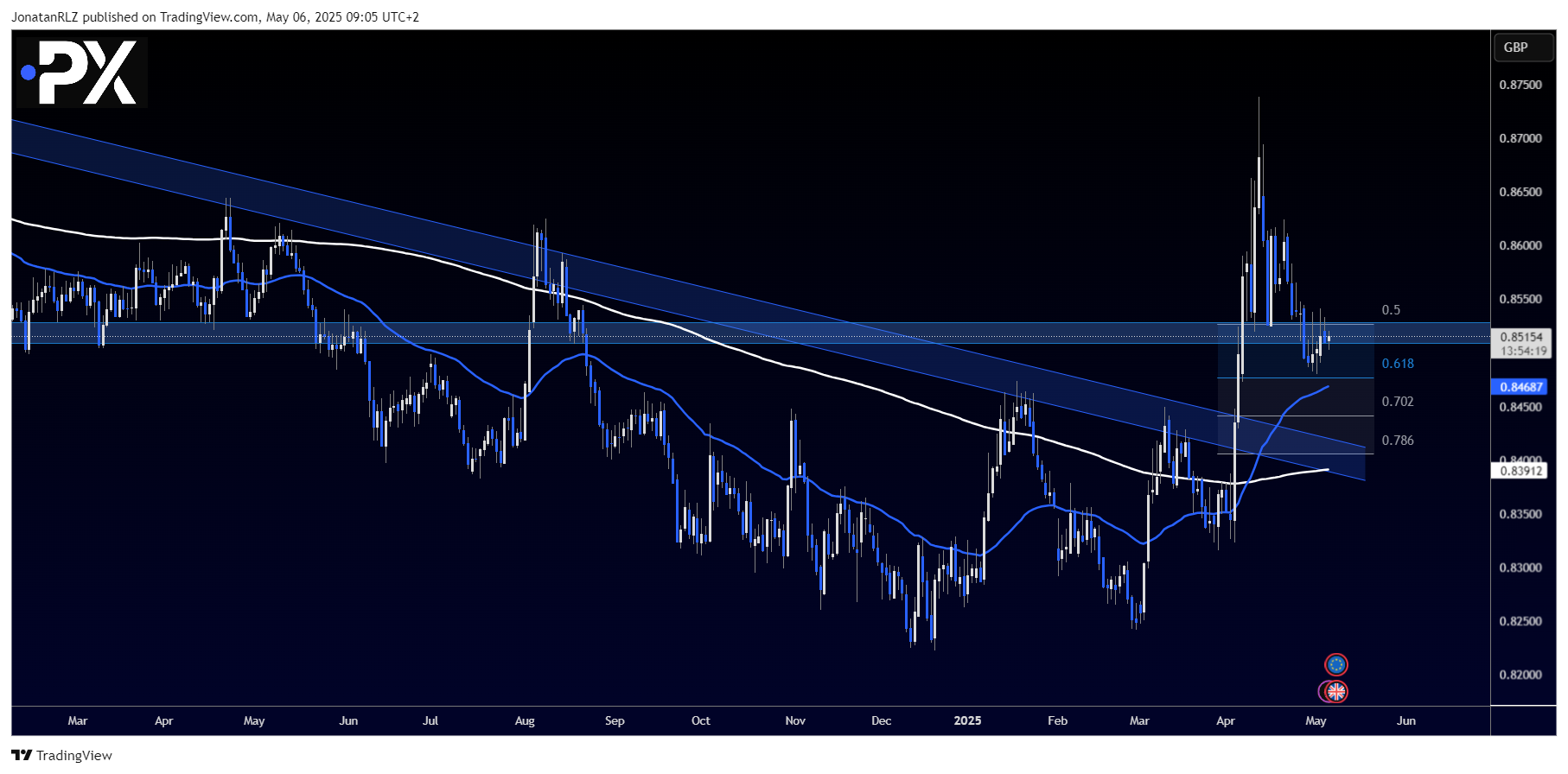

EUR/GBP has recently broken above a descending trendline that had been active since February 2023, potentially signalling a macro shift in the pair’s high time frame structure. A key indication of this shift is the fact that price is now trading above the 200-day simple moving average, which itself has begun sloping upwards, adding further bullish bias.

On the downside, the area between 0.8440 and 0.8470 is emerging as a potential zone of interest. This area includes the 0.702 Fibonacci retracement level at 0.8440 and the daily 50 EMA at 0.8470. The fact that the 50 EMA aligns with the 0.618 Fibonacci retracement level adds further confluence. A retest of this zone could potentially attract buyers, especially if broader market sentiment remains supportive.

To the upside, the next major level to reclaim is the 50% Fibonacci retracement level of the broader downtrend, which sits around 0.8520. This level is also confluent with a long-term high time frame support and resistance zone. While it is currently acting as resistance, a sustained break and reclaim above this level would confirm it as new support and further reinforce the bullish case.

As we approach key data releases this week, including the EU balance of trade and UK inflation data on 8 May, traders should remain attentive to potential volatility. These events could provide the catalyst for either validating the recent bullish break or testing the resilience of the newly established support levels.

Trading involves risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.