Welcome back, everyone, to another technical update on EUR/USD.

We begin today’s report on the daily timeframe, where there are no major developments, but the overall structure remains bullish.

Price continues to form higher highs and higher swing lows, indicating that the uptrend is still intact on the higher timeframes.

However, today’s session is particularly important due to several high-impact news releases that could act as key catalysts:

- Eurozone Inflation Rate

- EU and U.S. GDP Growth

- U.S. Personal Spending & Personal Income

These reports could trigger significant volatility and may determine whether EUR/USD breaks higher or reverses back into support.

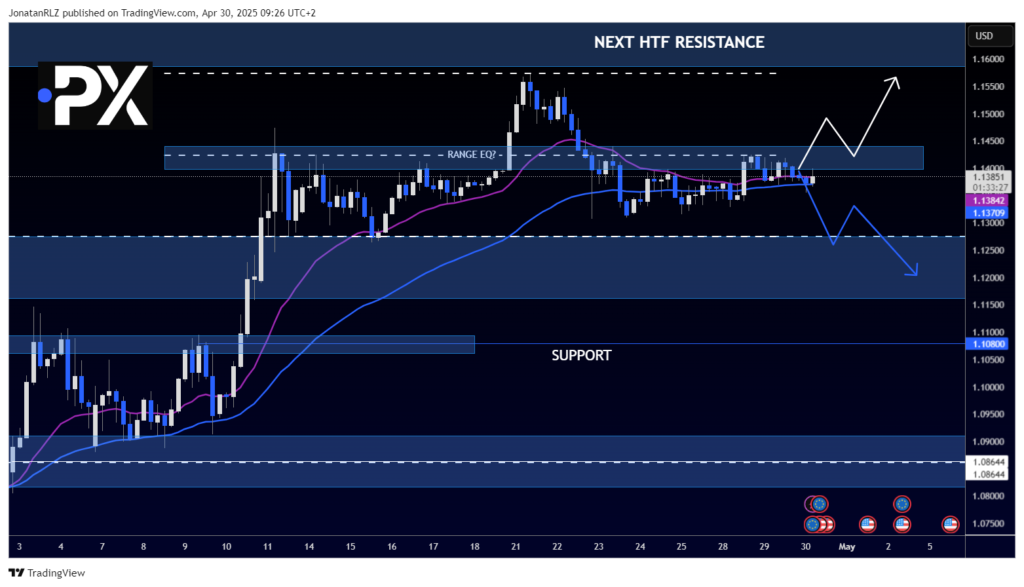

4H Chart – Coiling Below Range EQ, Momentum Building

Dropping down to the 4-hour chart, price is still trading just below the range EQ level marked around 1.14200, as noted in yesterday’s update.

We’re also seeing the 20 EMA and 50 EMA on the 4-hour chart start to flatten out, providing a clear visual representation of the current sideways market environment.

Despite the consolidation, there are bullish signs building, with local higher highs and higher lows starting to emerge on the 4H structure.

Key Levels to Watch:

- Range EQ (Reclaim Level): ~1.14200 – A confirmed reclaim could open the way to a test of range highs at 1.15500

- Range Lows / Local Support: ~1.12800 – A break below could target the higher timeframe breakout level at 1.12000

- Deeper Support (HTF): ~1.10800 – This level could come into play if we see significant downside momentum following bearish data surprises

Given the amount of macro data on the calendar today, it’s critical to monitor price behavior around these levels, particularly during and after the news releases.

We’ll be watching closely and will provide follow-ups based on how price reacts.

Your capital is at risk.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.