Welcome to another technical update on EUR/USD.

Starting with the daily chart, while EUR/USD has been trading in a relatively confined range over the past few weeks, we are now starting to see some interesting developments.

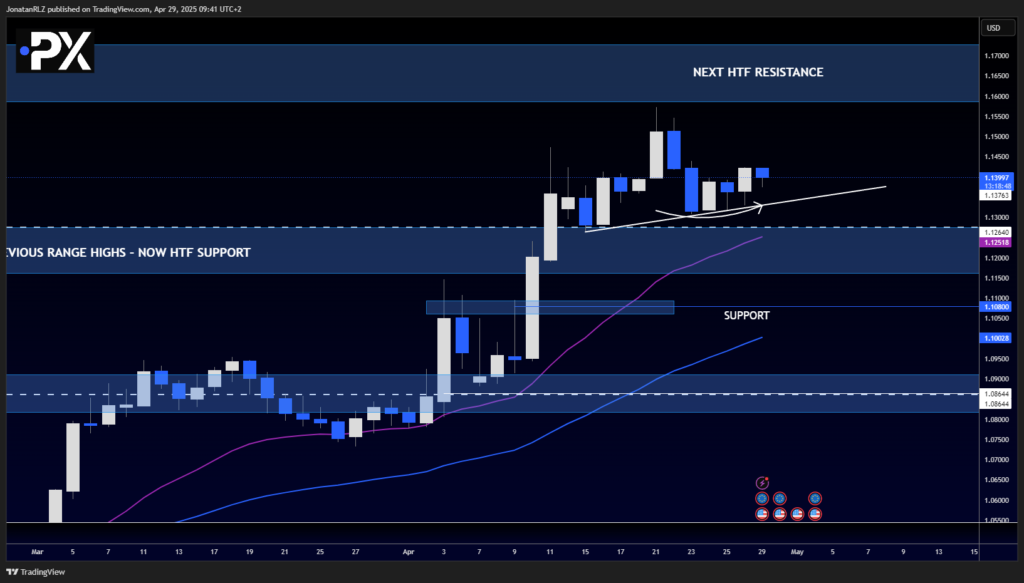

I’ve added a trendline on the chart, and we can observe a potential higher low forming.

The higher low is forming at a well-respected swing area, suggesting buyers are defending this zone.

Additionally, yesterday’s daily candle closed as a strong bullish candle, indicating that bulls stepped in and took control during yesterday’s session.

If this bullish price action can carry over into sustained momentum, we might finally see a resolution of the broader sideways ranging market that has been frustrating directional traders.

Let’s now zoom into the lower timeframes to see if we can gather any more information from price action that could signal continuation—or another stall within the range.

4H Chart – Breakout Faces EQ Resistance Ahead of U.S. JOLTS Data

Zooming into the 4-hour chart, we can see that the bullish daily candle from yesterday has now led to a low-timeframe breakout here on the 4H. However, that move has pushed us directly into the range EQ zone, which continues to act as resistance.

If bulls are able to sustain momentum and reclaim the range EQ, we would then shift our focus toward the 1.15500 area—the top of the current range and the next major resistance zone.

It’s also important to mention that we have the U.S. JOLTS Job Openings report on deck today. While the release hadn’t occurred at the time of this writing, this kind of high-impact data release can serve as a fundamental catalyst, pushing EUR/USD decisively out of its current consolidation.

We’ll be closely watching how price reacts to both the technical breakout attempt and any potential volatility triggered by the JOLTS report.

The content provided here is for informational purposes only. It is not intended as personal investment advice and does not constitute a solicitation or invitation to engage in any financial transactions, investments, or related activities. Past performance is not a reliable indicator of future results.

The financial products offered by the Company are complex and come with a high risk of losing money rapidly due to leverage. These products may not be suitable for all investors. Before engaging, you should consider whether you understand how these leveraged products work and whether you can afford the high risk of losing your money.

The Company does not accept clients from the Restricted Jurisdictions as indicated in our website/ T&C. Some services or products may not be available in your jurisdiction.

The applicable legal entity and its respective products and services depend on the client’s country of residence and the entity with which the client has established a contractual relationship during registration.